Canada Secondary Refrigerants Market

Canada Secondary Refrigerants Market Size, Share, and COVID-19 Impact Analysis, By Type (Glycols, Salt Brines, Carbon Dioxide, and Others), By Application (Commercial Refrigeration, Industrial Refrigeration, Heat Pumps, Air Conditioning, and Others), and Canada Secondary Refrigerants Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Canada Secondary Refrigerants Market Insights Forecasts to 2035

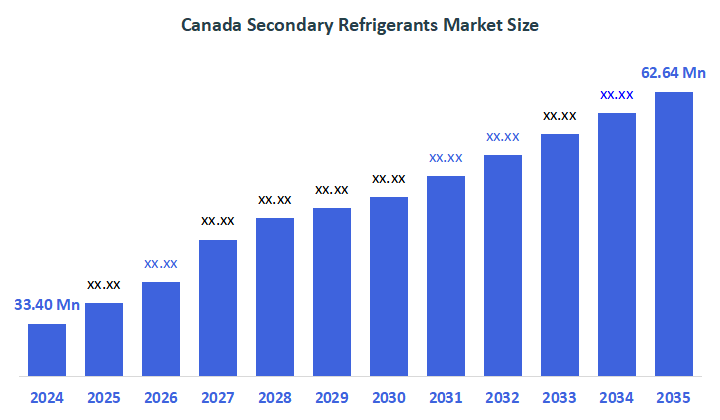

- The Canada Secondary Refrigerants Market Size was estimated at USD 33.40 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.75% from 2025 to 2035

- The Canada Secondary Refrigerants Market Size is Expected to Reach USD 62.64 Million by 2035

According to a research report published by Decisions Advisors, the Canada Secondary Refrigerants Market is anticipated to reach USD 62.64 million by 2035, growing at a CAGR of 6.75% from 2025 to 2035. Laws that phase out high-GWP refrigerants and the demand for more energy-efficient and environmentally friendly cooling solutions are driving growth in the secondary refrigerant market. With government regulations aimed at lowering greenhouse gas emissions and the growing use of sustainable cooling technologies, which are the main market drivers, the industry is predicted to grow significantly.

Market Overview

The Canadian secondary refrigerants market is defined as the segment of the refrigeration and cooling industry that focuses on the use of secondary fluids (also called secondary refrigerants or coolants) to transfer thermal energy between the primary refrigerant system and the cooled space or process. For example, air functions as a secondary refrigerant in an air conditioner. Additionally, the materials are used in large air refrigeration units as a transport medium with cooling capacity. Secondary refrigerants also have important properties like high specific heat, chemical stability, low viscosity, non-corrosiveness, and excellent heat transfer. Calcium chloride brines and propylene glycols are used as secondary refrigerants in heat pumps, industrial refrigeration, and commercial refrigeration. Chilled water appears to be used as a secondary refrigerant in high-temperature applications. The shift encourages both public and private organisations to invest in novel cooling solutions that improve thermal efficiency while decreasing ecological footprint to achieve environmentally friendly seeks and worldwide climate objectives. The market exhibits promising growth potential due to corporate commitment to green initiatives as well as the development of electric vehicles, heat pumps, and cold chain logistics.

Cancoil USA, a Kinston, Ontario-based subsidiary of Cancoil, is growing its operations in Texas at taxpayer expense. The business, which produces industrial heat transfer and commercial refrigeration products, has decided to construct a new manufacturing facility in Jacksonville, Texas. The facility is expected to generate over $28 million in capital investment and 120 new jobs.

Report Coverage

This research report categorises the market for the Canada secondary refrigerants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada secondary refrigerants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada secondary refrigerants market.

Driving Factors

The market for secondary refrigerants in Canada is driven by the increasing need for eco-friendly, energy-efficient refrigeration solutions in important sectors like cold storage, food processing, and pharmaceuticals, as well as strict government regulations. The high need for dependable, sustainable secondary refrigerants to preserve product safety and quality is further increased by the growth of the cold chain logistics and retail industries. The appeal of secondary refrigerants is increased by technological advancements in heat transfer fluids, heat exchangers, and piping that maximise performance and energy efficiency. The market growth is accelerated as a result of increased awareness of sustainable practices, pressure to reduce costs, integration with renewable energy, and smart IoT/AI-driven refrigeration systems. The country market development is also supported by partnerships between chemical companies and HVAC manufacturers, as well as by retrofitting current systems to compliance standards.

Restraining Factors

The Canadian secondary refrigerants market is constrained by some factors, including high upfront costs, difficulties with retrofitting, regulatory fragmentation, a lack of expertise, competition from alternatives, and efficiency concerns.

Market Segmentation

The Canada secondary refrigerants market share is classified into type and application.

- The glycols segment held a substantial market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada secondary refrigerants market is differentiated by type into glycols, salt brines, carbon dioxide, and others. Among these, the glycols segment held a substantial market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is driven by the superior properties of glycols, such as their high heat conductivity, low freezing temperatures, and corrosion resistance. Glycols' characteristics make them ideal for use in closed-loop systems, such as water-based heating and cooling processes, HVAC, and refrigeration. Glycols are essential for industrial refrigeration, and food processing because they provide consistent temperature control and a longer system life.

- The air conditioning segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The Canada secondary refrigerants market is divided by application into commercial refrigeration, industrial refrigeration, heat pumps, air conditioning, and others. Among these, the air conditioning segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. This is due to growing energy constraints and the growing need for sustainable cooling in the commercial, industrial, and residential sectors; the use of secondary refrigerants in air conditioning systems will significantly increase. Moreover, better energy performance, less of an impact on the environment, and lower operating costs are all results of the arrangement.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada secondary refrigerants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- A-Gas International

- Messer Canada

- Freeze Co. Systems, Ltd.

- ECODYNE Limited

- Northern Green Tech

- Maple Leaf Recovery Systems

- Canadian Eco Refrigerants

- Others

Recent Developments:

- In April 2025, A Gas has expanded its Canadian capabilities by acquiring Refrigerant Services Inc. (RSI), a well-established refrigerant reclamation company. The deal was finalised in late March and strengthens A Gas’ position as a global leader in environmentally responsible refrigerant lifecycle management.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada secondary refrigerants market based on the below-mentioned segments:

Canada Secondary Refrigerants Market, By Type

- Glycols

- Salt Brines

- Carbon Dioxide

- Others

Canada Secondary Refrigerants Market, By Application

- Commercial Refrigeration

- Industrial Refrigeration

- Heat Pumps

- Air Conditioning

- Others

FAQ

Q: What is the size and forecast of the Canadian secondary refrigerants market?

A: The market was valued at approximately USD 33.40 million in 2024 and is projected to grow to USD 62.64 million by 2035, exhibiting a CAGR of 6.75% during 2025-2035.?

Q: What types of secondary refrigerants are prominent in Canada?

A: Key types include glycols, salt brines, and carbon dioxide. Glycols held a substantial market share in 2024 due to their superior heat conductivity, low freezing temperature tolerance, and corrosion resistance, making them ideal for industrial refrigeration and HVAC applications.?

Q: What are the main application segments of secondary refrigerants?

A: Major applications encompass commercial refrigeration, industrial refrigeration, heat pumps, air conditioning, and others. The air conditioning segment held a significant share in 2024 and is expected to grow rapidly, driven by increasing energy constraints and the demand for sustainable cooling solutions.?

Q: What drives the growth of the Canadian secondary refrigerants market?

A: Growth drivers include stringent government regulations phasing out high global warming potential refrigerants, increasing demand for eco-friendly and energy-efficient refrigeration systems, expansion of cold chain logistics, food processing, and pharmaceutical industries. Technological advancements in heat transfer fluids and system components improve thermal performance and energy efficiency. Sustainability awareness and integration with renewable energy and smart IoT/AI-based systems further enhance market growth.?

Q: What challenges does the market face?

A: Challenges include high upfront costs, difficulties in retrofitting existing systems, fragmented regulations, lack of technical expertise, competition from alternative refrigerants, and concerns about efficiency.?

Q: Who are the key companies operating in Canada?

A: Leading companies include A-Gas International, Messer Canada, Freeze Co. Systems Ltd., ECODYNE Limited, Northern Green Tech, Maple Leaf Recovery Systems, and Canadian Eco Refrigerants.?

Q: What are recent notable developments?

A: In April 2025, A-Gas expanded Canadian operations by acquiring Refrigerant Services Inc. (RSI), reinforcing its leadership in environmentally responsible refrigerant management.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |