China Forage Seed Market

China Forage Seed Market Size, Share, By Crop Type (Cereals, Legumes, and Grasses), By Product Type (Stored Forage and Fresh Forage), China Forage Seed Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China Forage Seed Market Insights Forecasts to 2035

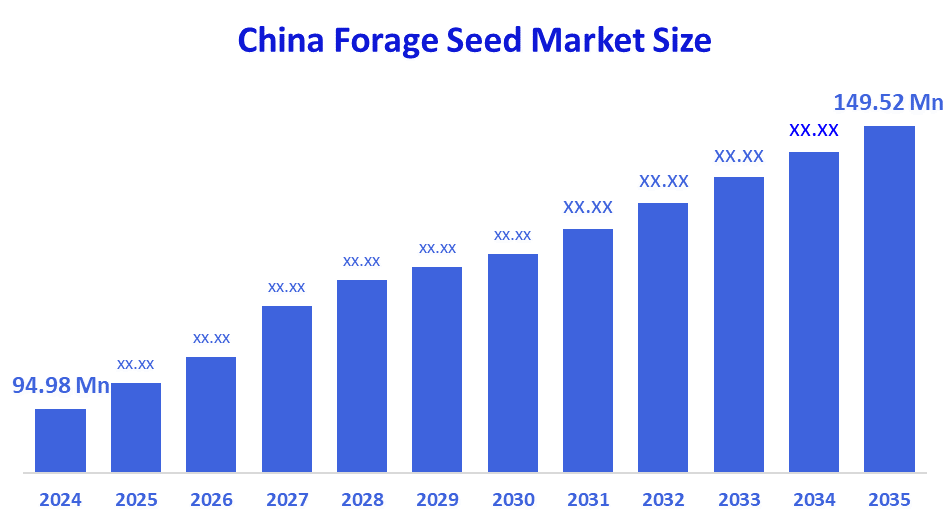

- China Forage Seed Market Size 2024: USD 94.98 Million

- China Forage Seed Market Size 2035: USD 149.52 Million

- China Forage Seed Market CAGR 2024: 4.21%

- China Forage Seed Market Segments: Crop Type and Product Type

The China forage seed market encompasses seeds of grasses, cereals, and legumes grown as feeds for cattle, sheep, and goats. Seeds are considered crucial for pasture development, production of silage, and making of hay vital in sustainable livestock farming and stable meat and dairy supplies. Increasing animal protein consumption in China and the local government's support to modern livestock practices are the factors propelling the market demand.

The government, led projects are focusing on increasing the area of high, quality forage grasslands to 9 million hectares by 2030 and domestic forage seed production to 75%, which will help in cutting down import dependency and securing feed. New seed breeding techniques are helping to enhance crop quality, for example, varieties that are high yielding, stress tolerant, and disease resistant. Besides, the market is getting a lift from precision agriculture, mechanized sowing, and climate, adapted seed development. There are bright prospects for turning up the scale of sustainable seed production, upgrading local seed breeding circuits, and applying state, of, the, art agricultural technologies as China faces a rapidly growing demand for livestock feed.

Market Dynamics of the China Forage Seed Market:

The China forage seed market is experiencing growth due to the increasing need for quality livestock feed, the thriving meat and dairy sectors, and the growing adoption of modern farming methods. To understand the full picture, farmers and agribusinesses are motivated by the awareness of animal nutrition and the necessity to enhance feed efficiency to invest in top, notch forage seeds. Besides, the creation of hybrid and high, yield varieties as well as progress in seed treatment technologies are the factors that make the market growth possible.

The market is impacted by the changing weather conditions, shortage of suitable land, and the high operational costs of cultivation and storage among others. Besides, small, scale farmers and insufficient access to the most advanced seed varieties in certain areas also limit the market growth.

In the longer run, there are possibilities for the market to rise due to the increased governmental assistance for forage production, farm mechanization, and green agriculture projects. Combining biotechnology in creating drought, and disease, resistant seeds, the proliferation of large, scale dairy and meat farms and the growth in imports of good, quality forage seeds will help raise the market to a higher level. Furthermore, the implementation of precision farming practices and the cooperation between seed companies and research institutions in the agricultural sector will lead to the best production and quality in China.

Market Segmentation

China Forage Seed Market share is classified into crop type and product type.

By Crop Type:

The China forage seed market is divided by crop type into cereals, legumes, and grasses. Among these, the grasses segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The grasses segment is dominated by factors such as wide climatic adaptability, high biomass production rates, short regrowth cycles, adaptability to grazing systems, increased demand from organized dairy units, increased operations in feedlot systems, and continued requirement for supply of large quantities of low-cost roughage in livestock-raising regions.

By Product Type:

The China forage seed market is divided by product type into stored forage and fresh forage. Among these, the stored forage segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The stored forages market is dominated by the need for feed security on a year-round basis, rapid uptake of silages, growth in commercial feedlots, increased stocking rates, decreased seasonal variability, improved storage facilities, and evolving concepts on the need for a steady feed supply in extensive meat production.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China forage seed market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Forage Seed Market:

- AMPAC Seed Company

- Forage Genetics International, LLC

- Pennington Seed, Inc.

- DLF

- Gansu Yasheng Industrial (Group) Co. Ltd

- Groupe Limagrain (Vilmorin)

- Barenbrug China

Recent Developments in China Forage Seed Market:

In May 2024, S&W Seed Company launched Double Team Forage Sorghum, expanding its proprietary sorghum trait technology portfolio with a non-GMO over-the-top weed control solution for forage crops. The product enables effective management of grassy weeds directly over the crop, improving forage quality, field productivity, and operational efficiency for livestock feed producers.

In June 2022, Corteva Agriscience introduced Bovalta BMR corn silage designed to deliver higher yields and improved milk production performance. The product targets commercial dairy and livestock operations by enhancing fiber digestibility and feed efficiency, supporting better animal productivity, higher milk output, and improved overall farm profitability.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China forage seed market based on the below-mentioned segments:

China Forage Seed Market, By Crop Type

- Cereals

- Legumes

- Grasses

China Forage Seed Market, By Product Type

- Stored Forage

- Fresh Forage

FAQ

Q: What is the China forage seed market size?

A: China Forage Seed Market is expected to grow from USD 94.98 million in 2024 to USD 149.52 million by 2035, growing at a CAGR of 4.21% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by rising demand for high-quality livestock feed, expansion of the meat and dairy sectors, and adoption of modern farming practices. Hybrid and high-yield seed varieties, advances in seed treatment technologies, and government support for forage production further accelerate market growth.

Q: What factors restrain the China forage seed market?

A: Constraints include unpredictable weather, limited cultivable land, high operational costs, fragmented small-scale farming, and insufficient access to advanced seed varieties in certain regions, which together slow market expansion and increase production challenges.

Q: How is the market segmented by crop type?

A: The market is segmented into cereals, legumes, and grasses.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |