Global Cell Culture Supplements Market

Global Cell Culture Supplements Market Size, Share, and COVID-19 Impact Analysis, By Product (Serum-based Supplements, Protein-based & Recombinant Supplements, Chemically Defined Supplements, Others), By Application (Biopharmaceutical Manufacturing, Cell & Gene Therapy, Drug Discovery, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Cell Culture Supplements Market Summary

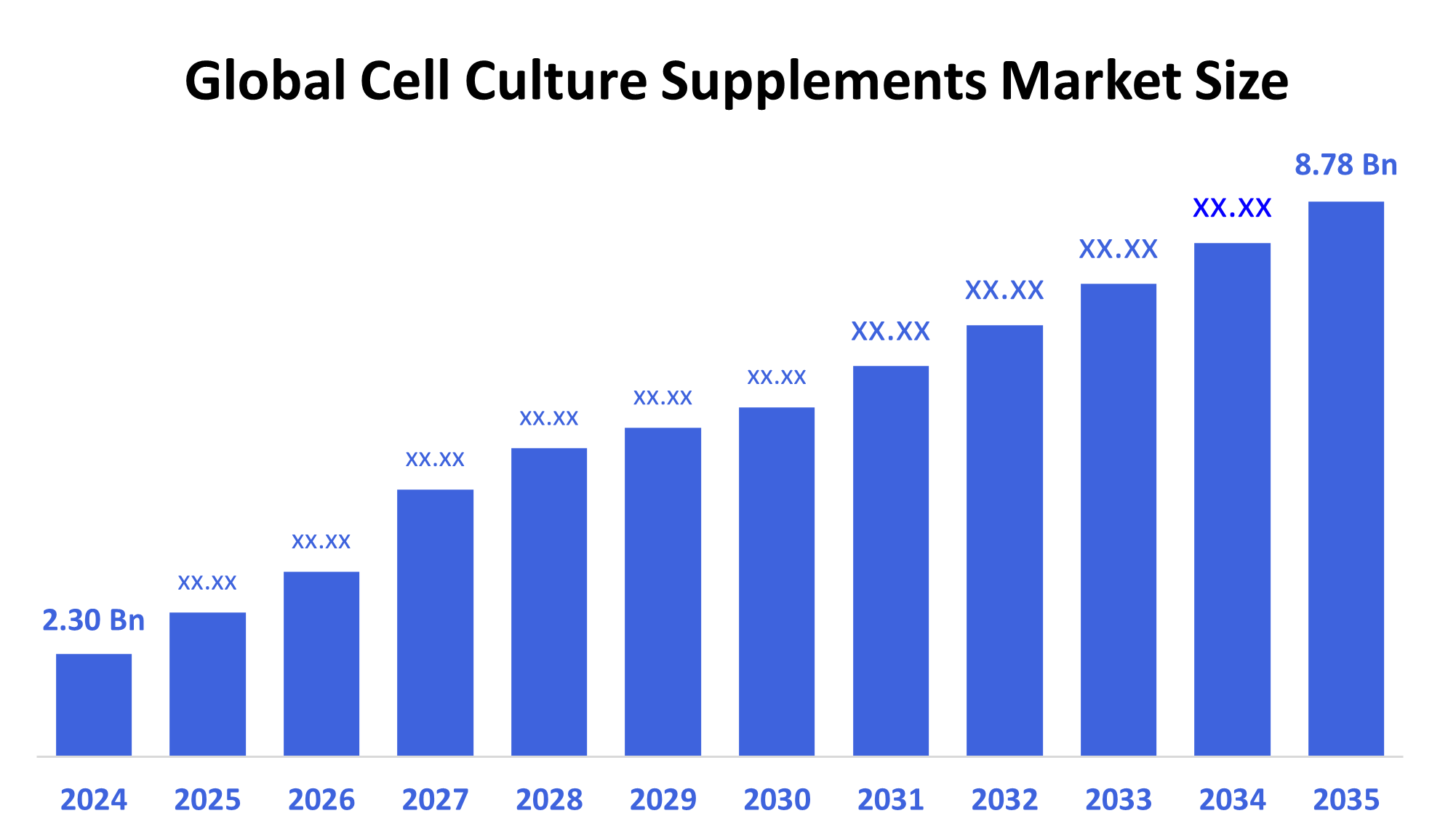

The Global Cell Culture Supplements Market Size Was Estimated at USD 2.30 Billion in 2024 and is Projected to Reach USD 8.78 Billion by 2035, Growing at a CAGR of 12.95% from 2025 to 2035. The market for cell culture supplements is expanding because of the growing demand for biopharmaceuticals, the growing use of cell-based research, the development of regenerative medicine, the expansion of vaccine production, and the growing investment in biotechnology and life sciences. These factors are driving the need for high-quality culture media components.

Key Regional and Segment-Wise Insights

- In 2024, the market for cell culture supplements in North America accounted for the largest revenue share of 35.25% and led the global market.

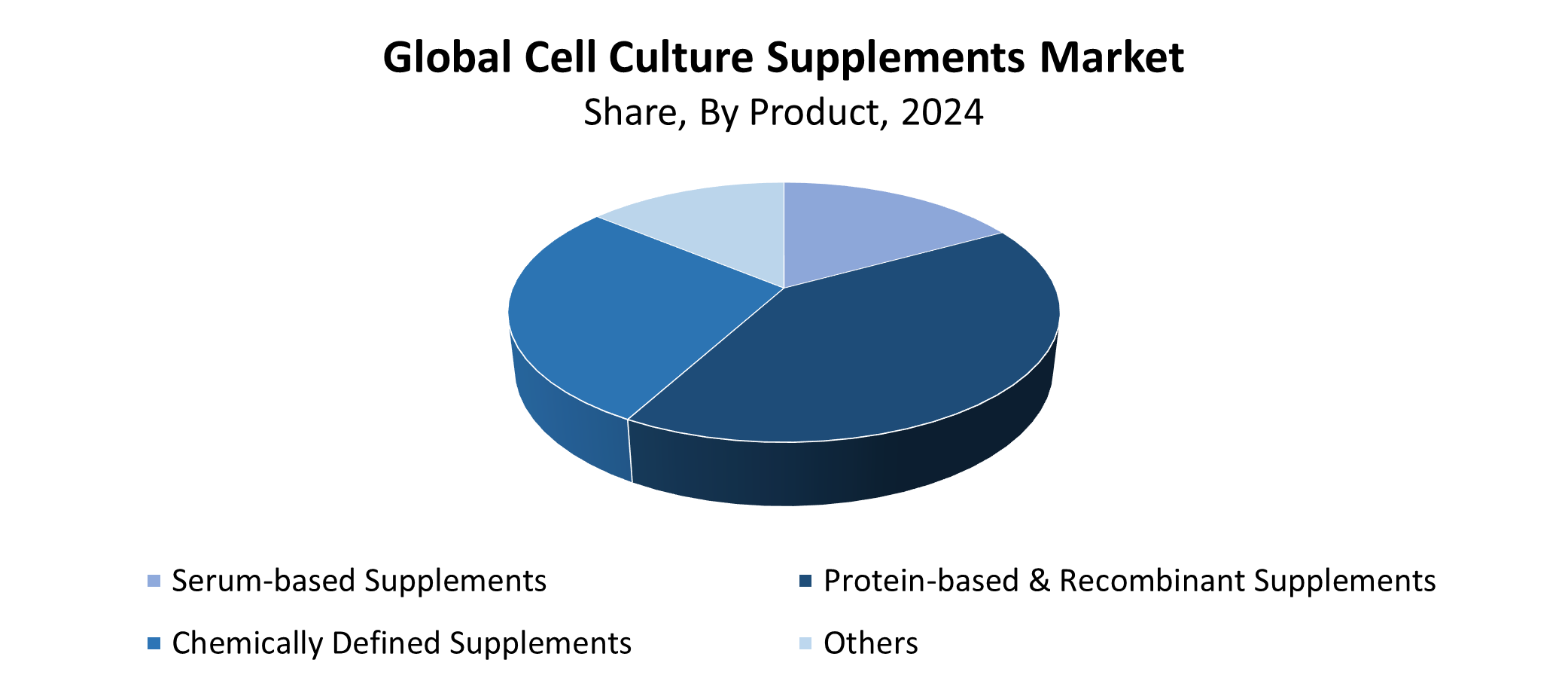

- In 2024, the protein-based and recombinant supplements segment led the market by product, accounting for 41.36% revenue share.

- In 2024, the biopharmaceutical manufacturing segment had the largest market share of 47.32% and led the market based on application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.30 Billion

- 2035 Projected Market Size: USD 8.78 Billion

- CAGR (2025-2035): 12.95%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market for cell culture supplements represents an economic sector dedicated to developing and supplying essential additives that support cell viability and growth and proliferation in both manufacturing and research applications. The supplements include vitamins alongside growth factors, hormones, amino acids, and additional components that support the in vitro culture of cells. The market experiences rapid expansion because vaccine production, along with monoclonal antibody and biopharmaceutical manufacturing, relies heavily on cell culture technologies. The rising demand for advanced cell culture conditions in cancer research, along with stem cell therapy and regenerative medicine, is driving increased requirements for high-quality supplements.

The advances in technology have significantly enhanced both the efficiency and effectiveness of cell culture supplement products. The development of chemically defined animal-free supplements has enhanced reproducibility while reducing contamination risk and meeting regulatory standards for clinical and pharmaceutical applications. The development of high-throughput screening technology and automation systems has enhanced the development process, along with the practical usage of supplements. Life sciences and biotechnology receive worldwide government support through research funds, funding, and infrastructure development. The acceleration of research, together with increased production capabilities, is expanding the market throughout developed and emerging nations. The market development is supported by rising investments in biomanufacturing, together with collaborations between public and private entities.

Product Insights

The protein-based and recombinant supplements segment dominated the cell culture supplements market in 2024 with the largest revenue share of 41.36%. The essential functions of these supplements in supporting cell development and productivity during biopharmaceutical production and cell-based research establish their market dominance. Protein-based supplements, including albumin and transferrin, provide essential nutrients and stability to cultured cells, yet recombinant versions maintain better purity and consistency with reduced contamination risks compared to animal-derived products. Consumers' growing preference for animal-free, chemically defined supplements produced under GMP conditions drives the increasing demand for recombinant products. The market leadership of these products derives from their extensive use in therapeutic protein manufacturing and stem cell cultivation, and vaccine development.

Throughout the forecasted period, the chemically defined supplements segment of the cell culture supplements market is anticipated to grow at the fastest CAGR. The rapid growth stems from the rising demand for dependable supplements without animal components, which minimize contamination risks and cell culture process variability. The precise nutrient composition control of chemically defined supplements makes them ideal for applications such as biopharmaceutical manufacturing and stem cell research, as well as regenerative medicine. The rising regulatory standards, together with the expanding adoption of Good Manufacturing Practice (GMP) standards, push manufacturers to transition their production towards chemically defined formulations. The segment's growth accelerates because of both technological advances and increased public understanding of animal-based production methods.

Application Insights

The biopharmaceutical manufacturing segment led the cell culture supplements market with the largest revenue share of 47.32% in 2024. The leading market position stems from the expanding production of monoclonal antibodies together with vaccines, recombinant proteins, and gene therapies, which all rely on advanced cell culture methods. The demand for high-quality supplements to enhance cell growth and productivity, along with product consistency, has surged because of increased interest in scalable, effective biologic therapies. The market growth stems from both bioprocessing technology progress and increased biopharmaceutical research and development funding. The use of standardized chemically defined supplements receives additional support from product safety and efficacy regulations, which bolsters the segment's leading market position.

The cell and gene therapy segment within the cell culture supplements market is projected to experience its fastest CAGR throughout the forecast period. The rapid expansion stems from increased research along with marketing of next-generation cell and gene therapies, which target rare diseases, cancers, and genetic conditions. Specialized and optimized cell culture conditions for these treatments create an increased market for advanced supplements that support cell viability, proliferation, and genetic modification processes. The segment growth receives additional momentum from regulatory approvals, combined with manufacturing process improvements and growing investments into regenerative medicine. Cell and gene therapy development will drive market growth because it requires new, reliable, and scalable culture supplements.

Regional Insights

In 2024, North America led the global cell culture supplements market with the largest revenue share of 35.25%. North America's position as a market leader stems from its well-established biopharmaceutical industry, together with its extensive adoption of modern biologics and its dedicated research and development activities in life sciences. The market expansion depends heavily on top biotechnology companies, along with sophisticated healthcare infrastructure and growing investments in regenerative medicine and cell-based medicine. The market expansion receives additional support through new regulatory standards and growing consumer interest in animal-free premium supplements. The United States occupies the leading position when it comes to backing research in cell culture and bioprocessing technology. North America stands as the most substantial and influential market for cell culture supplements across the globe.

Europe Cell Culture Supplements Market Trends

The European cell culture supplement market will experience substantial expansion throughout the forecast period because of growing biopharmaceutical production and research operations. The development of innovative treatments, including vaccines, monoclonal antibodies, and regenerative medicines by Germany, the UK, and France, drives up market demand for high-quality supplements. The European Medicines Agency (EMA), together with other regulatory bodies, drives innovation and sets high-quality standards to promote the adoption of chemically defined and animal-free supplements. Biotechnology investments, together with academic-pharmaceutical business partnerships, drive faster product development. Europe's position as a vital market for cell culture supplements stems from its growing contract manufacturing organization (CMO) activity and increasing interest in personalized medicine.

Asia Pacific Cell Culture Supplements Market Trends

The Asia Pacific cell culture supplements market is anticipated to grow at the fastest CAGR throughout the forecast period. The fast expansion results from growing biotechnology and biopharmaceutical production investments, which mainly target China, India, Japan, and South Korea. The increasing demand for biologics, along with vaccines and modern cell and gene treatments, requires higher standards of cell culture supplements. The market growth stems from improvements in healthcare facilities as well as expanding research activities and government initiatives that promote local biomanufacturing development. International companies choose this area because it offers low-cost manufacturing facilities and a growing number of contract manufacturing organizations (CMOs). The rising use of cell culture supplements within the Asia Pacific is driven by expanding understanding of customized therapeutics and regenerative medicine.

Key Cell Culture Supplements Companies:

The following are the leading companies in the cell culture supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Repligen Corporation

- Sartorius AG

- Thermo Fisher Scientific Inc.

- STEMCELL Technologies

- Danaher

- R&D Systems (Bio-Techne)

- HiMedia Laboratories

- Corning Inc.

- Proteintech Group, Inc

- Others

Recent Developments

- In April 2025, Thermo Fisher (USA) and RoosterBio partnered up to improve the production of cell and exosome therapies. The agreement enhances their standing in the expanding market for cell culture supplements by providing scalable, GMP-compliant products.

- In December 2024, HUB Organoids (Netherlands) was purchased by MilliporeSigma, a division of Merck KGaA in the United States, to increase its capacity for 3D cell models. By decreasing the use of animals in preclinical testing and increasing demand for sophisticated media formulations suited to organoid and 3D cultures, which are essential for drug discovery, this action benefits the expanding cell culture supplement market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cell culture supplements market based on the below-mentioned segments:

Global Cell Culture Supplements Market, By Product

- Serum-based Supplements

- Protein-based & Recombinant Supplements

- Chemically Defined Supplements

- Others

Global Cell Culture Supplements Market, By Application

- Biopharmaceutical Manufacturing

- Cell & Gene Therapy

- Drug Discovery

- Others

Global Cell Culture Supplements Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |