China Endoscopy Devices Market

China Endoscopy Devices Market Size, Share By Product (Endoscopes, Endoscopy Visualization Systems), By Application (Gastrointestinal (GI) Endoscopy, Laparoscopy), China Endoscopy Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China Endoscopy Devices Market Insights Forecasts to 2035

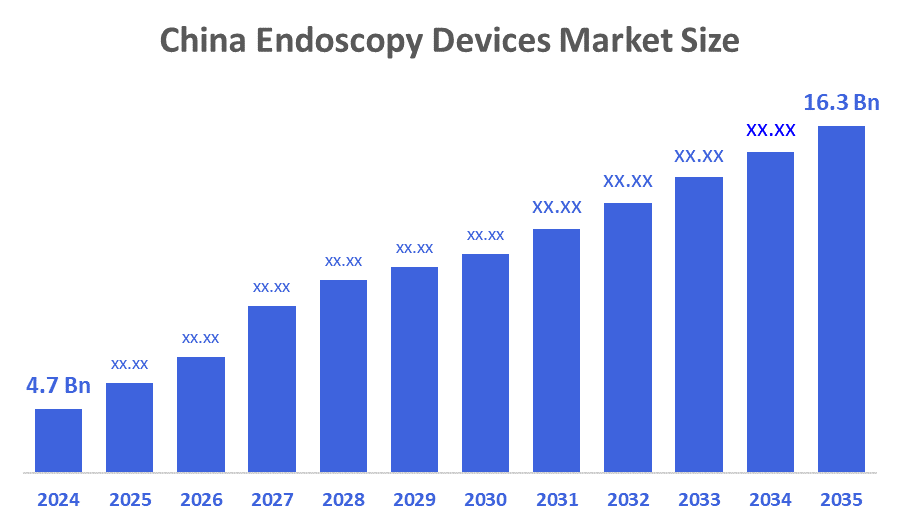

- China Endoscopy Devices Market Size 2024: USD 4.7 Bn

- China Endoscopy Devices Market Size 2035: USD 16.3 Bn

- China Endoscopy Devices Market CAGR 2024: 11.97%

- China Endoscopy Devices Market Segments: Product and Application

The Chinese Endoscopy Devices Market Size is a rapidly growing market, due to a rise in the incidences of gastrointestinal diseases, colorectal cancer screening programs, and rising awareness about the value of early diagnosis services in both rural and urban areas. These services are being faced with tough competition from within, between local manufacturers who offer relatively cheaper endoscopic systems developed within the country, and international players who are introducing technologically advanced endoscopic platforms. The government efforts in hospital infrastructures renovation, changed processes in public procurements, and favorable reimbursement models are all working together to positively trigger increased adoption. In addition, there is a tremendous value addition from a blend of concepts including high definition visualization, AI-assisted lesion identification, cloud-based storage systems, and keyhole invasive procedures.

NMPA reforms are positively shaping China’s endoscopy device market by streamlining approval pathways, improving review efficiency for innovative devices, and reducing time to market. At the same time, strengthened whole-life-cycle regulation and post-market surveillance enhance product safety, quality compliance, and long-term industry credibility.

China's endoscopy market is expanding steadily owing to the increasing number of cases associated with the gastrointestinal tract and the screening of cancer, an aging population, and awareness of healthcare, led by the country's healthcare initiatives. Artificial intelligence, robotic-assisted endoscopies, cloud image solutions, and tele-endoscopic solutions have dramatically enhanced accuracy and operation efficiencies. There are increasing prospects in terms of diagnostic and therapeutic endoscopies, high-definition imaging solutions, minimally invasive surgery tools, and artificial intelligence-assisted solutions for the detection of lesions. Today, the market is moving on to higher-value, technology-enabled products, and these are further led by ‘smart manufacturing and digital hospitals. Here, innovation and initiatives led by the country's federal government are leading the market's growth, in spite of ‘centralized procurement and pricing.

Market Dynamics of the China Endoscopy Devices Market

The China endoscopy device market is driven by a large and rapidly aging population, rising prevalence of gastrointestinal diseases, expanding reimbursement coverage, and strengthening the hospital and primary healthcare infrastructure. Increase in the healthcare expenditure and rising disposable incomes are accelerating adoption of advanced endoscopy systems, high-definition imaging platforms, and minimally invasive surgical devices. The market is moving towards the high-value, technology-driven solutions such as AI-assisted detection, robotic endoscopy, and connected imaging platforms. These market is supported by a vast patient base that enables rapid clinical validation and localization, China is attracting strong domestic and global investments and emerging as a key innovation and manufacturing hub for next-generation endoscopy devices.

The China endoscopy device market faces restraints such as strong pricing pressure from centralized procurement programs, reimbursement limitations for high-end and innovative systems, and intense competition from cost-competitive domestic manufacturers. In addition, dependence on imported core components, intellectual property protection concerns, and geopolitical tensions impacting medical technology supply chains continue to pressure margins and slow innovation, despite the market’s large patient base, expanding screening programs, and long-term growth potential.

The future of China’s endoscopy device market appears highly positive and bright, driven by the rapid technological innovation, expanding healthcare demand, and the supportive reforms in medical device regulation and reimbursement. Advanced in high-definition endoscopy systems, AI-assisted lesion detection, robotic and the minimally invasive endoscopic tools, and the smart imaging platforms are creating new growth opportunities. Faster device approvals, growing acceptance of real-world clinical evidence, and the deeper integration with hospital digital systems are improving market access and adoption. Furthermore, developments in smart manufacturing, localized production, cloud-based image management, big data analytics, and precision diagnostics are improving product quality, supply chain resilience, clinical efficiency, and patient outcomes throughout China's developing endoscopic care ecosystem.

Market Segmentation

The China endoscopy devices market share is classified into product and application.

By Product

The China endoscopy devices market is divided by product into endoscopes, endoscopy visualization systems. Among these, the endoscopes segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because endoscopes are fundamental to nearly all diagnostic and therapeutic procedures, making them an indispensable and high-volume product in various medical fields like gastroenterology, pulmonology, and urology.

By Application

The China endoscopy devices market is divided by application into gastrointestinal endoscopy, laparoscopy. Among these, the gastrointestinal endoscopy segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because there is a significant and increasing burden of gastrointestinal diseases in China, including conditions such as colorectal cancer, gastroesophageal reflux disease (GERD), and inflammatory bowel disease (IBD).

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China endoscopy devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Endoscopy Devices Market

- Cook Medical

- Olympus Corporation,

- Smith and Nephew PLC

- Zhejiang Tiansong Medical Instrument Co. Ltd.

- Boston Scientific Corporation

- Karl Storz SE & Co. KG

- Medtronic plc

- Fujifilm Holdings Corporation

- Stryker Corporation

- PENTAX Medical

- Johnson and Johnson

- Others

Recent Developments in China Endoscopy Devices Market

In November 2023, Olympus launched its next-generation EVIS X1 endoscopy system in China, featuring advanced imaging technologies that enhance diagnostic accuracy, supporting innovation, hospital upgrades, and continued growth in the China endoscopy device market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the China endoscopy devices market based on the below-mentioned segments:

China Endoscopy Devices Market, By Product

- Endoscopes

- Endoscopy Visualization Systems

China Endoscopy Devices Market, Application

- Gastrointestinal Endoscopy

- Laparoscopy

FAQ

Q: What is the China endoscopy devices market size?

A: China endoscopy devices market is expected to grow from USD 4.7 billion in 2024 to USD 16.3 billion by 2035, growing at a CAGR of 11.97% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by a large and rapidly aging population, rising prevalence of gastrointestinal diseases, expanding reimbursement coverage, and strengthening the hospital and primary healthcare infrastructure.

Q: What factors restrain the China endoscopy devices market?

A: Constraints include the strong pricing pressure from centralized procurement programs, reimbursement limitations for high-end and innovative systems, and intense competition from cost-competitive domestic manufacturers.

Q: How is the market segmented by product?

A: The market is segmented into endoscopes, endoscopy visualization systems.

Q: Who are the key players in the China endoscopy devices market?

A: Key companies include Cook Medical, Olympus Corporation, Smith and Nephew PLC, Zhejiang Tiansong Medical Instrument Co. Ltd., Boston Scientific Corporation, Karl Storz SE & Co. KG, Medtronic plc, Fujifilm Holdings Corporation, Stryker Corporation, PENTAX Medical, Johnson and Johnson, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |