China Ferrite Magnet Market

China Ferrite Magnet Market Size, Share, and COVID-19 Impact Analysis, By Grade (Ceramic Magnets, Alnico Magnets, Samarium Cobalt Magnets, Neodymium Magnets, and Others), By Application (Motors and Generators, Sensors and Actuators, Magnetic Resonance Imaging (MRI), Loudspeakers and Microphones, and Others), and China Ferrite Magnet Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

China Ferrite Magnet Market Insights Forecasts to 2035

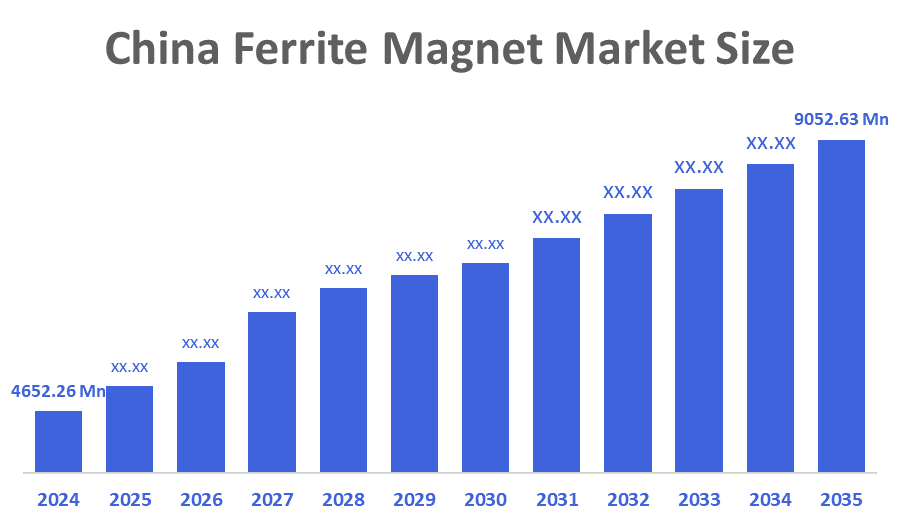

- The China Ferrite Magnet Market Size Was Estimated at USD 4,652.26 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.24% from 2025 to 2035

- The China Ferrite Magnet Market Size is Expected to Reach USD 9,052.63 Million by 2035

According to a Research Report Published by Decision Advisior & Consulting, the China Ferrite Magnet Market is anticipated to reach USD 9,052.63 million by 2035, growing at a CAGR of 6.24% from 2025 to 2035. The primary drivers driving the market are electronics demand, automotive electrification, industrial machinery growth, cost advantages over rare-earth magnets, and Asia Pacific dominance.

Market Overview

The China ferrite magnet market refers to the industry that focuses on the production, distribution, and application of ferrite magnets. Ferrite magnets, also known as ceramic magnets, are permanent magnets made primarily from iron oxide combined with barium or strontium carbonate. They differ by their electrical insulating qualities, strong enticement, and dark grey colour. These magnets are widely used in electronics, appliances, automobile parts, and renewable energy systems due to their affordability and resistance to corrosion. Due to its large supplies of raw materials, strong industrial base, and high demand from both local and foreign markets, China leads the world in the production of ferrite magnets. There are major exporters and producers in the sector, with China making up the majority of the world's manufacturing. Guangdong, Hangzhou, and the Pearl River Delta have become important hubs for the manufacture of electronics and magnets. The ferrite magnet market, which is essential to the worldwide electronics and industrial supply chain, is continuously expanding in China due to new applications and technical advancements.

Anhui Sinomag Technology Co., Ltd. announced plans to invest USD 29.5 million in expanding its ferrite magnet production capacity in Vietnam. The move is explicitly aimed at diversifying geopolitical risk and mitigating exposure to US-China trade tensions and potential tariffs.

In April 2025, China’s Ministry of Commerce expanded export restrictions on rare earth elements, requiring licenses for key materials. The move was framed around national security and supply chain control, and reports noted that some Indian firms received approvals under the new licensing regime.

Report Coverage

This research report categorises the market for the China ferrite magnet market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China ferrite magnet market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China ferrite magnet market.

Driving Factors

China’s ferrite magnet market is driven by growth in electronics as ferrite magnets play a critical role in everyday devices such as speakers, sensors, and transformers. With China's vast electronics manufacturing demand for these magnets continues to rise steadily. Automotive and EV expansion increasingly relies on ferrite magnets for electric motors, alternators, and hybrid systems. China's strong push toward electric vehicle adoption further accelerates magnet consumption will boost the market growth. These magnets are indispensable I industrial machinery and medical technologies. China's rapid industrialization and urban growth fuel the need for cost-effective permanent magnets. Compared to other magnet ferrites, magnets are more affordable and resistant to corrosion, which makes them a preferred choice for large-scale applications.

Restraining Factors

The China ferrite magnet market faces key restraints, competition from rare-earth magnets, environmental regulations, raw material price volatility, supply chain diversification, and technological substitution.

Market Segmentation

The China ferrite magnet market share is classified into grade and application.

- The ceramic magnets segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China ferrite magnet market is divided by grade into ceramic magnets, alnico magnets, samarium cobalt magnets, neodymium magnets, and others. Among these, the ceramic magnets segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by their affordability, durability, and resistance to corrosion. They are extensively applied across electronics, automotive systems. Household appliances and industrial machinery make them indispensable in everyday technologies, with vast manufacturing reinforcing its dominance in the global magnet industry.

- The motors and generators segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China ferrite magnet market is segmented by application into motors and generators, sensors and actuators, magnetic resonance imaging (MRI), loudspeakers and microphones, and others. Among these, the motors and generators segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the leading application segment where ferrite magnets are extensively utilized in electric motors, alternators, and generators, with strong demand coming from both the automotive sector (EVs, hybrids, and conventional vehicles) and industrial machinery. The country’s fast-paced electric vehicle adoption and ongoing industrial growth position motors and generators as the primary driver of ferrite magnet demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within China ferrite magnet market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ningbo Ketai Magnetic Materials Co., Ltd.

- Zhaobao Magnet

- UPSUN Magnetics

- CJ Magnet

- Tengye Magnetic

- Bromag

- SDM Magnetics

- Courage Magnet

- New-Mag

- Dailymag Magnetic Technology Co., Ltd.

- Souwest Magnetech Development Co., Ltd.

- Others

Recent Developments:

- In March 2025, SDM Magnetics Co., Ltd. introduced a new line of cost-effective ferrite magnets designed for consumer electronics and industrial machinery, strategically positioned as alternatives to rare-earth magnets amid global supply concerns. Manufactured via powder metallurgy, resulting in durable, chemically stable magnets.

- In August 2025, Hengdian Group DMEGC Magnetic Limited announced the launch of a broad portfolio of hard ferrite magnets and ferrite cores, targeting electronics, automotive, and communication industries, further cementing its position as the world’s largest permanent magnet ferrite manufacturer.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the China ferrite magnet market based on the below-mentioned segments:

China Ferrite Magnet Market, By Grade

- Ceramic Magnets

- Alnico Magnets

- Samarium Cobalt Magnets

- Neodymium Magnets

- Others

China Ferrite Magnet Market, By Application

- Motors And Generators

- Sensors And Actuators

- Magnetic Resonance Imaging (MRI)

- Loudspeakers And Microphones

- Others

FAQ

Q: What is the current and forecasted size of the China ferrite magnet market?

A: The market was valued at approximately USD 4,652.26 million in 2024 and is projected to grow at a CAGR of 6.24%, reaching around USD 9,052.63 million by 2035.

Q: What are the primary types of grades in China ferrite magnet market?

A: Major types of ceramic magnets, alnico magnets, samarium cobalt magnets, neodymium magnets, and others. Among these, the ceramic magnets segment held a substantial share in 2024. segment is driven by their affordability, durability, and resistance to corrosion. They are extensively applied across electronics, automotive systems.

Q: What are the main application forms in the market?

A: The main applications are loudspeakers and microphones, and others. Among these, the motors and generators segment dominated the market in 2024. This is the leading application segment where ferrite magnets are extensively utilized in electric motors, alternators, and generators, with strong demand coming from both the automotive sector (EVs, hybrids, and conventional vehicles)

Q: What are the key driving factors for market growth?

A: Growth is driven by electronics demand, automotive electrification, industrial machinery growth, cost advantages over rare-earth magnets, and Asia Pacific dominance.

Q: What challenges does the market face?

A: Challenges include competition from rare-earth magnets, environmental regulations, raw material price volatility, supply chain diversification, and technological substitution.

Q: Who are some key players in the market?

A: Key companies include Hengdian Group, DMEGC Magnetic Limited, Ningbo Zhaobao Magnet Co., Ltd., Ningbo Souwest Magnetech Development Co., Ltd., SDM Magnetics Co., Ltd., and Dailymag Magnetic Technology Co., Ltd.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 212 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |