Global Cell and Gene Therapies in CNS Disorders Market

Global Cell and Gene Therapies in CNS Disorders Market Size, Share, and COVID-19 Impact Analysis, By Therapy Type (Gene Therapy, Cell Therapy, and Gene-Modified Cell Therapy (combination approaches)), By Disease Type (Parkinsons Disease, Alzheimers Disease, Spinal Muscular Atrophy (SMA), Amyotrophic Lateral Sclerosis (ALS), Huntingtons Disease, and Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

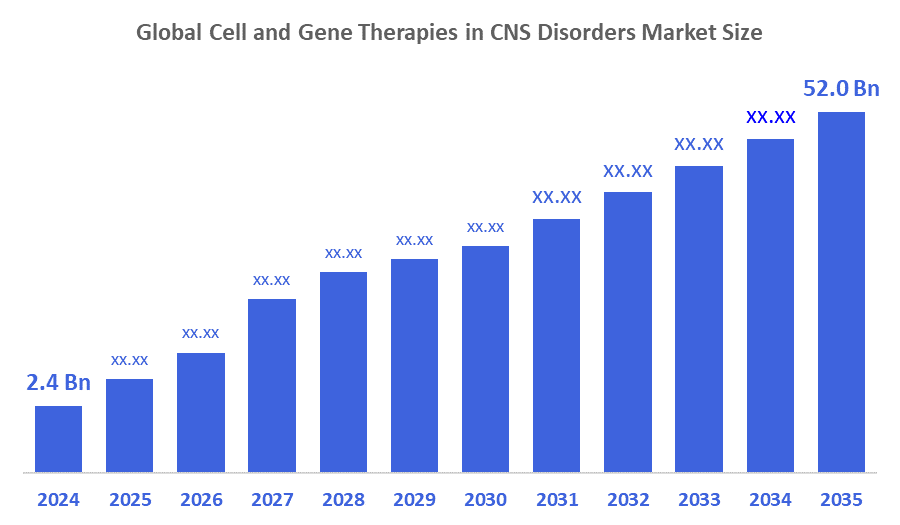

Global Cell and Gene Therapies in CNS Disorders Market Size Insights Forecasts to 2035

- The Global Cell and Gene Therapies in CNS Disorders Market Size Was valued at USD 2.4 Billion in 2024

- The Global Cell and Gene Therapies in CNS Disorders Market Size is Expected to Grow at a CAGR of around 32.26% from 2025 to 2035

- The Worldwide Cell and Gene Therapies in CNS Disorders Market Size is Expected to Reach USD 52.0 Billion by 2035

- Asia-Pacific is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Cell And Gene Therapies In CNS Disorders Market Size Was Worth Around USD 2.4 Billion In 2024 And Is Predicted To Grow To Around USD 52.0 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 32.26% From 2025 To 2035. Healthcare markets which are currently developing will enable future growth opportunities through their investment in these three areas: rare and pediatric CNS disorders research, gene editing technology development, and better delivery systems that will support the rising demand for personalized medical treatments.

Market Overview

The global cell and gene therapies in CNS disorders market refers to the development and commercialization of advanced therapeutic approaches that use genetic modification or living cells to treat neurological diseases affecting the central nervous system. The therapies operate as treatment methods which provide solutions to the root problems of diseases instead of dealing with their visible manifestations. The market exists because neurodegenerative and genetic disorders occur more frequently and because there are medical needs which remain untreated and because research and development funding has increased. The development of clinical success rates advances because researchers keep making progress with viral vectors and gene editing methods and stem cell technology and specialized delivery systems. Market growth receives support from regulatory frameworks which help business operations and from the development of clinical studies and from the partnerships between biotechnology companies and research organizations.

Report Coverage

This research report categorizes the cell and gene therapies in CNS disorders market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cell and gene therapies in CNS disorders market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cell and gene therapies in CNS disorders market.

Driving Factors

The market expansion occurs because of four main factors which include increasing cases of neurological and genetic CNS disorders and rising demand for targeted long-term treatments and advancements in gene editing and viral vector technologies and higher clinical trial activity and existing regulatory systems and government research institution and biopharmaceutical company funding which supports new and regenerative medical therapies.

Restraining Factors

The market faces several obstacles which include costly treatment expenses, difficult production methods, insufficient data about long-term safety, governmental approval processes, ethical issues, and limited patient treatment options for developing areas.

Market Segmentation

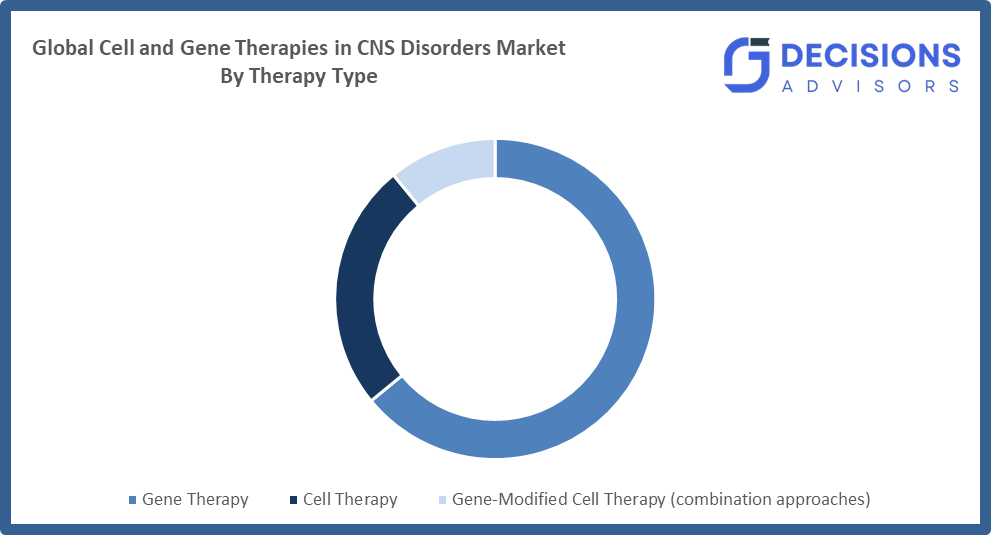

The cell and gene therapies in CNS disorders market share is classified into therapy type and disease type.

- The gene therapy segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the therapy type, the cell and gene therapies in CNS disorders market is divided into gene therapy, cell therapy, and gene-modified cell therapy (combination approaches). Among these, the gene therapy segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The treatment rewires brain circuits through its genetic inheritance therapy which provides lasting medical benefits for CNS genetic disorders and neurodegenerative diseases. The combination of viral vector technology improvements and higher clinical trial success rates and expanded regulatory approvals and biopharmaceutical companies' investment activities will drive substantial market growth throughout the upcoming forecast period.

- The spinal muscular atrophy (SMA) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the disease type, the cell and gene therapies in CNS disorders market is divided into parkinson’s disease, alzheimer’s disease, spinal muscular atrophy (SMA), amyotrophic lateral sclerosis (ALS), huntington’s disease, and others. Among these, the spinal muscular atrophy (SMA)segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment will continue to expand throughout the forecast period because current approved high-value gene therapies together with early newborn screening diagnosis and effective clinical results drive treatment accessibility. The segment will maintain its growth during the forecast period because reimbursement policies provide advantages and treatment methods become more widely used and genetic treatment methods keep advancing.

Regional Segment Analysis of the Cell and Gene Therapies in CNS Disorders Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the cell and gene therapies in CNS disorders market over the predicted timeframe.

North America is anticipated to hold the largest share of the cell and gene therapies in CNS disorders market over the predicted timeframe. The strong biopharmaceutical presence together with advanced research infrastructure and high R&D spending and early adoption of innovative therapies and favorable reimbursement policies and supportive regulatory pathways which include accelerated approvals for advanced and rare disease therapies across the United States and Canada.

Asia-Pacific is expected to grow at a rapid CAGR in the cell and gene therapies in CNS disorders market during the forecast period. The combination of six factors which include rising healthcare costs and growing rates of neurological disorders and increased clinical trial activities and government support programs and better regulatory systems and biopharmaceutical companies expanding their research activities in advanced therapeutic development across emerging markets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Cell and gene therapies in CNS disorders market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novartis AG

- Biogen Inc.

- Roche Holding AG (Genentech)

- Bluebird Bio, Inc.

- Sangamo Therapeutics, Inc.

- REGENXBIO Inc.

- Voyager Therapeutics, Inc.

- uniQure N.V.

- Ionis Pharmaceuticals, Inc.

- Pfizer Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, The American Society of Gene & Cell Therapy and Orphan Therapeutics Accelerator launched CGTxchange, a marketplace that revived deprioritized cell and gene therapies for ultra-rare diseases, matching shelved programs with partners and funding.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the cell and gene therapies in CNS disorders market based on the below-mentioned segments:

Global Cell and Gene Therapies in CNS Disorders Market, By Therapy Type

- Gene Therapy

- Cell Therapy

- Gene-Modified Cell Therapy (combination approaches)

Global Cell and Gene Therapies in CNS Disorders Market, By Disease Type

- Parkinson’s Disease

- Alzheimer’s Disease

- Spinal Muscular Atrophy (SMA)

- Amyotrophic Lateral Sclerosis (ALS)

- Huntington’s Disease

- Others

Global Cell and Gene Therapies in CNS Disorders Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the CAGR of the cell and gene therapies in CNS disorders market over the forecast period?

A: The global cell and gene therapies in CNS disorders market is projected to expand at a CAGR of 32.26% during the forecast period.

- What is the market size of the cell and gene therapies in CNS disorders market?

A: the global cell and gene therapies in CNS disorders market size is estimated to grow from USD 2.4 billion in 2024 to USD 52.0 billion by 2035, at a CAGR of 32.26% during the forecast period 2025-2035.

- Which region holds the largest share of the cell and gene therapies in CNS disorders market?

A: North America is anticipated to hold the largest share of the Cell and Gene Therapies in CNS Disorders market over the predicted timeframe.

- Who are the top 10 companies operating in the global cell and gene therapies in CNS disorders market?

A: Novartis AG, Biogen Inc., Roche Holding AG (Genentech), Bluebird Bio, Inc., Sangamo Therapeutics, Inc., REGENXBIO Inc., Voyager Therapeutics, Inc., uniQure N.V., Ionis Pharmaceuticals, Inc., Pfizer Inc., and Others.

- What are the market trends in the cell and gene therapies in CNS disorders market?

A: The market for cell and gene therapies which target CNS disorders currently experiences four main trends which include rising clinical trial activities and improved viral vector technologies and increasing regulatory approvals and growing funding for precise and regenerative medical treatments.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |