China Business Process Outsourcing Market

China Business Process Outsourcing Market Size, Share, By Service Type (KPO, Customer Service, Human Resource, Finance & Accounting), By Application (BFSI, Healthcare, Manufacturing, IT & Telecommunications, Retail, Government & Defense, and Others), China Business Process Outsourcing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China Business Process Outsourcing Market Insights Forecasts to 2035

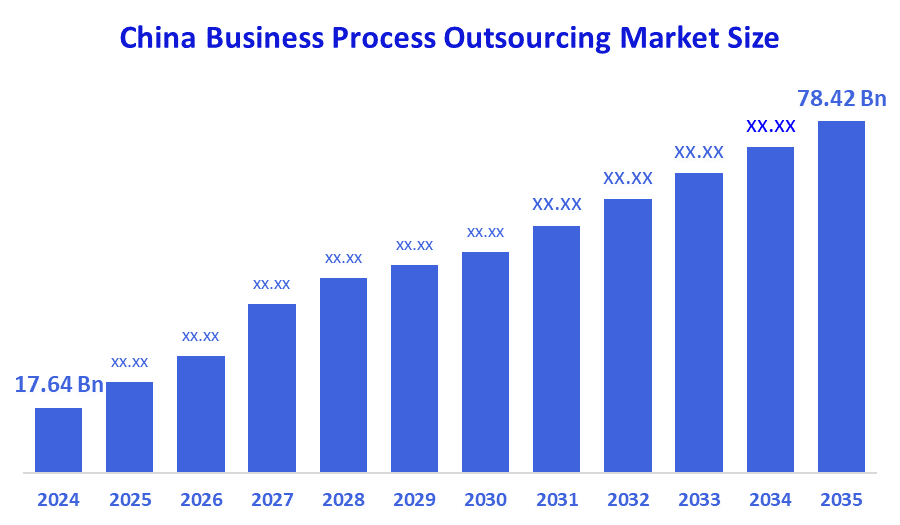

- China Business Process Outsourcing Market Size 2024: USD 17.64 Billion

- China Business Process Outsourcing Market Size 2035: USD 78.42 Billion

- China Business Process Outsourcing Market CAGR 2024: 12.16%

- China Business Process Outsourcing Market Segments: Service Type and Application

The China business process outsourcing market is a large and the rapidly growing sector which is encompassing customer service centers, IT support, finance and accounting outsourcing, HR services, and the knowledge process outsourcing across multiple industries. It is evolving from basic cost-driven operations toward technology-enabled, cloud-based, and AI-assisted platforms, supported by strong government initiatives, digital transformation policies, increasing demand for efficiency, and a skilled workforce. The market features intense competition between domestic service providers and multinational firms, rapid adoption of automation, robotic process automation (RPA), AI-driven analytics, and growing demand for scalable, data-secure, and compliance-focused outsourcing solutions within China’s distinct regulatory and economic framework.

In China, qualified BPO firms that meet the criteria of Advanced Technology Service Enterprises (ATSEs) can benefit from a reduced Corporate Income Tax (CIT) rate of 15%, compared to the standard 25%. This incentive supports IT, BPO, and KPO service providers delivering services to overseas clients, promoting technology-driven outsourcing and global competitiveness.

The China BPO market shows the strong growth, which is driven by the rising demand for cost-efficient business services, digital transformation, and technologies such as AI, robotic process automation (RPA), cloud computing, and advanced analytics. The opportunities in the market are expanding across customer service, finance and accounting, HR, IT support, and knowledge process outsourcing, which is hereby supported by government policies promoting technology-enabled service exports, tax incentives for Advanced Technology Service Enterprises (ATSEs), the increase in demand for global outsourcing, and digitalization initiatives, despite challenges such as regulatory compliance, data security, and intense competition between domestic and multinational service providers.

Market Dynamics of the China Business Process Outsourcing Market

The China Business Process Outsourcing (BPO) market is driven by rapid digital transformation, strong government support, favorable tax policies, and a surge in technology adoption, shifting from basic back-office services to advanced, technology-enabled outsourcing solutions. Increased investments in IT infrastructure, rising demand for global outsourcing, and the need for efficient customer service, finance, HR, and knowledge process operations are accelerating adoption. China is now moving from a low-cost service provider to a global leader in BPO solutions, attracting significant domestic and international investment and becoming a key hub for AI-driven, cloud-based, and data-secure outsourcing services.

The China BPO market faces restraints such as complex and evolving regulations, data security and privacy concerns, intellectual property risks, quality and service standardization challenges, talent shortages, and geopolitical tensions. Continued reliance on foreign technologies, software platforms, and specialized outsourcing expertise pressures domestic innovation, operational efficiency, and profitability despite the market’s strong growth potential.

The future of China’s BPO market looks promising and very bright, which is driven by the rapid technological innovation, government support, and the growing demand for digital outsourcing services. New growth prospects are being created by the emerging trends such as AI-powered automation, robotic process automation (RPA), cloud-based service platforms, blockchain-enabled secure transactions, Omni channel customer service, and the advanced analytics for finance, HR, and knowledge process outsourcing. Additionally, advances in machine learning, real-time data integration, and cybersecurity solutions are enhancing operational efficiency, service quality, regulatory compliance, and scalability across China’s expanding domestic and global BPO ecosystems.

Market Segmentation

The China business process outsourcing market share is classified into service type and application.

By Service type

The China business process outsourcing market is divided by service type into kpo, customer service, human resource, finance & accounting. Among these, the customer service segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because China has the world's largest e-commerce market, which necessitates extensive customer support for managing inquiries, order management, and after-sales services.

By Application

The China business process outsourcing market is divided by application into BFSI, healthcare, manufacturing, it & telecommunications, retail, government & defense, and others. Among these, the it & telecommunications segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is driven by the rapid expansion of IT firms, fast modernization, and the need for cost reduction and efficiency in managing complex digital infrastructures.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China business process outsourcing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Business Process Outsourcing Market

- Chinasoft International Co., Ltd.

- Infosys Ltd.

- M&Y Global Services

- Northking Information Technology Co., Ltd.

- Wipro Ltd

- Accenture

- Amdocs

- Capgemini SE

- China Customer Relations Centers, Inc.

- China Data Group Co., Ltd.

- Others

Recent Developments in China Business Process Outsourcing Market

In January?2024, Amdocs launched its End?to?End Service Orchestration (E2ESO) solution to improve efficiency for telecommunications service providers by automating service lifecycle and network orchestration.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China business process outsourcing market based on the below-mentioned segments:

China Business Process Outsourcing Market, By service type

- KPO

- Customer Service

- Human Resource

- Finance & Accounting

China Business Process Outsourcing Market, By application

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunication

- Retail

- Government & Defense

- Others.

FAQ

Q: What is the China business process outsourcing market size?

A: China business process outsourcing market is expected to grow from USD 17.64 billion in 2024 to USD 78.42 billion by 2035, growing at a CAGR of 12.16% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by rapid digital transformation, strong government support, favorable tax policies, and a surge in technology adoption, shifting from basic back-office services to advanced, technology-enabled outsourcing solutions.

Q: What factors restrain the China business process outsourcing market?

A: Constraints include complex and evolving regulations, data security and privacy concerns, intellectual property risks, quality and service standardization challenges, talent shortages, and geopolitical tensions.

Q: How is the market segmented by application?

A: The market is segmented into BFSI, healthcare, manufacturing, it & telecommunications, retail, government & defense, and others.

Q: Who are the key players in the China business process outsourcing market?

A: Key companies include Accenture, Amdocs, Capgemini SE, China Customer Relations Centers, Inc., China Data Group Co., Ltd., Chinasoft International Co., Ltd., Infosys Ltd., M&Y Global Services, Northking Information Technology Co., Ltd., and Wipro Ltd., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 207 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |