Canada Refrigeration Oil Market

Canada Refrigeration Oil Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Mineral, Synthetic, and Semi Synthetic), By Application (Refrigerators, Air Conditioners, Automotive, Coolers & Conditioners), and Canada Refrigeration Oil Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Canada Refrigeration Oil Market Insights Forecasts to 2035

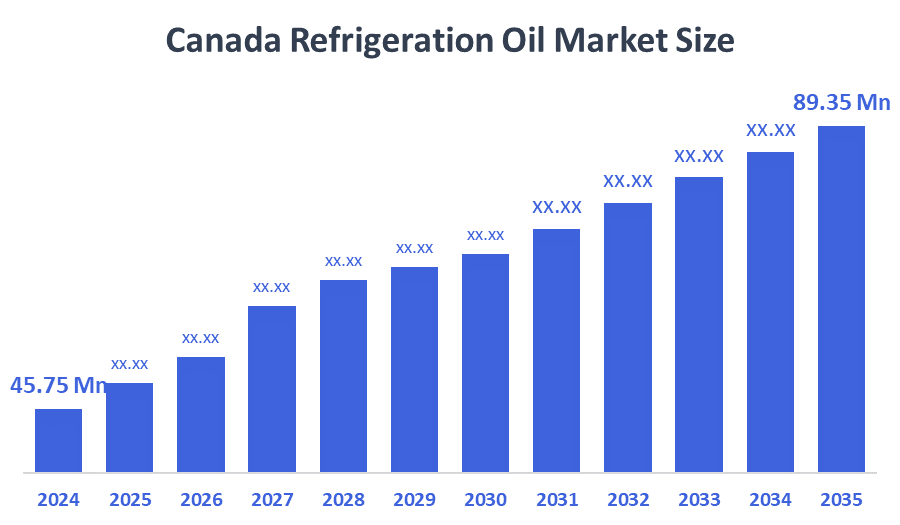

- The Canada Refrigeration Oil Market Size was estimated at USD 45.75 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.27% from 2025 to 2035

- The Canada Refrigeration Oil Market Size is Expected to Reach USD 89.35 Million by 2035

The Canada Refrigeration Oil Market is anticipated to reach USD 89.35 Million by 2035, growing at a CAGR of 6.27% from 2025 to 2035. The consumption of packaged and ready-to-eat food items, which are perishable and require lower storage temperatures, is rising as a result of the urban population's rapid growth and the slow change in eating habits. The increasing demand for cutting-edge electronics like air conditioners, refrigerators, and car air conditioning systems is the reason for this growth.

Market Overview

The lubricants designed especially for use in air conditioning and refrigeration systems in commercial, industrial, and residential settings are referred to as the refrigeration oil market. Compressors in air conditioning and cooling systems are lubricated with refrigeration oil to promote heat dissipation, reduce friction, and ensure smooth operation. Synthetic oils compatible with low-GWP (Global Warming Potential) refrigerants are being used in commercial and industrial cooling applications as refrigerant regulations tighten globally. The oils, especially HFOs (hydrofluoroolefins), are being developed to meet the thermodynamic specifications of sophisticated refrigerant blends. Refrigerators are becoming more and more common in homes, shops, supermarkets, and dining establishments. The demand for refrigeration systems has increased due to the requirement for low temperatures for the storage and transportation of pharmaceutical products. The development of the Canadian market is also greatly aided by technological developments, investments in modernising commercial and industrial infrastructure, and urban development initiatives that promote HVAC upgrades

Report Coverage

This research report categorises the market for the Canada refrigeration oil market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada refrigeration oil market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada refrigeration oil market.

Driving Factors

The market for Canadian refrigeration oil is primarily driven by the increasing need for ecologically friendly and energy-efficient refrigeration systems across a range of industries. Further, expanding cold chain infrastructure to support pharmaceutical storage and food preservation, increased use of synthetic refrigeration oils compatible with low Global Warming Potential (GWP) refrigerants, and strict environmental regulations encouraging the use of eco-friendly lubricants are important growth factors. Moreover, industry growth is also supported by the growing demand for high-performance lubricants that increase compressor efficiency, lower energy consumption, and extend equipment life.

Restraining Factors

Despite the significant growth, the industry could face several factors, such as manufacturers being forced to switch from high global warming potential (GWP) refrigerants like HFCs and HCFCs to environmentally friendly alternatives due to strict environmental regulations on lubricants and refrigerants. This requires oil reformulations and may raise costs. The spread of fake and inferior refrigeration oils raises concerns about quality and dependability, leading to premature wear and system malfunctions that erode customer confidence.

Market Segmentation

The Canada refrigeration oil market share is classified into product type and application.

- The synthetic segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada refrigeration oil market is segmented by product type into mineral, synthetic, and semi-synthetic. Among these, the synthetic segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because they are more effective than conventional mineral-based oils due to their superior lubricating qualities, low volatility, and outstanding thermal stability. The demand for synthetic refrigeration oil is fueled by these characteristics, which also increase system reliability, lower maintenance needs, and lengthen equipment lifespan. Additionally, new refrigeration systems that need specific lubricants have been developed as a result of refrigerant technology advancements, especially in the automotive and industrial sectors.

- The coolers & conditioners segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period.

The Canada refrigeration oil market is segmented by application into refrigerators, air conditioners, automotive, and coolers & conditioners. Among these, the coolers & conditioners segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period. This is driven by high-demand applications in industries like manufacturing, data centres, and hospitality, including water coolers, chillers, and portable air conditioners. Further, because these systems run constantly, oils with high oxidative stability, extended service life, and low sludge formation are necessary.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada refrigeration oil market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Imperial Oil Limited

- ExxonMobil Canada

- Petro-Canada Lubricants

- Shell Canada

- TotalEnergies Canada

- Lubricon Industries

- Bluewave Energy (Parkland)

- Recochem Inc

- Chemfax Products Ltd.

- Noco Lubricants

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Canada Refrigeration Oil Market based on the below-mentioned segments:

Canada Refrigeration Oil Market, By Product Type

- Mineral

- Synthetic

- Semi Synthetic

Canada Refrigeration Oil Market, By Application

- Refrigerators

- Air Conditioners

- Automotive

- Coolers & Conditioners

FAQ

- What was the market size of the Canada Refrigeration Oil Market in 2024?

The market size was estimated at USD 45.75 million in 2024.

- What is the projected market size by 2035?

The market is anticipated to reach USD 89.35 million by 2035.

- What is the expected growth rate (CAGR) during 2025-2035?

The market is expected to grow at a CAGR of around 6.27%.

- What are the main types of refrigeration oils in the market?

The market is segmented by product type into mineral, synthetic, and semi-synthetic oils.

- Which refrigeration oil type dominated the market in 2024?

The synthetic refrigeration oil segment dominated the market in 2024.

- What are the key application areas for refrigeration oils?

Applications include refrigerators, air conditioners, automotive, and coolers & conditioners.

- Which application segment held a significant market share in 2024?

The coolers & conditioners segment held a significant share in 2024.

- What are the main growth drivers of the Canadian Refrigeration Oil Market?

Growth is driven by increasing demand for eco-friendly, energy-efficient refrigeration systems across industries, expansion of cold chain infrastructure, adoption of low Global Warming Potential (GWP) refrigerants, and the need for high-performance lubricants that improve compressor efficiency and equipment lifespan.

- Who are the leading companies in the Canadian Refrigeration Oil Market?

Key players include Imperial Oil Limited, ExxonMobil Canada, Petro-Canada Lubricants, Shell Canada, TotalEnergies Canada, Lubricon Industries, Bluewave Energy (Parkland), Recochem Inc., Chemfax Products Ltd., and Noco Lubricants.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |