China Textile Recycled Market

China Textile Recycled Market Size, Share, By Material (Cotton, polyester, Wool, Polyamide, and Other), By Source (Apparel Waste, Home Furnishing Waste, Automotive Waste, and Others), By Process (Mechanical and Chemical), And China Textile Recycled Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China Textile Recycled Market Insights Forecasts to 2035:

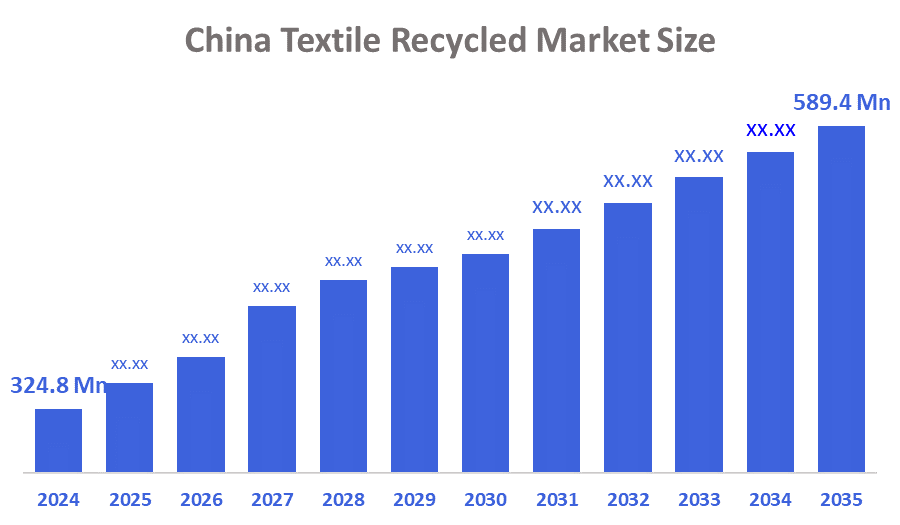

- China Textile Recycled Market Size 2024: USD 324.8 Million

- China Textile Recycled Market Size 2035: USD 589.4 Million

- China Textile Recycled Market CAGR: 5.57%

- China Textile Recycled Market Segments: Material, Source, and Process

The market for recycled textiles in China is on the fast track to expansion, owing to the sustainability discourse and the big chunk of textile waste produced by the largest textile market in the world. The demand from clothing, home textiles, and industrial applications is one of the main reasons for the growth of this market and it is supplemented by the changing consumer behaviour towards green products.

The government initiatives are the major driving force that is responsible for the development of the market. In 2022, a collaboration of China’s National Development and Reform Commission, Ministry of Commerce, and Ministry of Industry and Information Technology declared policies that would speed up the recycling of textile waste, aiming at a recycling rate of 25% and 2 million tons of recycled fiber by 2025 and even larger amounts by 2030. Among the additional measures are tax breaks, improved waste collection, and city trials for promoting "zero waste" and circular practices that use waste.

The industry is being transformed by technological progress. Development in textile-to-textile (T2T) recycling, chemical recycling for mixed fabrics, and AI-assisted sorting systems are improving the quality of fiber recovery and the efficiency of processing, which in turn is helping China to become a closed-loop textile economy.

Market Dynamics of the China Textile Recycled Market:

In China, the recycled textile market mainly relies on the government heavily supporting the circular economy, growing environmental concerns, and the pressure to reduce textile waste increasing. The purchasing of recycled fibers has been made easier for brands and manufacturers through the support of policies that reduce waste, encourage carbon neutrality, and promote sustainable manufacturing. The demand for recycled polyester and cotton from the apparel, home textiles, and automotive industries is a major driving factor of the market.

However, the market also has some limitations, like the varying quality of recycled fibers, the expensive sorting and collection process, and the insufficient advanced recycling infrastructure in certain areas. The technology used for fiber separation is still a challenge, particularly for mixed textiles, which makes it difficult to adopt the recycling process on a large scale.

Moreover, the market still has to overcome these hurdles, and it is a question of time before the situation changes. The opening up of new avenues through the availability of the latest chemical recycling technology, increased funding in the process of recycling textiles into textiles, and the establishment of partnerships between the world's leading brands and Chinese recyclers are just a few instances of the opportunities. The ever-expanding consumer awareness regarding environmentally friendly fashion and the demand for textiles made from recycled materials for export purposes are among the factors that will eventually provide long-term opportunities for the market to grow.

Market Segmentation

The China Textile Recycled Market share is classified into material, source, and process.

By Material:

The Chinese textile recycled market is categorised by material into cotton, polyester, wool, polyamide, and other. Among these, the polyester segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The high recyclability of polyester fibers, strong demand from the clothing and home textiles industries, and growing use of recycled polyester (rPET) as a response to sustainability regulations and circular economy initiatives in China are the main drivers of this trend.

By Source:

China's textile recycled market is divided by source into apparel waste, home furnishing waste, automotive waste, and others. Among these, the apparel waste segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The high clothing consumption, rapid fashion turnover, and increasing government initiatives to promote textile waste collection and recycling, as well as circular fashion practices, are the major factors driving the development in China.

By Process:

China's textile recycled market is classified by process into mechanical and chemical. Among these, the mechanical segment held the majority market share in 2024 and is predicted to grow at a remarkable rate over the forecast period. The recycling of cotton and polyester textiles to produce applications like yarns, insulation, and non-woven products is mainly on account of their economical nature, the recycling infrastructure already in place, and the great demand for the recycled products.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China textile recycling market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Textile Recycled Market:

- Far Eastern New Century Corporation (China operations)

- Fujian Billion Polymerization Fiber Technology Industrial Co., Ltd.

- Zhejiang Jiaren New Materials Co., Ltd.

- Hua Lun Chemical Fiber Co., Ltd.

- Hangzhou Hanbang Chemical Fiber Co., Ltd.

- Jiangsu Zhongyuan Industrial Group Co., Ltd.

- Others

Recent Developments in China Textile Recycled Market:

- In April 2025, Grace Yibin opened the first pilot plant in China for the recycling of textile waste into dissolving pulp through the method of post-industrial and post-consumer textile waste.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China textile recycling market based on the following segments:

China Textile Recycled Market, By Material

- Cotton

- Polyester

- Wool

- Polyamide

- Other

China Textile Recycled Market, By Source

- Apparel Waste

- Home Furnishing Waste

- Automotive Waste

- Others

China Textile Recycled Market, By Process

- Mechanical

- Chemical

FAQ

- What is the base year and forecast period for the China Textile Recycled Market?

The base year is 2024, with historical data from 2020–2023. The forecast period spans 2025–2035.

- What is the market size and growth outlook of the China Textile Recycled Market?

The market was valued at USD 324.8 million in 2024 and is expected to reach USD 589.4 million by 2035, growing at a CAGR of 5.57% during 2025–2035.

- Which material segment dominates the market?

The polyester segment dominated the market in 2024 due to its high recyclability, cost efficiency, and strong demand from apparel and home textile applications.

- Which source contributes the largest share to the market?

Apparel waste accounted for the largest market share in 2024, driven by high clothing consumption, fast fashion turnover, and improved textile waste collection initiatives.

- Which recycling process holds the major market share?

Mechanical recycling held the majority share in 2024 owing to its economic viability, established infrastructure, and widespread use for cotton and polyester recycling.

- What challenges does the market face?

Key challenges include inconsistent recycled fiber quality, high sorting and collection costs, limited advanced recycling infrastructure, and technical difficulties in recycling blended textiles.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |