China Biological Seed Treatment Market

China Biological Seed Treatment Market Size, Share, By Product (Microbials, Bacteria, Fungi, And Botanicals & Others), By Crop Type (Corn, Wheat, Soybean, Sunflower, Vegetable Crops, And Others), And China Biological Seed Treatment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China Biological Seed Treatment Market Insights Forecasts to 2035

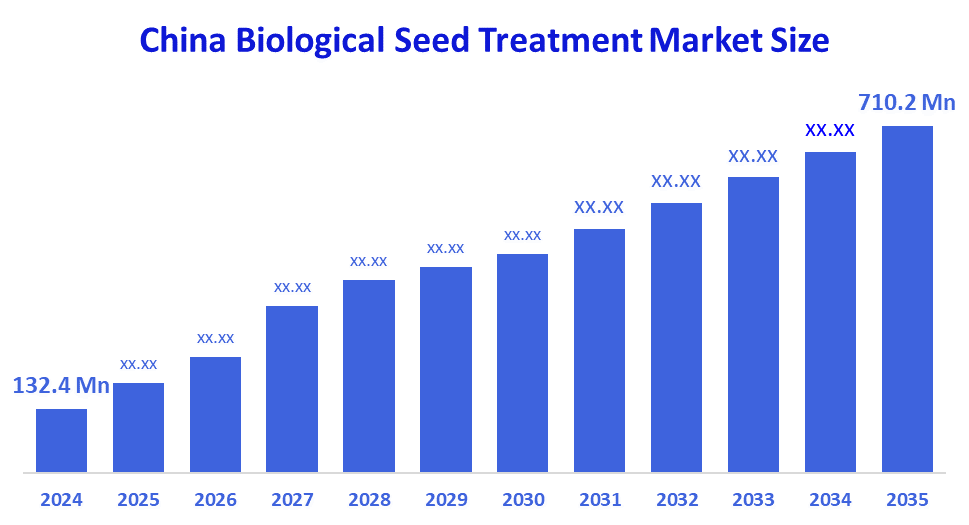

- China Biological Seed Treatment Market Size 2024: USD 132.4 Million

- China Biological Seed Treatment Market Size 2035: USD 710.2 Million

- China Biological Seed Treatment Market CAGR 2024: 16.5%

- China Biological Seed Treatment Market Segments: Product and Crop Type

The China biological seed treatment market includes chemicals, agronomics and agriculture inputs that apply biological material to crop seeds before planting to help improve germination, combat against disease, improve plant performance and increase stress tolerance in plants. Biological seed treatments have become more significant reduce chemical residue in the environment, improve the health of soil and elevate production levels. These are the part of larger category of seed treatment products, since they fit within the rapidly advancing agriculture sector in China as it moves towards farming methods that include environmental issues and requirements along with producing crops efficiently.

The biological seed treatment in China are backed by government support, including the Action Plan for Revitalizing the Seed Industry, aimed to strengthen the domestic seed industry and ensure that farmers have access to high-quality, high-yielding seed and seed treatment solutions as part of national food security strategies. China record 706.5 million-ton grain harvest in 2024, followed by state plans to further improve key crop yields through enhanced farming techniques, including improved seed quality and digital agriculture technologies.

As technology advances, Chinese biological seed treatment providers are now using application systems including improved encapsulation and coating technologies guarantee that the microbial action agents remain viable after they have been applied to seeds and stored for future use. With the advent of new digital tools and technologies for precision farming, farmers, digital farming tools enable a farmer to maximize the effectiveness of a given treatment relative to a specific crop by utilizing their own biological database information as a guide.

Market Dynamics of the China Biological Seed Treatment Market:

The China biological seed treatment market is driven by the sustainable agricultural intensification, growing awareness of environmental issues, regulatory pressure to reduce the use of high-risk chemical pesticides, increased concerns for protecting soil and water quality, offer lower environmental risk and support soil health, expanding organic farming, and rising consumer demand for foods with fewer chemical residues environmental and public health priorities.

The China biological seed treatment market is restrained by the higher per-unit costs, greater complexity compared with conventional chemical treatments, less accessible to cost-sensitive growers, limited awareness and understanding of the long-term benefits of biological treatments, and lack of skilled labours.

The future of China biological seed treatment market is bright and promising, with versatile opportunities emerging from the adoption of precision agriculture and its related digital farming platforms, farmland, farmers and agri-businesses will have additional ways to better utilise crop inputs. At the same time, current government policies promote sustainable farming practices and provide better access to safe, locally-grown food which creates opportunities for both domestic and international investments into R&D, regionalised products and localised agricultural solutions that fit the varied agricultural areas of China.

Market Segmentation

The China Biological Seed Treatment Market share is classified into product and crop type.

By Product:

The China biological seed treatment market is divided by product into microbials, bacteria, fungi, and botanicals & others. Among these, the microbials segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Enhanced crop performance, provide natural protection against pests, growing demand for sustainable agriculture, cost effective solution and technological advancements all contribute to the microbials segment's largest share and higher spending on biological seed treatment when compared to other product.

By Crop Type:

The China biological seed treatment market is divided by crop type into corn, wheat, soybean, sunflower, vegetable crops, and others. Among these, the vegetable crops segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The vegetable crops segment dominates because of high consumer demand for chemical-free produce, need for sustainable farming, growth in controlled environment, premium pricing, and supported by government pushes for green agriculture.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China biological seed treatment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Biological Seed Treatment Market:

- Syngenta AG

- Bayer AG

- BASF SE

- Corteva Agriscience

- UPL Limited

- FMC Corporation

- Sumitomo Chemical Co., Ltd.

- Adama Ltd.

- Koppert Biological Systems

- Novozymes A/S

- Jiangsu Lier Chemical

- Shangdong Weifang Rainbow

- Guangzhou Wenshan

- Others

Recent Developments in China Biological Seed Treatment Market:

In December 2024, BASF launched a new bio-based seed treatment for soil-borne disease protection, improving germination and growth, aligning with sustainable demands.

In October 2024, Syngenta introduced advanced seed treatments for corn/soybean, boosting vigor and disease resistance with chemical formulations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China biological seed treatment market based on the below-mentioned segments:

China Biological Seed Treatment Market, By Product

- Microbials

- Bacteria

- Fungi

- Botanicals & Others

China Biological Seed Treatment Market, By Crop Type

- Corn

- Wheat

- Soybean

- Sunflower

- Vegetable Crops

- Others

FAQ

Q: What is the China biological seed treatment market size?

A: China biological seed treatment market is expected to grow from USD 132.4 million in 2024 to USD 710.2 million by 2035, growing at a CAGR of 16.5% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the sustainable agricultural intensification, growing awareness of environmental issues, regulatory pressure to reduce the use of high-risk chemical pesticides, increased concerns for protecting soil and water quality, offer lower environmental risk and support soil health, expanding organic farming, and rising consumer demand for foods with fewer chemical residues environmental and public health priorities.

Q: What factors restrain the China biological seed treatment market?

A: Constraints include the higher per-unit costs, greater complexity compared with conventional chemical treatments, less accessible to cost-sensitive growers, limited awareness and understanding of the long-term benefits of biological treatments, and lack of skilled labours.

Q: How is the market segmented by product?

A: The market is segmented into microbials, bacteria, fungi, and botanicals & others.

Q: Who are the key players in the China biological seed treatment market?

A: Key companies include Syngenta AG, Bayer AG, BASF SE, Corteva Agriscience, UPL Limited, FMC Corporation, Sumitomo Chemical Co., Ltd., Adama Ltd., Koppert Biological Systems, Novozymes A/S, Jiangsu Lier Chemical, Shangdong Weifang Rainbow, Guangzhou Wenshan, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |