Global Carbon Fiber Reinforced Plastic Market

Global Carbon Fiber Reinforced Plastic Market Size, Share, and COVID-19 Impact Analysis, By Material (PAN-based, Pitch-based), By Product (Thermosetting, Thermoplastic), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Carbon Fiber Reinforced Plastic Market Summary

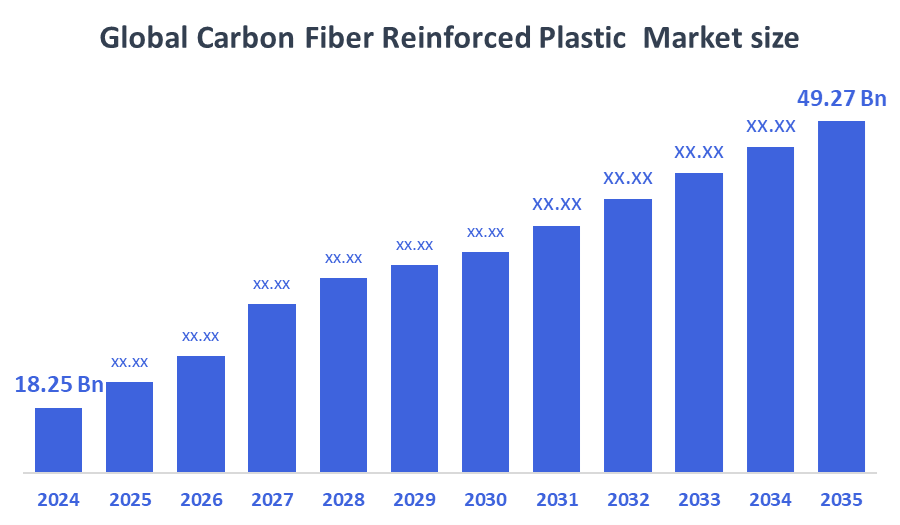

The Global Carbon Fiber Reinforced Plastic Market Size Was Estimated at USD 18.25 Billion in 2024 and is Projected to Reach USD 49.27 Billion by 2035, Growing at a CAGR of 9.45% from 2025 to 2035. The market for carbon fiber reinforced plastic (CFRP) is expanding due to the need for lightweight, high-strength materials in the wind energy, automotive, and aerospace industries, as well as improvements in manufacturing techniques and a growing emphasis on sustainability and fuel economy.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 35.47% and dominated the market globally.

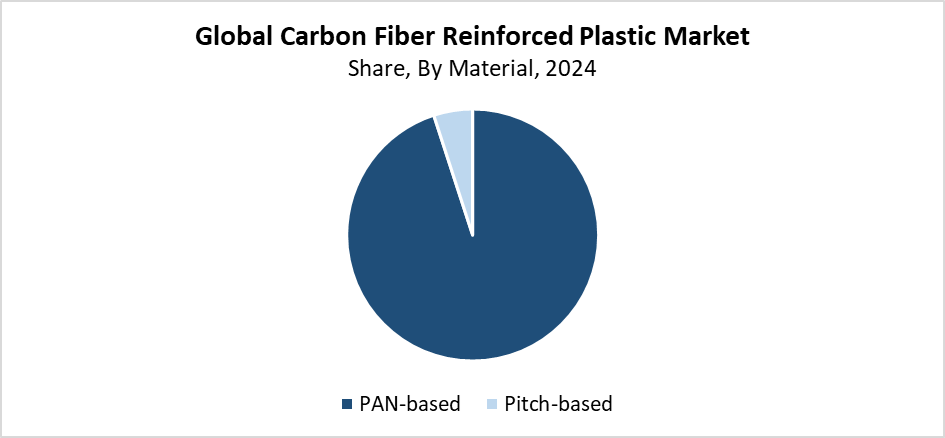

- In 2024, the PAN-based segment had the highest market share and led the market by material, accounting for 95.12%.

- In 2024, the thermosetting CFRP segment had the biggest market share and led the market by product, accounting for 73.15%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 18.25 Billion

- 2035 Projected Market Size: USD 49.27 Billion

- CAGR (2025-2035): 9.45%

- North America: Largest market in 2024

- Europe: Fastest growing market

The carbon fiber reinforced plastic market operates as the industry that develops and implements composite materials, which consist of carbon fiber reinforcement in polymer matrices. The wind energy industry, together with sports equipment manufacturing and automotive, aerospace, and construction industries, is increasingly adopting CFRPs because these materials offer outstanding weight-to-strength ratios as well as corrosion resistance properties. The increasing requirement for lightweight materials that boost fuel economy and reduce emissions, specifically in automotive and aerospace sectors, serves as the primary driver for market expansion. The expanding market of electric vehicles, which require weight reduction for better range performance, also contributes to the market growth. The demand for high-performance energy-efficient materials such as CFRP continues to rise because of more stringent emission standards and rising environmental sustainability consciousness.

Technological developments, including automation and resin transfer molding (RTM), together with 3D printing, have significantly improved CFRP manufacturing operations by decreasing production time and expenses. These technological advancements have made CFRP more affordable for widespread market applications. The worldwide adoption of sustainable materials receives support from governments through regulations that promote low-emission technology and research funding, and financial incentives. Advanced composites receive support from U.S. and EU programs, which focus on carbon neutrality through their energy and transportation sectors. The CFRP market growth receives strong and sustained momentum through initiatives that come from both public organizations and private entities.

Material Insights

The PAN-based segment held the largest market share of 95.12% and dominated the carbon fiber reinforced plastic (CFRP) market in 2024. The mechanical properties of PAN-based carbon fibers, including stiffness along with high tensile strength and thermal stability, make them popular among users. The qualities of these materials make them suitable for high-demand applications across wind energy, automotive, and aerospace sectors. The acceptance of PAN fibers has expanded because of new manufacturing techniques and improved precursor processing methods that produce better quality fibers at lower costs. The worldwide demand for lightweight fuel-efficient solutions finds support from the high strength-to-weight ratio of CFRP materials based on PAN. Industries that focus on performance and efficiency continue to depend on PAN-based CFRPs for their unmatched market dominance and broad application range.

During the forecast period, the pitch-based segment of the carbon fiber reinforced plastic (CFRP) market is expected to grow at a significant CAGR. The special properties of pitch-based carbon fibers, including their high modulus, excellent thermal conductivity, and outstanding dimensional stability, lead to their market expansion. The excellent properties of pitch-based carbon fibers enable them to serve specialized applications in electronics, high-performance sporting goods, aircraft, and defense. The rising popularity of pitch-based CFRPs emerges from growing requirements for modern materials in structural components, thermal management systems, and satellite structures. The processing technology improvements lead to lower costs and broader accessibility of pitch-based carbon fibers. The market shows strong growth potential because of rising interest in high-performance materials and innovative material development.

Product Insights

The thermosetting CFRP segment dominated the carbon fiber reinforced plastic market by holding the largest revenue share of 73.15% in 2024. Thermosetting resins such as epoxy, polyester, and vinyl ester find wide application due to their outstanding mechanical properties together with thermal stability and chemical resistance, and fatigue resistance. The properties of thermosetting CFRPs make them ideal for demanding applications within the automotive, marine, and aerospace sectors. The broad availability of filament winding and resin transfer molding (RTM) processing methods supports their widespread adoption. Structural components depend on thermosetting composites because these materials provide exceptional load-bearing capacity along with long-term durability. The industry continues to favor thermosetting CFRPs as the primary material because strong, lightweight materials remain in high demand.

The thermoplastic CFRP segment is anticipated to grow at a significant CAGR because it offers superior recyclability and faster processing times, and stronger impact resistance when compared to thermosetting composites. The reheatable and reshapable nature of thermoplastic CFRPs makes them ideal for high-volume manufacturing needs, particularly in consumer electronics and automotive sectors. The growing demand for sustainable materials with extended durability and reduced weight has driven thermoplastic composite adoption. Modern automated manufacturing techniques, including 3D printing and automated fiber placement (AFP), have enabled efficient production of complex thermoplastic CFRP components. Businesses across different sectors are projected to drive substantial growth in the thermoplastic market because they need fast solutions that minimize environmental impact while maintaining product performance standards.

Regional Insights

North America led the worldwide carbon fiber reinforced plastic (CFRP) market with 37.42% revenue share during 2024. The aerospace and defense industries, together with automotive businesses, serve as the primary push factors because they need lightweight materials that deliver high strength. Leading companies across the region continue to allocate funds toward modern composite technology development and expanded manufacturing capabilities. The increasing usage of CFRP materials is supported by the expanding market for sustainable energy technologies such as wind turbines and automotive fuel efficiency solutions. The market growth receives additional support from government initiatives for renewable energy and research funding dedicated to advanced material development. The leading position of North America in the CFRP market stems from its robust industrial infrastructure combined with a skilled workforce and constant technological progress.

Europe Carbon Fiber Reinforced Plastic Market Trends

The European Carbon Fiber Reinforced Plastic (CFRP) market is expected to grow at the fastest CAGR because of the increasing demand for lightweight high-performance materials across wind energy, construction, automotive, and aerospace sectors. CFRPs receive manufacturer adoption support from strict EU carbon emission standards because these materials help improve fuel efficiency and reduce environmental impact. The region contains major aerospace and automotive companies that dedicate substantial resources to developing advanced composite materials to achieve better performance and structural enhancements. The ongoing research and development activities receive support from government funding and innovation programs, which drive material innovation and application.

Asia Pacific Carbon Fiber Reinforced Plastic Market Trends

The Asia Pacific Carbon Fiber Reinforced Plastic (CFRP) market is growing significantly because of the developing automotive and aerospace sectors, along with construction and wind energy industries across China, Japan, South Korea, and India. A vital expanding component stems from the increasing requirement for high-performance materials, which help lower emissions while enhancing fuel efficiency. The growing electric vehicle market, together with renewable energy investments and infrastructure development, drives the adoption of CFRP. The area benefits from three important factors, which include its strong manufacturing base alongside decreased production costs, as well as government initiatives that promote sustainable technology, together with advanced materials. The Asia Pacific region has emerged as a major CFRP market contributor and will experience substantial growth due to its industrial growth, supportive regulations, and developing technology base.

Key Carbon Fiber Reinforced Plastic Companies:

The following are the leading companies in the carbon fiber reinforced plastic market. These companies collectively hold the largest market share and dictate industry trends.

- DowAksa

- Hyosung Corporation

- Teijin Limited

- SGL Group

- Mitsubishi Rayon Co., Ltd.

- Toray Industries, Inc.

- Cytec Solvay Group

- Gurit Holding AG

- Hexcel Corporation

- Others

Recent Developments

- In March 2025, the Mercedes-AMG PETRONAS Formula 1 Team declared that they would qualify for the 2025 season and build their W16 race car using cutting-edge sustainable carbon fiber composites. This was the first time Formula 1 would use sustainable carbon fiber. Integrating these environmentally friendly materials without sacrificing functionality or security was the aim. The fibers and resin system components are both used in the composites, which comprise roughly 75% of the car's material. The team is working on projects that address each component.

- In September 2024, Union Textiles of India declared that, in contrast to its present complete reliance on imports from the US, France, Japan, and Germany, India would start producing carbon fiber domestically by 2025–2026. This is a crucial strategic move because the European Union intends to tax carbon-intensive imports in 2026 as part of its Carbon Border Adjustment Mechanism.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the carbon fiber reinforced plastic market based on the below-mentioned segments:

Global Carbon Fiber Reinforced Plastic Market, By Material

- PAN-based

- Pitch-based

Global Carbon Fiber Reinforced Plastic Market, By Product

- Thermosetting CFRP

- Thermoplastic CFRP

Global Carbon Fiber Reinforced Plastic Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |