Global Cat Therapeutic Diet Market

Global Cat Therapeutic Diet Market Size, Share, and COVID-19 Impact Analysis, By Indication (Renal Care, Obesity Care, Diabetic Care, Dental Care, Gastrointestinal Care, Recovery Care, Joint Care, Oncology Care, Others), By Distribution Channel (E-commerce, Veterinary hospitals & clinics, Retail Pharmacies, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Cat Therapeutic Diet Market Size Summary

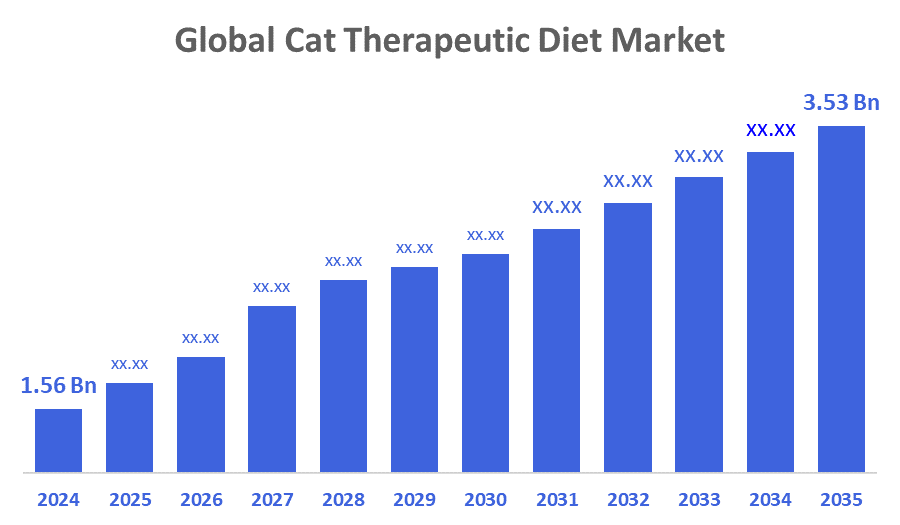

The Global Cat Therapeutic Diet Market Size Was Estimated at USD 1.56 Billion in 2024 and is Projected to Reach USD 3.53 Billion by 2035, Growing at a CAGR of 7.71% from 2025 to 2035. The market for cat therapeutic diets is expanding due to several factors, including a trend toward high-end, scientifically supported pet food products, veterinary recommendations, increased pet ownership, the prevalence of feline chronic disorders, and growing awareness of pet health.

Key Regional and Segment-Wise Insights

- With 39.73% revenue share, North America led the cat therapeutic diet market in 2024.

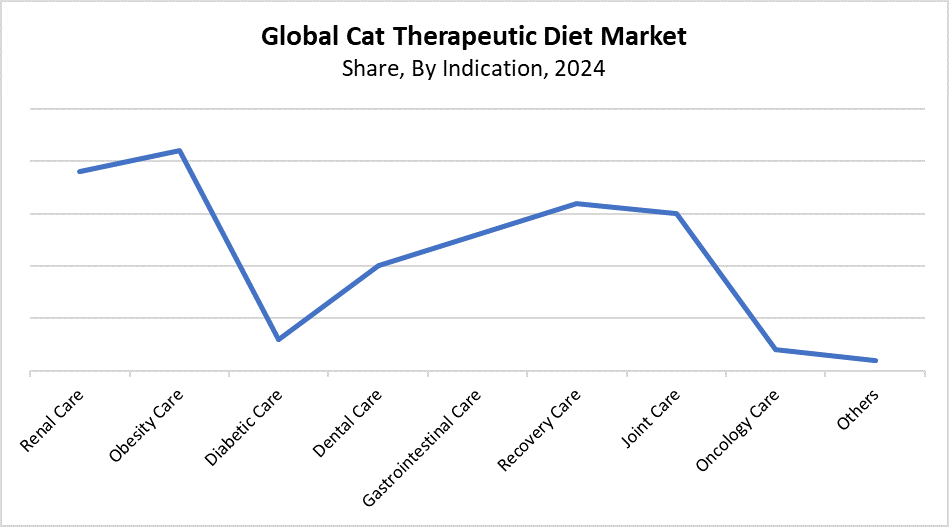

- In 2024, the obesity care segment had the biggest market share, accounting for 21.7% and led the market by indication.

- The veterinary hospital and clinic sector had the largest market share in 2024 by distribution channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.56 Billion

- 2035 Projected Market Size: USD 3.53 Billion

- CAGR (2025-2035): 7.71%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

The market for cat therapeutic diets operates as a specialized sector within pet nutrition that develops therapeutic diets to address various feline conditions, such as diabetes and kidney disease and allergies and obesity, and gastrointestinal problems. Veterinarians commonly advise or prescribe these diets to support clinical treatment while improving feline health outcomes. The growing number of pet cats and increasing pet owner knowledge about pet health and preventive care, combined with the escalating rates of chronic diseases in domestic cats, drive the market growth. Therapeutic diets tailored to individual kitty health needs emerge from both pet owners' spending habits toward high-quality health-conscious pet food and the growing trend of pet humanization.

The advancements in veterinary nutrition technology and pet food composition techniques have led to better taste and performance of therapeutic cat diets. Companies employ precision nutrition together with innovative ingredients and health research to develop customized treatments for various medical conditions. The industry continues to expand because consumers can now access diets customized for individual breeds and dietary needs. Government programs, together with regulatory frameworks across numerous nations, have implemented improved labeling guidelines and food safety rules to support veterinarian-recommended diets. The cat therapeutic diet sector experiences increased innovation, together with strengthened veterinarian-pet food producer relationships and enhanced customer trust because of these initiatives.

Indication Insights

The obesity care segment led the cat therapeutic diet market by holding the largest revenue share of 21.7% during 2024. The rising number of obese cats has driven this market segment to dominate because veterinarians, together with pet owners, now understand the serious health risks, including diabetes and arthritis, and heart disease. Most cats gain weight because their owners feed them too much, and they live indoors with little physical activity. The rising knowledge about feline obesity dangers has led to an increase in demand for specialized therapeutic meals that focus on weight control and calorie limitation. The long-term solution for obesity management involves these specific diets because their formulas target fat reduction without losing muscle tissue and keep cats feeling full.

The cat therapeutic diet market’s renal care segment is anticipated to grow at a significant rate throughout the forecast period. The increased incidence of chronic kidney disease (CKD) among aging cats drives this market growth because it represents the most common feline health condition. Early detection combined with sustained nutritional management through therapeutic renal diets helps slow down kidney disease progression, which makes these diets essential for veterinary treatment. These specialty diets feature reduced phosphorus levels and controlled protein content, together with added omega-3 fatty acids to support kidney function and improve life quality. The rising veterinary recommendations, together with pet owner education and better diagnostic methods, drive the growing demand for renal-specific diets.

Distribution Channel Insights

In 2024, the veterinary hospitals and clinics segment led the cat therapeutic diet market through the largest revenue share. Doctors maintain a critical position in diagnosing feline medical problems while they recommend proper dietary solutions, which drives this market leadership. The dependence of pet owners on veterinary advice for managing chronic conditions such as renal disease and obesity and diabetes, and allergies leads clinics to become the primary distribution channel for therapeutic diets. These establishments offer professionally endorsed, veterinarian-approved brands that cannot be found at traditional retail stores. The regular increase in veterinary visits and rising awareness about preventive pet healthcare practices support this pattern. The demand continues to originate from personalized clinical treatment approaches, which remain the main driver in this distribution channel.

The e-commerce segment of the cat therapeutic diet market will experience the fastest CAGR during the forecast period because digital usage and shifting customer preferences for online purchasing continue to rise. The advantages of home delivery combined with subscription services and affordable prices, and a wide selection of therapeutic items have led pet owners to increasingly purchase customized diets through online platforms. The rise of tele-veterinary consultations continues to support the trend through online prescriptions and remote diagnosis of therapeutic diets. Online platforms provide pet owners with detailed product information along with reviews and recommendations that help them choose their purchases wisely. The rapid expansion of this channel results from both its simple accessibility and the growing number of internet users who understand digital technologies.

Regional Insights

The cat therapeutic diet market is dominated by the North America region, generating the largest revenue share of 39.73% in 2024. The market dominance stems from high pet ownership rates and better pet health knowledge, and easy veterinary treatment access. Specialized diets have become popular among United States and Canadian pet owners who need them for treating chronic illnesses like obesity and kidney disease, and food allergies in their cats. The market expansion occurs because of strong distribution channels, which include e-commerce and pet specialty shops, together with luxury pet food brands and established veterinary networks. The industry leads globally because of increasing pet healthcare expenses, together with rising pet humanization practices, which drive scientific therapeutic feeding demand.

Europe Cat Therapeutic Diet Market Trends

The market for therapeutic cat diets in Europe is growing significantly in 2024 because people in the region prioritize responsible pet care and increased knowledge about cat health needs. Germany, along with France and the United Kingdom, stands at the forefront because their pet owners tend to purchase specialized diets for treating extended illnesses, which include obesity and digestive and renal issues. The region thrives due to its well-established veterinarian network and increasing consumer interest in advanced pet food products, as well as pet food safety laws that support the industry. The market grows because veterinary diet prescriptions become more available through online platforms, and the growing trend of purchasing pet products through the internet. Customer preferences in this market are heavily influenced by the growing emphasis on sustainability alongside natural ingredient usage.

Asia Pacific Cat Therapeutic Diet Market Trends

The Asia Pacific cat therapeutic diet market is expected to grow at the fastest CAGR during the forecast period due to rising pet adoption rates, along with improved financial strength among the middle class and increased awareness of pet health. The Asian countries, including China, Japan, India, and South Korea, are witnessing both urbanization and pet humanization trends, which are driving higher demand for specialized cat foods. Veterinarians, together with pet owners, receive encouragement to adopt therapeutic nutrition because cat populations now face rising occurrences of obesity and kidney disease, and allergic conditions. The market in this region grows at a higher rate because of expanding veterinarian services and growing internet usage, and the entry of foreign pet food companies.

Key Cat Therapeutic Diet Companies:

The following are the leading companies in the cat therapeutic diet market. These companies collectively hold the largest market share and dictate industry trends.

- Colgate-Palmolive Company

- FORZA10

- Veterinary Nutrition Group

- Nestlé

- Vetdiet

- MONGE SPA P.IVA

- General Mills Inc.

- Virbac

- Farmina Pet Foods

- Trovet

- Mars Petcare

- Dechra

- Rayne Clinical Nutrition

- Others

Recent Developments

- In July 2025, Nestlé Purina India introduces Indoor Delights and Friskies Meaty Grills. By supporting indoor cats' demands and focusing on nutritional diversity, Indoor Delights strengthens Purina's position in India's expanding cat food market.

- In February 2025, Nestlé Purina's pyramid-shaped wet cat food is now available in the US as Fancy Feast Gems and in Europe under Gourmet Revelations. It has patented easy-release serving technology and is made to accommodate the natural feeding habits of cats.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the cat therapeutic diet market based on the below-mentioned segments:

Global Cat Therapeutic Diet Market, By Indication

- Renal Care

- Obesity Care

- Diabetic Care

- Dental Care

- Gastrointestinal Care

- Recovery Care

- Joint Care

- Oncology Care

- Others

Global Cat Therapeutic Diet Market, By Distribution Channel

- E-commerce

- Veterinary hospitals & clinics

- Retail Pharmacies

- Others

Global Cat Therapeutic Diet Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 245 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |