Canada Metal Cans and Glass Jars Market

Canada Metal Cans and Glass Jars Market Size, Share, and COVID-19 Impact Analysis, By Type (Metal Cans and Glass Jars), By Application (Preserved Food, Pet Food, Milk Powder, and Others), and Canada Metal Cans and Glass Jars Market Insights Forecasts to 2035

Report Overview

Table of Contents

Canada Metal Cans and Glass Jars Market Insights Forecasts to 2035

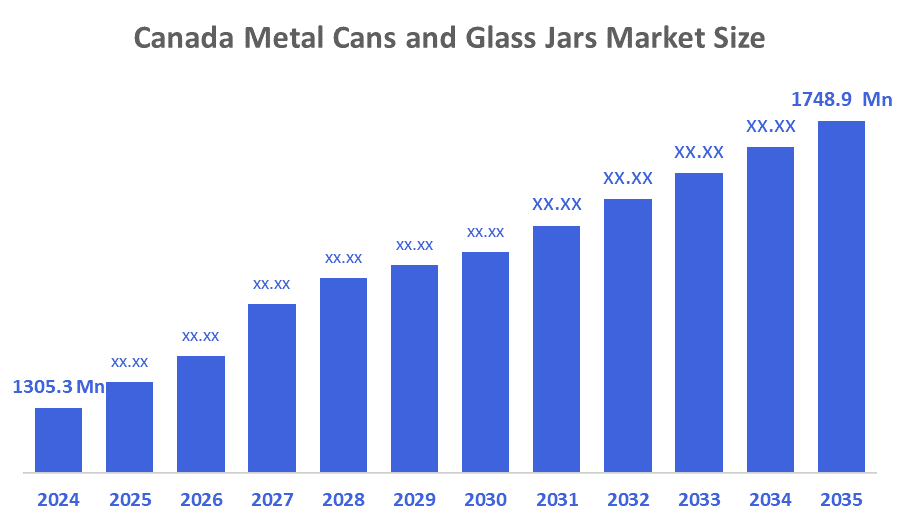

- The Canada Metal Cans and Glass Jars Market Size Was Estimated at USD 1305.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.7% from 2025 to 2035

- The Canada Metal Cans and Glass Jars Market Size is Expected to Reach USD 1748.9 Million by 2035

According to a research report published by Decision Advisior & Consulting, the Canadian Metal Cans and Glass Jars Market size is anticipated to reach USD 1748.9 Million by 2035, growing at a CAGR of 2.7% from 2025 to 2035. The market is driven by the growing need for eco-friendly and recyclable packaging. Glass jars and metal cans are favored as they are recyclable, long-lasting, and capable of maintaining product integrity.

Market Overview

Light metal cans made of steel or aluminium that are used as food and drink containers are produced by Canada's metal can manufacturing sector. In the food and beverage business, glass jars are used as packaging materials. The benefits they provide, like sterility, chemical stability, and reusability, are the primary cause of their widespread use. Additionally, metal cans are utilized for packaging and are typically chosen over glass. High levels of B2B/B2C digitalization and adoption of innovative goods and technology.

Glass jars were imported for C$51.9 million and exported for C$13.2 million in August 2025, leaving Canada with a $38.7 million negative trade balance. Glass jars exports from Canada fell from C$13.5 million to C$13.2 million between July and August of 2025, a loss of C$347k. In August 2025, Canada's glass jars exports rose by 10% year over year.

From May 2024 to April 2025, the world imported 15 cargoes of metal cans from Canada. Five Canadian exporters delivered these imports to five global buyers, representing a 150% increase over the previous year.

As of September 2025, 85% of beer sales in Canada are in cans, while only 7% are in bottles, according to Andrew Oland, president and CEO of Moosehead Breweries. Cans accounted for 65% of the market just five years ago.

Report Coverage

This research report categorizes the market for the Canada metal cans and glass jars market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada metal cans and glass jars market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada metal cans and glass jars market.

Driving Factors

The metal cans and glass jars market in Canada is driven by reuse and recyclable containers are becoming more popular among consumers, as is the focus on environmental sustainability and regulatory pressure to use less plastic. As they convey beauty and quality, companies utilize glass and metal packaging for premium positioning. the requirement for durable, portable, and recyclable packaging for foods, beverages, and health products that are ready to consume.

Restraining Factors

The metal cans and glass Jars market in Canada is restrained by the high cost of supplies and the energy-intensive manufacturing procedures used to make glass jars and metal cans. Significant obstacles are also presented by regulatory limits on packaging materials, especially those pertaining to food safety and impact on the environment. The increasing demand for paper and plastic containers is going to impede metal and glass packaging in the decades to come. Although improvements such as lighter glass and stronger metal alloys are helping to mitigate some of these issues, cost remains a significant barrier.

Market Segmentation

The Canada metal cans and glass Jars market share is categorised into type and application.

- The metal cans segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada metal cans and glass jars market is segmented by type into metal cans and glass jars. Among these, the metal cans segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the widespread use of metal cans in the food and beverage sector, as well as the rise of interest in consumable foods and drinks. Self-heating steel cans, EZO cans, and lids that are simple to open.

- The preserved food segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Canada metal cans and glass jars market is segmented into preserved food, pet food, milk powder, and others. Among these, the preserved food segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by a strong growth rate throughout the forecast period since these containers are widely used for a variety of food items, such as meat and prepared foods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada metal cans and glass jars market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canadian Canning Inc.

- CCL Industries

- Ampak Inc.

- Consolidated Bottle

- Vessel Packaging Co.

- University Bottles and Packaging

- Wells Can Company Ltd

- Cannasupplies

- Stanpac

- Eugene Allrd Produits

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Canada Metal Cans and Glass Jars Market based on the below-mentioned segments:

Canada Metal Cans and Glass Jars Market, By Type

- Metal Cans

- Glass Jars

Canada Metal Cans and Glass Jars Market, By Application

- Preserved Food

- Pet Food

- Milk Powder

- Others

FAQ’s

Q: What is the Canadian metal cans and glass jars market size?

A: The Canada Metal Cans and Glass Jars Market size is expected to grow from USD 1305.3 million in 2024 to USD 1748.9 million by 2035, growing at a CAGR of 2.7% during the forecast period 2025-2035.

Q: What a metal cans and glass jars, and their primary use?

A: Light metal cans made of steel or aluminium that are used as food and drink containers are produced by Canada's metal can manufacturing sector. In the food and beverage business, glass jars are used as packaging materials. The benefits they provide, like sterility, chemical stability, and reusability, are the primary cause of their widespread use.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the reuse and recyclable containers are becoming more popular among consumers, as is the focus on environmental sustainability and regulatory pressure to use less plastic. As they convey beauty and quality, companies utilize glass and metal packaging for premium positioning.

Q: What factors restrain the Canadian metal cans and glass jars market?

A: The market is restrained by the high cost of supplies and the energy-intensive manufacturing procedures used to make glass jars and metal cans. Significant obstacles are also presented by regulatory limits on packaging materials, especially those pertaining to food safety and impact on the environment.

Q: How is the market segmented by application?

A: The market is segmented into preserved food, pet food, milk powder, and others.

Q: Who are the key players in the Canadian metal cans and glass jars market?

A: Key companies include Canadian Canning Inc., CCL Industries, Ampak Inc., Consolidated Bottle, Vessel Packaging Co., University Bottles and Packaging, Wells Can Company Ltd, Cannasupplies, Stanpac, and Eugene Allrd Produits.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 231 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |