Global Chestnut Flour Market

Global Chestnut Flour Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Type (Roasted Chestnut Flour and Raw Chestnut Flour), By Application (Bakery Products, Confectionery, and Beverages), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Chestnut Flour Market Summary, Size & Emerging Trends

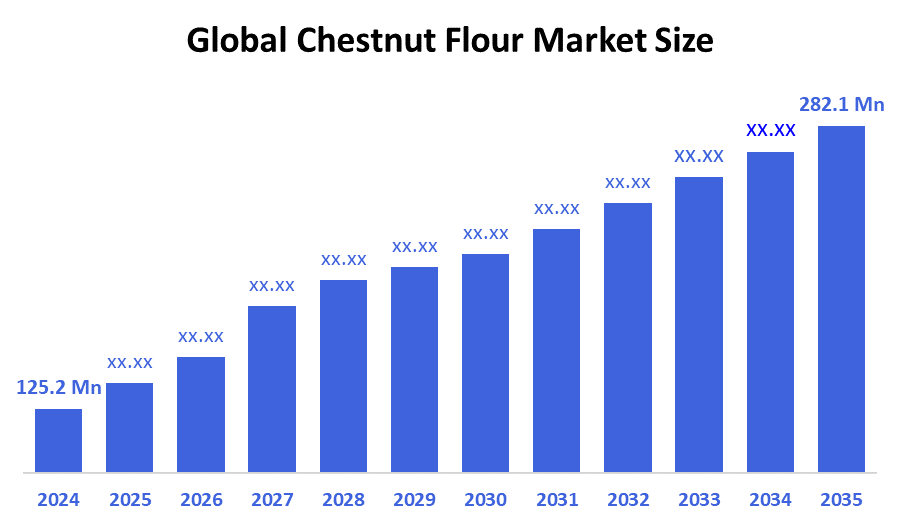

According to Decision Advisor, The Global Chestnut Flour Market Size is expected to grow from USD 125.2 Million in 2024 to USD 282.1 Million by 2035, at a CAGR of 7.66% during the forecast period 2025-2035. Rising demand for gluten-free and nutrient-rich flour alternatives in bakery and confectionery products is a key driver for the chestnut flour market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the chestnut flour market during the forecast period.

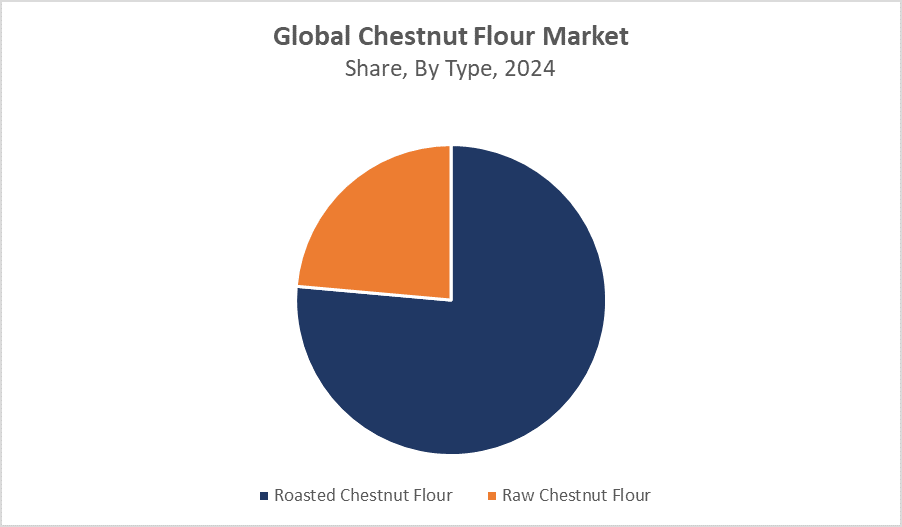

- In terms of type, roasted chestnut flour dominated in terms of revenue during the forecast period.

- In terms of application, bakery products accounted for the largest revenue share in the global chestnut flour market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 125.2 Million

- 2035 Projected Market Size: USD 282.1 Million

- CAGR (2025-2035): 7.66%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Chestnut Flour Market

The chestnut flour market focuses on producing flour from chestnuts, prized for being gluten-free and nutritionally rich. It serves as a popular, healthy substitute for wheat flour in bakery, confectionery, and beverage products. Growing consumer awareness about gluten intolerance and the demand for clean-label, organic foods are key growth drivers. Governments worldwide support chestnut farming through subsidies and research initiatives, promoting sustainable and eco-friendly agriculture. Additionally, the rising trend toward plant-based diets and natural ingredients boosts chestnut flour demand, particularly in developed markets. This shift aligns with consumers’ preferences for healthier and more environmentally responsible food choices, making chestnut flour a sought-after ingredient in various food industries.

Chestnut Flour Market Trends

- Growing consumer preference for gluten-free and allergen-free products.

- Increasing use of chestnut flour in premium bakery and confectionery products.

- Expansion of organic and clean-label product lines incorporating chestnut flour.

Chestnut Flour Market Dynamics

Driving Factors: Rising health consciousness and gluten intolerance awareness

Increasing health awareness among consumers is a primary driver for the chestnut flour market. As more people seek nutritious, gluten-free alternatives, chestnut flour stands out due to its rich nutrient content including fiber, vitamins, and minerals. The global rise in celiac disease and gluten sensitivity has created a growing demand for safe, gluten-free food ingredients. Chestnut flour’s versatility makes it suitable for a wide range of culinary uses, from baking breads and pastries to thickening sauces and making beverages, which further boosts its popularity among both home cooks and food manufacturers.

Restrain Factors: High production cost and limited shelf life

Despite its benefits, chestnut flour faces challenges related to cost and preservation. Its production is more expensive than traditional wheat flour due to labor-intensive harvesting and processing methods. This higher price point can deter consumers in budget-conscious regions. Additionally, chestnut flour has a shorter shelf life caused by its natural moisture content and susceptibility to spoilage, making storage and transportation more difficult. Seasonal harvest cycles and dependency on chestnut yields also contribute to inconsistent supply, which can disrupt steady market availability.

Opportunity: Expanding applications and rising organic food trends

There is significant opportunity for chestnut flour in emerging product categories beyond bakery, including beverages, snack foods, and dietary supplements. The increasing global shift toward organic, natural, and clean-label products aligns well with chestnut flour’s organic cultivation potential. Innovations in packaging such as vacuum sealing or modified atmosphere packaging can help extend shelf life, making chestnut flour more accessible to distant markets. Collaborations with food developers to create new product formats can further expand its adoption.

Challenges: Competition from other gluten-free flours and supply chain disruptions

The chestnut flour market competes with established gluten-free flours like almond, coconut, and rice flour, which are often more readily available and have established consumer bases. Price competitiveness and consumer familiarity give these alternatives an edge. Moreover, supply chain disruptions caused by unpredictable climate events such as droughts or storms can impact chestnut harvests and availability. Geopolitical tensions affecting trade routes and raw material sourcing can also cause fluctuations in supply and pricing, posing risks to consistent market growth.

Global Chestnut Flour Market Ecosystem Analysis

The global chestnut flour market ecosystem includes key participants such as chestnut growers, milling and processing companies, distributors, and end-users in bakery, confectionery, and beverage industries. Leading manufacturers focus on product innovation and organic certification to meet evolving consumer demands. Regulatory bodies enforce food safety and labeling standards to ensure product quality. Sustainable cultivation and fair trade practices are gaining importance within the ecosystem, driving market expansion globally.

Global Chestnut Flour Market, By Type

Roasted chestnut flour holds the largest share in the global chestnut flour market, accounting for approximately 65% of total revenue in 2024. This dominance is attributed to its enhanced flavor profile, which offers a rich, nutty, and slightly sweet taste highly preferred in modern bakery and confectionery products. Roasting also improves shelf stability by reducing moisture content, making the flour less prone to spoilage and easier to store. These qualities have led to widespread use in packaged baked goods, health snacks, gluten-free bread mixes, and even gourmet culinary products. Its versatility and consumer appeal make roasted chestnut flour the top-selling product type globally.

Raw chestnut flour accounts for about 35% of global market revenue in 2024. It is mainly used in traditional and regional cuisines, especially in European and Asian countries where chestnut-based dishes have cultural significance. Unlike roasted flour, raw chestnut flour has a milder and more neutral flavor, which is preferred in specific applications like handmade pasta, pancakes, and traditional holiday desserts. However, it has a shorter shelf life and higher moisture content, which limits its commercial scalability. Despite these challenges, it retains a stable share in regions with strong culinary traditions involving chestnut-based recipes.

Global Chestnut Flour Market, By Application

The bakery products segment dominates the global chestnut flour market, accounting for approximately 58% of total revenue in 2024. This strong market position is fueled by the rising demand for gluten-free baked goods, especially among health-conscious and celiac consumers. Chestnut flour is widely used in products like breads, muffins, cakes, and pastries due to its rich flavor, dense texture, and nutritional value. The growth of artisanal and organic bakeries globally also contributes to its adoption. Additionally, its compatibility with other alternative flours (like almond or oat flour) makes it a popular choice in blended flour mixes designed for high-end or specialty baking.

The beverages segment is emerging, capturing an estimated 12% of the global chestnut flour market revenue in 2024. Chestnut flour is increasingly being used in health and functional drinks, such as smoothies, plant-based nutritional shakes, and gluten-free beer formulations. Its natural sweetness, low fat content, and high fiber make it attractive for wellness beverages. Innovative startups and niche beverage companies in North America and Europe are experimenting with chestnut-based drinks, contributing to the segment’s growth. While still small compared to bakery, the beverages segment shows high growth potential as demand for plant-based and gluten-free beverages continues to rise.

Asia Pacific leads the global chestnut flour market, accounting for approximately 42% of total revenue in 2024.

This dominance is driven by a combination of traditional dietary use, increasing health awareness, and large-scale chestnut production. Countries like China, Japan, and South Korea have a long-standing history of using chestnuts in everyday cuisine, making chestnut flour a familiar and accepted ingredient.

China, in particular, is the largest global producer of chestnuts

which ensures abundant raw material availability and lower production costs. Rising consumer interest in functional and gluten-free foods, along with a growing organic and clean-label food movement, further supports regional market expansion. Government support for sustainable agriculture and export-oriented chestnut processing also strengthens the region's position.

North America is the fastest-growing market for chestnut flour, with a projected CAGR of approximately 7.8% from 2025 to 2035.

This growth is fueled by the surging popularity of gluten-free diets, increased prevalence of celiac disease and gluten intolerance, and a strong demand for nutrient-rich flour alternatives.

The U.S. and Canada are actively seeking plant-based, allergen-free, and organic products, creating a ripe market for chestnut flour in bakery, snacks, and specialty health foods. Moreover, the region has seen a rise in artisanal food startups and health-focused brands incorporating chestnut flour into innovative formulations. While domestic chestnut production is limited, increasing imports and investments in premium gluten-free products continue to accelerate growth in this region.

WORLDWIDE TOP KEY PLAYERS IN THE CHESTNUT FLOUR MARKET INCLUDE

- NutriFlour Inc.

- Chestnut Valley Ltd.

- Organic Mills Co.

- Mountain Harvest Foods

- GreenEarth Ingredients

- PureChestnut Enterprises

- NutraFlour Global

- Harvest Foods International

- TerraGrain

- Others

Product Launches in Chestnut Flour Market

- In March 2024, NutriFlour Inc., a leading player in the alternative flours segment, introduced a new line of organic roasted chestnut flour specifically designed for gluten-free bakery manufacturers in North America. This product launch is strategically timed to capitalize on the growing consumer demand for clean-label, allergen-free, and nutrient-dense baking ingredients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the chestnut flour market based on the below-mentioned segments:

Global Chestnut Flour Market, By Type

- Roasted Chestnut Flour

- Raw Chestnut Flour

Global Chestnut Flour Market, By Application

- Bakery Products

- Confectionery

- Beverages

Global Chestnut Flour Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What are the main drivers of growth in the Chestnut Flour Market?

A: Rising demand for gluten-free products, growing health consciousness, and increased adoption of plant-based diets are major growth drivers.

Q: What challenges are limiting the growth of the Chestnut Flour Market?

A: High production costs, limited shelf life, seasonal supply issues, and competition from other gluten-free flours are key challenges.

Q: What are the key trends shaping the Chestnut Flour Market?

A: Major trends include clean-label and organic product expansion, premium gluten-free product development, and the rise of chestnut flour in functional beverages.

Q: What opportunities exist for market players in the Chestnut Flour industry?

A: Opportunities include expanding into beverages and health foods, innovations in packaging for shelf life extension, and tapping into organic and clean-label trends.

Q: Who are the top players in the Global Chestnut Flour Market?

A: Leading companies include NutriFlour Inc., Chestnut Valley Ltd., Organic Mills Co., Mountain Harvest Foods, GreenEarth Ingredients, PureChestnut Enterprises, and NutraFlour Global.

Q: Which application segment is emerging in the Chestnut Flour Market?

A: The beverages segment is an emerging application, gaining traction in health drinks, smoothies, and gluten-free beers.

Q: What was a notable recent product launch in the Chestnut Flour Market?

A: In March 2024, NutriFlour Inc. launched a new line of organic roasted chestnut flour targeting gluten-free bakery manufacturers in North America.

Q: What is the long-term outlook for the Global Chestnut Flour Market?

A: The market is expected to see steady and robust growth through 2035, supported by increasing consumer preference for healthy, gluten-free, and sustainable food ingredients.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |