China E-Cigarette And Vape Market

China E-Cigarette And Vape Market Size, Share, By Product (Disposable, Rechargeable, And Modular Devices), By Category (Open And Closed), By Distribution Channel (Online And Retail), And China E-Cigarette And Vape Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China E-Cigarette And Vape Market Insights Forecasts to 2035

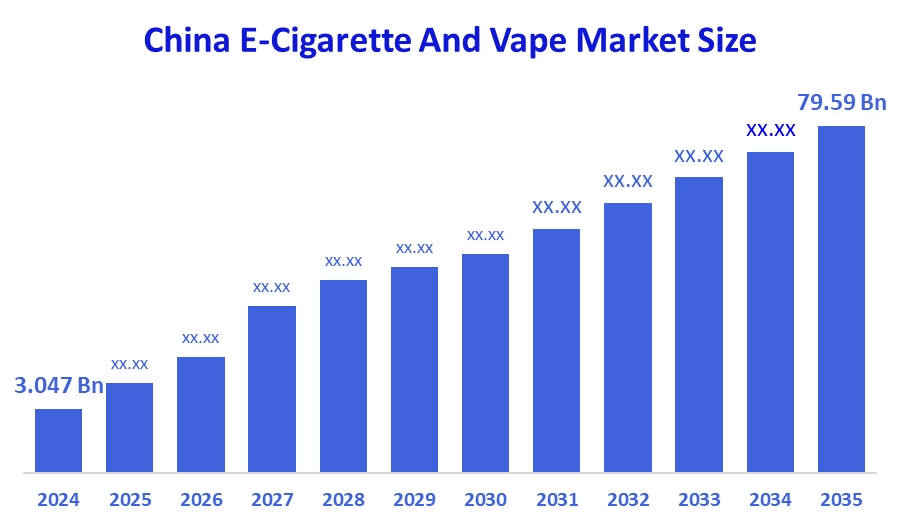

- China E-Cigarette And Vape Market Size 2024: USD 3.047 Billion

- China E-Cigarette And Vape Market Size 2035: USD 79.59 Billion

- China E-Cigarette And Vape Market CAGR 2024: 34.53%

- China E-Cigarette And Vape Market Segments: Product, Category, and Distribution Channel

The China e-cigarette and vape market consists of electronic nicotine delivery systems also referred to as ENDS which include e-cigarettes, vape pens, pod systems, rechargeable and modular devices, as well as their consumable products such as e-liquids and cartridge liquids. ENDS utilize battery operated heat coils to vaporize liquids often containing nicotine and produce an aerosol that can be inhaled. The electronic nicotine delivery systems manufacturer’s position this as a potentially less harmful option than smoking traditional tobacco without combustion or tar in China market.

The e-cigarette and vape in China are backed by government support, including the Measures for the Administration of Electronic Cigarettes and Electronic Cigarettes National Mandatory Standards have regulated aspects of the products such as quality control, nicotine content, and sale distribution mandatory and establishing a standardization process for the entire industry and consumer protection purposes. According to government control of exports from China, the domestic e-cigarette market has declined dramatically from 19.6 billion yen in 2020 to approximately 4.2 billion yen in 2023 due to the regulatory restrictions placed on this industry. In contrast, the e-cigarette manufacturers in China continue to export on a large scale to other countries, especially as the world’s leading electronic cigarette manufacturer.

As technology advances, Chinese e-cigarette and vape providers are now using innovative approaches to ceramic atomizer cores, manufacturers are developing longer-lasting battery systems and integrating e-cigarettes with smart devices. Additional improvements include the use of ceramic heating cores for enhanced atomization, new environmentally friendly materials that may be biodegradable and new e-cigarettes with built-in applications that allow the consumer to interface with the product.

Market Dynamics of the China E-Cigarette And Vape Market:

The China e-cigarette and vape market is driven by the China's vast amounts of production and exporting countries, its strong overseas demand supporting production, continue to create competitively priced as device prices appear competitive technological advancement and supportive government policies further drives the market.

The China e-cigarette and vape market is restrained by the strict domestic regulatory controls including nicotine content limits, flavor restrictions, and online sales prohibitions, suppressed local market growth and reduced profitability for many smaller players.

The future of China e-cigarette and vape market is bright and promising, with versatile opportunities emerging from the product's compliance and harm-reduction-focused positioning will create ongoing opportunities. Also, product development focusing on health-oriented product availability, as well as developing new technologies that will give consumers a safer experience, also support significant growth in overseas markets as regulations evolve globally.

Market Segmentation

The China E-Cigarette And Vape Market share is classified into product, category, and distribution channel.

By Product:

The China e-cigarette and vape market is divided by product into disposable, rechargeable, and modular devices. Among these, the rechargeable segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Cost effectiveness offering better long term value, sustainability appeal boost rechargeable sales, and advanced features increase their desirability all contribute to the rechargeable segment's largest share and higher spending on e-cigarette and vape when compared to other product.

By Category:

The China e-cigarette and vape market is divided by category into open and closed. Among these, the closed segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The closed segment dominates because of convenience and simplicity requiring no maintenance, user friendly, fitting modern lifestyle, and brand popularity increase their appeal in the China market.

By Distribution Channel:

The China e-cigarette and vape market is divided by distribution channel into online and retail. Among these, the retail segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Strict regulations making them the only legal sales channel, direct consumer interaction, controlled brand promotion, and customer education all contribute to the retail segment's largest share and higher spending on e-cigarette and vape when compared to other distribution channel.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China e-cigarette and vape market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China E-Cigarette And Vape Market:

- RELX

- YOOZ

- MOTI

- REJO

- Smoore International Holdings Ltd.

- Shenzhen Uwell Technology Co., Ltd.

- Innokin Technology Ltd.

- Hangsen International Group Limited

- Joyetech Electronics Co.Ltd.

- ALD Group

- Others

Recent Developments in China E-Cigarette And Vape Market:

In November 2025, RELX International showcased its new nicotine pouch technology, AiePouch. These pouches are less than 1mm thick, offering discreet use and faster nicotine absorption. The product represents a strategic shift towards modern oral nicotine products for potential launch in EU markets

In November 2025, REJO, a global provider of heated tobacco solutions, unveiled the REJO MULTI device. This innovative device featured a dual-heating system, allowing compatibility with a wide range of heated sticks, including TEREA, HEETS, LEVIA, and China Tobacco manufactured sticks.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China e-cigarette and vape market based on the below-mentioned segments:

China E-Cigarette And Vape Market, By Product

- Disposable

- Rechargeable

- Modular Devices

China E-Cigarette And Vape Market, By Category

- Open

- Closed

China E-Cigarette And Vape Market, By Distribution Channel

- Online

- Retail

FAQ

Q: What is the China e-cigarette and vape market size?

A: China e-cigarette and vape market is expected to grow from USD 3.047 billion in 2024 to USD 79.59 billion by 2035, growing at a CAGR of 34.53% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the China’s dominant position in manufacturing and export markets, strong overseas demand bolstering production despite subdued domestic consumption, China-produced devices remain competitive due to cost efficiency and scale.

Q: What factors restrain the China e-cigarette and vape market?

A: Constraints include the strict domestic regulatory controls including nicotine content limits, flavor restrictions, and online sales prohibitions, suppressed local market growth and reduced profitability for many smaller players.

Q: How is the market segmented by product?

A: The market is segmented into disposable, rechargeable, and modular devices.

Q: Who are the key players in the China e-cigarette and vape market?

A: Key companies include RELX, YOOZ, MOTI, REJO, Smoore International Holdings Ltd., Shenzhen Uwell Technology Co., Ltd., Innokin Technology Ltd., Hangsen International Group Limited, Joyetech Electronics Co.Ltd., ALD Group, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |