Global Chillers Market

Global Chillers Market Size, Share, and COVID-19 Impact Analysis, By Product (Water-Cooled and Air-Cooled), By Application (Industrial and Commercial) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Chillers Market Size Insights Forecasts to 2035

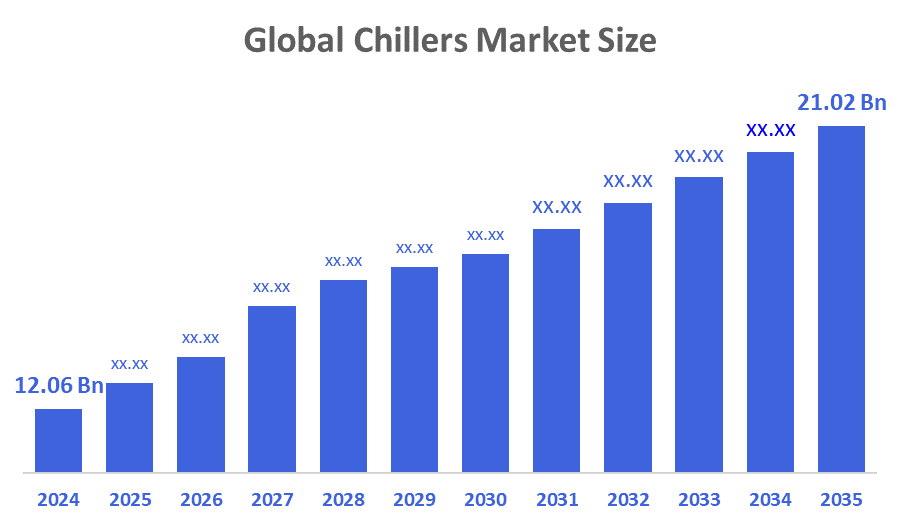

- The Global Chillers Market Size Was valued at USD 12.06 Billion in 2024

- The Global Chillers Market Size is Expected to Grow at a CAGR of around 5.18% from 2025 to 2035

- The Worldwide Chillers Market Size is Expected to Reach USD 21.02 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Chillers Market Size was worth around USD 12.06 Billion in 2024 and is predicted to Grow to around USD 21.02 Billion by 2035 with a compound annual growth rate (CAGR) of 5.18% from 2025 to 2035. The market shows constant growth lessened by the increasing demand for energy-efficient cooling solutions as a result of heightened environmental worries, the fast-growing construction industry, and ongoing technological improvements, one of the most notable being the merging of the Internet of Things (IoT) and artificial intelligence (AI) in these systems.

Market Overview

The global chillers market is defined as the sector that is concerned with the production and marketing of cooling devices that excel in taking the heat from liquids by means of vapor-compression or absorption refrigeration cycles, and such devices find a lot of applications in industries, commerce, and domestic use too, in fact, these chillers are being used for temperature regulation in HVAC, food and beverage, pharmaceuticals, chemicals, data centers, and plastic sectors. The main factors behind the market's vertical rise are the influx of new industries, the growth of data center infrastructure, and the consumers' requirements for cooling systems that consume less energy. Also, the changeover to new technologies, such as smart chillers, IoT integration and the use of environment-friendly refrigerants, is the main reason for the changing nature of the industry. Furthermore, the tough energy efficiency regulations and the sustainability standards are the factors that are promoting manufacturers all over the world to make the chiller systems that are less polluting but at the same time very powerful.

Report Coverage

This research report categorizes the chillers market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the chillers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the chillers market.

Driving Factors

One of the main factors that drive chiller market is the increasing demand for environmentally friendly and energy-efficient cooling solutions. Due to the rising energy costs, companies in industrial and commercial sectors are selecting the latest chillers known for their low power consumption. Moreover, strict government regulations to reduce carbon emissions are supporting the use of environmentally safe refrigerants and more efficient systems. The move towards sustainability is hence pushing the market growth.

Restraining Factors

The market for chillers worldwide encounters limitations like expensive upfront installation and upkeep, energy-consuming processes, sophisticated system interconnections, rules concerning the environment for refrigerants, low usage in economically sensitive areas, and the presence of other cooling technology options.

Market Segmentation

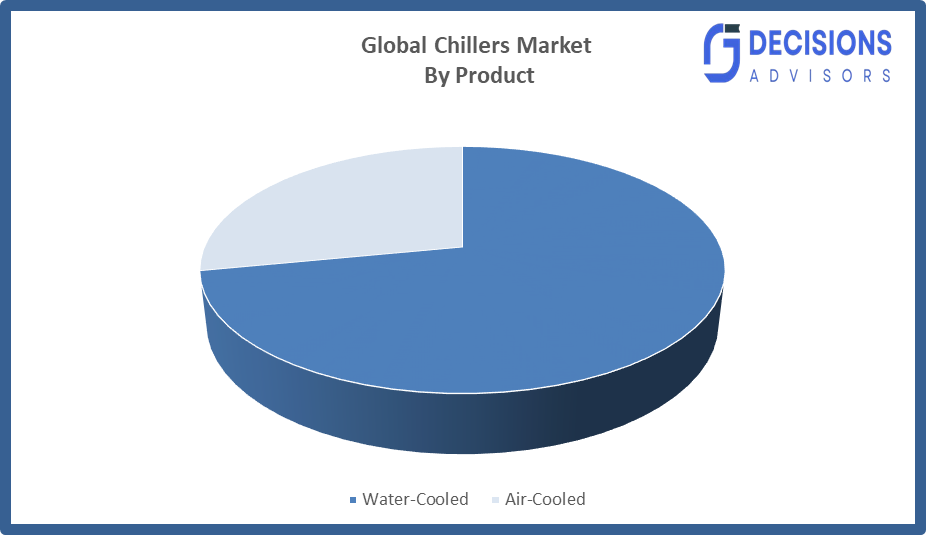

The chillers market share is classified into product and application.

- The water-cooled segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the chillers market is divided into water-cooled and air-cooled. Among these, the water-cooled segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Water-cooled chillers are able to provide a very wide range of cooling capacity from 10 tons up to 4,000 tons, making them very suitable for indoor applications. They can easily support the numerous industries that produce a lot of heat. Water-cooled chillers are able to cope with the extreme cooling loads that are typically found in chemical plants, manufacturing facilities, and hospitals.

- The commercial segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the chillers market is divided into industrial and commercial. Among these, the commercial segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The main function of chillers is to remove or negate the heat that has been gathered from different internal and external sources. Sunlight, wind, and outdoor temperature are examples of external factors that lead to heat gain, while indoor influences consist of moisture from people, lighting, and heat generated by electronic or mechanical machines. Chillers provide an advantage in managing such diverse factors in commercial areas and thus their demand is anticipated to increase over the next several years.

Regional Segment Analysis of the Chillers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the chillers market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the chillers market over the predicted timeframe. The major factors behind the growth of the market in the region are the Chinese electronics assembly lines, Indian pharmaceutical industry, and the contract manufacturing in Southeast Asia. Companies like Daikin are using local suppliers for component sourcing, which leads to shorter lead times and reduced costs. The Indian government campaigns like "Make in India" aimed for a 25% manufacturing GDP share, which resulted in a long grounding of cooling demand.

North America is expected to grow at a rapid CAGR in the chillers market during the forecast period. The escalation of the commercial, industrial, and residential usage of energy-efficient cooling solutions has been one of the major factors stimulating the market growth. To illustrate, in May 2024, a new propane (R290) commercial and industrial chiller for the U.S. market was launched by G&D Chillers, a company based in Oregon, which is now making it count as “the first in the [U.S.] commercial chilling industry to reintroduce propane as a natural refrigerant.” G&D Chillers, which has more than three decades of expertise in creating chillers for brewing, cannabis, food processing, wine, and other manufacturing sectors, revealed the unit named Elite R290 at the Craft Brewers Conference that took place April 21-24 in Las Vegas. Climate change and global warming are contributing factors to the increasing demand for dependable cooling systems. The energy efficiency and performance of the systems have been improved through the use of advanced technologies such as smart chillers and IoT integration.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the chillers market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Trane

- Cold Shot Chillers

- Tandem Chillers

- Drake Refrigeration, Inc

- Refra

- Carrier

- FRIGEL FIRENZE S.p.A.

- Midea

- Daikin Industries, Ltd.

- Johnson Controls

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, CVC and Tabreed had formed a partnership to acquire UAE district cooling assets, which deepened private?equity exposure to the region’s HVAC infrastructure.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the chillers market based on the below-mentioned segments:

Global Chillers Market, By Product

- Water-Cooled

- Air-Cooled

Global Chillers Market, By Application

- Industrial

- Commercial

Global Chillers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the CAGR of the chillers market over the forecast period?

A: The global chillers market is projected to expand at a CAGR of 5.18% during the forecast period.

- What is the market size of the chillers market?

A: The global chillers market size is estimated to grow from USD 12.06 billion in 2024 to USD 21.02 billion by 2035, at a CAGR of 5.18% during the forecast period 2025-2035.

- Which region holds the largest share of the chillers market?

A: Asia Pacific is anticipated to hold the largest share of the chillers market over the predicted timeframe.

- Who are the top 10 companies operating in the global chillers market?

A: Trane, Cold Shot Chillers, Tandem Chillers, Drake Refrigeration, Inc, Refra, Carrier, FRIGEL FIRENZE S.p.A., Midea, Daikin Industries, Ltd., Johnson Controls, and Others.

- What are the market trends in the chillers market?

A: The main developments noticed in the chillers market are, greater acceptance of energy-efficient systems, increased application of refrigerants with low global warming potential (GWP), rising need for smart chillers fitted with Internet of Things (IoT) capabilities, the extension of the district cooling system, and a greater emphasis on meeting sustainability standards.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 199 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |