Canada Organic Coffee Market

Canada Organic Coffee Market Size, Share, and COVID-19 Impact Analysis, By Type (Arabica, and Robusta), By Packaging Form (Stand-Up Pouches, Jars and Bottles, and Others), and Canada Organic Coffee Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Canada Organic Coffee Market Insights Forecasts to 2035

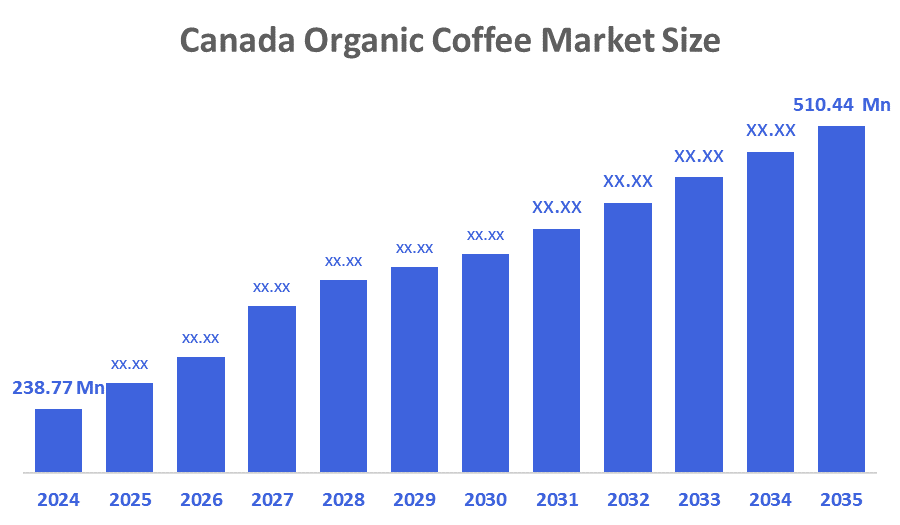

- The Canada Organic Coffee Market Size was estimated at USD 238.77 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.15% from 2025 to 2035

- The Canada Organic Coffee Market Size is Expected to Reach USD 510.44 Million by 2035

According to a research report published by Decision Advisior and Consulting, the Canada Organic Coffee Market is anticipated to reach USD 510.44 million by 2035, growing at a CAGR of 7.15% from 2025 to 2035. Individuals' growing health consciousness, the availability of new products such as single-origin coffees, organic cold brews, and ready-to-drink (RTD) formats, and a growing understanding of the environmental impact of conventional farming practices are all driving market growth.

Market Overview

The Canadian organic coffee market is a subset of the country's coffee market that only sells organic coffee beans and products grown without synthetic fertilisers, pesticides, or chemicals and processed in accordance with strict organic certification guidelines. It comprises importing, roasting, packaging, and retailing of organic coffee throughout Canada. Organic coffee is produced without the use of synthetic pesticides or other forbidden ingredients. This method focuses on renewing the soil and keeping it healthy by utilising natural fertilisers and organic farming techniques. The attractiveness of organic coffee stems from its sustainability and the cleaner, more natural environment in which the beans are grown. The growing trend of ethical shopping is also driving the industry. This association with social and economic justice, particularly for small-scale coffee producers, makes organic coffee more desirable to people ready to pay a premium for items that correspond with their ethical convictions.

Minister of Agriculture and Agri-Food announced a $640,000 investment in the Canadian Organic Growers (COG) to help increase Canadian consumer demand for Canadian-made organics produced locally by Canadian organic farmers. The revelation was made at Chelsea Market during Canada's National Organic Week, an annual event that promotes and celebrates organic food growing and products across the country. The demand for organic foods in Canada is increasing, and there are many hardworking and ambitious organic food producers around the country.

Report Coverage

This research report categorises the market for the Canada organic coffee market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada organic coffee market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada organic coffee market.

Driving Factors

Canada's coffee consumption is increasing as a result of shifting consumer preferences, a rise in coffee shops, and growing interest in speciality and premium coffee. High-quality beans, distinctive brewing processes, and coffee origin are important to consumers, as are sustainability and ethical sourcing practices. Convenience is driving an increase in the popularity of internet shopping for coffee items. Innovative marketing strategies, a variety of menu options, and loyalty programs are used by both independent cafes and big chains to compete. As cafes develop into social hubs that serve a range of drinks, including specialised lattes and non-coffee choices, the coffee culture flourishes. Quick, on-the-go coffee options are also growing in popularity. Furthermore, Gen Z's desire for customisation and one-of-a-kind experiences is driving demand for a wide range of flavoured organic coffees, boosting the market.

In February 2024, Salt Spring Coffee officially launched Canada’s first Regenerative Organic Certified (ROC) coffee, marking a major milestone in sustainable agriculture and ethical sourcing. The new roast, called Village Trade Dark Roast, is now available both in stores and online.

Restraining Factors

The Canadian organic coffee market is growing rapidly, but it confronts constraining issues such as high certification prices, limited supply chain resilience, consumer price sensitivity, and regulatory impediments. The high manufacturing costs and restricted availability of organic farming supplies are significant concerns.

Market Segmentation

The Canada organic coffee market share is classified into type and packaging form.

- The Arabic segment held a substantial share in 2024 and is anticipated to grow at a significant CAGR over the forecast period.

The Canada organic coffee market is divided by type into arabica, and robusta. Among these, the Arabic segment held a substantial share in 2024 and is anticipated to grow at a significant CAGR over the forecast period. For coffee lovers who value flavour, these organically cultivated beans are widely sought after since they preserve their inherent flavours without the influence of artificial chemicals. Health-conscious consumers seeking a healthier product devoid of pesticides and dangerous chemicals are drawn to organic Arabica coffee. Arabica beans meet consumer need for healthier options since they have more antioxidants and less caffeine than Robusta beans.

- The stand-up pouches segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The Canada organic coffee market is segmented by packaging form into stand-up pouches, jars and bottles, and others. Among these, the stand-up pouches segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. It can be packaged affordably in plastic stand-up pouches, which have superior moisture barriers made of PET, PE, and aluminium layers to prolong shelf life and avoid contamination. Further, compared to more conventional options like retort pouches, they offer flexibility and reduce transportation and storage costs because they are heat-sealable and durable, with their space efficiency and suitability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada organic coffee market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- St. Joseph Island Coffee Roasters

- Ethical Bean Coffee

- Birch Bark Coffee Company

- Baden Coffee Company

- Planet Bean Coffee

- Spirit Bear Coffee Company

- Muskoka Roastery Coffee Co.

- Jim's Organic Coffee

- Farm & Forest Organic Coffee Roasters

- Kicking Horse Coffee

- Others

Recent Developments:

- In January 2025, Artigiano, Vancouver's premium coffee and café brand known for its speciality coffee and European-inspired atmosphere, is pleased to announce the acquisition of Salt Spring Coffee, a pioneer in organic and fair-trade coffee roasting. With this acquisition, Artigiano becomes Canada's second-largest organic coffee roaster and the only one that roasts Regenerative Organic Certified coffee.

- In November 2024, Zavida Coffee Roasters announced the expansion of its Organica line at Costco Canada, introducing a new 76-count format and launching three new naturally flavoured organic coffees. By offering larger pack sizes and new flavours, Zavida is targeting both value-conscious and sustainability-focused consumers, reinforcing its role in the expanding organic coffee market.

Key Target Audience

Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Canada organic coffee market based on the below-mentioned segments:

Canada Organic Coffee Market, By Type

- Arabic

- Robusta

Canada Organic Coffee Market, By Packaging Form

- Stand-Up Pouches

- Jars and Bottles

- Others

FAQ

- What is the projected size of the Canadian Organic Coffee Market?

The Canadian Organic Coffee Market was valued at USD 238.77 million in 2024 and is expected to reach USD 510.44 million by 2035, growing at a CAGR of 7.15% from 2025 to 2035.?

- What are the main types of organic coffee in Canada?

The market is segmented by type into Arabica and Robusta. Arabica holds the largest share due to its flavour profile and health benefits, while Robusta is also present but less dominant.?

- What are the common packaging formats for organic coffee in Canada?

The primary packaging formats are stand-up pouches, jars and bottles, and others. Stand-up pouches dominate the market due to their cost-effectiveness, durability, and superior shelf life.?

- What factors are driving the growth of the organic coffee market in Canada?

Key drivers include rising health consciousness, demand for speciality and premium coffee, ethical sourcing, sustainability, and the convenience of online shopping. Consumers are increasingly seeking products that align with their values regarding health and the environment.?

- What are the main challenges facing the organic coffee market in Canada?

The main challenges include high certification costs, limited supply chain resilience, price sensitivity among consumers, and regulatory hurdles. These factors can impact the availability and affordability of organic coffee products.?

- Which companies are leading the Canadian Organic Coffee Market?

Key players include St. Joseph Island Coffee Roasters, Ethical Bean Coffee, Birch Bark Coffee Company, Baden Coffee Company, Planet Bean Coffee, Spirit Bear Coffee Company, Muskoka Roastery Coffee Co., Jim's Organic Coffee, Farm & Forest Organic Coffee Roasters, and Kicking Horse Coffee.?

- What recent developments have occurred in the Canadian organic coffee sector?

Recent developments include Artigiano's acquisition of Salt Spring Coffee, making Artigiano the second-largest organic coffee roaster in Canada, and Zavida Coffee Roasters expanding its Organica line at Costco Canada with new formats and flavours.?

- Who is the target audience for this market report?

The report is relevant for market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 150 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |