Canada Veterinary DNA Testing Market

Canada Veterinary DNA Testing Market Size, Share, and COVID-19 Impact Analysis, By Sample Type (Blood, Saliva, Semen, and Others), By Test Type (Breed Profile, Genetic Diseases, Health and Wellness), and Canada Veterinary DNA Testing Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Canada Veterinary DNA Testing Market Insights Forecasts to 2035

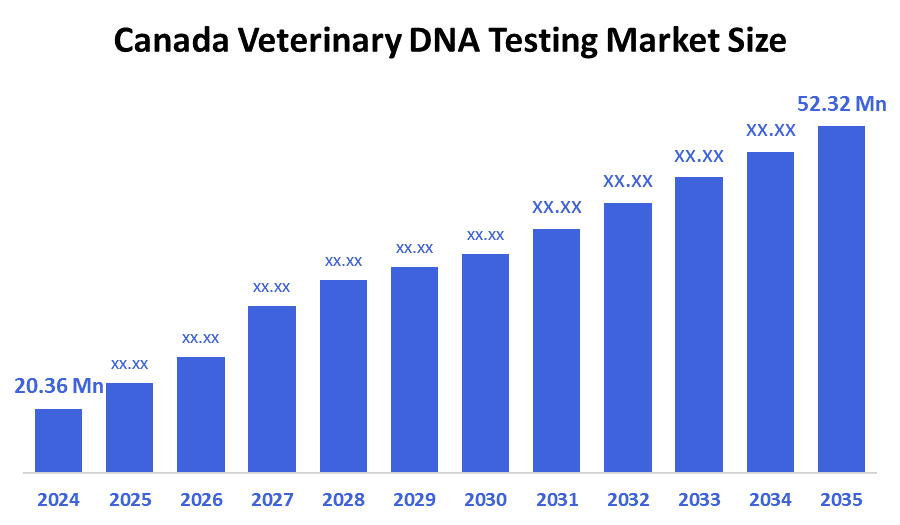

- The Canada Veterinary DNA Testing Market Size was estimated at USD 20.36 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.96% from 2025 to 2035

- The Canada Veterinary DNA Testing Market Size is Expected to Reach USD 52.32 Million by 2035

According to a research report published by decision advisor and Consulting, the Canada Veterinary DNA Testing Market is anticipated to reach USD 52.32 million by 2035, growing at a CAGR of 8.96 % from 2025 to 2035. The market is growing as a result of a number of factors, including the growing number of pets with different genetic backgrounds, the growing interest in personalised pet healthcare, the growing awareness among pet owners of the advantages of DNA testing, and the cooperation between geneticists and veterinary professionals.

Market Overview

The market for veterinary DNA testing in Canada is the industry of animal health diagnostics that employs DNA-based technologies to find genetic characteristics, illnesses, ancestry, and breed-specific hazards in livestock and companion animals. Analysing an animal's genetic material to learn more about its breed, ancestry, and possible health risks is known as pet DNA testing. It executes by taking a tiny sample of the pet's DNA, which is frequently obtained from a blood sample or saliva swab. The breed composition of the pet and possible genetic health markers is then ascertained by sequencing the DNA and comparing it to an extensive database of genetic markers. Breed identification, which shows the mix of breeds in a pet's lineage, and health screening, which offers information on genetic health risks and predispositions, are the two primary forms of pet DNA testing that allow for proactive veterinary care. In February 2025, the Canadian government formally unveiled the Canadian Genomics Strategy (CGS), which aims to use genomics to boost economic growth, commercialisation, and innovation. Initiated the Canadian Genomics Strategy, supported by a $175.1 million federal investment spread across seven years, beginning in 2024–2025. The Strategy will improve Canada's capacity to apply genomics research in important industries.

Report Coverage

This research report categorises the market for the Canada veterinary DNA testing market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada veterinary DNA testing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada veterinary DNA testing market.

Driving Factors

The market for veterinary DNA testing in Canada is growing rapidly due to several important factors, such as the demand for genetic testing services to guarantee pet health, breed identification, and the prevention of hereditary diseases has increased with pet ownership. Early disease detection and individualised healthcare through DNA testing are encouraged by growing veterinarian and pet owner awareness of genetic health risks. Moreover, technological developments like AI-driven analytics and next-generation sequencing have increased test affordability, accessibility, and accuracy, which has increased consumer adoption. Pet owners can now invest more in high-end health services owing to rising disposable incomes, and market reach is increased by growing distribution through veterinary clinics and online sales, which boost the market expansion.

Restraining Factors

Despite encouraging growth, the Canadian veterinary DNA testing market is subject to significant restraining factors, such as adoption and affordability being restricted by the high expenses of comprehensive genetic panels and sophisticated DNA sequencing technologies. Strict regulatory and approval procedures for novel genetic tests frequently result in product launch delays and restrict market access for creative solutions.

Market Segmentation

The Canada Veterinary DNA Testing market share is classified into sample type and test type.

- The blood segment held a significant share in 2024 and is projected to grow at a rapid pace during the forecast period.

The Canada veterinary DNA testing market is segmented by sample type into blood, saliva, semen, and others. Among these, the blood segment held a significant share in 2024 and is projected to grow at a rapid pace during the forecast period. This is because blood samples are more accurate and reliable for intricate genetic analyses; there is a growing need for them in pet DNA testing. In contrast to saliva, which can be tainted by food or infections, blood samples have more stable and concentrated DNA. Further, blood is a preferred option for precise health diagnostics and advanced screenings linked to hereditary diseases, especially in clinical settings.

- The health and wellness segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada veterinary DNA testing market is segmented by test type into breed profile, genetic diseases, health and wellness. Among these, the health and wellness segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. There is an increasing need about the breeds, characteristics, and possible health risks of their pets, and pet owners are becoming more and more interested in pet DNA testing. Further, encourages early preventive care and aids in predicting size, temperament, and exercise requirements.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada veterinary DNA testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HealthGene Corp.

- Labgenvet

- Biovet Inc

- Prevtec Microbia

- IDEXX Canada

- Others

Recent Developments:

- In June 2025, the launch of the Catalyst Cortisol Test, IDEXX Laboratories provided veterinarians with a quick in-clinic tool to identify and treat canine endocrine disorders such as Cushing's syndrome and Addison's disease. Additionally, the tool has monitoring features that enable patients with Cushing's syndrome to receive customised treatment adjustments.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035.decision advisor has segmented the Canada Veterinary DNA Testing Market based on the below-mentioned segments:

Canada Veterinary DNA Testing Market, By Sample Type

- Blood

- Saliva

- Semen

- Others

Canada Veterinary DNA Testing Market, By Test Type

- Breed Profile

- Genetic Diseases

- Health and Wellness

FAQ

- What was the market size of the Canada Veterinary DNA Testing Market in 2024?

The market size was estimated at USD 20.36 million in 2024.

- What is the expected growth rate for the market?

The market is expected to grow at a CAGR of 8.96% from 2025 to 2035.

- What is the projected market size by 2035?

The market is anticipated to reach USD 52.32 million by 2035.

- What sample types are included in the market segmentation?

The market segments by sample type include blood, saliva, semen, and others.

- What types of tests are offered in the market?

Test types include breed profile, genetic diseases, and health and wellness.

- What factors are driving the market growth?

Growth is primarily driven by increasing pet ownership with diverse genetics, rising awareness among pet owners about the benefits of genetic testing, collaborations between geneticists and veterinarians, technological advances like AI-driven analysis and next-generation sequencing, and enhanced distribution through clinics and online channels.

- Who are the leading companies in this market?

Key players include HealthGene Corp., Labgenvet, Biovet Inc., Prevtec Microbia, and IDEXX Canada.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 167 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |