China Electric Vehicle Battery Housing Market

China Electric Vehicle Battery Housing Market Size, Share, and COVID-19 Impact Analysis, By Battery Type (Lithium-Ion, Solid-State, Nickel-Metal Hydride, Lead-Acid, and Others), By Material (Steel, aluminum, Composites, and Others), and China Electric Vehicle Battery Housing Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

China Electric Vehicle Battery Housing Market Insights Forecasts to 2035

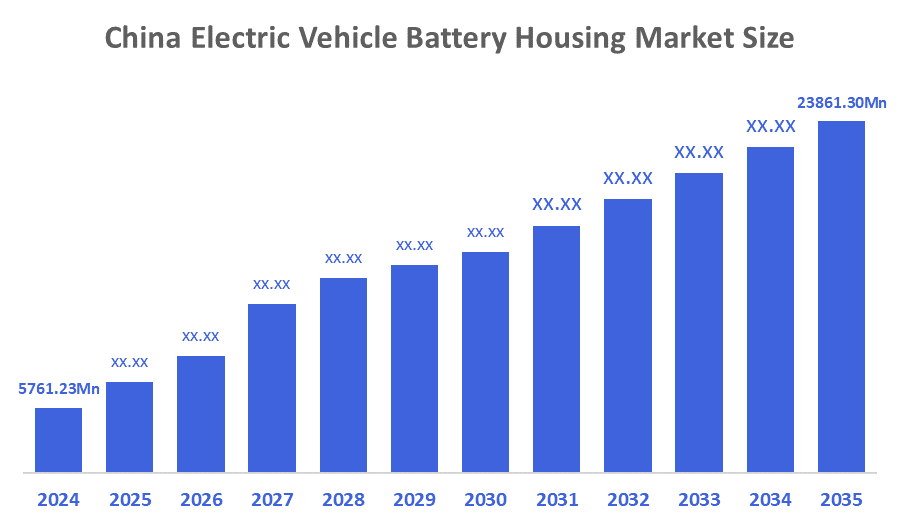

- The China Electric Vehicle Battery Housing Market Size Was Estimated at USD 5,761.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.79% from 2025 to 2035

- The China Electric Vehicle Battery Housing Market Size is Expected to Reach USD 23,861.30 Million by 2035

According to a Research Report Published by Decision Advisior & Consulting, the China Electric Vehicle Battery Housing Market is anticipated to reach USD 23,861.30 million by 2035, growing at a CAGR of 13.79% from 2025 to 2035. The primary drivers of the market are government EV policies, rising demand for lightweight materials, rapid EV adoption, safety regulations, and commercial fleet expansion.

Market Overview

The China electric vehicle (EV) battery housing market refers to the industry segment that focuses on Devices that secure and protect battery packs, ensuring mechanical strength and resistance to vibration, corrosion, and impact. These housings, composed of steel, aluminum, or innovative composites, are critical for passenger cars, business fleets, and high-performance EVs, balancing cost-effectiveness, lightweight efficiency, and durability. Aside from structural integrity, they are vital for safety compliance, meeting crash and fire protection regulations, and integrating thermal management systems to minimize overheating. Battery housings increase driving range, extend battery life, and promote China's rapid EV industry expansion by combining lightweight construction, long-term durability, and corrosion resistance. Moreover, the market is undergoing a transformation, driven by technological improvements and rising customer demand. The push for sustainable transportation solutions has resulted in an increase in the production of high-capacity batteries, which are critical for improving the performance and range of electric vehicles. Additionally, Companies are increasingly investing in innovative materials like aluminum and composites to boost performance while lowering weight. The expansion of charging infrastructure and increased demand for New Energy Vehicles will drive market growth, establishing China as a global leader in EV battery housing.

Between 2014 and 2025, Chinese EV and battery firms (such as BYD and CATL) invested more than $143 billion to obtain raw materials, battery components, and overseas production facilities, to bypass trade obstacles and strengthen their worldwide dominance in the EV ecosystem.

Report Coverage

This research report categorises the market for the China electric vehicle battery housing market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China electric vehicle battery housing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China electric vehicle battery housing market.

Driving Factors

China's EV battery house industry is driven by strong government policies and incentives that encourage electric vehicle adoption in passenger and public vehicles, as well as national efforts to reduce carbon emissions. Rising demand for lightweight materials like aluminum and composites boosts vehicle efficiency, but steel remains popular in low-cost vehicles, and advanced composites gain popularity in higher-end applications. Safety and thermal management concerns drive innovation, with housings built to meet crash and fire standards and incorporating cooling systems to improve battery life. Commercial EV fleets, including buses and trucks, are driving up demand for durable, high-integrity housings. Supported by China's extensive EV ecosystem, proximity to key battery manufacturers like CATL and BYD, and investments in domestic and international raw materials are boosting the market growth.

Restraining Factors

The China electric vehicle battery housing market faces key restraints such as high production costs, raw material price volatility, technological complexity, regulatory challenges, supply chain risks, and intense competition.

Market segmentation

The China electric vehicle battery housing market share is classified into battery type and material.

- The lithium-ion segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China electric vehicle battery housing market is divided by battery type into lithium-ion, solid-state, nickel-metal hydride, lead-acid, and others. Among these, the lithium-ion segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by It is affordable, safe, and has a long service life. LFP batteries, which are popular in passenger vehicles, buses, and commercial fleets, have emerged as the backbone of China's electrification effort, accounting for more than 81% of total installations by 2024.

- The aluminum segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China electric vehicle battery housing market is segmented by material into steel, aluminum, composites, and others. Among these, the aluminum segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the leading segment, driven by its lightweight nature increases driving range and overall efficiency. Its high corrosion resistance and thermal conductivity make it ideal for both passenger and commercial EVs, ensuring durability and efficient heat management. As a result, leading manufacturers like BYD and CATL rely extensively on aluminum housings for mainstream electric vehicle production.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within China electric vehicle battery housing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BYD Company Ltd.

- CATL (Contemporary Amperex Technology Co. Ltd.)

- CITIC Dicastal Co. Ltd.

- Minth Group Ltd.

- Wuxi Weifu High-Technology Group Co., Ltd.

- Guangdong Hongtu Technology Holdings Co. Ltd.

- Others

Recent Developments:

- In November 2025, GAC Group has indeed launched China's first pilot production line for large-format (over 60 Ah) all-solid-state battery cells, advancing the technology toward commercialization for mass-market EVs.? This promises over 50% higher energy density, potentially extending EV ranges beyond 1,000 km while improving safety through solid electrolytes.

- In November 2024, Novelis collaborated with Chinese automakers like Li Auto to incorporate lightweight aluminum solutions into car designs, such as battery enclosures, to improve performance and efficiency. The collaboration focuses on lightweight aluminum technologies integrated into nine important components of Li Auto's Li MEGA MPV, including battery casings.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035.Decision Advisior has segmented the China electric vehicle battery housing market based on the below-mentioned segments:

China Electric Vehicle Battery Housing Market, By Battery Type

- Lithium-Ion

- Solid-State

- Nickel-Metal Hydride

- Lead-Acid

- Others

China Electric Vehicle Battery Housing Market, By Material

- Steel

- Aluminum

- Composites

- Others

FAQ

Q: What is the current and forecasted size of the China electric vehicle battery housing market?

A: The market was valued at approximately USD 5,761.23 million in 2024 and is projected to grow at a CAGR of 13.79%, reaching around USD 23,861.30 million by 2035.

Q: What are the primary battery types in the China electric vehicle battery housing market?

A: The battery types are lithium-ion, solid-state, nickel-metal hydride, lead-acid, and others. Among these, the lithium-ion segment held a substantial share in 2024. The segment is driven by It is affordable, safe, and has a long service life.

Q: What are the main materials in the market?

A: The main materials are steel, aluminum, composites, and others. Among these, the aluminum segment dominated the market in 2024. This is the leading segment, driven by its lightweight nature increases driving range and overall efficiency.

Q: What are the key driving factors for market growth?

A: Growth is driven by government EV policies, rising demand for lightweight materials, rapid EV adoption, safety regulations, and commercial fleet expansion.

Q: What challenges does the market face?

A: Challenges include the high production costs, raw material price volatility, technological complexity, regulatory challenges, Supply Chain Risks, and intense competition.

Q: Who are some key players in the market?

A: Key companies include BYD Company Ltd., CATL (Contemporary Amperex Technology Co. Ltd.), CITIC Dicastal Co. Ltd., Minth Group Ltd., Wuxi Weifu High-Technology Group Co. Ltd., Guangdong Hongtu Technology Holdings Co. Ltd., and others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |