China RO Antiscalant Market

China RO Antiscalant Market Size, Share, and COVID-19 Impact Analysis, By Type (Neutral pH Antiscalant, Broad Spectrum Antiscalant, and Others), By Application (Brackish Water, Sea Water, and Others), and China RO Antiscalant Market Size Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China RO Antiscalant Market Size Insights Forecasts to 2035

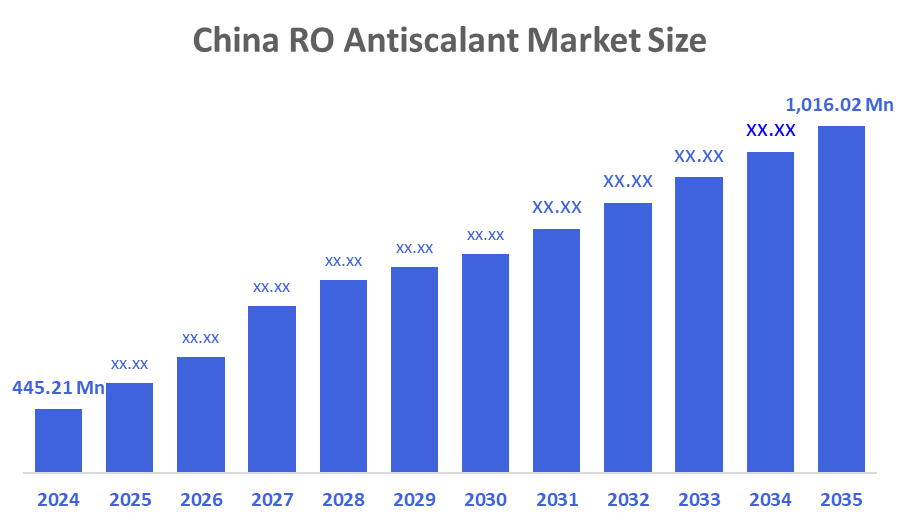

- The China RO Antiscalant Market Size Was Estimated at USD 445.21 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.79% from 2025 to 2035

- The China RO Antiscalant Market Size is Expected to Reach USD 1,016.02 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, the China RO Antiscalant Market Size is Anticipated to Reach USD 1,016.02 Million by 2035, Growing at a CAGR of 7.79% from 2025 to 2035. The primary drivers of the market size are industrial expansion, water scarcity concerns, technological innovation, stricter environmental regulations, and Sectoral Applications.

Market Overview

The China RO antiscalant market refers to the industry that creates, distributes, and uses chemical additives to prevent scale formation in reverse osmosis (RO) water treatment systems. These antiscalants are essential for preserving the effectiveness and lifespan of RO membranes, ensuring consistent water purification in industrial, municipal, and saltwater environments. The market offers a diverse range of product types, including neutral pH and broad-spectrum formulations, and it serves key sectors such as brackish water treatment, seawater desalination, and industrial water management. Furthermore, demand for effective antiscalants to prevent scaling in RO membranes is growing in areas such as municipal water treatment, pharmaceuticals, and food processing. Technological improvements and strict regulatory standards are further shaping market trends, creating new opportunities for participants. The market provides significant opportunities for innovation, partnership agreements, and capacity development. Companies that focus on product efficacy, regulatory compliance, and environmental standards are experiencing growing demand. The impact of strict rules for the environment is becoming more apparent. Compliance with these regulations may increase demand for high-performance antiscalants, as industries' efforts to meet legal requirements while optimizing operations.

Tianjin Hengtong and Shandong Jiahua are advancing similar initiatives with facility upgrades and technological enhancements to meet rising RO and ZLD demands. These moves align with China's antiscalant market, valued at 535.6 USD million in 2024, where domestic firms like these hold strong positions amid 230,000+ metric tons annual consumption.

Report Coverage

This research report categorises the market for the China RO antiscalant market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China RO antiscalant market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China RO antiscalant market.

Driving Factors

China RO antiscalant market is primarily driven by rapid industrialization in textiles, chemicals, oil and gas, and power generation, combined with expanding urbanization, has increased municipal water treatment needs. Severe freshwater scarcity, particularly in northern regions, requires RO salinity and brackish water treatment, with antiscalants playing an important role in maintaining membrane performance. Stricter environmental rules requiring Zero Liquid Discharge (ZLD) in industries like textiles and chemicals drive up demand, as these projects rely largely on RO systems. Simultaneously, technological advancements such as neutral pH and broad-spectrum formulations, as well as nanotechnology advances and eco-friendly treatments, improve performance and sustainability.

Restraining Factors

The China RO antiscalant market faces key restraints such as environmental concerns, technical limitations, competition from alternative technologies, dependence on industrial demand cycles, and limited awareness in smaller enterprises.

Market segmentation

The China RO antiscalant market share is classified into type and application.

- The broad spectrum antiscalant segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China RO antiscalant market is divided by type into neutral pH antiscalant, broad spectrum antiscalant, and others. Among these, the broad spectrum antiscalant segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by its adaptability and broad use. These formulations are particularly efficient against a variety of scaling chemicals, including calcium carbonate, sulfates, and silica, making them appropriate for a wide range of water chemistry. Their vast applicability has resulted in widespread deployment by industrial RO systems, seawater desalination plants, and brackish water treatment facilities.

- The brackish water segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China RO antiscalant market is segmented by application into brackish water, sea water, and others. Among these, the brackish water segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the leading application segment due to the country's wide eastern regions, brackish groundwater and industrial effluents necessitate substantial treatment. Reverse osmosis systems built for brackish water are widely used in textiles, the chemical industry, and municipal water facilities, producing a high demand for antiscalants to ensure efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within China RO antiscalant market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shandong Taihe

- Tianjin Hengtong, Shandong Jiahua

- Henan Qingshuiyuan

- Zhejiang Kinte

- Shanghai Yuanhua Water Treatment Co., Ltd.

- Nanjing Chemical Industry Co., Ltd. (subsidiaries in water treatment)

- Guangzhou Lvyuan Water Purification Materials Co., Ltd.

- Hebei Longxin Chemical Co., Ltd.

- Others

Recent Developments:

- In April 2024, Gradiant announced the launch of its CURE Chemicals product line, which features around 300 proprietary formulations, including antiscalants, cleaners, corrosion inhibitors, biocides, coagulants, and flocculants. The initiative is designed to boost water treatment efficiency while reducing environmental impact, aligning with global sustainability goals and regulatory pressures.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China RO antiscalant market based on the below-mentioned segments:

China RO Antiscalant Market, By Type

- Neutral Ph Antiscalant

- Broad Spectrum Antiscalant

- Others

China RO Antiscalant Market, By Application

- Brackish Water

- Sea Water

- Others

FAQ

Q: What is the current and forecasted size of the China RO antiscalant market?

A: The market was valued at approximately USD 445.21 million in 2024 and is projected to grow at a CAGR of 7.79%, reaching around USD 1,016.02 million by 2035.

Q: What are the primary types in the China RO antiscalant market?

A: The primary types are neutral pH antiscalant, broad spectrum antiscalant, and others. Among these, the broad spectrum antiscalant segment held a substantial share in 2024. The segment is driven by its adaptability and broad use. These formulations are particularly efficient against a variety of scaling chemicals, including calcium carbonate, sulfates, and silica, making them appropriate for a wide range of water chemistry.

Q: What are the main application forms in the market?

A: The main application forms are brackish water, sea water, and others. Among these, the brackish water segment dominated the market in 2024. This is the leading application segment due to the country's wide eastern regions, brackish groundwater, and industrial effluents necessitate substantial treatment.

Q: What are the key driving factors for market growth?

A: Growth is driven by industrial expansion, water scarcity concerns, technological innovation, stricter environmental regulations, and Sectoral Applications.

Q: What challenges does the market face?

A: Challenges include environmental concerns, technical limitations, competition from alternative technologies, dependence on industrial demand cycles, and limited awareness in smaller enterprises.

Q: Who are some key players in the market?

A: Key companies include Shandong Taihe, Tianjin Hengtong, Shandong Jiahua, Henan Qingshuiyuan, Zhejiang Kinte, Shanghai Yuanhua Water Treatment Co., Ltd., Nanjing Chemical Industry Co., Ltd. (subsidiaries in water treatment), Guangzhou Lvyuan Water Purification Materials Co., Ltd., Hebei Longxin Chemical Co., Ltd., and Others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |