Canada Office Supplies Market

Canada Office Supplies Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Desk, Filing, Binding, Computer/Printer, and Others), By Application (Enterprises, Household, Educational Institutions, and Others), and Canada Office Supplies Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Office Supplies Market Size Insights Forecasts to 2035

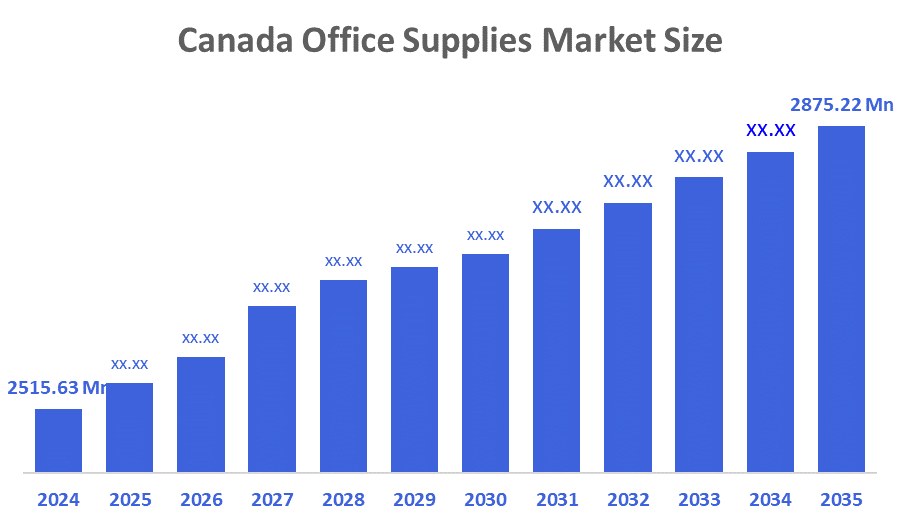

- The Canada Office Supplies Market Size was estimated at USD 2515.63 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.22% from 2025 to 2035

- The Canada Office Supplies Market Size is Expected to Reach USD 2875.22 Million by 2035

According to a Research Report Published by Decisions Advisors and Consulting, The Canada Office Supplies Market Size is anticipated to Reach USD 2875.22 Million by 2035, Growing at a CAGR of 1.22% from 2025 to 2035. Some of the factors driving market growth include the rise in small and medium-sized businesses (SMEs), the growing demand for eco-friendly and sustainable products, and the growing dependence on e-commerce platforms that provide a quick and efficient way to shop.

Market Overview

The business related to retail and distribution of office supplies, stationery, equipment, and related products to households, businesses, and institutions across Canada is known as the office supplies market. It contains both conventional office necessities (pens, paper, and binders) and contemporary ones (computers, peripherals, and printing services). The industry for office supplies is going through major shifts, primarily due to the acceptance of modern technology and environmentally friendly practices. In response to consumers' increasing concern about the environment, there has been a noticeable shift towards eco-friendly products. It has raised demand for goods such as energy-saving office gadgets, reused papers, and ecological writing instruments. Cloud-based programs and computerised document storage systems are adopted as a result of business applications of digital transformation, which predominantly decrease the dependence upon conventional paper. Also, the market for tech accessories, workplace furniture, and customised stationery is growing as an outcome of remote and hybrid work models.

Regional Master Standing Offer (RMSO) and Public Services and Procurement Canada (PSPC) manage the centralised office equipment contracting procedure. It does cover writing instruments, ink and lead refills, binders, folders, stationery, organisers, and cutting tools. Utilising consolidated government purchasing, the RMSO offers affordable access to more than 3,000 high-usage items that meet environmental sustainability standards. These items are given out regionally to eligible suppliers with an emphasis on assisting SMEs and Aboriginal-owned enterprises.

Report Coverage

This research report categorises the market for the Canada office supplies market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada office supplies market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada office supplies market.

Driving Factors

The market for office supplies in Canada is mostly driven by the ongoing need for merchandise that supports remote and hybrid work models, which has made expensive products like computer parts and comfortable desk supplies necessary for private office configurations. In addition, driving growth are the education sector's expansion and the ongoing emergence of new businesses (SMEs and startups), both of which need a consistent, extensive supply of paper and writing supplies. Last but not least, the primary source of growth is the increasing demand from both customers and companies for sustainable and environmentally friendly products, requiring producers to keep coming across new ideas using recycled materials and ethical sourcing in order to comply with Canada's "green purchasing" laws.

In August 2022, Denis Office Supplies & Furniture and Supreme Basics, two reputable Canadian office supply dealers, were purchased by Staples Canada (via its business-to-business division Staples Professional). This action broadens Staples' supply chain and delivery network while fortifying its product and service portfolio (print & marketing, technology, furniture).

Restraining Factors

The main factor limiting the Canadian office supply market is the widespread effects of digital transformation, which continually lowers demand for conventional physical supplies like paper and filing products as more companies use cloud computing and digital workflows. The steady growth of remote and hybrid work models, which fragmented previously centralised office procurement, exacerbates this structural decline by reducing profit margins and forcing suppliers to restructure their operations.

Market Segmentation

The Canada office supplies market share is classified into product and application.

- The filing segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Canada office supplies market is divided by product into desk, filing, binding, computer/printer, and others. Among these, the filing segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The filling segment mostly includes paper supplies due to its daily requirement in the cooperate industry. The steady need for printing, paperwork, and administrative duties in the business, government, and educational sectors is what propels the paper supplies market. Paper copies are still necessary for basic paper goods is also increased by the expansion of small and medium-sized businesses (SMEs). The growing environmental consciousness has led to an increase in the use of recycled and eco-friendly paper options.

- The educational institutions segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period.

The Canada office supplies market is segmented by application into enterprises, households, educational institutions, and others. Among these, the educational institutions segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period. The market is constantly driven by educational institutions' requirements for classroom supplies, stationery, filing supplies, and textbooks. The growth of schools, colleges, and online educational sites raises demand for traditional as well as electronic supplies. The sales are further increased by seasonal procurement cycles, such as the back-to-school season. Regular consumption is also supported by government investments in educational infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada office supplies market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Staples Canada

- Novexco Inc.

- Grand & Toy

- Lyreco Canada

- Hamster

- CWS (Canadian Workplace Solutions)

- OfficeCentral

- Peninsula Office Supplies

- Quill Canada

- WBM Office Systems

- Others

Recent Developments:

- In October 2023, A strategic partnership was announced by Novexco and Canadian Workplace Solutions (CWS), two significant dealer organisations in Canada, to enhance competitive purchasing conditions for independent office-supply dealers nationwide. Their declared objective is to strengthen the independent dealer channel and give suppliers access to more dealers by combining their strengths to create a more efficient distribution network.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada office supplies market based on the below-mentioned segments:

Canada Office Supplies Market, By Product

- Desk

- Filing

- Binding

- Computer/Printer

- Others

Canada Office Supplies Market, By Applications

- Enterprises

- Household

- Educational Institutions

- Others

FAQ

- What is the current market size of the Canadian Office Supplies Market?

The market size was estimated at approximately USD 2,515.63 million in 2024.

- What is the expected market size by 2035?

The market is projected to grow to about USD 2,875.22 million by 2035.

- What is the expected compound annual growth rate (CAGR) during 2025-2035?

The market is anticipated to grow at a CAGR of approximately 1.22% during the forecast period.

- What are the main product segments in the Canadian office supplies market?

Major product segments include desk supplies, filing supplies, binding supplies, computer/printer supplies, and others. Among these, the filing supplies segment dominated the market in 2024 and is expected to show substantial growth.

- What applications drive demand in the office supplies market?

Key applications include enterprises, households, educational institutions, and others. Educational institutions held a significant market share in 2024 and are anticipated to grow rapidly, driven by requirements for classroom and administrative supplies.

- What factors are driving market growth?

Growth is driven by the rise in small and medium-sized enterprises (SMEs), increasing demand for eco-friendly and sustainable products, and expanding e-commerce platforms enabling efficient procurement. Hybrid and remote work models also increase demand for tech accessories and ergonomic office furniture.

- What restrains market growth?

Digital transformation reduces demand for traditional paper and filing products. Additionally, remote and hybrid work models fragment centralised procurement, reducing profit margins and forcing market realignment.

- What are recent market developments?

In 2023, Staples Canada acquired two significant Canadian office supply dealers, Denis Office Supplies & Furniture and Supreme Basics, enhancing its supply chain and broadening its service offerings. Another development involved strategic partnerships among independent Canadian office-supply dealers to strengthen competitive purchasing.

- Who are the key companies in the Canadian office supplies market?

Major players include Staples Canada, Novexco Inc., Grand & Toy, Lyreco Canada, Hamster, Canadian Workplace Solutions (CWS), OfficeCentral, Peninsula Office Supplies, Quill Canada, and WBM Office Systems.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 175 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |