China Corporate Training Market

China Corporate Training Market Size, Share, and COVID-19 Impact Analysis, By Training Program (Technical Training, Soft Skills, Quality Training, Compliance, and Others), By Industries (Retail, Pharmaceutical and Healthcare, Financial Services, Professional Services, Public Enterprises, Information Technology, and Others), and China Corporate Training Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China Corporate Training Market Insights Forecasts to 2035

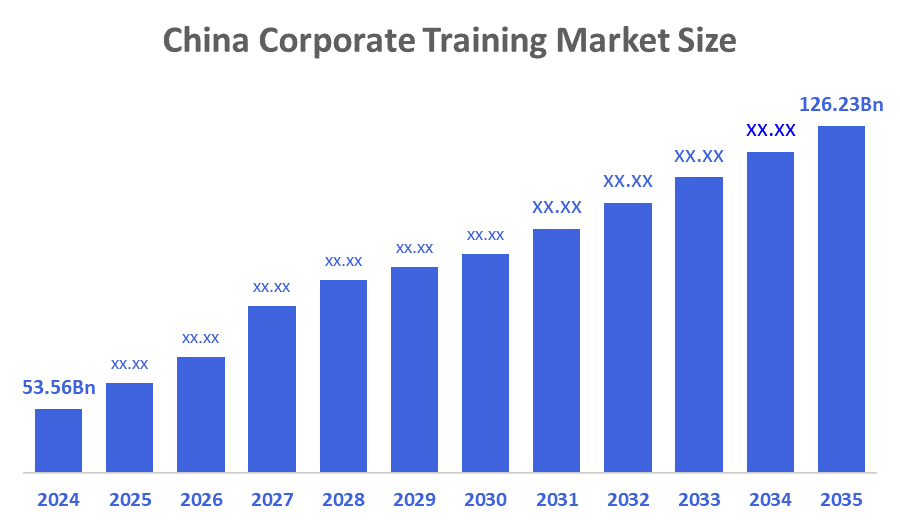

- The China Corporate Training Market Size Was Estimated at USD 53.56 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.11% from 2025 to 2035

- The China Corporate Training Market Size is Expected to Reach USD 126.23 Billion by 2035

According To a Research Report Published by Decisions Advisors & Consulting, The China Corporate Training Market Size Is Anticipated To Reach USD 126.23 Billion By 2035, Growing At a CAGR Of 8.11% From 2025 to 2035. The need for upskilling and reskilling, government policies encouraging lifelong learning, compliance and regulatory requirements, digital transformation, and the increasing involvement of SMEs in employee development represent a few of the factors that are driving the market.

Market Overview

The China corporate training market refers to the industry segment that provides learning development programs for employees in multiple industries, through on-site, off-site, and digital platforms. It offers technical training, legal education, leadership development, and skill enhancement activities. Corporate training enhances employees' productivity, motivation, performance, and retention, which helps corporations to achieve their business goals. As industries undergo rapid transformation due to technological advancement, globalization, and changing markets, the demand for new skills is rising. Moreover, the training programs help to acquire the knowledge, which is boosting the industry growth and offers opportunities for professional growth and advancement for employee engagement and satisfaction. In addition to increased demand for specialized skills in fields like AI, data science, and cybersecurity, businesses are investing in training programs that enable employees to keep up with shifting industry standards and technological standards.

The county policies promote education and professional growth are driving businesses to invest in continuous learning and skills development. These policies ensure that workers in different industries remain competitive and flexible by implementing these policies. The governing authority highlights the significance of workforce skills, which boost overall economic development for the nation.

The Ministry of Science and Technology of China sponsors the International Training Program (ITP), which offers officials, engineers, scientists, intellectuals, and researchers from developing nations short-term training in China. Its goals are to promote knowledge sharing, improve innovative capacity, and fortify scientific and technological collaboration.

China encourages lifelong learning. Through initiatives like executive education and vocational retraining, Businesses are increasingly funding staff development, with SMEs accounting for 97% of recent sponsors. This is in line with economic objectives, such as 4.9% wage growth by 2050 and 4.7% annual per capita GDP growth.

Report Coverage

This research report categorises the market for the China corporate training market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China corporate training market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China corporate training market.

Driving Factors

The market for corporate training in China is being driven by rapid technological change, especially in it, telecom, advanced manufacturing, and healthcare are pushing employees to stay competitive. Initiatives taken by the government, such as vocational training, executive education, and lifelong learning programs this make corporate training a strategic priority and raise the market growth. Regulatory education across the industry requires employees must ensure they are trained in compliance, safety, and quality standards, boosting the demand for corporate training services. Additionally shift towards AI-driven learning tools and blended learning models is expanding access to training, reducing costs, and making corporate training more scalable. Along with this, a notable driver is the increasing involvement of small and medium-sized enterprises, with nearly all recent sponsors of employee development programs, which broadens the market beyond large corporations.

Restraining Factors

The China corporate training market faces key restraints, including high training program prices, inconsistent provider quality, low awareness among SMEs, cultural aversion to change, complicated regulations, and difficulties with digital adoption.

Market Segmentation

The China corporate training market share is classified into training program and industries.

- The technical training segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China corporate training market is divided by training program into technical training, soft skills, quality training, compliance, and others. Among these, the technical training segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is fueled by the nation's quick move toward industrial modernization and digital transformation. Businesses are placing a high premium on IT, digital skills, and engineering training in order to keep up with automation and modern production. Government programs encourage businesses to adopt modern technology and boost capacities, which accelerates the demand in the market.

- The information technology segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China corporate training market is segmented by industries into retail, pharmaceutical and healthcare, financial services, professional services, public enterprises, information technology, and others. Among these, the information technology segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. The segment is leading the market because the country's increasing adoption of AI, cloud computing, big data, and cybersecurity necessitates ongoing employee upskilling, and its sizable IT workforce in software, telecom, and digital services drives extensive training needs. Chinese IT organizations prioritize training to meet international standards because of their ambition for international competitiveness.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within China corporate training market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Edstellar

- The Really Great Teacher Company

- 6Wresearch Reported Players

- Local Specialized Firms

- New Oriental Education & Technology Group

- China Distance Education Holdings

- Huatu Education

- Tarena International, Inc.

- Skillsoft (China Operations)

- CEIBS

- Others

Recent Developments:

- In July 2025, China launched a new AI and robotics training ground to accelerate advanced manufacturing and urban governance, aiming to attract robotics firms and strengthen its innovation ecosystem. By building an excellent robotics cluster, you hope to contribute to Sichuan's broader plan to position Western China as a hub for innovation and industrial transformation.

- In March 2025, AmCham China officially launched its 2025 Leadership Development Program (LDP) in Beijing, welcoming 24 participants from 20 organizations for an eight-month journey focused on leadership, strategy, and US-China business dynamics. Brings together professionals from multiple sectors, fostering collaboration and shared learning

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China corporate training market based on the below-mentioned segments:

China Corporate Training Market, By Training Program

- Technical Training

- Soft Skills

- Quality Training

- Compliance

- Others

China Corporate Training Market, By Industries

- Retail

- Pharmaceutical And Healthcare

- Financial Services

- Professional Services

- Public Enterprises

- Information Technology

- Others

FAQ

Q: What is the current and forecasted size of the China corporate training market?

A: The market was valued at approximately USD 53.56 billion in 2024 and is projected to grow at a CAGR of 8.11%, reaching around USD 126.23 billion by 2035.

Q: What are the primary types of training programs in the China corporate training market?

A: Major types include technical training, soft skills, quality training, compliance, and others. Among these, the technical training segment held a substantial share in 2024. The segment is fuelled by the nation's quick move toward industrial modernization and digital transformation.

Q: What are the main industry segments in the market?

A: The market is segmented into retail, pharmaceutical and healthcare, financial services, professional services, public enterprises, information technology, and others. Among these, the information technology segment dominated the market in 2024. The segment is leading the market because the country's increasing adoption of AI, cloud computing, big data, and cybersecurity necessitates ongoing employee upskilling, and its sizable IT workforce in software, telecom, and digital services drives extensive training needs.

Q: What are the key driving factors for market growth?

A: Growth is driven by the need for upskilling and reskilling, government policies encouraging lifelong learning, compliance and regulatory requirements, digital transformation, and the increasing involvement of SMEs in employee development.

Q: What challenges does the market face?

A: Challenges include high training program prices, inconsistent provider quality, low awareness among SMEs, cultural aversion to change, complicated regulations, and difficulties with digital adoption.

Q: Who are some key players in the market?

A: key companies include Edstellar, the Really Great Teacher Company,6wresearch reported players, local specialized firms, new oriental education & Technology Group, China Distance Education Holdings, Huatu Education, Tarena International, Inc., Skillsoft (China Operations), and CEIBS.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |