Canada Steel Pipe and Tubes Market

Canada Steel Pipe and Tubes Market Size, Share, and COVID-19 Impact Analysis, By Technology (Seamless, ERW, and SAW), By Application (Oil & Gas, Chemicals and Petrochemicals, Automotive & Transportation, Mechanical Engineering, Power Plant, Construction, and Others), and Canada Steel Pipe and Tubes Market Size Insights Forecasts to 2035

Report Overview

Table of Contents

Canada Steel Pipe and Tubes Market Size Insights Forecasts to 2035

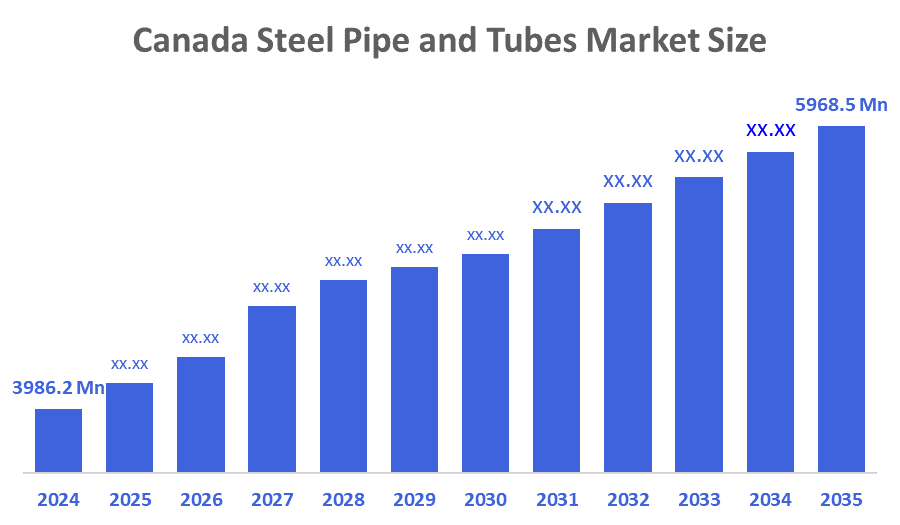

- The Canada Steel Pipe and Tubes Market Size Was Estimated at USD 3986.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.74% from 2025 to 2035

- The Canada Steel Pipe and Tubes Market Size is Expected to Reach USD 5968.5 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Canadian Steel Pipe and Tubes Market Size is anticipated to Reach USD 5968.5 Million by 2035, Growing at a CAGR of 3.74% from 2025 to 2035. The market is driven by due to a rise in mechanical engineering and pipeline installation projects. Welded tubes predominate in typical industrial and structural applications, while seamless pipes are mostly utilized in applications requiring extreme pressure.

Market Overview

The term steel pipes and tubes market refers to goods used in the manufacturing of steel pipes and tubes in several industries, including construction, oil and gas, automotive, and production. The market for steel pipes and tubes now has more opportunities due to the move toward renewable energy. Steel tubes are used for thermal conduction and structural purposes in solar thermal systems and wind turbines.

Canada imported 482 shipments of steel tubes and pipes during May 2024 to Apr 2025. These imports were supplied by 11 foreign exporters to 14 Canadian buyers, marking a growth rate of 165% compared to the preceding twelve months. In April 2025, 69 Steel tube pipes export shipments were made Worldwide to Canada.

The development of seamless pipe manufacture and the growing usage of steel pipes for infrastructure enhancement in emerging nations are examples of technological advancements. Additionally, the development of ecologically friendly steelmaking methods is being encouraged by growing demand from green practices and regulatory initiatives.

Canada’s Prime Minister Mark Carney announced new steps to protect Canada’s steel and lumber industries from US tariffs. To boost domestic demand, Ottawa cut steel import quotas for non-free trade agreement partners from 50% to 20% of 2024 levels, and imposed a 25% tariff on steel derivative products, such as wind towers, fasteners, and wires.

Report Coverage

This research report categorizes the market for the Canada steel pipe and tubes market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada steel pipe and tubes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada steel pipe and tubes market.

Driving Factors

The steel pipe and tubes market in Canada is driven by homes and businesses; steel pipes are used in the construction, oil and gas, automotive, and production industries, among others, to make steel pipes and tubes. In both commercial and private contexts, pipes made of steel pipes and tubes are used to transport liquids, gases, and solids. One of the main factors driving the steel pipe and tubes market in Canada is the rise in pipeline transportation projects and oil and gas exploration.

Restraining Factors

The steel pipe and tubes market in Canada is majorly restrained by the changes in prices for raw materials, especially scrap metal and iron ore, which are significant market constraints. Unstable demand from the energy sector and fluctuating hydrocarbon prices are two factors that have adversely affected the industry's performance. The industry's profit margin fluctuated throughout this time because to the disruption caused by unstable steel prices, which made it difficult for businesses to pass costs to consumers.

Market Segmentation

The Canadian steel pipe and tubes market share is categorised by technology and application.

- The seamless segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian steel pipe and tubes market is segmented by technology into seamless, ERW, and SAW. Among these, the seamless segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by their capacity to tolerate high temperatures and pressures, which makes them perfect for sectors like power generation, construction, and oil and gas. Their smooth structure guarantees dependability and longevity, which helps them maintain their leading position in the industry.

- The oil & gas segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Canadian steel pipe and tubes market is segmented into oil & gas, chemicals and petrochemicals, automotive & transportation, mechanical engineering, power plant, construction, and others. Among these, the oil & gas segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by its broad use in energy infrastructure initiatives. This market benefits from substantial investments made specifically for pipeline construction and maintenance, as well as a well-established supply chain.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada steel pipe and tubes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Salit Steel

- Boss Easy Clamp

- Global Steel

- Hallmark Tubulars Ltd

- Autotube

- Canpipe

- Imperial Steel Products

- CTS Industries Ltd

- Proline Pipe Equipment

- Westlund & Fusionex

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2025, Steelmakers Stelco and ArcelorMittal announced price increases on 5-6 November for their Canadian products. Both companies raised the price of their Canadian steel products by C$100/short ton, in letters sent to customers during the week. The price increases come after months of mounting concern about the state of the Canadian steel industry.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Canada Steel Pipe and Tubes Market based on the below-mentioned segments:

Canada Steel Pipe and Tubes Market, By Technology

- Seamless

- ERW

- SAW

Canada Steel Pipe and Tubes Market, By Application

- Oil & Gas

- Chemicals and Petrochemicals

- Automotive & Transportation

- Mechanical Engineering

- Power Plant

- Construction

- Others

FAQ’s

Q: What is the Canadian steel pipe and tubes market size?

A: The Canada Steel Pipe and Tubes Market size is expected to grow from USD 3986.2 million in 2024 to USD 5968.5 million by 2035, growing at a CAGR of 3.74% during the forecast period 2025-2035

Q: What a steel pipes and tubes, and their primary use?

A: The term steel pipes and tubes market refers to goods used in the manufacturing of steel pipes and tubes in several industries, including construction, oil and gas, automotive, and production. The shift toward renewable energy has created new opportunities for the steel pipes and tubes market. Wind turbines and solar thermal systems use steel tubes for structural and thermal conduction applications

Q: What are the key growth drivers of the market?

A: Market growth is driven by homes and businesses; steel pipes are used in the construction, oil and gas, automotive, and production industries, among others, to make steel pipes and tubes. In both commercial and private contexts, pipes made of steel pipes and tubes are used to transport liquids, gases, and solids.

Q: What factors restrain the Canadian steel pipe and tubes market?

A: The Market is restrained by the changes in prices for raw materials, especially scrap metal and iron ore, which are significant market constraints. Unstable demand from the energy sector and fluctuating hydrocarbon prices are two factors that have adversely affected the industry's performance

Q: How is the market segmented by technology?

A: The market is segmented into seamless, ERW, and SAW

Q: Who are the key players in the Canadian steel pipe and tubes market?

A: Key companies include Salit Steel, Boss Easy Clamp, Global Steel, Hallmark Tubulars Ltd, Autotube, Canpipe, Imperial Steel Products, CTS Industries Ltd, Proline Pipe Equipment, and Westlund & Fusionex.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Pages | 164 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |