Global Cell Therapy Raw Materials Market

Global Cell Therapy Raw Materials Market Size, Share, and COVID-19 Impact Analysis, By Product (Media, Sera, Antibodies, Reagents & Buffers, and Others), By End Use (CROs & CMOs, and Biopharmaceutical & Pharmaceutical Companies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

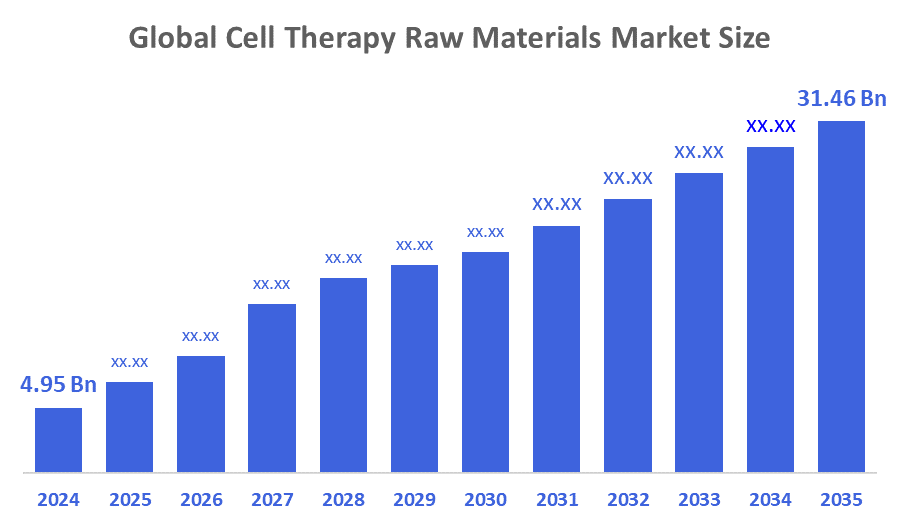

Global Cell Therapy Raw Materials Market Size Insights Forecasts to 2035

- The Global Cell Therapy Raw Materials Market Size Was Estimated at USD 4.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 18.31% from 2025 to 2035

- The Worldwide Cell Therapy Raw Materials Market Size is Expected to Reach USD 31.46 Billion by 2035

- Europe is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Cell Therapy Raw Materials Market Size was worth around USD 4.95 Billion in 2024 and is predicted to Grow to around USD 31.46 Billion by 2035 with a compound annual growth rate (CAGR) of 18.31% from 2025 to 2035. The market is anticipated to be driven by advancements in cell culture goods, such as medium and sera, as well as the rising incidence of chronic illnesses, including cancer, diabetes, and autoimmune disorders. The increasing shift of early-stage cell therapy pipelines into multicenter trial formats, which raises demand for standardised raw materials that maintain consistent performance across dispersed manufacturing sites and diverse production environments, is driving the market's sustained growth.

Market Overview

The cell therapy raw materials market includes all the essential inputs used to culture, expand, modify, and preserve therapeutic cell populations for research, clinical development, and commercial manufacturing purposes. Such materials mainly comprise media, sera, cell culture supplements, antibodies, reagents, buffers, as well as numerous auxiliary components that are used for the controlled growth and functional stability of immune cells, stem cells, and engineered cell lines. Demand comes mainly from biopharmaceutical and pharmaceutical companies that are developing autologous and allogeneic therapy pipelines, with a growing share of purchases from CROs, CMOs, and other specialised facilities engaged in process development, analytics, and fill-finish operations. The cell therapy raw materials market keeps changing in line with the demand for high, quality, GMP, GMP-compliant raw materials, which ensure the consistent production of diverse therapeutic platforms, as worldwide cell therapy programs are getting scaled up. The cell therapy raw materials are the backbone of various cell therapies and their mass production. Such therapies, including stem cell therapies, immune cell therapies, and gene therapies, hold great promise for the treatment of a variety of diseases, ranging from cancer to autoimmune disorders.

Thermo Fisher’s acquisition of PeproTech, completed in 2022, is a strategically important move for the cell therapy raw materials. PeproTech is a recognised leader in recombinant proteins, particularly cytokines and growth factors, which are critical raw materials for cell and gene therapy manufacturing. It is an anticipated $1.85 billion cash purchase price.

Merck announced it about invest €23 million to expand its cell culture media production capacity. This is indeed highly relevant to the cell therapy raw materials, because cell culture media is one of the most critical raw materials used in manufacturing advanced therapies like CAR-T, Treg, and stem cell treatments.

Report Coverage

This research report categorises the cell therapy raw materials market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cell therapy raw materials market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the cell therapy raw materials market.

Driving Factors

The increasing demand for advanced and innovative cell therapies, together with the growing number of clinical trials in regenerative medicine, are the main factors that significantly accelerate the cell therapy raw materials market. The market experiences a demand for raw materials like growth factors, culture media, sera, and scaffolding materials, which are indispensable for the processes of cell growth, differentiation, and functionality. Apart from that, continuous inflow of funds for research and development and improvement of manufacturing technologies contribute to the speeding up of market growth. It has been observed that there is more emphasis on the ability to scale up and reduce the costs of cell therapy production, thus creating a lot of opportunities for the market players.

Restraining Factors

This is due to the extraordinarily high cost of manufacturing and obtaining these specialised materials, as well as the extremely strict quality and regulatory requirements; the cell therapy raw materials industry is severely constrained. Batch-size restrictions and production lead times limit availability, delaying expansion plans for manufacturers getting ready for commercial-scale operations.

Market Segmentation

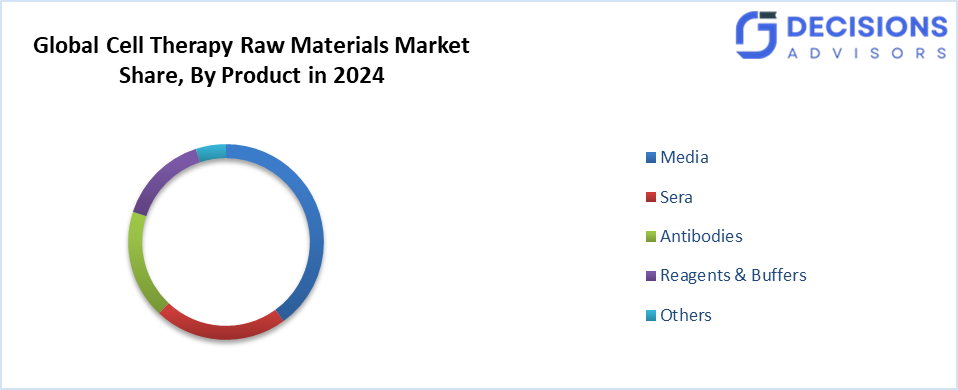

The cell therapy raw materials market share is classified into product, and end use.

- The media segment accounted for the largest share in 2024 and is anticipated to grow at a rapid pace during the forecast period.

Based on the product, the cell therapy raw materials market is divided into media, sera, antibodies, reagents & buffers, and others. Among these, the media segment accounted for the largest share in 2024 and is anticipated to grow at a rapid pace during the forecast period. The increased use of specialised media designed for immune cells, stem cells, and vector-producing lines is what propels growth in this area. Facilities increase their purchase of chemically defined and serum-free formulations as therapy pipelines progress toward higher-volume production, resulting in consistent yearly growth for this market.

- The biopharmaceutical & pharmaceutical companies segment accounted for the highest market revenue in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the end use, the cell therapy raw materials market is segmented into CROS & CMOS, and biopharmaceutical & pharmaceutical companies. Among these, the biopharmaceutical & pharmaceutical companies segment accounted for the highest market revenue in 2024 and is projected to grow at a substantial CAGR during the forecast period. This is due to ongoing improvements in their production lines and growing pipelines for cell-based therapies, large manufacturers consume the raw materials. Further, to support GMP-grade workflows, from early development to commercial-scale manufacture, these companies enhance the procurement of media, supplements, sera, and reagents, which maintains this segment's leading position.

Regional Segment Analysis of the Cell Therapy Raw Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the cell therapy raw materials market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the cell therapy raw materials market over the predicted timeframe. This regional market is influenced by the increasing establishment of cell therapy manufacturing clusters in East Asia and South Asia. The regional hubs are continually scaling specialised facilities for stem, cell banking, immune, cell production, and viral, vector synthesis, which results in a continuous demand for GMP raw materials. Besides China, South Korea, Japan, India, and the countries of Southeast Asia perform large, scale procurement of media, cytokines, and ancillary materials as their clinical pipelines diversify and their regulatory authorities enhance quality frameworks.

Growth in India is the result of the national life, science programs and pharmaceutical, manufacturing expansion efforts that not only challenge the biologics infrastructure to be modernised, but also create a favourable environment for the use of compliant raw materials in cell culture, expansion, and fill/finish operations of both public and private sectors.

Europe is projected to grow at a rapid CAGR in the cell therapy raw materials market during the forecast period. Europe records a consistent expansion, with a major impetus being a region-wide focus on harmonised quality frameworks for advanced therapy manufacturing. Strong regulatory alignment across member states supports the increase in adoption of GMP, grade media, specialised reagents, and cell processing materials across research centres, CDMOs, and commercial producers. Moreover, European biotech networks' cross-border cooperation is quickening the setting up of standardised workflows which depend on high-purity raw materials for T, cell, MSC, and pluripotent stem cell programs.

Growth in the German market is supported by ongoing federal investment in biologics and ATMP production facilities that are up to date. Such initiatives increase the need for controlled cell culture inputs, chemically defined media, and ancillary reagents, which are used in mAbs, vaccines, and cell therapy operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cell therapy raw materials market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ACROBiosystems

- Actylis

- BD

- Bio-Techne

- Charles River Laboratories

- Corning Incorporated

- GE HealthCare

- Lonza

- Merck KGaA

- Miltenyi Biotec

- Sartorius AG

- Sartorius CellGenix GmbH

- STEMCELL Technologies

- Thermo Fisher Scientific

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Qkine, a Cambridge-based bioactive protein manufacturer, announced the launch of its Cell Therapy Grade recombinant proteins designed to meet stringent requirements for cell therapy research, process development, and GMP manufacturing. The launch represents Qkine's dedication to providing the cell therapy ecosystem with top-notch, regulatory-ready solutions that accelerate process development, shorten intervals, and lower risk in delivering life-saving medicines to patients.

- In April 2024, OrganaBio launched HematoPAC-HSC-CB-GMP, an on-demand GMP-compliant source of CD34+ hematopoietic stem cells (HSCs) derived from fresh human cord blood, designed to accelerate advanced therapy manufacturing and support next-generation cell and gene therapies. HSCs have been utilised for a long time to treat blood malignancies, and more recently, they have been used in gene treatments for blood disorders such as beta thalassemia and sickle cell disease.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the cell therapy raw materials market based on the below-mentioned segments:

Global Cell Therapy Raw Materials Market, By Product

- Media

- Sera

- Antibodies

- Reagents & Buffers

- Others

Global Cell Therapy Raw Materials Market, By End Use

- CROs & CMOs

- Biopharmaceutical & Pharmaceutical Companies

Global Cell Therapy Raw Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global cell therapy raw materials market?

The market was valued at USD 4.95 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 31.46 billion by 2035.

- What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 18.31% from 2025 to 2035.

- Which product segment holds the largest share?

The media segment accounted for the largest share in 2024 and is expected to grow rapidly.

- Which end-use segment leads the market?

Biopharmaceutical & pharmaceutical companies generated the highest revenue in 2024.

- Which region will hold the largest market share?

Asia Pacific is anticipated to hold the largest share during the forecast period.

- What drives growth in this market?

Advancements in cell culture products, rising chronic diseases, and increasing clinical trials fuel demand.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 287 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |