Canada Oat Oil Market

Canada Oat Oil Market Size, Share, and COVID-19 Impact Analysis, By Product (Cold-Pressed, Refined, and Others), By End-use (Personal Care & Cosmetics, Food and Beverage, Pharmaceuticals, Animal Health, and Other End-uses), and Canada Oat Oil Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Oat Oil Market Size Insights Forecasts to 2035

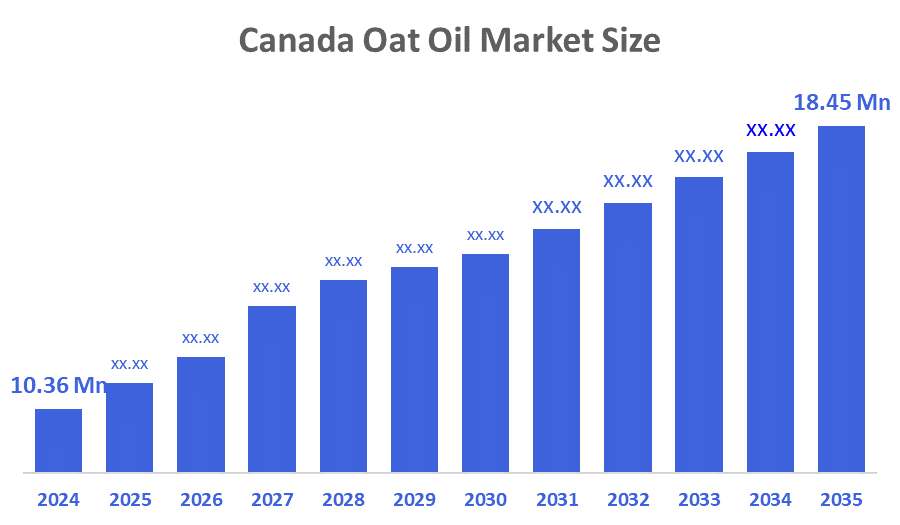

- The Canada Oat Oil Market Size was estimated at USD 10.36 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.39% from 2025 to 2035

- The Canada Oat Oil Market Size is Expected to Reach USD 18.45 Million by 2035

According to a Research Report Published by Decisions Advisors and Consulting, The Canada Oat Oil Market Size is anticipated to Reach USD 18.45 Million by 2035, Growing at a CAGR of 5.39% from 2025 to 2035. Oat oil has become a popular ingredient in clean-label cosmetics and wellness formulations due to growing awareness of its moisturising, anti-inflammatory, and antioxidant qualities. Furthermore, the market is expanding due to consumers' increasing preference for nutrient-dense, sustainable oils over synthetic ones.

Market Overview

The market for oat oil is a segment of the Canadian agri-food and natural products business dedicated to the extraction, processing, and distribution of oat-based oil, which is mainly utilised in applications related to food and beverage, pharmaceuticals, personal care & cosmetics, and animal health. The increasing consumer demand for natural, plant-based ingredients in skincare, haircare, and dietary products is the main factor propelling the market's expansion. Among the nutritional and health benefits that are propelling the Canadian oat oil market are the essential fatty acids, antioxidants, and vitamin E content of oat oil, which promote skin and cardiovascular health. The creation of goods is likely to be driven by partnerships between agricultural suppliers and cosmetic formulators.

The estimated 3.37 million metric tons (mmt) of oats will be produced in 2025, according to Statistics Canada. This is marginally less than earlier projections but in line with general patterns. A modest 3% year-over-year increase in the oat-seeded acreage to approximately 1.2 million hectares indicates that oat cultivation is still popular, especially in provinces like Saskatchewan, Alberta, and Manitoba.

Oat export volumes are still high, with an estimated 2.4 million tonnes of total oat exports, which reflects demand for both grain and value-added products. Oats are also expected to be used more frequently in the domestic industry and food, which will fuel the expansion of oat oil applications in food, cosmetics, and nutraceuticals.

Report Coverage

This research report categorises the market for the Canada oat oil market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada oat oil market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada oat oil market.

Driving Factors

The market expansion is driven by the rising demand for natural, organic, and plant-based ingredients in food, cosmetics, and personal hygiene products. Further, because of its moisturising and anti-inflammatory qualities, oat oil is being quickly adopted by the skincare and cosmetics industry, which is greatly boosting market growth. Consumers favour brands that practice environmental responsibility, and sustainability trends that support eco-friendly sourcing and renewable agriculture also support the oat oil market. Moreover, developments in product formulations and extraction techniques improve the quality of oat oil and increase its potential uses in dietary supplements and functional foods, which encourages the wide adoption. Increased market accessibility is achieved through the expansion of retail channels, such as e-commerce and health-focused stores influenced the market growth.

The trade in oat oil is consistent with larger patterns in Canadian oilseed markets, where exports of crops and processing products account for 15–25% of all exports of oilseed products. The majority of oat oil is produced domestically and exported as an ingredient or as a finished product that contains an ingredient.

Restraining Factors

High production costs, supply chain problems, and competition from alternative oils are the main obstacles or limiting factors facing the Canadian oat oil market.

Market Segmentation

The Canada oat oil market share is classified into product and end use.

- The refined segment held a significant share in 2024 and is projected to grow at a rapid pace during the forecast period.

The Canadian oat oil market is divided by product into cold-pressed, refined, and others. Among these, the refined segment held a significant share in 2024 and is projected to grow at a rapid pace during the forecast period. The segment growth is boosted by its growing application in the production of personal care and cosmetics on a large scale. Enhanced colour stability, less odour, and longer shelf life are all benefits of the refining process that make it appropriate for mass-market formulations and functional food items. This is due to their reliable quality and simplicity of incorporation into emulsions, creams, and hair treatments; manufacturers prefer refined versions.

- The personal care & cosmetics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Canada oat oil market is segmented by end use into personal care & cosmetics, food and beverage, pharmaceuticals, animal health, and other end-uses. Among these, the personal care & cosmetics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This segmental growth is driven by the growing preference of consumers for ingredients that are natural, skin-friendly, and sourced sustainably. A vital component of face serums, body lotions, haircare formulas, and baby care products, oat oil has exceptional emollient, moisturising, and anti-inflammatory qualities. Its acceptance among international cosmetic brands has been reinforced by the continuous trend toward clean beauty and vegan formulas.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada oat oil market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Quaker Oats Company of Canada

- Richardson International

- Grain Millers Canada

- Avena Foods

- SunOpta Canada

- Ceapro Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Oat Oil Market based on the below-mentioned segments:

Canada Oat Oil Market, By Product

- Cold-Pressed

- Refined

- Others

Canada Oat Oil Market, By End Use

- Personal Care & Cosmetics

- Food and Beverage

- Pharmaceuticals

- Animal Health

- Other End-uses

FAQ

- What is the current size of the Canadian oat oil market?

The Canada oat oil market was estimated at approximately USD 10.36 million in 2024.

- What is the projected market size by 2035?

The market is expected to grow to about USD 18.45 million by 2035, with a CAGR of around 5.39% during the forecast period 2025-2035.

- What are the key product segments in the oat oil market?

The market is segmented by product into cold-pressed, refined, and others. The refined segment holds a significant share due to the benefits of cosmetics and personal care.

- Which end-use segment dominates the market?

Personal care & cosmetics dominated the market in 2024 and are anticipated to continue growing substantially, driven by consumer demand for natural and sustainable ingredients.

- What are the main driving factors for market growth?

Growth is fueled by rising demand for natural, organic, and plant-based ingredients, oat oil’s moisturising and anti-inflammatory properties, sustainability trends, and advancements in extraction and formulation.

- Who are the key players in the Canadian oat oil market?

Major companies include Quaker Oats Company of Canada, Richardson International, Grain Millers Canada, Avena Foods, SunOpta Canada, and Ceapro Inc.

- What recent market developments have taken place?

Collaborative partnerships between agricultural suppliers and cosmetic formulators are driving innovation and product development.

- Which retail channels enhance market accessibility?

Increasing online sales and health-focused stores improve oat oil market penetration.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 173 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |