Global Carbon Dioxide Market

Global Carbon Dioxide Market Size, Share, and COVID-19 Impact Analysis, By Source (Hydrogen, Ethyl Alcohol, Ethylene Oxide, Substitute Natural Gas, Other Sources), By Application (Food & Beverage, Oil & Gas, Medical, Rubber, Firefighting, Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Carbon Dioxide Market Summary

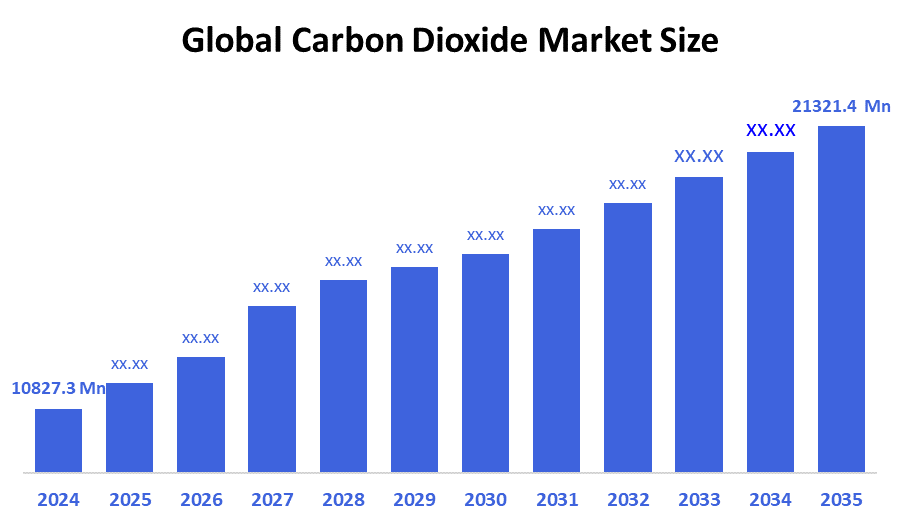

The Global Carbon Dioxide Market Size Was Estimated at USD 10827.3 Million in 2024 and is Projected to Reach USD 21321.4 Million by 2035, Growing at a CAGR of 6.35% from 2025 to 2035. The market for carbon dioxide is expanding as a result of increased demand in the fields of food processing, beverage carbonation, medicine, industry, enhanced oil recovery, and green and sustainable technologies.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 41.4% and dominated the market globally.

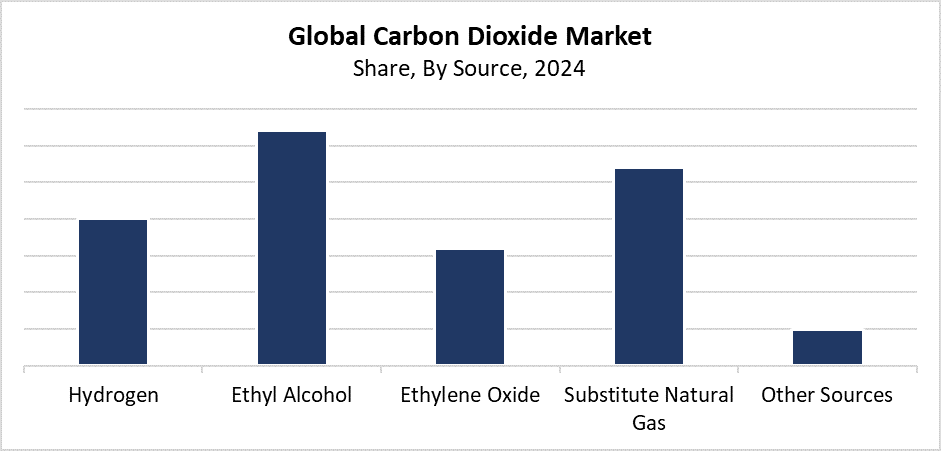

- In 2024, the ethyl alcohol segment had the highest market share by source, accounting for 32.3%.

- In 2024, the food and beverage segment had the biggest market share by application, accounting for 40.6%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 10827.3 Million

- 2035 Projected Market Size: USD 21321.4 Million

- CAGR (2025-2035): 6.35%

- North America: Largest market in 2024

The Carbon dioxide market encompasses worldwide trading operations and uses of carbon dioxide across industrial sectors, including oil and gas, food and beverage, healthcare, and chemical applications. Carbon dioxide serves multiple functions in water treatment systems and also keeps food fresh through refrigeration and adds bubbles to beverages while protecting welds during metal joining. The market experiences steady expansion because industries need more CO? and new applications emerge for fire suppression and enhanced oil recovery (EOR). The worldwide focus on sustainability and waste reduction drives growing interest in treating CO? as an industrial value instead of merely waste material.

The CO? market experiences a significant transformation through recent technological advancements in carbon capture, utilization, and storage systems. The environment benefits from reduced environmental impact as supply options grow through progress in direct air collection and bio-based CO? synthesis and liquefaction, and transportation methods. The worldwide governments show their support for these projects through their financial backing and regulatory support, which targets greenhouse gas emission reduction. The Paris Climate Accord, along with other global agreements, pushes industries to adopt low-carbon technologies by creating a growing market for CO? in advanced manufacturing processes, building materials, and synthetic fuel production.

Source Insights

The ethyl alcohol segment led the carbon dioxide (CO?) market with the largest revenue share of 32.3% in 2024. Ethyl alcohol production through fermentation generates substantial amounts of CO?, which becomes the primary reason for this market dominance. Ethanol plants, especially those processing biofuel, use their captured purified carbon dioxide for industrial applications spanning chemical production and medicinal and food, and beverage manufacturing. The market leader emerges from the easy access to fermentation plants along with affordable CO? extraction from this production method. The growing worldwide ethanol production stemming from renewable energy initiatives and biofuel market expansion enables the development of ethyl alcohol-based CO? production.

During the expected timeframe, the substitute natural gas (SNG) segment of the carbon dioxide (CO?) market is projected to grow at a significant CAGR. The expanding use of cleaner energy sources, together with synthetic fuels and mounting environmental concerns together with government mandates for greenhouse gas reduction, drive this market growth. Gasification of coal, biomass, or other feedstocks through SNG production results in CO? as a secondary product. Modern advancements in carbon capture systems, together with gasification technology, enable industries to efficiently extract and utilize increasing amounts of CO?. The increasing investments in renewable energy infrastructure, together with worldwide initiatives for low-carbon energy solutions, are accelerating the expansion of the SNG segment within the CO? market.

Application Insights

The food and beverage industry held the largest revenue share of 40.6% in 2024 and led the carbon dioxide (CO?) market. This industry dominates because CO? serves multiple roles in food processing operations and packaging preservation, as well as beverage carbonation for both soft drinks and alcoholic products. The preservation of perishable products requires CO? applications to extend their shelf life and maintain their freshness while ensuring their safety. High-purity food-grade CO? demand has skyrocketed because consumers worldwide prefer packaged foods and convenience products, while carbonated beverage sales continue to grow, especially in developing markets. The segment maintains its leading position because the food industry continues to adopt modified atmosphere packaging (MAP) techniques at an increasing rate.

The medical segment of the carbon dioxide (CO?) market is anticipated to grow at the fastest CAGR during the forecast period. Medical applications of CO? are experiencing rising demand because the gas serves multiple purposes, including insufflation in minimally invasive techniques and respiratory stimulation during surgeries and gas mixture component. The expanding elderly population, alongside rising chronic disease rates and increasing demand for sophisticated healthcare services, drives this segment's fast expansion. Medical technology improvements combined with worldwide growth in surgical operations continue to drive increasing CO? requirements within healthcare facilities.

Regional Insights

North America leads the carbon dioxide (CO?) market by securing the largest revenue share of 41.4% during 2024. The established industrial network of the region, along with high food and beverage processing consumption and extensive enhanced oil recovery (EOR) operations with CO? usage, explains this market dominance. The market thrives because of strong CO2 production and delivery infrastructure alongside advanced CCU technology and key market leaders. The medical along with chemical, and wastewater treatment sector growth adds to the significant CO? application within this region. Various government initiatives throughout North America that promote sustainable practices, together with carbon management, drive both investment and innovation in CO?-related applications.

Asia Pacific Carbon Dioxide Market Trends

The Asia Pacific region experiences substantial growth in its carbon dioxide (CO?) market because of expanding industrial requirements from chemicals and food & beverage sectors, along with healthcare development and rapid urban and industrial expansion. The requirement for food-grade CO? continues to grow because of increasing sales of packaged and carbonated products, primarily in developing countries such as China and India. The area has witnessed growing demand for CO? because of its expanding usage in water treatment processes and medical applications. The growth of industry receives support from environmental policies that enforce carbon capture programs and government initiatives that promote carbon storage and utilization. The rising CO? demand in the Asia Pacific stems from investments directed toward sustainable manufacturing alongside clean energy development and industrial gas infrastructure expansion.

Europe Carbon Dioxide Market Trends

The European carbon dioxide (CO?) market experiences constant growth because the chemical industry, together with food and beverage businesses and healthcare services, requires high volumes of this gas. The adoption of advanced CCUS technologies by Europe depends on its strict environmental rules, together with its sustainability focus. The rising availability of captured CO? enables its application in enhanced oil recovery and synthetic fuel creation, together with other industrial purposes. The increasing preference for packaged goods and fizzy drinks strengthens market demand. The growth of environmentally friendly CO? production methods receives support through funding for green technologies and circular economy initiatives. European CO? market growth and innovation result from governmental policies that aim to decrease carbon emissions and provide support for renewable energy systems.

Key Carbon Dioxide Companies:

The following are the leading companies in the carbon dioxide market. These companies collectively hold the largest market share and dictate industry trends.

- Acail Gas

- Quimetal

- Linde AG

- Air Liquide

- Sicgil India Limited

- Greco Gas Inc.

- Messer Group

- Air Sources and Chemicals, Inc.

- SOL Group

- Taiyo Nippon Sanso Corporation

- Others

Recent Developments

- In April 2025, Air Liquide is actively promoting market expansion by participating in the Porthos CO? Transportation and Storage Project in Rotterdam, the biggest industrial port in Europe. Air Liquide, one of the major industrial partners, is reducing CO2 emissions by 50% at its hydrogen production in Rozenburg by utilizing its CRYOCAP carbon capture technology. Up to 2.5 million tonnes of CO? will be captured, transported, and stored annually in depleted gas fields beneath the North Sea as a result of the public-private Porthos effort. This amount can be increased to 10 million tonnes. For the first time in Europe, CO? will be kept in a reservoir of this kind. Air Liquide is aiding the region's transition to low-carbon industrial operations and decarbonizing hard-to-abate industries by utilizing its expertise in carbon capture and storage (CCS). This is in line with the EU's objective of becoming carbon neutral by 2050.

- In April 2023, ExxonMobil and Linde have signed a long-term contract for the off-take and long-term storage of up to 2.2 million metric tons of CO? per year from the latter's planned clean hydrogen Sourceion project in Beaumont, Texas, which is expected to begin operations in 2025. Linde's supply of low-carbon hydrogen to OCI Global's blue ammonia plant and other industrial users throughout the U.S. Gulf Coast is supported by this CO? capture. With ExxonMobil serving as the storage supplier, the agreement demonstrates the growing momentum in carbon capture and storage (CCS). As CCS becomes a key component of emission reduction plans, this partnership makes a substantial contribution to the decarbonization of industrial processes, which is a noteworthy development in the carbon dioxide business.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the carbon dioxide market based on the below-mentioned segments:

Global Carbon Dioxide Market, By Source

- Hydrogen

- Ethyl Alcohol

- Ethylene Oxide

- Substitute Natural Gas

- Other Sources

Global Carbon Dioxide Market, By Application

- Fruit & Vegetables

- Oil & Gas

- Medical

- Rubber

- Firefighting

- Other Applications

Global Carbon Dioxide Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |