China Smart Sensors Market

China Smart Sensors Market Size, Share, And COVID-19 Impact Analysis, By Sensors Type (Touch, Flow, Image, Temperature & Humidity, Motion, Pressure, Light, Position, And Others), By Technology (Micro Electro-Mechanical Systems, Complementary Metal-Oxide Semiconductors, And Others), By Component (Analog To Digital Converters, Digital To Analog Converters, Transceivers, Amplifiers, Microcontrollers, And Others), And By End Use (Industrial, Aerospace & Defence, Consumer Electronics, Healthcare, Retail, Commercial, And Others), And China Smart Sensors Market Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

China Smart Sensors Market Size Insights Forecasts to 2035

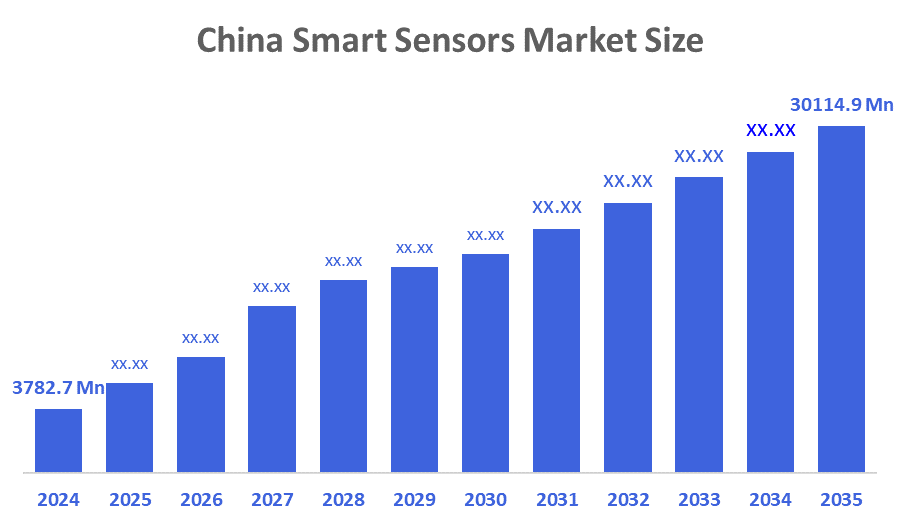

- China Smart Sensors Market Size Was Estimated at USD 3782.7 Million in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 20.75% from 2025 to 2035.

- China Smart Sensors Market Size is Expected to Reach USD 30114.9 Million by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The China Smart Sensors Market Size is anticipated to Reach USD 30114.9 Million by 2035, Growing at a CAGR of 20.75% from 2025 to 2035. The China Smart Sensors market is driven by accelerated loT adoption across industries, government investment in smart infrastructure and surveillance, growth in predictive maintenance and asset monitoring, cost reduction of sensor hardware, and need for energy efficiency and remote monitoring.

Market Overview

Smart sensors are smart devices that are created using a combination of sensing elements and an embedded processing chip and communication capabilities. Unlike traditional sensors, they do not require external processing units in order to interpret, transmit, or act upon the data they generate. The smart sensor market in China consists of the usage and sale of sophisticated smart sensors that, in addition to traditional sensing elements, incorporate a microprocessor for autonomous collection, processing, and communication of data. In many sectors of the economy, smart sensors in China are facilitating automation, machine-to-machine communication, and data analytics. Therefore, smart sensors play an important role in the movement toward digital transformation as they offer contextual awareness, self-calibration, and the ability to be operated remotely. Applications for smart sensors include environmental sensing, biometric monitoring, automotive safety, and diagnostic monitoring of industrial equipment.

The rapid adoption of Industry 4.0, the development of the Internet of Things, and an increasing demand for autonomous vehicles and smart consumer electronics are all contributing to the expansion of the China Smart Sensor market. The Chinese government supports this growth by investing heavily in smart city initiatives, manufacturing (through the Made in China 2025 initiative), energy efficiency and localisation of the smart sensor industry. To encourage this growth, it has provided both financial and policy assistance to companies manufacturing these types of sensors, particularly artificial intelligence (AI) and edge-computing based sensors, to reduce foreign dependence on advanced micro-electromechanical systems (MEMS), and to maintain national technological leadership in quantum sensing and automotive sensors.

Report Coverage

This research report categorizes the market for the China smart sensors market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China smart sensors market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China smart sensors market.

Driving Factors

The China smart sensors markets in Japan are driven by aging population and rising healthcare demand for wearable tech and remote patient monitoring, massive IoT adoption increasing internet penetration, smart manufacturing and industry 4.0 drives sensor use for automation reducing the downtime, government initiatives supporting digitization, automation, and “Made in China 2025”promote domestic sensor production, reducing import reliance, and technological advancements enhance sensor capabilities making them more attractive.

Restraining Factors

High initial investment costs, intense price pressure from domestic competition, a lack of standardized protocols, supply chain dependencies for high-end components, shortage of skilled professionals to manage these system, and data security and privacy concern restrain the China smart sensor market in China.

Market Segmentation

The China smart sensor market share is classified into sensors type, technology, component, and end use.

- The pressure segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The China smart sensors market is segmented by sensors type into touch, flow, image, temperature & humidity, motion, pressure, light, position, and others. Among these, the pressure sensor segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by a their essential and widespread application across the automotive, industrial automation like Tire Pressure Monitoring Systems (TPMS), and consumer electronics sectors, driven by government initiatives and technological advancements, and growth in healthcare sector in patient diagnosis require highly accurate pressure measurement.

- The micro electro-mechanical systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The China smart sensors market is segmented by technology into micro electro-mechanical systems, complementary metal-oxide semiconductors, and others. Among these, the micro electro-mechanical systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to technology’s inherent advantages in miniaturization, cost effectiveness, and high precision, which align perfectly with the mass-production demands of China’s dominant consumer electronics and automotive industries, government support and industrial automation, and proliferation of IoT and smart cities.

- The microcontrollers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The China smart sensors market is segmented by component into analog to digital converters, digital to analog converters, transceivers, amplifiers, microcontrollers, and others. Among these, the microcontrollers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by processing vast sensor data for booming sectors like IoT, Automotive, and Smart Cities, by government initiatives and massive manufacturing scale, with advanced 32-bit MCUs handling complex AI/Edge computing, making them essential for automation and connectivity.

- The consumer electronics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. (Industrial, Aerospace & Defence, Consumer Electronics, Healthcare, Retail, Commercial, And Others

The China smart sensors market is segmented by end use into industrial, aerospace & defence, consumer electronics, healthcare, retail, commercial, and others. Among these, the consumer electronics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to China being the world’s largest electronics market, driving huge demand for sensors in popular devices like smartphones, wearable, and smart home gadgets, fuelled by 5G, AI, and a tech-savvy population, with government support for domestic tech and widespread adoption of miniaturized, high-performance sensors for enhanced user experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The China smart sensors market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hesai Technology

- RoboSense

- Novosense Microelectronics

- Hikvision Technology

- Dahua Technology

- Xiaomi

- BOE Technology

- GoerTek

- SenseTime

- DJI Technology Co., Ltd

- SmartSens Technology (Shanghai) Co.Ltd

- Honeywell

- Infineon

- STMicroelcetronics

- Bosch

- Omron

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In May 2025, Hesai Technology led the development of China’s national automotive LiDAR standard GB/T 45500-2025. This standard provides a unified framework for the industry. Earlier, Mercedes-Benz announced a partnership with Hesai to co-develop smart cars for global markets.

• In June 2024, ASENSING showcased an ultra-small MEMS chip, providing motion-sensing options for Original Equipment Manufacturers (OEMs), specializing in high precision positioning technology, building a large manufacturing base involving production and research and a development in Shanghai, one of China’s most important automotive manufacturing hubs.

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2025 to 2035. Decisions Advisors has segmented the China Smart Sensors Market based on the below-mentioned segments:

China Smart Sensors Market, By Sensors Type

- Touch

- Flow

- Image

- Temperature & Humidity

- Motion

- Pressure

- Light

- Position

- Others

China Smart Sensors Market, By Technology

- Micro Electro-Mechanical Systems

- Complementary Metal-Oxide Semiconductors

- Others

China Smart Sensors Market, By Component

- Analog to Digital Converters

- Digital to Analog Converters

- Amplifiers

- Microcontrollers

- Others

China Smart Sensors Market, By End Use

- Industrial

- Aerospace & Defence

- Consumer Electronics

- Healthcare

- Retail

- Commercial

- Others

FAQ’s

Q. What is the projected market size & growth rate of the China smart sensors market?

A. China smart sensors market was valued at USD 3782.7 million in 2024 and is projected to reach USD 30114.9 million by 2035, growing at a CAGR of 20.75% from 2025 to 2035.

Q. What are the key driving factors for the growth of the China smart sensors market?

A. The China smart sensors markets in Japan are driven by aging population and rising healthcare demand for wearable tech and remote patient monitoring, massive IoT adoption increasing internet penetration, smart manufacturing and industry 4.0 drives sensor use for automation reducing the downtime, government initiatives supporting digitization, automation, and “Made in China 2025”promote domestic sensor production, reducing import reliance, and technological advancements enhance sensor capabilities making them more attractive.

Q. What are the top players operating in the China smart sensors market?

A. Hesai Technology, RoboSense, Novosense Microelectronics, Hikvision Technology, Dahua Technology, Xiaomi, BOE Technology, GoerTek, SenseTime, DJI Technology Co., Ltd, SmartSens Technology (Shanghai) Co.Ltd, Honeywell, Infineon, STMicroelcetronics, Bosch, Omron, and Others

Q. What segments are covered in the China smart sensors report?

A. China smart sensors market is segmented based on Sensors Type, Technology, Component, and End Use.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 148 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |