China Cold Chain Market

China Cold Chain Market Size, Share, By Type (Storage, Transportation), By Temperature Range (Chilled, Frozen), China Cold Chain Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China Cold Chain Market Insights Forecasts to 2035

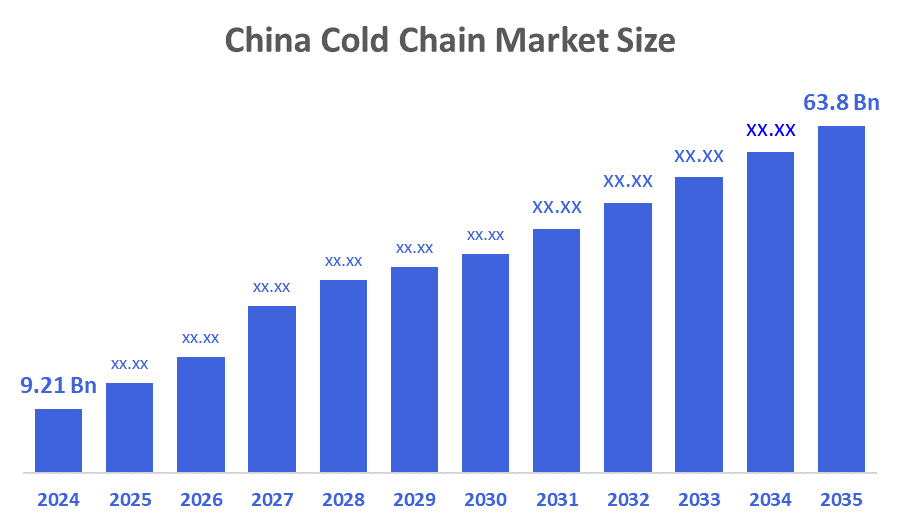

- China Cold Chain Market Size 2024: USD 9.21 Bn

- China Cold Chain Market Size 2035: USD 63.8 Bn

- China Cold Chain Market CAGR 2024: 19.24%

- China Cold Chain Market Segments: Type and Temperature Range

The China Cold Chain Market Size encompasses the storage, transportation, and distribution of the temperature-sensitive products, including food, pharmaceuticals, and the perishable goods. It is one of the rapidly growing sector which is driven by the strong government support, stringent safety regulations, and surging consumer demand for fresh, high-quality products. In order to address the growing need for effective, dependable, and technologically sophisticated solutions, domestic logistics and cold chain providers are driving the market's growth and dynamism. China is becoming a key participant in cold chain logistics because to investments in automated multi-temperature warehouses, refrigerated trucks, IoT-enabled monitoring, and digital supply chain systems that improve productivity, traceability, and product quality.

China’s 14th Five-Year Plan for cold-chain logistics (2021–2025) aims to build a comprehensive, green, and smart cold-chain system linking urban and rural areas while connecting internationally. The plan promotes investment, advanced technologies, and regulatory oversight to improve efficiency, reduce food and pharmaceutical spoilage, and strengthen safety across China’s growing cold-chain market.

The growing demand for fresh and safe food, increasing urbanization, and supportive government policies promoting infrastructure investment and safety standards, the Chinese cold chain market presents substantial growth opportunities. Despite of being challenges such as high costs and fragmented regional networks, government initiatives drive innovation in automation, smart warehousing, IoT monitoring, and temperature-controlled logistics. Rising consumer awareness, expansion of e-commerce, and integration of digital supply chain solutions are accelerating adoption, while partnerships with international logistics providers and technology firms are enhancing efficiency, traceability, and sustainability across China’s cold chain ecosystem.

Market Dynamics of the China Cold Chain Market

The China cold chain market is driven by the growing consumer needs for fresh and the safe food, strong government support through policies and the infrastructure investments, which is increasing adoption on advanced technologies and a focus on the efficiency and the sustainability. There is rise in demand for the because of the urbanization, expanding E-commerce, and improving the logistics infrastructure. AI-driven temperature control, automated multi-temperature warehouses, IoT-enabled monitoring, and smart cold storage are all increasing operational efficiency and product quality. As it moves from dispersed, antiquated cold storage to a cutting-edge, technologically advanced cold chain ecosystem, China is drawing substantial global and domestic investment and establishing new benchmarks for the logistics of food and pharmaceuticals.

The China cold chain market faces restraints such as strict government regulations, fragmented regional standards, rising operational and energy costs, quality control challenges among smaller providers, and talent shortages in logistics and technology management. Continued reliance on imported refrigeration equipment, sensors, and advanced monitoring systems further pressures innovation, profitability, and supply chain stability, despite the market’s strong growth potential.

The future of China’s cold chain market looks promising and bright, which is driven by the rapid technological innovations, the supportive government policies, and the growing consumer demand for fresh and safe pharmaceuticals. The advancement in the IoT-enabled temperature monitoring, AI driven inventory and the route management are creating the new growth opportunities. Developments in smart refrigeration systems, energy-efficient storage solutions, digital supply chain integration, and big data analytics for tracking product quality are enhancing operational efficiency, regulatory compliance, and adoption across China’s expanding cold chain ecosystem, positioning it as a key enabler of food safety and pharmaceutical logistics.

Market Segmentation

The China cold chain market share is classified into type and temperature range.

By Type

The China cold chain market is divided by type into storage, transportation. Among these, the plug-in storage segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because of the storage facilities, such as refrigerated warehouses and cold rooms, are critical for preserving perishable goods (food, pharmaceuticals, etc.) at optimal low temperatures for extended periods, from production to distribution centers.

By Temperature Range

The China cold chain market is divided by temperature range into chilled, frozen. Among these, the chilled segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is dominating because the massive consumer demand for fresh produce, dairy products, and ready-to-eat meals, which all require specific temperature controls above freezing point.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China cold chain market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Cold Chain Market

- JD.com

- Arcticold Food

- Xianyi Holding Group

- Gaishi Group, John Swire & Sons (H.K.) Ltd.

- Beijing Ershang Group Co. Ltd.

- NICHIREI CORPORATION

- China Merchants Americold Logistics Company Ltd.

- Jinjiang International (Group) Co., Ltd.

- SF Express

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China cold chain market based on the below-mentioned segments:

China Cold Chain Market, By Type

- Storage

- Transportation

China Cold Chain Market, By Temperature Range

- Chilled

- Frozen

FAQ

Q: What is the China cold chain market size?

A: China cold chain market is expected to grow from USD 9.21 billion in 2024 to USD 63.8 billion by 2035, growing at a CAGR of 19.24% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the growing consumer needs for fresh and the safe food, strong government support through policies and the infrastructure investments.

Q: What factors restrain the China cold chain market?

A: Constraints include the strict government regulations, fragmented regional standards, rising operational and energy costs, quality control challenges among smaller providers.

Q: How is the market segmented by propulsion type?

A: The market is segmented into storage and transportation.

Q: Who are the key players in the China cold chain market?

A: Key companies include JD.com, Arcticold Food, Xianyi Holding Group, Gaishi Group, John Swire & Sons (H.K.) Ltd., Beijing Ershang Group Co. Ltd., NICHIREI CORPORATION, China Merchants Americold Logistics Company Ltd., Jinjiang International (Group) Co., Ltd., SF Express and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |