China Elevator Ropes Market

China Elevator Ropes Market Size, Share, and COVID-19 Impact Analysis, By Functionality (Traction, Governor, Compensation, and Others), By Elevator Type (Machine room [MR] elevator, Machine room less [MRL] elevator, Hydraulic elevator, and Others), and China Elevator Ropes Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China Elevator Ropes Market Size Insights Forecasts to 2035

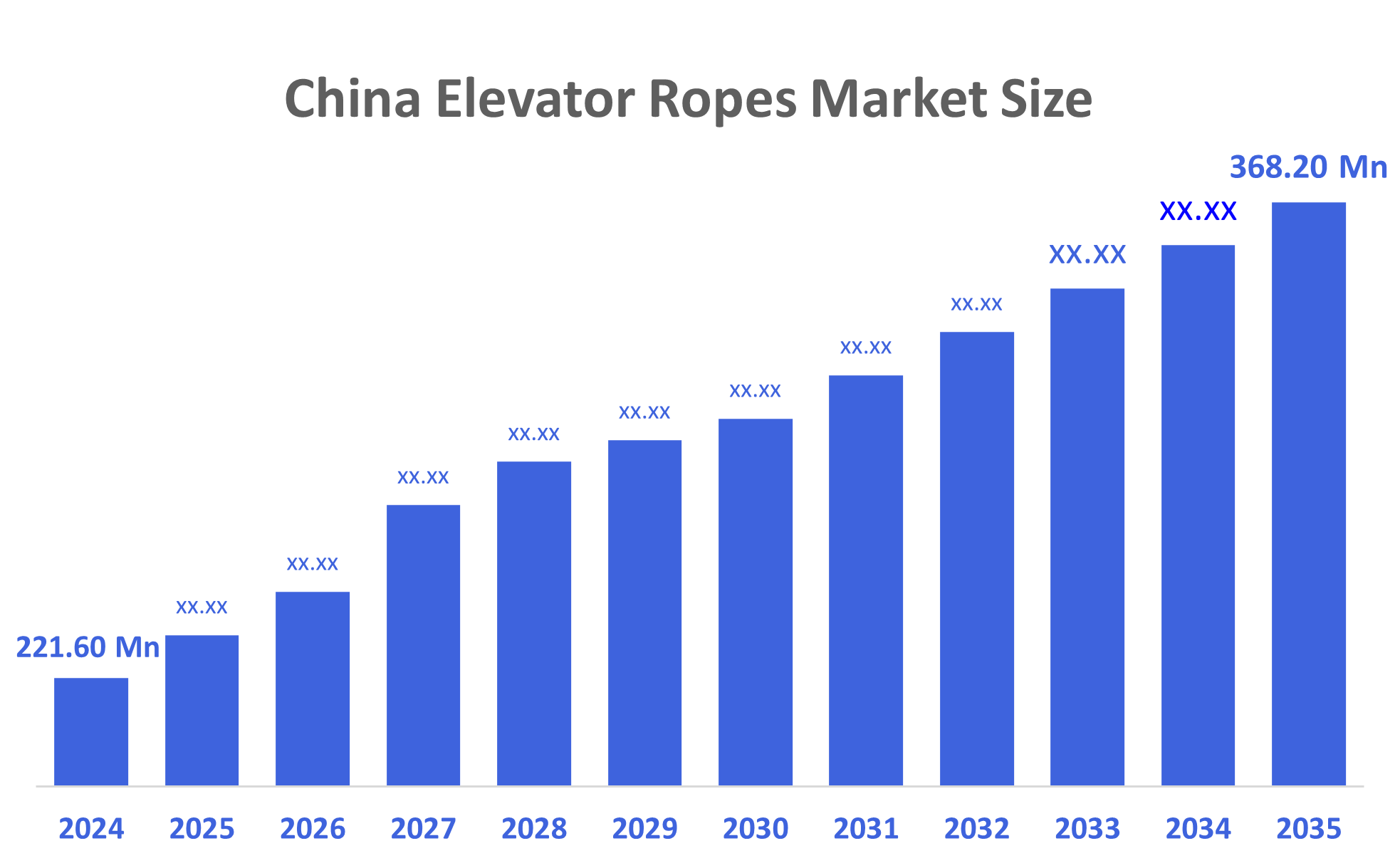

- The China Elevator Ropes Market Size Was Estimated at USD 221.60 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.72% from 2025 to 2035

- The China Elevator Ropes Market Size is Expected to Reach USD 368.20 Million by 2035

According to a Research Report Published by Decisions Advisors, The China Elevator Ropes Market Size is Anticipated to Reach USD 368.20 Million by 2035, Growing at a CAGR of 4.72% from 2025 to 2035. The primary drivers of the market are Rapid urbanization, an increase in high-rise building construction, the need to repair outdated elevators, improvements in rope material technology, and government infrastructure projects.

Market Overview

The China elevator ropes market refers to the industry segment that makes, distributes, and maintains ropes for elevator suspension, compensation, and traction systems. It involves the need for maintenance, replacements, and new elevator installations in residential, commercial, and industrial buildings. Elevator ropes, constructed of specific steel or fiber cores, are critical components that guarantee the safe movement and balancing of elevator cars. They are primarily composed of wires, cores, and strands. These ropes are available in a range of sizes depending on the core type, such as 6*19 F, 8*19 S, 6*19 S, and so on. Lift ropes are an important part of an elevator system because they allow an elevator carriage to move over the lift way. The wire core of an elevator rope is an important component that supports the strands and helps to maintain the rope's relative position under varying loads. In addition, the China Elevator Ropes Market offers several investment opportunities, particularly in technological innovation and manufacturing capacity expansion. Investing in R&D to develop high-performance, ecologically friendly, fire-resistant ropes can provide you with a competitive advantage. The rising requirement to modernize existing elevator systems presents an opportunity for manufacturers to provide updated ropes that fulfill greater safety standards. Furthermore, the rise in refurbishment and modernization initiatives for older elevators boosts demand. The fast-growing construction industry, along with more people having money to spend and cities growing, is creating a strong base for the market to expand.

Mingyang Smart Energy, a Chinese company, has announced plans to invest up to GBP 1.5 billion (approximately EUR 1.7 billion) in Scotland to construct what it claims will be the first fully integrated offshore wind turbine manufacturing facility in the UK.

Report Coverage

This research report categorises the market for the China elevator ropes market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China elevator ropes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China elevator ropes market.

Driving Factors

China's thermal anemometers market is primarily driven by China's rapid urbanization is a pivotal catalyst for over 60% new urban infrastructure projects incorporating advanced elevator systems, directly fueling the market. China's construction industry is one of the world's largest, with residential, commercial, and industrial developments requiring elevators. Additionally, elevator ropes require replacement every 7- 10 years due to wear and tear. With millions of elevators already installed, the aftermarket demand for ropes is a significant growth driver. China's urban development policies and investment in public infrastructure, such as metrosystems, hospitals, airports, and increased elevator installation, while the regulation emphasizing safety standards encourages replacement with high-quality ropes, boosting the market growth.

Restraining Factors

The China Elevator Ropes Market faces key restraints such as high raw material costs, strict safety regulations, limited innovation in rope technology, dependence on replacement cycles, Economic Slowdowns & Construction Decline, and competition from alternative elevator systems.

Market segmentation

The China elevator ropes market share is classified into functionality and elevator type.

- The traction segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China elevator ropes market is divided by functionality into traction, governor, compensation, and others. Among these, the traction segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by their widespread use in all types of buildings, making them indispensable, ensuring continual demand. Because of their frequent wear and tear, these ropes often require replacement every seven to ten years, resulting in a consistent aftermarket cycle. This combination of necessity, widespread use, and frequent replacement solidifies traction ropes as the dominating segment in China's elevator rope market.

- The machine room [MR] elevator segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China elevator ropes market is segmented by elevator type into machine room [MR] elevator, machine room less [MRL] elevator, hydraulic elevator, and others. Among these, the machine room [MR] elevator segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the leading segment, driven by their traditional design, which includes a separate machine room placed above the shaft. They are still widespread in older residential and commercial buildings, although their design takes up more room, costs more to build, and provides less energy efficiency than modern alternatives. While new MR elevator installations are steadily falling, they have a prominent position in the replacement market due to the huge number of existing systems that are still in operation.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within China elevator ropes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Huayuan Wire Rope Co., Ltd.

- Nantong Shenwei Steel Wire Rope Co., Ltd.

- Qingdao Huazhuo HD Machinery Co., Ltd.

- Ningbo Jindler Electro-Mechanic Co., Ltd.

- Savera Group (China Office)

- Others

Recent Developments:

- In September 2024, New Mandatory National Standard: The national standard GB 8903-2024 "Steel Wire Ropes for Elevators" was issued on June 25, 2024, and became mandatory on September 25, 2024, replacing the previous GB/T 8903-2018 standard. This update reflects the government's push for improved quality and safety across the elevator industry.

- In July 2023, Jiangsu Safety Group Co., Ltd. (formerly Jiangsu Safety Wire Rope Co., Ltd.) held a new product release conference at the WEE 2023 exhibition for their "8×19S-CGSF" FC wire ropes designed for mid-rise elevators with lifting speeds of up to 6.0 m/s. These ropes were specifically engineered for mid-rise elevators capable of operating at lifting speeds of up to 6.0 m/s, highlighting the company’s focus on enhancing both safety and performance in modern elevator systems.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China elevator ropes market based on the below-mentioned segments:

China Elevator Ropes Market, By Functionality

- Traction

- Governor

- Compensation

- Others

China Elevator Ropes Market, By Elevator Type

- Machine Room [MR] Elevator

- Machine Room Less [MRL] Elevator

- Hydraulic Elevator

- Others

FAQ

Q: What is the current and forecasted size of the China Elevator Ropes Market?

A: The market was valued at approximately USD 221.60 million in 2024 and is projected to grow at a CAGR of 4.72%, reaching around USD 368.20 million by 2035.

Q: What are the primary functionalities in the China Elevator Ropes Market?

A: The primary functionalities are traction, governor, compensation, and others. Among these, the traction segment held a substantial share in 2024. The segment is driven by their widespread use in all types of buildings, making them indispensable, ensuring continual demand.

Q: What are the main elevator types in the market?

A: The main elevator types in the market are machine room [MR] elevator, machine room less [MRL] elevator, hydraulic elevator, and others. This is the leading segment, driven by their traditional design, which includes a separate machine room placed above the shaft

Q: What are the key driving factors for market growth?

A: Growth is driven by Rapid urbanization, an increase in high-rise building construction, the need to repair outdated elevators, improvements in rope material technology, and government infrastructure projects.

Q: What challenges does the market face?

A: Challenges include high raw material costs, strict safety regulations, limited innovation in rope technology, dependence on replacement cycles, Economic Slowdowns & Construction Decline, and competition from alternative elevator systems.

Q: Who are some key players in the market?

A: Key companies include Huayuan Wire Rope Co., Ltd., Nantong Shenwei Steel Wire Rope Co., Ltd., Qingdao Huazhuo HD Machinery Co., Ltd., Ningbo Jindler Electro-Mechanic Co., Ltd., Savera Group (China Office), and Others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |