China Marine Interior Market

China Marine Interior Market Size, Share, and COVID-19 Impact Analysis, By Material (Aluminum, Steel, Composites, Joinery, and Others), By Product (Ceilings and Wall Panel, Furniture, Galleys and Pantries, Lighting, and Others), and China Marine Interior Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China Marine Interior Market Insights Forecasts to 2035

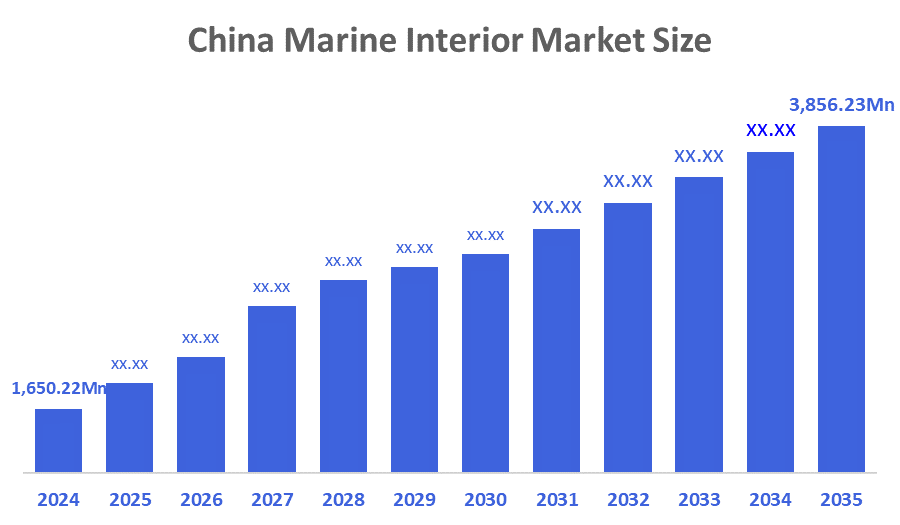

- The China Marine Interior Market Size Was Estimated at USD 1,650.22 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.02% from 2025 to 2035

- The China Marine Interior Market Size is Expected to Reach USD 3,856.23 Million by 2035

According To a Research Report Published By Decisions Advisors & Consulting, The China Marine Interior Market Size Is Anticipated To Reach USD 3,856.23 Million By 2035, Growing At a CAGR Of 8.02% From 2025 to 2035. The primary drivers fueling the market are shipbuilding dominance, rising cruise tourism, naval modernization, and demand for eco-friendly interior solutions.

Market Overview

The China marine interior market refers to the industry that specializes in the design, production, and installation of interior systems and components for marine boats, including cargo ships, cruise ships, ferries, yachts, and naval vessels. It aims to improve onboard functionality, safety, comfort, and aesthetics through both new installations and retrofits. By integrating amenities like a personalized storage solution and sturdy materials that can resist water damage, these facilities contribute to the enhancement of the passenger travel experience. The desire for luxury yachts, the upsurge of cruise tourism, vessel restoration, and increased safety regulations are all contributing to this industry's steady growth. As more Chinese consumers choose cruise vacations, there is an increasing demand for high-end marine interior products and services. As leading companies in the industry focus on innovative technologies, sustainable materials, and creative design, the preferences of cruise operators and passengers are evolving. Both domestic and foreign businesses are fighting for market share, creating a competitive environment. A growing middle class, rising disposable income, and government programs are some of the factors boosting the sector and fueling market expansion.

China’s gross ocean product (GOP) exceeded 10 trillion yuan (about USD 1.4 trillion) in 2024, marking the first time the marine economy crossed this threshold. This milestone highlights the country’s robust growth and heavy investment across shipping, fisheries, tourism, and naval industries.

In 2024, China’s commercial shipbuilding orderbook surpassed USD 123 billion, underscoring its dominance in the global maritime industry. This surge reflects both strong global trade demand and the impact of geopolitical disruptions, which have prompted shipping companies to secure new capacity and diversify supply chains.

Report Coverage

This research report categorises the market for the China marine interior market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China marine interior market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China marine interior market.

Driving Factors

The market for the marine interior in China is being driven by the country's dominance in shipbuilding, producing more than half of the world's vessels. This ensures that there will always be a demand for interior outfitting on cruise ships, cargo ships, tankers, and naval forces. The need for luxury cruise ships is being driven by rising disposable income and domestic travel, which is driving market expansion. However, this trend is also driving demand for premium, personalized interiors in passenger cabins and entertainment areas. The demand for specialist interiors, such as crew quarters and command centers, is also being driven by the growth of the defense sector. While retrofits are a crucial market segment, the modernization of aged fleets opens up potential for interior replacement, including wall panels, flooring, and lighting. China's marine sector, which surpassed 10 trillion yuan in 2024 and indirectly stimulates the interior market, is being boosted by government backing for maritime expansion.

Restraining Factors

The China marine interior market faces key restraints, including high installation & maintenance costs, supply chain volatility, regulatory & safety compliance, limited luxury expertise, retrofit complexity, and environmental pressures.

Market Segmentation

The China marine interior market share is classified into material and product.

- The steel segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China marine interior market is divided by material into aluminum, steel, composites, joinery, and others. Among these, the steel segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by the defence and cargo ships are major in shipbuilding scale, which raises the steel demand. Where the market standard for steel interiors is driving the segment's expansion. It is also a cost-effective choice, providing a balance between strength and affordability, and it satisfies strict fire safety and durability requirements, making it crucial for compliance.

- The ceilings and wall panel segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China marine interior market is segmented by product into ceilings and wall panel, furniture, galleys and pantries, lighting, and others. Among these, the ceilings and wall panels dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. Ceilings and wall panels are the dominant segment due to their extensive use in various types of vessels, including submarines and cargo ships. They are the backbone of the industry because they adhere to strict fire safety and durability regulations. Additionally, panels are frequently changed throughout renovations, guaranteeing consistent market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within China marine interior market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CSSC (China State Shipbuilding Corporation)

- Shanghai Waigaoqiao Shipbuilding Co. Ltd. (SWS)

- Guangzhou Shipyard International (GSI)

- Dalian Shipbuilding Industry Co. (DSIC)

- China International Marine Containers (CIMC)

- Maritime Montering China (MMCh)

- YIS Marine (Ningbo JingTong)

- JULY Marine Group

- Others

Recent Developments:

- In April 2025, the Adora Flora City, floated out at Shanghai Waigaoqiao Shipbuilding (SWS), is indeed a milestone for China’s cruise ship industry. It represents the country’s second-largest domestically built cruise ship, following the Adora Magic City, and signals a deeper push into the localization of cruise ship manufacturing.

- In October 2025, GNV·VIRGO (Dual-Fuel Ro-Ro Ship): China delivered its first domestically built large-scale dual-fuel roll-on/roll-off (Ro-Ro) passenger ship. The vessel can run on both conventional fuel and cleaner liquefied natural gas (LNG), reflecting the industry's shift towards green transformation showcased at the 2025 Marintec China exhibition.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China marine interior market based on the below-mentioned segments:

China Marine Interior Market, By Material

- Aluminum

- Steel

- Composites

- Joinery

- Others

China Marine Interior Market, By Product

- Ceilings And Wall Panel

- Furniture

- Galleys And Pantries

- Lighting

- Others

FAQ

Q: What is the current and forecasted size of the China marine interior market?

A: The market was valued at approximately USD 1,650.22 million in 2024 and is projected to grow at a CAGR of 8.02%, reaching around USD 3,856.23 million by 2035.

Q: What are the primary material types of China marine interior market?

A: Major types include aluminum, steel, composites, joinery, and others. Among these, the Steel segment held a substantial share in 2024. The segment is driven by shipbuilding scale, most of which are cargo and defence vessels, where steel interiors are standard, boosting the demand in the market.

Q: What are the main product forms in the market?

A: The main product forms include ceilings and wall panel, furniture, galleys and pantries, lighting, and others. Among these, the construction segment dominated the market in 2024. Ceilings and wall panels are the dominant segment because of widespread use across all vessel types, from cargo ships to submarines.

Q: What are the key driving factors for market growth?

A: Growth is driven by shipbuilding dominance, rising cruise tourism, naval modernization, and demand for eco-friendly interior solutions.

Q: What challenges does the market face?

A: Challenges include high installation & maintenance costs, supply chain volatility, regulatory & safety compliance, limited luxury expertise, retrofit complexity, and environmental pressures.

Q: Who are some key players in the market?

A: Key companies include CSSC (China State Shipbuilding Corporation), Shanghai Waigaoqiao Shipbuilding Co. Ltd. (SWS), Guangzhou Shipyard International (GSI), Dalian Shipbuilding Industry Co. (DSIC), China International Marine Containers (CIMC), Maritime Montering China (mmch), YIS Marine (Ningbo jingtong), JULY Marine Group, and Others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |