Global Cardiac Surgery Instruments Market

Global Cardiac Surgery Instruments Market Size, Share, and COVID-19 Impact Analysis, By Product (Forceps, Clamps, Graspers, Scissors, Needle Holder, Others), By Application (Coronary Artery Bypass Grafting, Heart Valve Surgery, Pediatric Cardiac Surgery, Heart Transplant, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Cardiac Surgery Instruments Market Summary

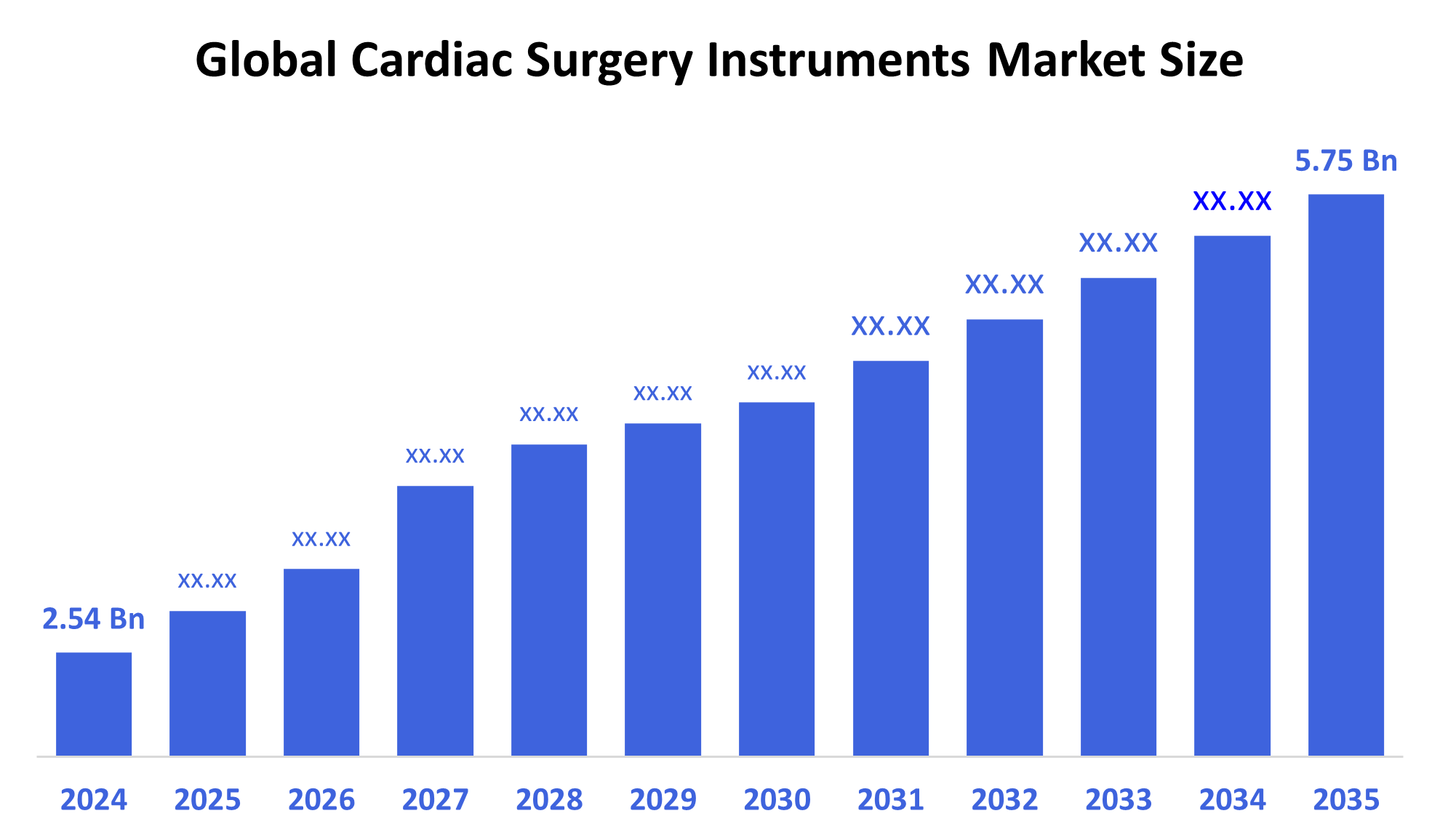

The Global Cardiac Surgery Instruments Market Size Was Estimated at USD 2.54 Billion in 2024 and is Projected to Reach USD 5.75 Billion by 2035, Growing at a CAGR of 7.71% from 2025 to 2035. The market for cardiac surgery instruments is expanding due to rising rates of cardiovascular disease, population aging, technological advancements, an increase in surgical procedures, improved healthcare infrastructure, and increased awareness of early cardiac intervention.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 47.28% and dominated the market globally.

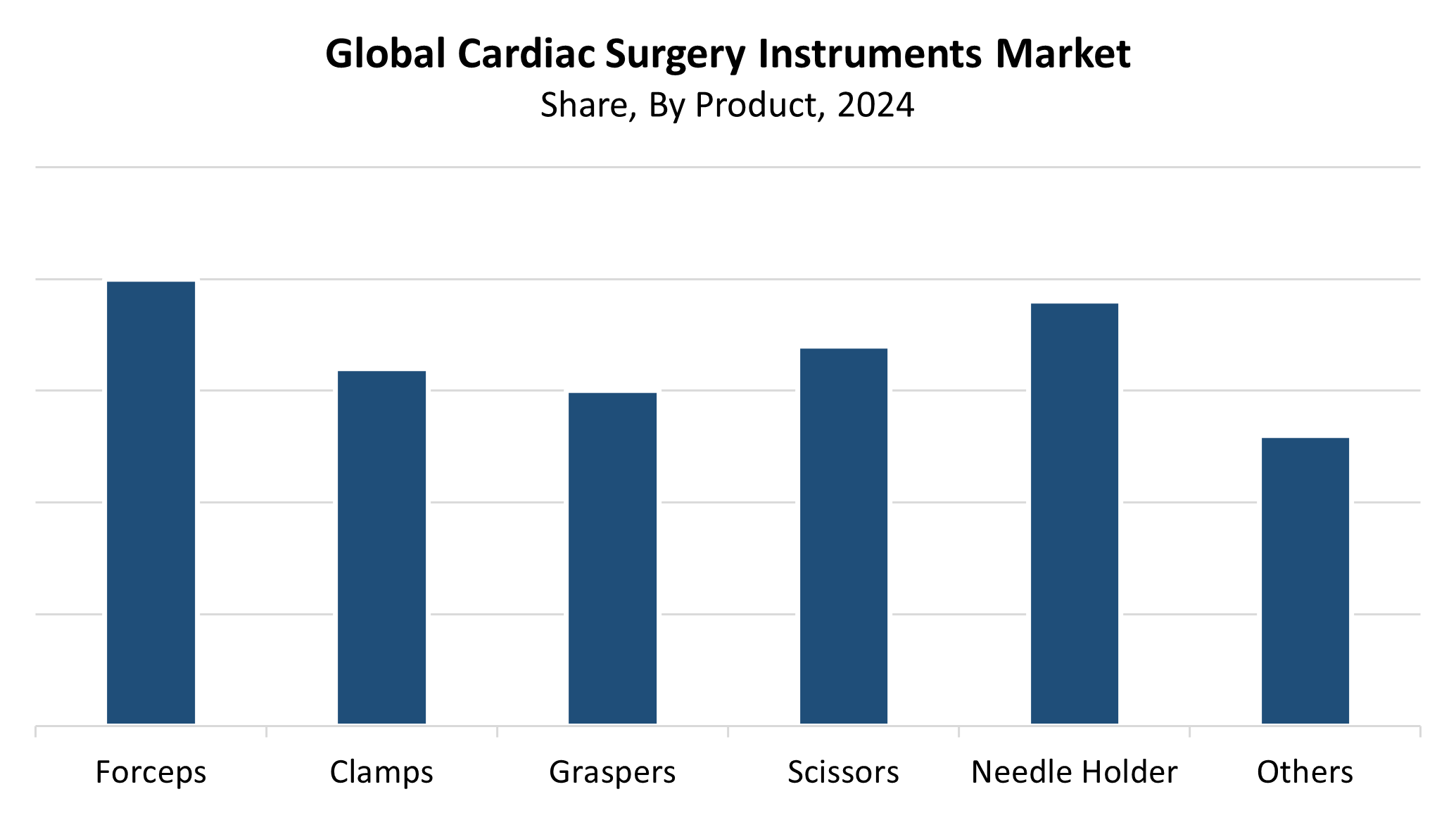

- In 2024, the forceps segment had the highest market share by product, accounting for 20.92%.

- In 2024, the coronary artery bypass grafting segment had the biggest market share by application, accounting for 30.83%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.54 Billion

- 2035 Projected Market Size: USD 5.75 Billion

- CAGR (2025-2035): 7.71%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market for cardiac surgery instruments comprises various instruments that surgeons use to treat heart diseases, including congenital heart defects, as well as heart valve issues and coronary artery disease. These tools exist to provide surgeons with precise control and accuracy throughout intricate cardiac operations and include forceps as well as scissors, clamps, retractors, and needle holders. The market growth primarily results from increasing surgical procedure counts and the growing elderly population, who face higher risks of heart disease, and the worldwide increase in cardiovascular disease occurrences. The healthcare market expands due to improved healthcare access and rising disease detection awareness, as well as escalating healthcare expenses.

Technology shapes the cardiac surgery instrument market in major ways. Modern technological progress, including robot-assisted surgical tools, minimally invasive surgical systems, and advanced imaging devices, continues to improve surgical outcomes and speed up patient recovery. The worldwide healthcare infrastructure investment, along with cardiovascular disease prevention initiatives, including research support and treatment discount programs, has become widespread. Medical programs that unite public and private entities push modern surgical methods and tools forward, which causes the cardiac surgery instrument market to grow consistently across both developed and developing nations.

Product Insights

The forceps segment dominates the cardiac surgery instruments market with the largest revenue share of 20.92% in 2024. Cardiac procedures require forceps instruments to perform exact tissue gripping and holding, and precise manipulation of surgical tissues. The widespread adoption of forceps instruments stems from their essential role in minimizing tissue damage while enhancing surgical precision. The segment's growth derives from increasing numbers of heart surgeries using both traditional and minimally invasive methods, together with the growing demand for specialized surgical tools. The market leadership of forceps instruments has been strengthened through enhancements in their ergonomic design, together with improved material strength, which provides surgeons with better comfort during procedures. The market dominance of high-quality forceps persists because hospitals and surgical centers maintain them as their number one priority in product-based environments.

The needle holder segment of the cardiac surgery instruments market is anticipated to grow at a significant CAGR throughout the forecasted period, because of its essential function in maintaining accuracy during suturing procedures of sensitive cardiac surgeries. The needle holders provide surgeons with the precise control and firm grip needed for both open-heart surgeries and minimally invasive procedures. The worldwide growth of cardiac procedures, along with enhanced surgical techniques, pushes demand for high-performance needle holders with ergonomic designs. The market growth of needle holders accelerates because manufacturers develop new materials and locking systems, and robotic surgical system compatibility. This growing preference will propel the segment toward substantial expansion throughout the next several years.

Application Insights

The coronary artery bypass grafting (CABG) segment held the largest revenue share of 30.83% and led the cardiac surgery instruments market. As one of the most widely performed cardiac operations worldwide, CABG serves as a treatment for severe coronary artery disease by enhancing the heart's blood flow. The increasing number of coronary artery disease patients stems from lifestyle-based risk factors, which include smoking alongside obesity, diabetes, and hypertension. The rising cases of coronary artery disease have created a growing need for CABG procedures. The increasing need for high-precision surgical instruments has emerged as a direct result of the situation. The segment's market dominance remains strong because the increasing adoption of specialized tools has been made possible through improved surgical techniques and the growing popularity of minimally invasive CABG procedures.

During the projected timeframe, the cardiac surgery instruments market's heart valve surgery segment is anticipated to grow at the fastest CAGR. The rising number of valvular heart diseases, including mitral regurgitation and aortic stenosis, particularly affects elderly patients, which drives this market expansion. The demand for precise and specialized tools for these treatments has surged significantly because of surgical technique advancements, including transcatheter and minimally invasive valve replacement and repair. The rising awareness about heart valve conditions, along with improved diagnostic methods and better patient results is driving more patients to undergo elective heart valve procedures. The rapid growth of this segment will be driven by healthcare systems expanding advanced cardiac care access, which leads to increased adoption of innovative surgical tools in heart valve procedures.

Regional Insights

North America led the cardiac surgery instruments market globally, with the largest revenue share of 47.28% in 2024. The market leadership of this region stems from its high cardiovascular disorder rates combined with its early use of advanced surgical equipment and established medical facilities. The presence of major medical device manufacturers and significant research and development investments has driven the development of advanced surgical equipment, together with innovative solutions. The market sustains its demand through increasing cardiac surgery occurrences and aging populations, and enhanced awareness about heart wellness. The worldwide market leader position of North America for cardiac surgical tools depends heavily on reimbursement frameworks as well as governmental support programs for cardiac healthcare.

Europe Cardiac Surgery Instruments Market Trends

The European market for cardiac surgery instruments will experience substantial growth throughout the forecast period, because the aging population faces higher heart disease risks and the prevalence of cardiovascular conditions continues to climb. The demand for advanced cardiac surgical devices has grown because medical professionals focus on improved surgical outcomes, while robotic technologies and less invasive surgical methods gain popularity. The market growth derives from supportive government programs along with better healthcare systems and rising healthcare investments in leading European countries. The development of new medical technologies grows because leading academic research facilities exist alongside qualified cardiac surgeons. The region's surgical procedure volume will increase steadily because patients and professionals are adopting early cardiac intervention practices, which will drive sustained market growth throughout the forecast period.

Asia Pacific Cardiac Surgery Instruments Market Trends

The Asia Pacific cardiac surgery instruments market is anticipated to grow at the fastest CAGR during the forecast period because of the developing healthcare facilities in developing countries, as well as increasing medical service requirements. The increasing rates of cardiovascular diseases throughout the region stem from urbanization, together with lifestyle changes and elevated occurrences of diabetes and hypertension. Medical tourism growth in Chinese, Indian, and Thai regions, together with rising awareness about heart disease detection and treatment methods, drives the demand for advanced cardiac surgical procedures. The market expands because governmental healthcare initiatives combine with increased investments in surgical equipment alongside hospital development. Asia Pacific has emerged as a key development hub for worldwide cardiac surgery device markets.

Key Cardiac Surgery Instruments Companies:

The following are the leading companies in the cardiac surgery instruments market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun Melsungen AG

- Delacroix-Chevailer

- Sklar Corporation

- KLS Martin Group.

- Surtex Instruments Limited

- Murray Surgical

- Medline Industries, Inc.

- Wexler Surgical

- Scanlan International

- STILLE

- Teleflex Incorporated

- BD

- Others

Recent Developments

- In November 2023, at MEDICA 2023, Surtex Instruments unveiled the Infinex microsurgery line, which includes precision scissors, diamond-dusted forceps, and needle holders that improve durability, grip, and stability. For cardiovascular and neurovascular operations, the Magna, Maestro, and Onyx collections blend artistry with cutting-edge coatings.

- In May 2022, Cardiac Services announced a partnership with Wexler Surgical to expand its surgical instrument portfolio. The collaboration introduced a wide range of cardiovascular and thoracic instruments, including clamps, forceps, needle holders, scissors, and retractors. The initiative emphasized quality, customization, and enhanced surgeon support through repair services and trial offerings

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cardiac surgery instruments market based on the below-mentioned segments:

Global Cardiac Surgery Instruments Market, By Product

- Forceps

- Clamps

- Graspers

- Scissors

- Needle Holder

- Others

Global Cardiac Surgery Instruments Market, By Application

- Coronary Artery Bypass Grafting

- Heart Valve Surgery

- Pediatric Cardiac Surgery

- Heart Transplant

- Others

Global Cardiac Surgery Instruments Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 235 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |