China Hiv Diagnostics Market

China Hiv Diagnostics Market Size, Share, By Product (Consumables, Instruments, Software and Services), End Use (Diagnostic Laboratories, Hospitals & Clinics, Home Settings), China Hiv Diagnostics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China Hiv Diagnostics Market Size Insights Forecasts to 2035

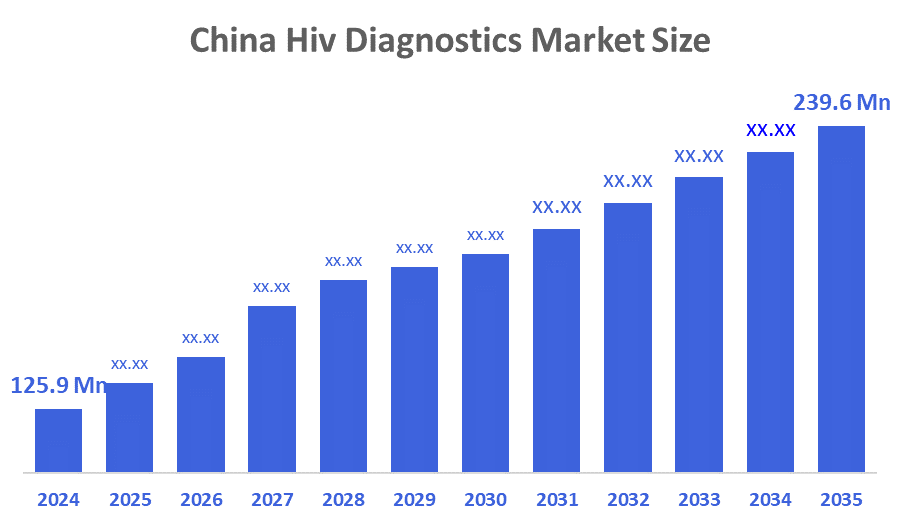

- China Hiv Diagnostics Market Size 2024: USD 125.9 Mn

- China Hiv Diagnostics Market Size 2035: USD 239.6 Mn

- China Hiv Diagnostics Market CAGR 2024: 6.02%

- China Hiv Diagnostics Market Segments: Product and End-Use

The China HIV Diagnostics Market Size is steadily expanding and represents a strategically important segment of the country’s healthcare and public health ecosystem, encompassing rapid test kits, ELISA assays, chemiluminescence immunoassays, nucleic acid testing (NAT), and point-of-care diagnostics. The market is increasingly evolving from conventional laboratory-based screening toward high-sensitivity molecular diagnostics, automated platforms, and decentralized testing solutions. Growth is driven by rising awareness and screening programs, government-led HIV prevention and surveillance initiatives, expanding hospital and blood bank testing, and improvements in diagnostic accuracy and turnaround time. In addition, the market is characterized by strong competition between domestic manufacturers and global diagnostic companies, continuous innovation in assay technologies, and increased investments in public health laboratories and infectious disease testing infrastructure, all operating within China’s tightly regulated and quality-focused healthcare framework.

China’s “Four Frees and One Care” policy supports expanded HIV testing, contributing to increased diagnostics uptake. By mid-2024, 1.33 million people were living with HIV/AIDS in China, with 29,135 new cases reported in Q2 2024, highlighting ongoing demand for screening and early diagnosis.

The China HIV diagnostics market offers significant growth potential, driven by expanding nationwide screening programs, rising awareness of early detection, and strong government commitments to HIV prevention and control. Advanced technologies such as nucleic acid testing (NAT), chemiluminescence immunoassays, rapid point-of-care tests, and AI-enabled laboratory automation are improving accuracy, throughput, and turnaround times. Large-scale public health screening, testing in hospitals and blood banks, maternity screening under PMTCT initiatives, and decentralized fast testing in community settings are important areas of opportunity. Despite price pressure and stringent regulations, the market also benefits from ongoing R&D in high-sensitivity assays, integration of digital health and big data for surveillance, and supportive public funding.

Market Dynamics of the China Hiv Diagnostics Market

The China HIV diagnostics market is driven by a surge in R&D innovation and the adoption of advanced technologies such as nucleic acid testing (NAT), chemiluminescence immunoassays, rapid point-of-care testing, and AI-enabled laboratory automation, alongside strong government commitment to HIV prevention and control. The market is further propelled by national public health strategies, expanded screening mandates, centralized procurement programs, and sustained public funding, accelerating the shift from conventional antibody screening toward high-sensitivity, early-stage diagnostic solutions. Rising testing demand across hospitals, blood banks, maternal health programs, and community clinics is creating large-scale investment opportunities. With growing emphasis on diagnostic accuracy, testing coverage, digital surveillance integration, and domestic manufacturing, China is emerging as a key hub in the global HIV diagnostics landscape, while fostering local innovation and attracting international collaborations despite regulatory and pricing pressures.

The China HIV diagnostics market faces restraints such as strict government price controls under centralized procurement, complex and evolving regulatory requirements, intellectual property protection concerns, and stringent quality and compliance standards. Despite strong market potential, profit margins are pressured by tender-based pricing, reliance on imported reagents and core technologies, shortages of highly skilled molecular diagnostics talent, and geopolitical uncertainties affecting supply chains.

The future of China’s HIV diagnostics market appears highly promising, supported by rapid technological advancement, proactive government public health policies, and rising demand for early, accurate, and widespread HIV screening. Emerging opportunities are being created through high-sensitivity molecular diagnostics, AI-assisted result interpretation, expanded point-of-care testing, and faster regulatory pathways for innovative assays. In addition, progress in laboratory automation, big data–driven disease surveillance, digital health integration, and smart manufacturing is improving testing efficiency, quality control, and regulatory compliance across China’s expanding HIV diagnostics ecosystem, strengthening its role in both domestic and global markets.

Market Segmentation

The China HIV diagnostics market share is classified into product and end use.

By Product

The China Hiv diagnostics market is divided by product into consumables, instruments, software and services. Among these, the consumables segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to diagnostic laboratories, hospitals, and point-of-care facilities require a constant and repetitive supply of these items for every test performed.

By End Use

The China Hiv diagnostics market is divided by end use into diagnostic laboratories, hospitals & clinics, home settings. Among these, the hospitals & clinics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to high patient volumes, integrated care, routine screenings (pre-op, antenatal), and established infrastructure for complex tests

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China Hiv diagnostics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Hiv Diagnostics Market

- Zhuhai Livzon Diagnostics Inc

- Hangzhou Biotest Biotech Co., Ltd.

- Shanghai Kehua Bio-Engineering Co., Ltd.

- Beijing Wantai Biological Pharmacy Enterprise Co., Ltd.

- Xiamen Kingmed Diagnostics Group Co., Ltd.

- Wuhan EasyDiagnosis Biomedicine Co., Ltd.

- Nanjing Vazyme Biotech Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Recent Developments in China Hiv Diagnostics Market

In December 2024, China expanded HIV testing across hospitals, community health centers, and self-testing channels to normalize routine screening. The initiative supports early diagnosis and strengthens the HIV diagnostics market, targeting over 90% diagnosis coverage by 2025.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China Hiv diagnostics market based on the below-mentioned segments:

Hiv Diagnostics Market, By Type

- Consumables

- Instruments

- Software and Services

China Hiv Diagnostics Market, By End Use

- Diagnostic Laboratories

- Hospitals & Clinics

- Home Settings

FAQ

Q: What is the China Hiv diagnostics market size?

A: China Hiv diagnostics market is expected to grow from USD 125.9 million in 2024 to USD 239.6 million by 2035, growing at a CAGR of 6.02% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven a surge in R&D innovation and the adoption of advanced technologies such as nucleic acid testing (NAT), chemiluminescence immunoassays, rapid point-of-care testing, and AI-enabled laboratory automation, alongside strong government commitment to HIV prevention and control.

Q: What factors restrain the China Hiv diagnostics market?

A: Constraints include such as strict government price controls under centralized procurement, complex and evolving regulatory requirements, intellectual property protection concerns, and stringent quality and compliance standards.

Q: How is the market segmented by product?

A: The market is segmented into consumables, instruments, software and services.

Q: Who are the key players in the China Hiv diagnostics market?

A: Key companies include Zhuhai Livzon Diagnostics Inc., Hangzhou Biotest Biotech Co., Ltd., Shanghai Kehua Bio-Engineering Co., Ltd., Beijing Wantai Biological Pharmacy Enterprise Co., Ltd., Xiamen Kingmed Diagnostics Group Co., Ltd., Wuhan EasyDiagnosis Biomedicine Co., Ltd., Nanjing Vazyme Biotech Co., Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 269 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |