China XR Hardware Market

China XR Hardware Market Size, Share, and COVID-19 Impact Analysis, By Type (Virtual Reality (VR), Augmented Reality (AR), Mixed Reality (MR), and Others), By End-Use (Education, Automotive, Retail, Manufacturing, Aerospace, Healthcare, gaming, and Others), and China XR Hardware Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

China XR Hardware Market Size Insights Forecasts to 2035

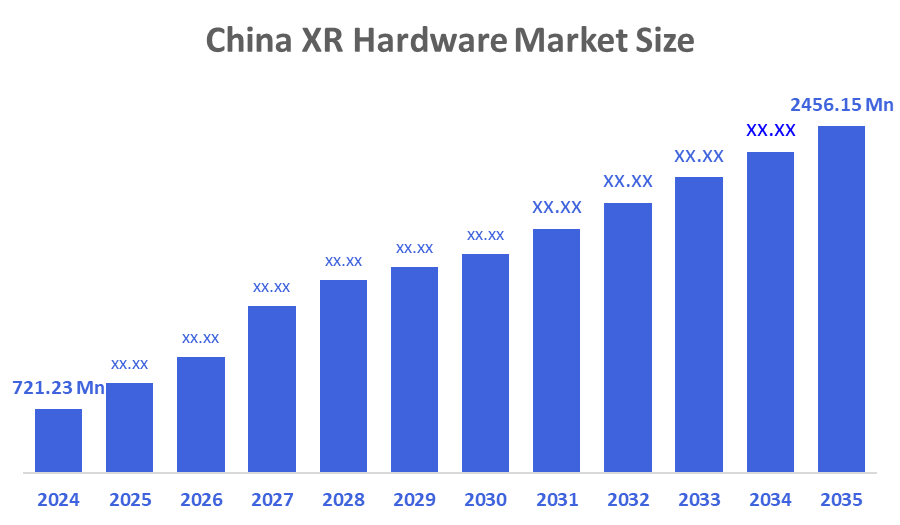

- The China XR Hardware Market Size Was Estimated at USD 721.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.78% from 2025 to 2035

- The China XR Hardware Market Size is Expected to Reach USD 2,456.15 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, the China XR Hardware Market is Anticipated to Reach USD 2,456.15 Million by 2035, Growing at a CAGR of 11.78% from 2025 to 2035. The primary drivers of the market size are rapid technological innovation, strong government support, and rising demand across gaming, education, healthcare, and enterprise applications.

Market Overview

The China XR hardware market refers to a range of technologies, including VR headsets, AR glasses, and MR equipment, that enable immersive digital experiences by combining virtual and physical surroundings. This industry is quickly developing, owing to government initiatives, technological innovation, and increased consumer demand. While gaming and entertainment are still the primary drivers, businesses such as education, healthcare, manufacturing, and automotive are increasingly using XR technology for training, visualization, and operational efficiency. With significant investment from domestic tech giants and integration with AI, 5g, and cloud computing, China is establishing itself as a worldwide powerhouse for XR development and deployment.

Additionally, collaboration between government agencies and industry stakeholders will probably become more important as the China XR hardware market develops. Considerably, the industry is expected to increase significantly due to consumer demand, innovation, and a favorable regulatory framework. While the consumer interest in XR technologies has clearly increased, especially among younger populations. This pattern shows a change in how people interact with digital content and raises the possibility that XR gadgets will become ubiquitous in daily life. As the market grows, regulatory frameworks are taking shape. Policymakers are focusing on developing standards to address safety and privacy concerns, which could have a substantial impact on how companies operate in the market.

Local businesses like Pico (owned by ByteDance), DPVR, and NOLO dominate the home market and are rapidly focusing on consumers, notably gaming. Apple's Vision Pro has also "reignited excitement" in China's XR realm, causing local players to focus and compete more intensely.

GravityXR has received significant investment from prominent companies such as HongShan (previously Sequoia China), Gaorong Capital, manufacturing giant Goertek, and game developer miHoYo. This demonstrates considerable private-sector confidence in the home market's potential.

Report Coverage

This research report categorises the market for the China XR hardware market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China XR hardware market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China XR hardware market.

Driving Factors

China XR hardware market is primarily driven by VR, AR, and MR devices are rapidly expanding, driven by rising demand for immersive technologies in gaming, education, manufacturing, and e-commerce industries. Key drivers include advances in displays, processing capabilities, and tracking systems that provide more realistic simulations, as well as government policies that encourage AR/VR adoption in public services and industries, which are aided by China's extensive manufacturing infrastructure and cost-competitive domestic brands. Consumer adoption is dominated by entertainment and gaming, while enterprise applications in training, healthcare, and retail gain from urbanization and digital transformation. Particularly, AR sales, particularly AI glasses, increased by 193% year on year in 2025, exceeding VR growth.

Restraining Factors

The Chinese XR hardware market faces key restraints such as including high device costs, limited content ecosystems, consumer awareness & acceptance, technical challenges, and strong global competition.

Market segmentation

The China XR hardware market share is classified into type and end-use.

- The virtual reality (VR) segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China XR hardware market is divided by type into virtual reality (VR), augmented reality (AR), mixed reality (MR), and others. Among these, the virtual reality (VR) segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by its Widespread application in gaming and immersive entertainment. Even in 2025, VR still generates the most income among all XR categories, predicted at roughly US$3.4 billion, demonstrating its dominance despite slowing growth.

- The gaming segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The China XR hardware market is segmented by end-use into education, automotive, retail, manufacturing, aerospace, healthcare, gaming, and others. Among these, the gaming segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the leading segment due to the most intense customer base and provides highly engaging experiences that resonate with players. Local manufacturers, such as Pico, DPVR, and nolo, have adapted their devices to satisfy gaming needs, while content providers like Mihoyo continue to build XR-compatible titles that fulfill demand. This robust ecosystem assures that gaming generates the largest share of XR hardware sales.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within China XR hardware market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pico (ByteDance)

- DPVR

- NOLO

- Goertek

- GravityXR

- Huawei

- Tencent

- Others

Recent Developments:

- In December 2025, China’s XR market is accelerating with GravityXR’s Jizhi G-X100 chip, a 5nm mixed reality processor boasting 9ms photon-to-photon latency faster than Apple’s Vision Pro, designed for lightweight MR headsets and AI glasses. Signals China’s aggressive push in XR hardware innovation, showcased at VR/AR Expo China 2025 in Shanghai.

- In September 2025, Microsoft announced a partnership with a major Chinese tech company to co-develop mixed reality applications tailored for China’s local market, marking a strategic expansion of its XR footprint in the region. The collaboration focuses on developing MR applications customized for Chinese users, addressing cultural, linguistic, and regulatory needs

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China XR hardware market based on the below-mentioned segments:

China XR Hardware Market, By Type

- Virtual Reality (VR)

- Augmented Reality (AR)

- Mixed Reality (MR)

- Others

China XR Hardware Market, By End-Use

- Education

- Automotive

- Retail

- Manufacturing

- Aerospace

- Healthcare

- Gaming

- Others

FAQ

Q: What is the current and forecasted size of the China XR hardware market?

A: The market was valued at approximately USD 721.23million in 2024 and is projected to grow at a CAGR of 11.78%, reaching around USD 2,456.15 million by 2035.

Q: What are the primary types in the China XR hardware market?

A: The primary types are virtual reality (VR), augmented reality (AR), mixed reality (MR), and others. Among these, the virtual reality (VR) segment held a substantial share in 2024. The segment is driven by its Widespread application in gaming and immersive entertainment.

Q: What are the main end-use forms in the market?

A: The main end-use forms are education, automotive, retail, manufacturing, aerospace, healthcare, gaming, and others. Among these, the gaming segment dominated the market in 2024. This is the leading segment due to the most intense customer base and provides highly engaging experiences that resonate with players.

Q: What are the key driving factors for market growth?

A: Growth is driven by rapid technological innovation, strong government support, and rising demand across gaming, education, healthcare, and enterprise applications.

Q: What challenges does the market face?

A: Challenges include high device costs, limited content ecosystems, consumer awareness & acceptance, technical challenges, and strong global competition.

Q: Who are some key players in the market?

A: Key companies include Pico (ByteDance), DPVR, NOLO, Goertek, GravityXR, Huawei, Tencent, Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 190 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |