China PFAS Testing Market

China PFAS Testing Market Size, Share, and COVID-19 Impact Analysis, By Application (Drinking Water, Waste Water, Soil, Food and Beverages, and Others), By Method (EPA, DIN, ISO, ASTM, and Others), and China PFAS Testing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China PFAS Testing Market Insights Forecasts to 2035

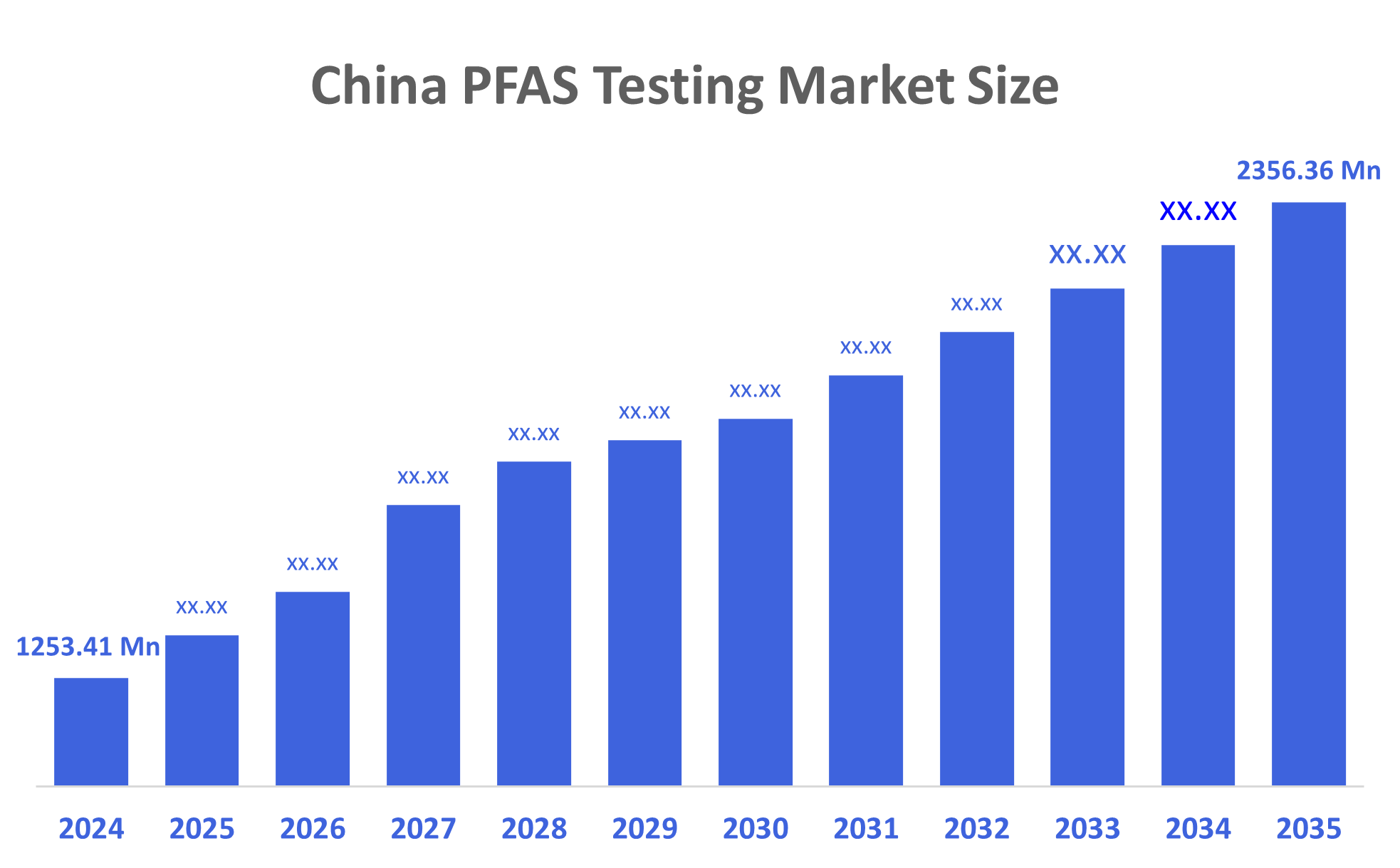

- The China PFAS Testing Market Size Was Estimated at USD 1,253.41 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.91% from 2025 to 2035

- The China PFAS Testing Market Size is Expected to Reach USD 2,356.36 Million by 2035

According to a Research Report Published by Decisions Advisors, The China PFAS Testing Market Size is Anticipated to Reach USD 2,356.36 Million by 2035, Growing at a CAGR of 5.91% from 2025 to 2035. The primary drivers of the market are stricter environmental regulations, rising public health concerns, industrial demand, Public Health Awareness, Technological Advancements, and global trade compliance requirements.

Market Overview

The China PFAS Testing Market is the industry that detects and monitors PFAS, also known as "forever chemicals," in water, soil, air, food, and biological samples to ensure safety and compliance. PFAS are man-made compounds that are frequently used in industries such as textiles, electronics, vehicles, and chemicals. However, their ongoing presence in the environment and links to health risks required testing. This market includes laboratory services, modern instruments such as LC-MS/MS and GC/MS, consumables, and software solutions, all of which are being driven by stricter government regulations, international trade rules, and increased public health awareness. In essence, it is a network of technologies, services, and policies that work together to detect and control PFAS contamination, protecting the environment and human health while encouraging industrial compliance. Additionally, the demand for improved environmental monitoring and the extension of testing beyond basic environmental matrices are creating significant opportunities in China's PFAS testing market. The increasing emphasis on food safety, particularly for imported and domestically produced foods that may include PFAS residues, opens up substantial new testing opportunities as PFAS is influencing market strategies and product development.

The inclusion of PFASs, particularly with the detailed listing of numerous specific substances, demonstrates China's regulatory expansion from the limited scope of PFOS substances in the "List of Priority Controlled Chemicals (First Batch)" and PFOA substances in the "List of Priority Controlled Chemicals (Second Batch)" to the broader PFAS family. This reflects a substantial increase in the scope and stringency of regulations, aligning closely with international trends.

Agilent Technologies announced a $20 million investment to expand its Shanghai manufacturing center. The expansion was aimed at meeting the rising demand in China for advanced analytical instruments, particularly liquid chromatography (LC) and mass spectrometry (MS) systems, which are widely used in PFAS testing and other environmental and industrial applications

Report Coverage

This research report categorises the market for the China PFAS testing market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China PFAS testing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China PFAS testing market.

Driving Factors

China's PFAS testing market is primarily driven by Environmental concerns, and the government is putting more regulatory pressure on polluting industries. China's huge manufacturing sector and rapid modernization have raised awareness and concern about the contamination of water supplies, soil, and consumer products by Per and Polyfluoroalkyl Substances (PFAS). Strict environmental regulations, particularly those governing water quality and industrial effluent discharge, are driving industries to establish rigorous PFAS testing techniques. The government's push for cleaner production, as well as the "Healthy China 2030" campaign, has indirectly increased demand for precision testing procedures to ensure compliance and public safety. Furthermore, rising public knowledge of the negative health effects associated with PFAS exposure in drinking water and consumer items, such as textiles, generates growth in the market.

Restraining Factors

The China PFAS testing market faces key restraints such as limited technical expertise, fragmented regulations, limited awareness among stakeholders, dependence on imported technology, and slow adoption across industries.

Market segmentation

The China PFAS testing market share is classified into application and method.

- The drinking water segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China PFAS testing market is divided by application into drinking water, wastewater, soil, food and beverages, and others. Among these, the drinking water segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven since water safety is a significant public health priority. PFAS pollution in water is a severe concern, and the government has prioritized monitoring and control efforts. As a result, municipal water suppliers and environmental agencies are driving the need for testing, making this the most crucial sector in the country's PFAS testing activities.

- The EPA segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China PFAS testing market is segmented by method into EPA, DIN, ISO, ASTM, and others. Among these, the EPA segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the leading segment because, due to their high reputation and widespread regulatory acceptance, EPA standards have been the most important in driving China's PFAS testing practices and determining market compliance requirements. Methods like EPA 537.1 and EPA 533 are widely used to identify PFAS in drinking water and wastewater, making them the standard for accuracy and dependability.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within China PFAS testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Centre Testing International (CTI)

- Pony Testing International Group

- China Certification & Inspection Group (CCIC)

- SGS China (China division of SGS SA)

- Intertek China (China division of Intertek Group)

- Sinochem Environment Testing Center

- Others

Recent Developments:

- In August 2025, the Chinese sportswear company ANTA, in partnership with Donghua University, unveiled "AEROVENT ZERO". This is China's first independently developed, mass-produced, high-performance PFAS-free waterproof-breathable material, offering a domestic alternative to international technologies at a third of the cost.

- In July 2025, Sichuan province became the first region in China to introduce a local standard specifically targeting PFAS discharges. The regulation set defined limits for PFOA (Perfluorooctanoic acid) and PFOS (Perfluorooctane sulfonate) in chemical industrial parks, marking a major step in China’s efforts to control PFAS pollution.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China PFAS testing market based on the below-mentioned segments:

China PFAS Testing Market, By Application

- Drinking Water

- Wastewater

- Soil

- Food And Beverages

- Others

China PFAS Testing Market, By Method

- Epa

- Din

- Iso

- Astm

- Others

FAQ

Q: What is the current and forecasted size of the China PFAS testing market?

A: The market was valued at approximately USD 1,253.41 million in 2024 and is projected to grow at a CAGR of 5.91%, reaching around USD 2,356.36 million by 2035.

Q: What are the primary applications in the China PFAS testing market?

A: The primary applications are drinking water, wastewater, soil, food and beverages, and others. Among these, the drinking water segment held a substantial share in 2024. The segment is driven since water safety is a significant public health priority.

Q: What are the main methods in the market?

A: The main methods are EPA, DIN, ISO, ASTM, and others. Among these, the EPA segment dominated the market in 2024. This is the leading segment because, due to their high reputation and widespread regulatory acceptance, EPA standards have been the most important in driving China's PFAS testing practices and determining market compliance requirements.

Q: What are the key driving factors for market growth?

A: Growth is driven by stricter environmental regulations, rising public health concerns, industrial demand, Public Health Awareness, Technological Advancements, and global trade compliance requirements.

Q: What challenges does the market face?

A: Challenges include limited technical expertise, fragmented regulations, Limited Awareness Among Stakeholders, Dependence on Imported Technology, and slow adoption across industries.

Q: Who are some key players in the market?

A: Key companies include Centre Testing International (CTI), Pony Testing International Group, China Certification & Inspection Group (CCIC), SGS China (China division of SGS SA), Intertek China (China division of Intertek Group), Sinochem Environment Testing Center, and Others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |