Global Chiplet Market

Global Chiplet Market Size, Share, and COVID-19 Impact Analysis, By Processor Type (CPU Chiplets, GPU Chiplets, AI/ML Accelerators, FPGA Chiplets, APU Chiplets), By Packaging Technology (2.5D/3D Packaging, System-in-Package (SiP), Fan-Out Packaging, Multi-Chip Module (MCM), Flip-Chip Ball Grid Array (FCBGA)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Chiplet Market Summary

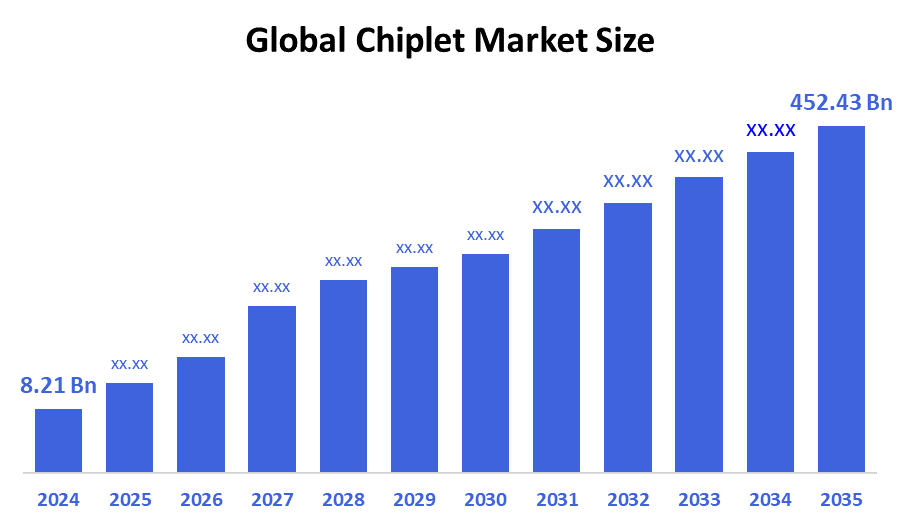

The Global Chiplet Market Size Was Estimated at USD 8.21 Billion in 2024 and is Projected to Reach USD 452.43 Billion by 2035, Growing at a CAGR of 43.98% from 2025 to 2035. Growing demand for high-performance computing, modular design flexibility, cost effectiveness, heterogeneous integration, shorter time-to-market, and advancements in packaging technologies like 2.5D and 3D integration are all driving growth in the chiplet market.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of over 39.7% and dominated the market globally.

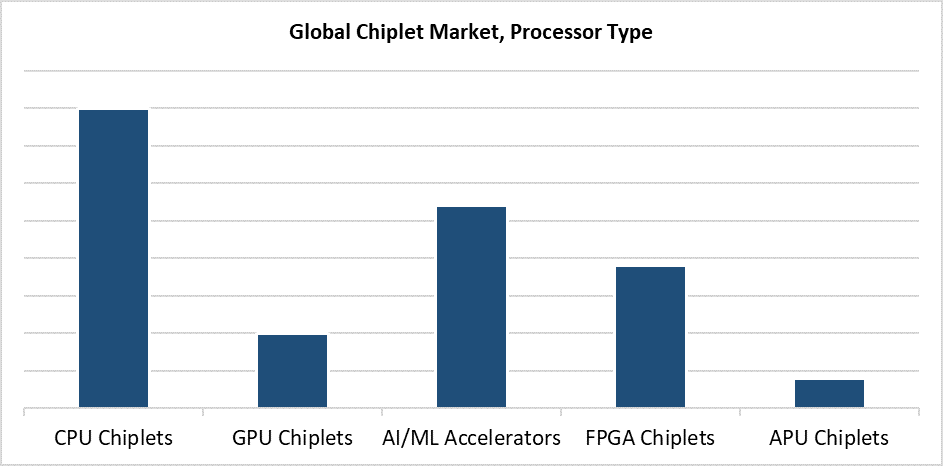

- In 2024, the CPU chiplets segment had the highest market share by processor type, accounting for 40.4%.

- In 2024, the 2.5D/3D packaging segment had the biggest market share by packaging technology.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 8.21 Billion

- 2035 Projected Market Size: USD 452.43 Billion

- CAGR (2025-2035): 43.98%

- Asia Pacific: Largest market in 2024

The chiplet market represents a developing segment of the semiconductor industry, focusing on the development and manufacturing of functional, smaller chips known as chiplets that assemble into a complete system-on-chip (SoC). The modular design method delivers multiple benefits compared to traditional monolithic chip structures by being more cost-effective and providing greater design adaptability, and enabling heterogeneous technology integration. The expanding demand for 5G technology and data centers, together with artificial intelligence applications and high-performance computing needs and automotive electronic systems, drives the market growth forward. The use of chiplets allows manufacturers to exceed Moore's Law restrictions while decreasing costs and development duration because they provide enhanced functionality through non-state-of-the-art node requirements for each component.

The development of more resilient chiplet ecosystems depends on technological advances such as 2.5D/3D packaging and sophisticated interconnect protocols like UCIe and heterogeneous integration. To facilitate integration, major players are dedicating funds to open chiplet architectures and design automation tools. Asian governments, along with the European Union and the United States federal agencies support market development through their programs. The U.S. CHIPS Act and Europe's Chips Joint Undertaking support global semiconductor supply chain competitiveness through billions of funding that targets semiconductor innovation, which includes chiplet research and domestic manufacturing infrastructure development.

Processor Type Insights

The CPU chiplets segment led the chiplet market with the largest revenue share of 40.4% in 2024. The increased demand for energy-efficient computing and high-performance computing solutions drives this growth across cloud services, enterprise IT infrastructure, and data centers. The scalability and modularity of CPU chiplets allow manufacturers to combine multiple processing cores inside one package to boost performance while lowering costs and simplifying design processes. The adoption of chiplet-based CPU architectures by major semiconductor companies aims to enhance yield rates and accelerate product development timelines. The worldwide semiconductor market sees rising CPU chiplet demand because AI and machine learning applications need heterogeneous computing systems and multi-core processor support.

The AI/ML accelerators segment of the chiplet market is anticipated to grow at the fastest CAGR throughout the forecast period. The rapid market growth stems mainly from the rising requirements of specific hardware that handles complex AI and machine learning workloads in sectors such as data analytics and natural language processing, and autonomous vehicles. Chiplet-based AI/ML accelerators enable flexible and scalable solutions with enhanced energy efficiency by integrating particular AI workload cores with standard processing components. The increasing complexity of AI models, along with the need for modular, efficient compute architectures, pushes industry leaders to invest in AI accelerator designs that use chiplet technology. Market expansion is expected to speed up because of this trend.

Packaging Technology Insights

The 2.5D/3D packaging segment led the chiplet market in 2024 because of its enhanced integration features, together with superior bandwidth and outstanding performance. These advanced packaging techniques minimize connection distance and energy usage through the arrangement of multiple chiplets on a single interposer or substrate, which boosts data transmission speed. The combination of different components, like CPUs and GPUs, and RAM modules, becomes possible in compact systems through 2.5D/3D packaging solutions. The growing popularity of 2.5D/3D packaging methods accelerates because high-performance computing needs in advanced networking alongside data centers and artificial intelligence systems keep increasing. Major semiconductor companies implement 2.5D/3D packaging to boost overall system performance while avoiding traditional scaling limitations.

The system-in-package (SiP) segment of the chiplet market is anticipated to experience a significant CAGR throughout the forecast period. The growing need for small multifunctional semiconductor solutions within consumer electronics, IoT devices, and mobile platforms drives this growth. The SiP technology allows multiple chiplets, including processors and memory, and RF components to be combined into a single package, which decreases power consumption while saving space. The shrinking size of advanced devices, together with their increasing power, requires SiP solutions that efficiently deliver advanced functionality with limited footprint expansion. The technical improvements in miniaturization and thermal management, and heterogeneous integration make SiP the preferred packaging option for OEMs who want to speed up product development and market delivery.

Regional Insights

The Asia Pacific chiplet market dominated globally with the largest revenue share of 39.7% in 2024. The strong semiconductor production framework of Taiwan, South Korea, China, and Japan drives this market superiority. The adoption of chiplet-based architectures continues to grow among major foundries and packaging facilities as well as chip design organizations throughout these nations, for performance enhancement and cost reduction. The rising consumer electronics demand and 5G infrastructure, AI, and high-performance computing requirements across the region propel chiplet integration development. Semiconductor innovation programs and national self-sufficiency initiatives from Asia Pacific governments expand the region's position as a primary center in the worldwide chiplet supply network.

Europe Chiplet Market Trends

Europe became a profitable chiplet market in 2024 because of rising semiconductor innovation investments combined with deliberate technical sovereignty development efforts. Through the EU Chips Act and other programs, the European Union has allocated substantial funds for local semiconductor R&D and manufacturing development, focusing on chiplet and advanced packaging technology applications. The rising need for efficient high-performance chips in automotive, industrial automation, and aerospace sectors, which Europe dominates, has driven the adoption of chiplet-based solutions. Multiple research institutions, together with chip manufacturing companies and government bodies, work together to establish Europe as an innovative and competitive force in the worldwide chiplet industry.

North America Chiplet Market Trends

The North American chiplet market is growing significantly through essential high-performance computing demands and major technological advancements, together with purposeful government support. The area has become a leading force in chiplet-based design and production due to large semiconductor companies, which include chiplet innovation pioneers. The growing demand for scalable modular chip architectures emerges from expanding data center requirements, cloud computing needs, AI developments, and defense applications. Government programs, including the Science Act and the U.S. CHIPS, have accelerated domestic production capabilities while expanding research and development, which has created a strong semiconductor supply chain. The market expansion in North America benefits from cooperative efforts between tech businesses and academic centers and foundries, which develop chiplet integration and sophisticated packaging techniques.

Key Chiplet Companies:

The following are the leading companies in the chiplet market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc. (AMD)

- Alibaba Group Holding Ltd. (T-Head)

- Intel Corporation

- Tenstorrent Inc.

- Broadcom Inc.

- NVIDIA Corporation

- Samsung Electronics Co., Ltd.

- Amazon Web Services, Inc. (AWS)

- Marvell Technology, Inc.

- Microsoft Corporation

- Others

Recent Developments

- In January 2025, YorChip and ChipCraft introduced a low-cost, low-power 8-bit 200Ms/s ADC chiplet. This solution addresses a gap in the chiplet market, offering designers a high-speed ADC without the high costs or power requirements of standard ASSPs or complex IP licensing for custom SoCs.

- In October 2024, The Open Compute Project and Berkeley Lab established a partnership to develop chiplet-based high-performance computing (HPC) technology. Through modular chiplet inventions, the initiative—which includes the Open Chiplet Economy Experience Center—aims to recover previous growth rates in HPC performance and energy efficiency.

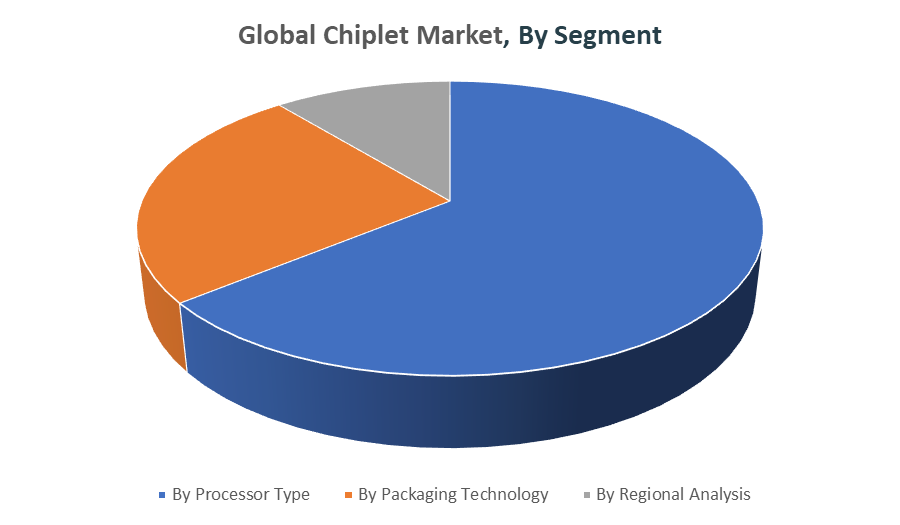

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035.Decision Advisors has segmented the chiplet market based on the below-mentioned segments:

Global Chiplet Market, By Processor Type

- CPU Chiplets

- GPU Chiplets

- AI/ML Accelerators

- FPGA Chiplets

- APU Chiplets

Global Chiplet Market, By Packaging Technology

- 2.5D/3D Packaging

- System-in-Package (SiP)

- Fan-Out Packaging

- Multi-Chip Module (MCM)

- Flip-Chip Ball Grid Array (FCBGA)

Global Chiplet Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |