Canada Next-Generation Firewall (NGFW) Market

Canada Next-Generation Firewall (NGFW) Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hardware NGFW, Virtual NGFW, and Cloud-Native NGFW), By Technology Features (Deep Packet Inspection (DPI), Intrusion Prevention System (IPS), Application Control, Threat Intelligence Integration, and AI/ML-enabled Threat Detection), and Canada Next-Generation Firewall (NGFW) Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Next-Generation Firewall (NGFW) Market Insights Forecasts to 2035

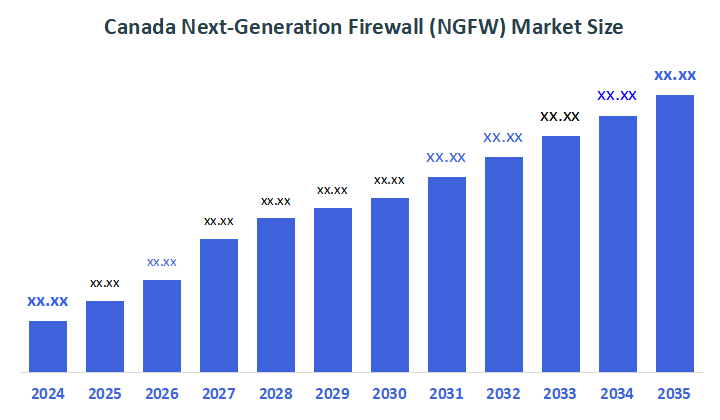

- The Canada Next-Generation Firewall (NGFW) Market Size is Expected to Grow at a CAGR of around 8.40% from 2025 to 2035

- The Canada Next-Generation Firewall (NGFW) Market Size is expected to reach at a substantial share by 2035

According to a research report published by Decisions Advisors, the Canada Next-Generation Firewall (NGFW) Market is expected to grow at a CAGR of 8.40% during the forecast period 2025-2035. The market's steady growth is driven by the growing demand for improved threat prevention, deep packet inspection, and AI-enabled detection capabilities to combat encrypted and sophisticated cyberattacks. Moreover, increased multi-cloud usage, regulatory compliance requirements, and the trend to zero-trust network architectures are all driving up demand for next-generation firewall solutions among organisations and service providers.

Market Overview

The Canada next-generation firewall (NGFW) market is an industry segment in Canada that develops, sells, and deploys advanced firewall solutions that combine traditional packet filtering with modern features like intrusion prevention, deep packet inspection, application awareness, and threat intelligence integration. It improves security by combining standard firewall capabilities with sophisticated features like intrusion detection and prevention, application layer filtering, and deep packet inspection. It has the capacity to identify and govern networked apps, allowing enterprises to apply detailed regulations. It also provides insights into user and device activities, which improves security monitoring and incident response. It is now becoming increasingly used for protecting digital assets around the world. It is distinguished by its role in defending Canadian businesses, government organisations, and service providers against increasing cyber threats while facilitating secure digital transformation.

Report Coverage

This research report categorises the market for the Canada next-generation firewall (NGFW) market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada next-generation firewall (NGFW) market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada next-generation firewall (NGFW) market.

Driving Factors

The Canadian next-generation firewall (NGFW) market is propelled by rising cyber threats, such as sophisticated IoT-based assaults and ransomware, necessitating strict compliance with regulations such as PIPEDA and critical infrastructure protections under the Critical Cyber Systems Protection Act. Moreover, rapid cloud usage, hybrid work practices, and 5G rollout in finance, healthcare, and government drive demand for advanced NGFWs from Palo Alto Networks and Fortinet, which provide AI-powered threat detection, zero-trust segmentation, and deep packet inspection capabilities. The rapid expansion of the Internet of Things (IoT), as well as increased internal and external risks, is driving demand for next-generation firewall solutions and services.

Restraining Factors

Despite escalating cyber risks, the Canadian NGFW market faces some barriers to adoption, such as high upfront implementation and ongoing maintenance costs continue to be a significant obstacle, particularly for small and medium-sized businesses. Moreover, integration issues with older IT systems complicate matters, while a scarcity of qualified cybersecurity personnel in Canada hinders enterprises' capacity to design and administer NGFW solutions efficiently.

Market Segmentation

The Canada next-generation firewall (NGFW) market share is classified into product and technology features.

- The cloud-native NGFW segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The Canada next-generation firewall (NGFW) market is divided by product into hardware NGFW, virtual NGFW, and cloud-native NGFW. Among these, the cloud-native NGFW segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. The rapid development is being driven by an increase in multi-cloud architectures, remote workforce connection, and the expansion of distant enterprise networks that require elastic, centrally managed firewall services.

- The deep packet inspection (DPI) segment held a substantial share in 2024 and is expected to grow at a remarkable CAGR over the forecast period.

The Canada next-generation firewall (NGFW) market is segmented by technology feature into deep packet inspection (DPI), intrusion prevention system (IPS), application control, threat intelligence integration, and AI/ML-enabled threat detection. Among these, the deep packet inspection (DPI) segment held a substantial share in 2024 and is expected to grow at a remarkable CAGR over the forecast period. This is driven by underlying capabilities to improve threat detection, visibility, and policy enforcement across modern enterprise networks. DPI enables enterprises to delve deep into traffic at a granular level in order to detect hidden dangers, illegal programs, and encrypted malware.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada next-generation firewall (NGFW) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Broadcom Inc.

- Fortinet Canada

- Palo Alto Networks Canada

- Cisco Systems Canada

- Check Point Software Technologies Canada

- Sophos Canada

- Others

Recent Development:

- In February 2025, Fortinet announced the launch of its new FortiGate G Series next-generation firewalls (70G, 50G, 30G), designed to deliver unmatched security and efficient network performance for distributed enterprises. These features, together with sophisticated networking support and FortiGuard AI-Powered Security Services, lower the risk of successful assaults and enable customers to future-proof their IT infrastructure while minimising operational costs and environmental impact.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada next-generation firewall (NGFW) market based on the below-mentioned segments:

Canada Next-Generation Firewall (NGFW) Market, By Product

- Hardware NGFW

- Virtual NGFW

- Cloud-Native NGFW

Canada Next-Generation Firewall (NGFW) Market, By Technology Feature

- Deep Packet Inspection (DPI)

- Intrusion Prevention System (IPS)

- Application Control

- Threat Intelligence Integration

- AI/ML-enabled Threat Detection

FAQ

- What is the projected market growth?

The Canada NGFW Market is expected to grow at a CAGR of 8.40% from 2025-2035, reaching at a substantial share by 2035.?

- What are the primary driving factors?

Rising cyber threats like ransomware and IoT attacks, PIPEDA compliance, cloud/hybrid work expansion, 5G rollout, and zero-trust needs drive demand for AI-powered NGFWs from Fortinet and Palo Alto Networks.?

- Which product segment leads the market?

Cloud-native NGFW held a significant share in 2024, growing rapidly due to multi-cloud architectures, remote work, and scalable firewall services for distributed networks.?

- What technology feature dominates?

Deep Packet Inspection (DPI) commanded a substantial share in 2024, with a remarkable CAGR ahead, enabling granular threat detection, malware visibility, and policy enforcement in encrypted traffic.?

- Who are the key players?

Major companies include Fortinet Canada, Palo Alto Networks Canada, Cisco Systems Canada, Broadcom Inc., Check Point Software Technologies Canada, and Sophos Canada.?

- What recent developments occurred?

In February 2025, Fortinet launched FortiGate G Series (70G, 50G, 30G) NGFWs with AI-powered security for distributed enterprises, reducing breach risks and operational costs.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 190 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |