China Wood Furniture Market

China Wood Furniture Market Size, Share, and COVID-19 Impact Analysis, By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online, and Others), By Application (Home Furniture, Office Furniture, Hospitality Furniture, and Others), and China Wood Furniture Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China Wood Furniture Market Size Insights Forecasts to 2035

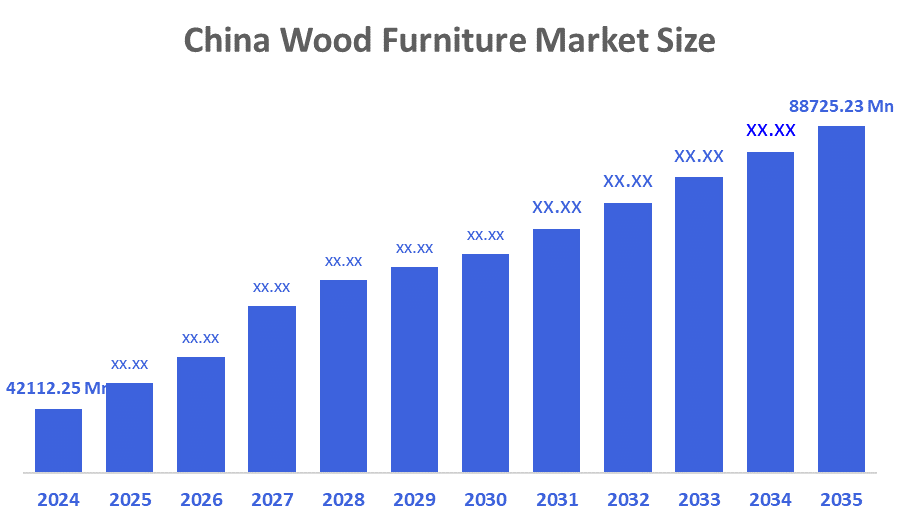

- The China Wood Furniture Market Size Was Estimated at USD 42,112.25Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.01% from 2025 to 2035

- The China Wood Furniture Market Size is Expected to Reach USD 88,725.23 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The China Wood Furniture Market Size is anticipated to Reach USD 88,725.23 Million by 2035, Growing at a CAGR of 7.01% from 2025 to 2035. The primary drivers of the market are urbanization, rising disposable incomes, eco-friendly trends, e-commerce expansion, customization & lifestyle preferences, and strong export demand.

Market Overview

The China wood furniture market refers to the industry that is largely concerned with the manufacture, distribution, and sale of wood-based products such as solid wood, engineered wood, porcelain veneers, plywood, and particleboard composites. It contains a diverse range of products, including domestic furniture such as beds, tables, chairs, cupboards, and sofas. Commercial elements such as office desks, hospitality chairs, and institutional applications cater to both domestic and foreign markets. Furthermore, the market includes production hubs in regions like as East China, with distribution via retail stores, e-commerce, supplements, and a direct B2B channel. Wood dominated China's overall furniture market, accounting for approximately 57%, due to its durability, aesthetic variety, and environmental trends that use certified or recycled materials. Advanced production technology is boosting China's wood furniture business. Advanced manufacturing technologies are benefiting China's wood furniture business by increasing production efficiency, customisation, and automated quality control. Robotics and digital design tools have greatly improved furniture manufacturing by lowering labor costs and boosting production speed. Furthermore, IoT integration into furniture is becoming more widespread. Smart wooden furniture, such as sensor-equipped tables, beds with charging stations, and voice-controlled cabinets, is popular among tech-savvy consumers. Overall, the Chinese Wood Furniture Market appears to be on course for future expansion, with opportunities for both established and new entrants to capitalize on emerging trends.

China's wood furniture export industry is still strong, with producers actively appealing to international markets. Exports increased by 24% in the first half of 2024, indicating robust global demand. A total of 256 million items were exported, demonstrating China's strong position as a major supplier in the world furniture market.

China's current Section 301 charges of 7.5% to 25% and its 20% IEEPA tariff will be stacked on top of the proposed Section 232 tariffs. According to an updated tariff calculator from Flexport, this means that imports of upholstered chairs from China may be subject to effective levies as high as 70%, exacerbating pricing pressure on importing suppliers and the shops they serve. connection

Report Coverage

This research report categorises the market for the China wood furniture market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China wood furniture market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China wood furniture market.

Driving Factors

China's wood furniture market is driven by rising urbanization, which boosts demand for residential and commercial furnishings as populations migrate to cities and new building developments develop. Rising disposable incomes within the expanding middle class allow for increased spending on expensive, fashionable, and customizable wood items, moving preferences away from basic to high-quality, functional designs. Government investments in infrastructure, smart cities, and housing drive up demand for home and office furnishings, while e-commerce expansion and omni-channel shopping make products more available nationwide. Sustainable trends, including eco-friendly materials like FSC-certified wood and bamboo, align with stronger environmental legislation and consumer awareness, promoting production innovation.

Restraining Factors

The Chinese wood furniture market faces key restraints such as high raw material costs, environmental regulations & sustainability pressure, global competition, logistics & supply chain disruptions, slow domestic growth rate, tariffs & trade barriers.

Market Segmentation

The China wood furniture market share is classified into distribution channel and application.

- The online segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China wood furniture market is divided by distribution channel into supermarkets & hypermarkets, specialty stores, online, and others. Among these, the online segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by due to their wide selection of products, affordable prices, and effective delivery services, major online retailers like Alibaba, JD.com, and Tmall have completely changed how customers buy furniture. Online furniture sales have increased due to younger consumers' preferences and the quick uptake of digital technologies.

- The home furniture segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China wood furniture market is segmented by application into home furniture, office furniture, hospitality furniture, and other. Among these, the home furniture segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the leading application segment due to the country's increasing urbanization, and the rising residential housing sector has resulted in high demand for bedroom, living room, and dining furniture. At the same time, a growing middle class is gravitating towards beautiful, durable, and adjustable solutions, making this sector particularly profitable. Beyond domestic consumption, home furniture dominates China's export collection.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within China wood furniture market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kuka Home

- Markor International Furniture Co., Ltd.

- Qumei Furniture Group

- Oppein Home Group Inc.

- Huafeng Furniture Group

- Hongye Furniture Group

- Landbond Furniture Group

- Yihua Lifestyle Technology Co., Ltd.

- Kangsheng Furniture

- QM Furniture (Qumei Modern)

- Others

Recent Developments:

- In September 2025, The Woodworking Fair China (WMF 2025) officially opened in Shanghai, spotlighting five key furniture manufacturing tracks and unveiling new woodworking system solutions. This year’s focus emphasized “Light High-End Customization” and strategies for overseas market growth, reflecting the industry’s shift toward premium, tailored furniture and global expansion.

- In October 2022, YESWOOD proudly announced that its official store count had surpassed 70 outlets nationwide. Remarkably, within just one month, the growth momentum accelerated even further the brand successfully opened 8 new offline physical stores, pushing its total presence to over 80 locations across China.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China wood furniture market based on the below-mentioned segments:

China Wood Furniture Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

China Wood Furniture Market, By Application

- Home Furniture

- Office Furniture

- Hospitality Furniture

- Others

FAQ

Q: What is the current and forecasted size of the China wood furniture market?

A: The market was valued at approximately USD 42,112.25million in 2024 and is projected to grow at a CAGR of 7.01%, reaching around USD 88,725.23 million by 2035.

Q: What are the primary distribution channels in the China wood furniture market?

A: The primary distribution channels are supermarkets & hypermarkets, specialty stores, online, and others. Among these, the online segment held a substantial share in 2024. The segment is driven by Due to their wide selection of products, affordable prices, and effective delivery services, major online retailers like Alibaba, JD.com, and Tmall have completely changed how customers buy furniture.

Q: What are the main application forms in the market?

A: The main application forms are home furniture, office furniture, hospitality furniture, and others. Among these, the home furniture segment dominated the market in 2024. This is the leading application segment due to the country's increasing urbanization, and the rising residential housing sector has resulted in high demand for bedroom, living room, and dining furniture.

Q: What are the key driving factors for market growth?

A: Growth is driven by urbanization, rising disposable incomes, eco-friendly trends, e-commerce expansion, customization & lifestyle preferences, and strong export demand.

Q: What challenges does the market face?

A: Challenges include High Raw Material Costs, Environmental Regulations & Sustainability Pressure, Global Competition, Logistics & Supply Chain Disruptions, Slow Domestic Growth Rate, Tariffs & Trade Barriers.

Q: Who are some key players in the market?

A: Key companies include Kuka Home, Markor International Furniture Co., Ltd., Qumei Furniture Group, Oppein Home Group Inc., Huafeng Furniture Group, Hongye Furniture Group, Landbond Furniture Group, Yihua Lifestyle Technology Co., Ltd., Kangsheng Furniture, QM Furniture (Qumei Modern), and Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 188 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |