China Sea Freight Transport Market

China Sea Freight Transport Market Size, Share, And COVID-19 Impact Analysis, By Cargo Type (Container, Bulk, Liquid, General Cargo), By Service Type (Deep-Sea Liner, Short Sea/Feeder, Bulk Tramp), By Trade Lane (Intra-Asia, Asia-Europe, Trans-Pacific, Asia-Africa), By End-Use Industry (Manufacturing, FMCG, Retail, Agriculture) And China Sea Freight Transport Market Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

China Sea Freight Transport Market Size Insights Forecasts to 2035

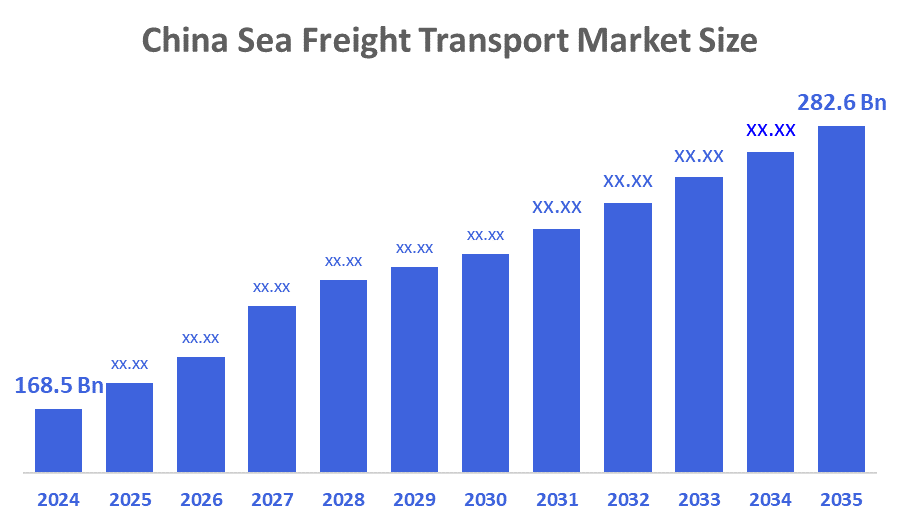

- China Sea Freight Transport Market Size Was Estimated at USD 168.5 Billion in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 4.81% from 2025 to 2035.

- China Sea Freight Transport Market Size is Expected to Reach USD 282.6 Billion by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The China Sea Freight Transport Market Size is anticipated to Reach USD 282.6 Billion by 2035, Growing at a CAGR of 4.81% from 2025 to 2035. The China Sea Freight Transport Market is driven by rising international trade, expansion of containerized shipments, port modernization, and adoption of AI-enabled logistics platforms.

Market Overview

The China sea freight transport market involves the transport of containerized, bulk, liquid and general cargo via Major Routes including intra-Asia routes, Asia to Europe Routes Trans-Pacific Route (Trans-Pacific), Asia to Africa Routes (Asia-Africa). It supports all types of manufacturers and retailers as well as the Energy Sector, Agriculture Sector, and E-commerce Sector by allowing large volumes to move at a lower cost. Demand continues to increase primarily because of Increased Export Demand, Improved Port Capacity, and Consistent Industrial Growth. Major factors impacting demand are E-commerce Fulfilment, Increased Container Availability, and Increased Investment in New Ship Fleet Operations.

Innovation is driving growth within this sector as Ports utilize Automated Crane Systems, AI-based Cargo Handling Systems, and Blockchain Cargo Tracking Systems. As of 2023, China’s ports handled approximately 4.96 billion tons of Foreign Trade Cargo, and they handled approximately 296 million TEUs of container cargo in 2022, demonstrating significant growth in capacity. Additionally, Government funded programs such as Port Digitalization Programs, Green Shipping Incentive Programs, and Multi-Modal Transportation Development Programs continue to drive growth within the industry. With total Import/Export trade valued at over 5 trillion USD and Increased Investment from Carriers such as COSCO providing additional opportunities for companies operating within the industry. Continued development of new Deep Water Port Terminals and Smart Port Projects provides Logistics Companies and Investors with Strong Growth Potential for the Future.

Report Coverage

This research report categorizes the market for the China sea freight transport market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China sea freight transport market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China sea freight transport market.

Driving Factors

The China’s sea freight market is driven by rising exports and growing international trade. Intra-Asia and global containerized cargo demand continues to expand, supporting higher shipping volumes. Investments in port modernization, automation, and infrastructure enhance operational efficiency and capacity. Adoption of digital logistics platforms, AI-based cargo handling, and real-time shipment tracking improves reliability, reduces delays, and strengthens supply chain management. These factors collectively accelerate market growth and attract investment in the sector.

Restraining Factors

The Chaina's ocean freight sector is heavily impacted by the unstable freight rates that hamper the profit margins. The disagreements over trade and the changes in tariffs make the demand very uncertain. The congestion at the ports and the limited connections to the hinterland not only slow down the cargo but also increase the costs of transportation. Moreover, the segment also suffers competition from the air and rail sectors that take the urgent shipments and hence the market can only grow to a limited extent.

Market Segmentation

The China sea freight transport market share is categorized by cargo type, service type, trade lane, and end-use industry.

- The containerized cargo segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The China sea freight transport market is segmented by cargo type into containerized cargo, bulk cargo, liquid cargo, and general cargo. Among these, the containerized cargo segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The?????? segment is expanding as a result of the need for shipments of consumer goods and electronics that are standardized, secure, and trackable. The main factors behind the growth of containerized cargo movement at the major ports in Asia are rapid e-commerce expansion, increased international trade volumes, efficient use of ports for container handling, and the deployment of advanced container tracking ??????systems.

- The deep-sea liner segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The China sea freight transport market is segmented by service type into deep-sea liner, short sea/feeder, and bulk tramp. Among these, the deep-sea liner segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its expansion is primarily supported by intercontinental trade among Asia, Europe, and North America, bigger vessel capabilities, more frequent scheduled departures, use of fuel-efficient mega-ships, and integrated port logistics that provide dependable and economically viable transport of high-value ??????cargo.

- The intra-Asia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The China sea freight transport market is segmented by trade lane into Intra-Asia, Asia-Europe, Trans-Pacific, and Asia-Africa. Among these, the intra-Asia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The????? expansion in this sector is largely influenced by the development of local manufacturing hubs, rising intra-Asian trade agreements, the short transit time of intermediate goods, the increasing demand of the emerging Southeast Asian markets, and the growing of port-to-port direct shipping ??????services.

- The manufacturing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The China sea freight transport market is segmented by end-use industry into manufacturing, FMCG & retail, agriculture & food, and chemicals & minerals. Among these, the manufacturing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The ?????segment's expansion is essentially sustained by China maintaining its position as the world's factory, high export volumes of machinery and electronics, the need for dependable logistics for heavy cargo, the adoption of intelligent warehousing, and the increasing demand for just-in-time deliveries that help in reducing inventory costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The China sea freight transport market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Key Companies

- China COSCO Shipping Corporation

- COSCO Shipping Development

- Sinotrans Limited

- Evergreen Marine Corporation

- Yang Ming Marine Transport Corp.

- A.P. Moller – Maersk

- MSC (Mediterranean Shipping Company)

- CMA CGM Group

- Hapag-Lloyd

- OOCL

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October?2025, China's?????? Ministry of Transport introduced the Green Shipping Corridors Initiative at the North Bund Forum. The initiative encourages the use of low carbon ships, ports with zero emissions, and the provision of green fuel to facilitate the most efficient and sustainable transport of cargo to reduce the shipping industry's environmental impact and help China maintain its leading role in global green shipping ??????practices.

- In September?2025, China?????? Customs and Ports Authorities decided to upgrade the New International Land Sea Trade Corridor. This multimodal rail sea road network increased the export efficiency, reduced the transit times, and deepened the connections from the inland to the port, which enhanced China's role in global trade and made it possible to carry international freight faster and with more ??????reliability.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China Sea Freight Transport Market based on the below-mentioned segments:

China Sea Freight Transport Market, By Cargo Type

- Containerized Cargo

- Bulk Cargo

- Liquid Cargo

- General Cargo

China Sea Freight Transport Market, By Service Type

- Deep-Sea Liner

- Short Sea/Feeder

- Bulk Tramp

China Sea Freight Transport Market, By Trade Lane

- Intra-Asia

- Asia-Europe

- Trans-Pacific

- Asia-Africa

China Sea Freight Transport Market, By End-Use Industry

- Manufacturing

- FMCG & Retail

- Agriculture & Food

- Chemicals & Minerals

FAQ’s

Q. What is the projected market size & growth rate of the China Sea Freight Transport Market?

A. The China Sea Freight Transport Market was valued at USD 168.5 billion in 2024 and is projected to reach USD 282.6 billion by 2035, growing at a CAGR of 4.81% from 2025 to 2035.

Q. What are the key driving factors for the growth of the China Sea Freight Transport Market?

A. Market growth is driven by rising international trade, expansion of containerized shipments, port modernization, AI-enabled logistics adoption, and increased demand from manufacturing, FMCG, agriculture, and e-commerce sectors.

Q. What are the top players operating in the China Sea Freight Transport Market?

A. China COSCO Shipping Corporation, COSCO Shipping Development, Sinotrans Limited, Evergreen Marine Corporation, Yang Ming Marine Transport Corp., A.P. Moller – Maersk, MSC, CMA CGM Group, Hapag-Lloyd, OOCL.

Q. What segments are covered in the China Sea Freight Transport Market report?

A. The market is segmented by Cargo Type (Containerized, Bulk, Liquid, General), Service Type (Deep-Sea Liner, Short Sea/Feeder, Bulk Tramp), Trade Lane (Intra-Asia, Asia-Europe, Trans-Pacific, Asia-Africa), and End-Use Industry (Manufacturing, FMCG & Retail, Agriculture & Food, Chemicals & Minerals).

Q. Which cargo type holds the largest market share in China Sea Freight Transport?

A. Containerized cargo accounted for the largest revenue share in 2024 due to the demand for standardized, secure, and trackable shipments of consumer goods and electronics.

Q. Which service type dominates the China Sea Freight Transport Market?

A. The deep-sea liner segment held the largest revenue market share in 2024, supported by intercontinental trade, mega-ships, scheduled departures, and integrated port logistics for high-value cargo.

Q. Which trade lane is most significant in the China Sea Freight Transport Market?

A. Intra-Asia trade lane accounted for the largest revenue share in 2024, driven by local manufacturing hubs, rising intra-Asian trade agreements, short transit times, and growing Southeast Asian market demand.

Q. What are the recent developments in the China Sea Freight Transport Market?

A. In October 2025, China launched the Green Shipping Corridors Initiative promoting low-carbon ships and sustainable ports; in September 2025, the New International Land-Sea Trade Corridor was upgraded to enhance multimodal freight efficiency and reduce transit times.

Q. Which end-use industry leads the China Sea Freight Transport Market?

A. The manufacturing sector held the largest revenue share in 2024 due to China’s high machinery and electronics exports, just-in-time deliveries, and intelligent warehousing adoption.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 178 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |