China Modern Oral Nicotine Products Market

China Modern Oral Nicotine Products Market Size, Share, and COVID-19 Impact Analysis, BY PRODUCT (Nicotine Pouches, Nicotine Gums, Nicotine Patches, and Others), By Strength (Light, Normal, Strong, and Extra Strong, and Others), and China Modern Oral Nicotine Products Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

China Modern Oral Nicotine Products Market Insights Forecasts to 2035

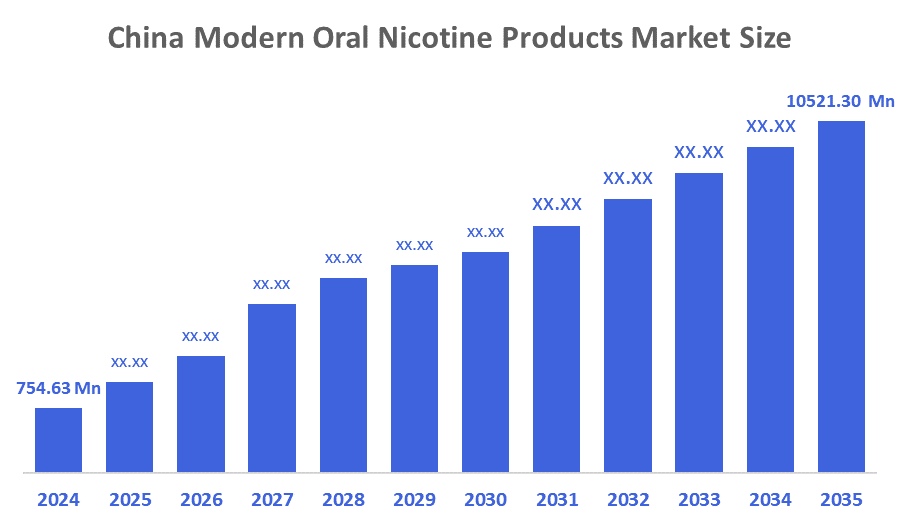

- The China Modern Oral Nicotine Products Market Size Was Estimated at USD 754.63 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 27.07% from 2025 to 2035

- The China Modern Oral Nicotine Products Market Size is Expected to Reach USD 10,521.30 Million by 2035

According to a Research Report Published by Decision Advisior & Consulting, the China Modern Oral Nicotine Products Market is anticipated to reach USD 10,521.30 million by 2035, growing at a CAGR of 27.07% from 2025 to 2035. The main factors driving the market include shifting customer preferences toward smoke-free options, quick product innovation, increased distribution, changes in regulations, and growing health consciousness.

Market Overview

The China modern oral nicotine products market refers to the industry segment in China that manufactures, markets, and supplies smoke-free, non-combustible nicotine substitutes. Instead of smoking or vaping, these products deliver nicotine orally, and they usually do not contain tobacco leaf. These tobacco-free, smokeless products, which come in nicotine pouches, lozenges, gum, and tablets, are made to give nicotine without the negative effects of chewing or smoking tobacco. More people are choosing oral nicotine products as a safer option as they become more conscious of the health concerns caused by smoking. In addition to assisting people in reducing back on or quitting smoking, the market is undergoing remarkable innovation, offering a wide variety of flavors and nicotine concentrations to suit different consumer tastes. The convenience of these products attracts users who wish to enjoy them without the cultural judgment associated with smoking, and demand has grown as a result of tighter government regulations to satisfy specific demands. Tobacco-free nicotine products are becoming more and more popular among consumers who wish to enjoy nicotine without the negative consequences of tobacco; this trend is especially apparent among younger demographics. Manufacturers are employing more targeted marketing strategies to attract clients who are trying to quit smoking and are health-conscious. This includes branding that highlights the clean and tidy aspects of these products, attracting a wider consumer base.

The STMA, a state-owned monopoly, controls the majority of the Chinese cigarette market. The STMA is in charge of every facet of the tobacco industry, protected by the law of the People's Republic of China on tobacco monopoly. Regarding the Chinese tobacco monopoly, even though smoking is bad for people's health, prohibiting smoking puts at risk social stability and government revenue.

In February 2024, Chinese researchers and producers published work on supercritical co? extraction of nicotine, highlighting investment in advanced facilities for large-scale production. This reflects China’s push into the raw material side of the modern oral nicotine industry.

Report Coverage

This research report categorises the market for the China modern oral nicotine products market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China modern oral nicotine products market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China modern oral nicotine products market.

Driving Factors

The market for modern oral nicotine products in China is being driven by rise in the adoption of oral nicotine products by consumers, which are seen as safer alternatives, especially among younger and urban populations, as a result of growing awareness of the risks associated with traditional cigarettes. The need for non-combustible nicotine alternatives is being driven by growing health consciousness. Because oral products are odorless, practical, and private, they complement current lifestyles and contribute to the industry's expansion. Harm-reduction goods are being encouraged by China's evolving tobacco control framework. The Tobacco Monopoly Law already applies to e-cigarettes, but it may soon apply to oral nicotine products as well, creating both business potential and regulatory obstacles. These products are becoming more accessible through convenience stores and e-commerce platforms; younger customers are particularly drawn to online channels, which is driving up market demand.

Restraining Factors

The China modern oral nicotine products market faces key restraints, including regulatory uncertainty, dominance of the state tobacco monopoly (STMA), limited consumer awareness, cultural preferences for traditional tobacco, and potential health concerns or misconceptions.

Market Segmentation

The China modern oral nicotine products market share is classified into product and strength.

- The nicotine pouches segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China modern oral nicotine products market is divided by product into nicotine pouches, nicotine gums, nicotine patches, and others. Among these, the nicotine pouches segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by consumers' growing preference toward smoke-free nicotine products that come in appealing flavors. As nicotine pouches are more relatable to regular people and are marketed as lifestyle choices rather than medical assistance, this leads manufacturers to continue releasing additional flavors and strengths. They also serve as a less risky option, which gives them a lot of opportunity to develop in the market.

- The strong segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China modern oral nicotine products market is segmented by strength into light, normal, strong, and extra strong, and others. Among these, the strong segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This segment is leading the market because it offers a pleasurable nicotine dose that successfully suppresses cravings without being harsh and strikes the ideal balance for the customer. In order to make this segment the most accessible and generally available choice, companies also frequently position it as the default or standard strength. Additionally, Cultural preferences also come into play because many Chinese users desire a significant nicotine impact, which makes this segment the most appealing option and accelerates market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within China modern oral nicotine products market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Swedish Match AB (Philip Morris International)

- Altria Group Inc.

- Domestic Startups (e.g., Shenzhen-based firms)

- China Tobacco (CNTC)

- British American Tobacco (BAT)

- Japan Tobacco International (JTI)

- Others

Recent Developments:

- In November 2025, RELX International unveiled a breakthrough in the modern oral nicotine category with the launch of AirPouch, part of its new nicotine pouch brand under the RELX name. Marketed as the world’s thinnest nicotine pouch, AirPouch measures less than 1 millimeter in thickness, offering a discreet and lightweight alternative to traditional oral nicotine formats.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the China modern oral nicotine products market based on the below-mentioned segments:

China Modern Oral Nicotine Products Market, By Product

- Nicotine Pouches

- Nicotine Gums

- Nicotine Patches

- Others

China Modern Oral Nicotine Products Market, By Strength

- Light

- Normal

- Strong

- Extra Strong

- Others

FAQ

Q: What is the current and forecasted size of the China modern oral nicotine products market?

A: The market was valued at approximately USD 754.63 million in 2024 and is projected to grow at a CAGR of 27.07%, reaching around USD 10,521.30 million by 2035.

Q: What are the primary product types of China modern oral nicotine products market?

A: Major types include nicotine pouches, nicotine gums, nicotine patches, and others. Among these, the nicotine pouches segment held a substantial share in 2024. The market is driven by consumers' growing preference toward smoke-free nicotine products that come in appealing flavors

Q: What are the main strengths forms in the market?

A: The market is segmented into light, normal, strong, and extra strong, and others. Among these, the strong segment dominated the market in 2024. This segment is leading the market because it offers a pleasurable nicotine dose that successfully suppresses cravings without being harsh and strikes the ideal balance for the customer.

Q: What are the key driving factors for market growth?

A: Growth is driven by shifting customer preferences toward smoke-free options, quick product innovation, increased distribution, changes in regulations, and growing health consciousness.

Q: What challenges does the market face?

A: Challenges include regulatory uncertainty, dominance of the state tobacco monopoly (STMA), limited consumer awareness, cultural preferences for traditional tobacco, and potential health concerns or misconceptions.

Q: Who are some key players in the market?

A: key companies include Swedish Match AB (Philip Morris International), Altria Group Inc., domestic startups (e.g., Shenzhen-based firms), China Tobacco (CNTC), British American Tobacco (BAT), Japan Tobacco International (JTI), and others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 177 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |