Canada Metal Cans Market

Canada Metal Cans Market Size, Share, and COVID-19 Impact Analysis, By Material (Aluminium, Steel), By Product (2-Piece Draw Redraw, 2-Piece Drawn and Ironed, 3-Piece), By Closure (Easy-Open End, Peel Off End, Others), By Applications (Food and Beverages, Chemical and Others), and Canada Metal Cans Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Metal Cans Market Insights Forecasts to 2035

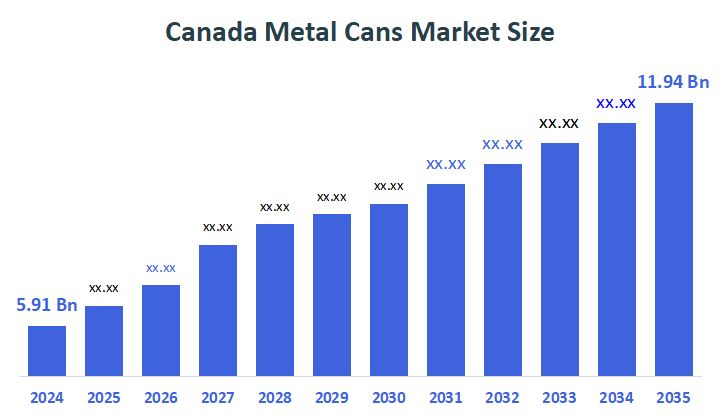

- The Canada Metal Cans Market Size Was Estimated at USD 5.91 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.6% from 2025 to 2035

- The Canada Metal Cans Market Size is Expected to Reach USD 11.94 Billion by 2035

According to a research report published by Decisions Advisors, the Canadian Metal Cans Market size is anticipated to reach USD 11.94 Billion by 2035, growing at a CAGR of 6.6% from 2025 to 2035. The market is driven by the growing popularity of packaged foods and drinks, packaging technological advancements, recyclability, convenience, and environmental tendencies.

Market Overview

The metal can manufacturing industry in Canada manufactures light metal cans made of aluminium or steel that are used as beverage and food containers. It also manufactures light metal shipping containers, including barrels, drums and pails. In the food and beverage business, metal cans are the most popular packaging option due to their excellent recyclability, greater defence against external pollutants, and extended shelf life. These cans can be made in any desired form and are recyclable, and may be utilized indefinitely.

In August 2025, Canada imported C$74.1 million and exported C$1.24 million worth of aluminium cans, leaving a $72.9 million negative trade balance. Aluminium exports from Canada fell by C$762k (-38%) from C$2M to C$1.24M between July and August of 2025. In the same time frame, imports went from C$68.3M to C$74.1M, an increase of C$5.82M (8.52%).

The United States (C$643k), the Netherlands (C$225k), Singapore (C$198k), Denmark (C$147k), and India (C$18.3k) accounted for the majority of Canada's aluminium can exports in August 2025. The United States (C$69.2M), China (C$1.13M), Germany (C$947k), Mexico (C$516k), and Israel (C$488k) were Canada's top importers of aluminium cans.

The Canadian health and wellness movement is influencing how functional and non-alcoholic beverages are used. In addition to the rising need for plant-based, organic, and fortified beverages, brand owners are switching to eco-friendly packaging.

Report Coverage

This research report categorizes the market for the Canada metal cans market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada metal cans market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada metal cans market.

Driving Factors

The metal can market in Canada is driven by the increasing need for environmentally friendly and recycled packaging. Considering metal cans, made up of steel and aluminium, can be reused without losing qualities, they are an environmentally beneficial choice for both producers and customers. The benefits of metal packaging include its longevity, recyclability, reusability, and superior aesthetic appeal. Additionally, there are several benefits to the growing use of metal cans in beverage packaging and the growing demand for beverages. This is thought to reduce landfill disposal and improve the environment. The EU's proposed draft for a packaging and packaging waste rule states that aluminium meets the highest recyclability performance grade of 95%.

Restraining Factors

The metal cans market in Canada is majorly restrained by the variations in the price of raw materials, particularly aluminium and steel. These metals are the primary components needed to make cans, and their prices are influenced by trade restrictions, mining costs, supply-demand imbalances, and energy costs. For success with alternative packaging, cost-effectiveness must be combined with sustainable practices. because of disruptions in the supply chain that are making essential materials scarce.

Market Segmentation

The Canadian metal cans market share is categorised by material, product, closure, and application.

- The aluminium segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian metal cans market is segmented by material into aluminium, steel. Among these, the aluminium segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by aluminium is a common material for food and beverage packaging since it is lightweight, resistant to rusting, and highly reusable.

- The 2-piece drawn and ironed segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on product, the Canadian metal cans market is segmented into 2-piece draw redraw, 2-piece drawn and ironed, 3-piece. Among these, the 2-piece drawn and ironed segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the company's dominance is mostly due to its efficient manufacturing process, which produces seamless cans with constant wall thickness and reduced material use. The cans are ideal for manufacturing huge amounts of beverages due to their structure, which increases structural strength while making them lightweight.

- The easy-open end segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian metal cans market is segmented by closure into easy-open end, peel-off end, others. Among these, the easy-open end segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the easily usable, safe, and convenient EOE closures that are offered, especially for prepared food and beverages, which helps this increment. By allowing consumers to open cans devoid the need for more equipment, the design adapts to the fast-paced lifestyle trends and on-the-go patterns that are becoming prevalent in cities.

- The food and beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on applications, the Canadian metal cans market is segmented into food and beverages, chemical and others. Among these, the food and beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the excessive amount caused by the growing usage of canned foods, bottled beverages, and prepared meals, all of which primarily rely on metal cans for convenience, safety, and preservation. Lacking the need for preservatives, metal cans' airtight barrier protects their contents from light, oxygen, and contamination, increasing the duration of their shelf life.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada metal cans market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canadian Canning Inc

- Vessel Packaging Co.

- Crown Holdings, Inc.

- Wells Can Company Ltd

- Consolidated Bottle

- Fast Track Packaging Inc

- Metalcraft Technology Inc

- Massilly North America

- Universal Can Company

- Coast Containers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In December 2024, the Canadian beverage brand, 1642, known for its qualitative tonics and mixers, introduced a new range of 355 ml tonic and ginger cans. The brand has yet again taken a step forward towards its commitment to sustainability.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Metal Cans Market based on the below-mentioned segments:

Canada Metal Cans Market, By Material

- Aluminium

- Steel

Canada Metal Cans Market, By Product

- 2-Piece Draw Redraw

- 2-Piece Drawn and Ironed

- 3-Piece

Canada Metal Cans Market, By Closure

- Easy-Open End

- Peel Off End

- Others

Canada Metal Cans Market, By Applications

- Food and Beverages

- Chemical

- Others

FAQ’s

Q: What is the Canadian metal cans market size?

A: The Canada Metal Cans Market size is expected to grow from USD 5.91 billion in 2024 to USD 11.94 billion by 2035, growing at a CAGR of 6.6% during the forecast period 2025-2035.

Q: What are metal cans, and their primary use?

A: The metal can manufacturing industry in Canada manufactures light metal cans made of aluminium or steel that are used as beverage and food containers. It also manufactures light metal shipping containers, including barrels, drums and pails. In the food and beverage business, metal cans are the most popular packaging option due to their excellent recyclability, greater defence against external pollutants, and extended shelf life.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the growing demand for recycled and eco-friendly packaging. Because metal cans, which are composed of steel and aluminium, can be reused without losing their quality, they are an environmentally advantageous option for both manufacturers and consumers. Longevity, recyclability, reusability, and higher aesthetic appeal are some advantages of metal packaging. The increasing usage of metal cans in beverage packaging and the rising demand for beverages also have a number of advantages.

Q: What factors restrain the Canadian metal cans market?

A: The Market is restrained by the variations in the price of raw materials, particularly aluminium and steel. These metals are the primary components needed to make cans, and their prices are influenced by trade restrictions, mining costs, supply-demand imbalances, and energy costs.

Q: How is the market segmented by material?

A: The market is segmented into aluminium, steel

Q: Who are the key players in the Canadian metal cans market?

A: Key companies include Canadian Canning Inc., Vessel Packaging Co., Crown Holdings, Inc., Wells Can Company Ltd, Consolidated Bottle, Fast Track Packaging Inc, Metalcraft Technology Inc, Massilly North America, Universal Can Company, and Coast Containers.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |