Global Chromium Mining Market

Global Chromium Mining Market Size, Share, and COVID-19 Impact Analysis, By Product (Ferrochrome, Chromite Ore, Chemicals), By Application (Metallurgical, Refractory, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Chromium Mining Market Size Summary

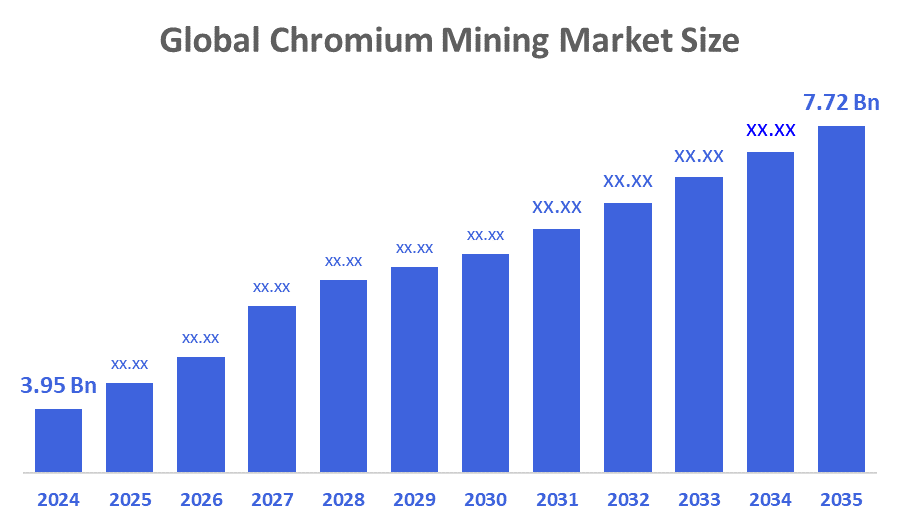

The Global Chromium Mining Market Size Was Valued at USD 3.95 Billion in 2024 and is Projected to Reach USD 7.72 Billion by 2035, Growing at a CAGR of 6.28% from 2025 to 2035. Infrastructure development, the manufacturing of automobiles, and the growing need for stainless steel are the main factors propelling the chromium mining market. Chromium consumption and market expansion worldwide are further boosted by technological developments in extraction, rising urbanisation, and expanding industry in emerging economies.

Key Regional and Segment-Wise Insights

- In 2024, the Middle East & Africa chromium mining market held the largest revenue share of 34.6% and dominated the global market.

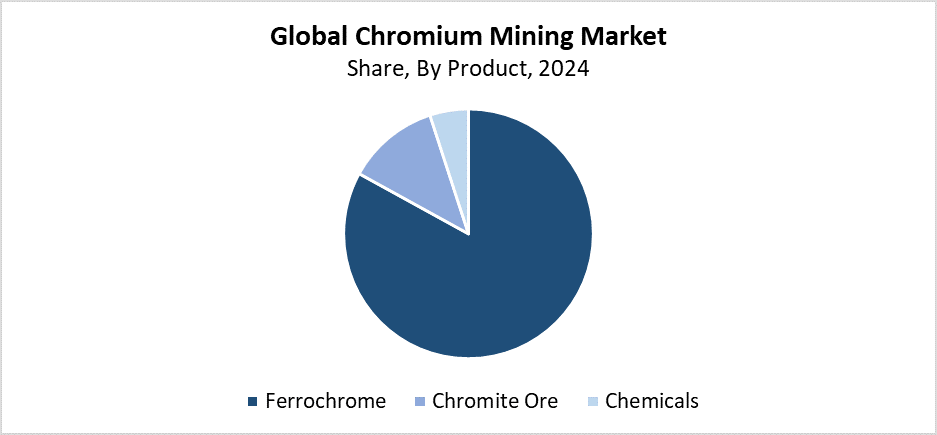

- In 2024, the ferrochrome segment held the highest revenue share of 83.4% and dominated the global market by product.

- With the biggest revenue share in 2024, the metallurgical segment led the worldwide market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3.95 Billion

- 2035 Projected Market Size: USD 7.72 Billion

- CAGR (2025-2035): 6.28%

- Middle East & Africa: Largest market in 2024

The global industry which produces chromium ore for chemical production and stainless steel alloy manufacturing operates as the chromium mining market. The industrial, automotive, and metallurgical sectors rely on chromium because it provides essential characteristics, including hardness, high melting point, and corrosion resistance. The market continues to expand because stainless steel demand for industrial operations, automobile production, and infrastructure development keeps rising steadily. The demand for chromium has risen because developing countries China, Brazil, and India, have expanded their urban areas and industrial operations. The market continues to grow because the defence and aerospace sectors keep expanding.

The mining sector has achieved higher chromium recovery rates through advanced processing systems, which also reduce operating expenses to enhance both production efficiency and environmental sustainability. The industry transforms because of automation adoption and remote monitoring systems, and environmentally sustainable extraction methods. The chromium mining sector receives backing through government programs which support sustainable mining operations. These support mineral exploration investments. The global chromium market will experience new growth opportunities because of policies that promote resource conservation and domestic mining development.

Product Insights

The ferrochrome segment led the chromium mining market with the largest revenue share of 83.4% in 2024. The stainless steel production industry maintains its position as the primary chromium consumer because ferrochrome serves as its fundamental material. The alloy serves as an essential industrial material because it provides outstanding strength, corrosion resistance, and long service life for automotive and construction uses. The demand for Ferrochrome materials continues to grow because of new construction activities and the requirement for superior materials. Production and export activities continue to grow because developing nations, including China and India, pursue industrialisation. The ongoing requirement for stainless steel across multiple industrial sectors will maintain Ferrochrome as the primary chromium mining product worldwide.

The chromite ore segment of the chromium mining market is expected to grow at the fastest CAGR because chemical, refractory, and metallurgical industries have increasing requirements for these materials. The primary source of chromium, which is used to produce ferrochrome, stainless steel, and other industrial chemicals, is chromite ore. The steel and alloy industry expansion in developing countries has led to increased mining activities for chromium. The final product quality and extraction efficiency have improved through advancements in ore beneficiation technologies. These advancements are accompanied by sustainable mining practices. The worldwide chromium mining market section will grow rapidly because mineral exploration investments keep rising while chromite finds new applications in pigments, refractories, and foundry sands.

Application Insights

The metallurgical segment held the largest revenue share and led the global chromium mining market during 2024. The widespread usage of chromium in the manufacture of stainless steel and other metal alloys is the main factor behind this supremacy. Chromium functions as an essential metal for metallurgical operations because it provides strength and hardness, together with corrosion resistance. The segment achieved growth because stainless steel demand rose in manufacturing, automotive, and construction sectors, while emerging economies underwent fast industrialisation. The market demand received additional support through metal processing technology advancements, together with worldwide infrastructure spending growth. The metallurgical application functions as the main income source for chromium mining because it drives modern industrial progress.

The refractory segment of the chromium mining market is expected to grow at the fastest CAGR during the forecast period. The main factor driving this growth comes from the rising demand for materials which can withstand extreme heat conditions in cement production, steel manufacturing, and glass manufacturing industries. The high melting point and thermal stability of chromium make it essential for refractory bricks and linings which operate in reactors, kilns, and furnaces. The growing industrial operations, together with infrastructure projects in developing countries, create a rising need for refractory materials. The industrial sector growth stems from organisations adopting technologically advanced machinery. This leads to an increase in chromium mining market refractory applications.

Regional Insights

The Middle East and Africa region leads the global chromium mining market by holding the largest revenue share of 61.3% in 2024. South Africa leads the world in chromite deposits, which explains why high-grade chromite reserves dominate the market. The region benefits from its strong mining infrastructure and favourable government policies, and increasing foreign investments, which focus on expanding extraction and processing capabilities. The location of the company provides direct access to major international markets. This allows for successful exports. The region maintains its position as a leader because worldwide demand for metallurgical-grade chromium and stainless steel continues to increase. The Middle East and Africa maintain their position as the leading global producers of chromium through both mining output and income generation.

Asia Pacific Chromium Mining Market Trends

The Asia Pacific chromium mining market experiences steady growth because of increasing infrastructure development, industrial expansion, and stainless steel demand. The principal chromium users are China and India because they require it for metallurgical operations in industrial manufacturing, automotive production, and construction activities. The region satisfies its supply needs through imports and strategic partnerships because it has fewer chromite reserves than Africa does. The market expansion receives assistance from government initiatives, which promote domestic mining operations. These initiatives reduce dependency on imports. The demand for chromium-based products continues to grow because of the expanding chemical and refractory industries across the Asia Pacific region. The region shows strong market potential for chromium mining because of its stable demand patterns and evolving supply chain methods.

Europe Chromium Mining Market Trends

The market for chromium mining in Europe experiences significant growth because important sectors, including metallurgy, aerospace, automotive, and construction, drive increasing demand. The production of stainless steel and speciality alloys, which are widely utilised in Europe's modern manufacturing and industrial sectors, needs chromium. Europe depends on imported chromite resources because it has minimal native deposits, yet maintains powerful trade systems and refining operations to fulfil its requirements. Environmental regulations, together with sustainable production requirements, push companies to invest in new processing systems which operate more efficiently. They operate in an environmentally friendly manner. The demand for high-performance materials continues to grow because renewable energy infrastructure expands and electric car manufacturing operations increase in the region.

Key Chromium Mining Companies:

The following are the leading companies in the chromium mining market. These companies collectively hold the largest market share and dictate industry trends.

- AFARAK Group PLC

- Tharisa Plc

- KWG Resources Inc.

- DEV Mining Company

- Noront Resources Ltd.

- Tata Steel Mining Ltd.

- Glencore Plc

- Outokumpu Oyj

- Eurasian Resources Group

- Samancor Chrome

- Others

Recent Development

- In April 2025, in the Mahasamund district of Chhattisgarh, a composite license was issued for the exploration of nickel, chromium, and platinum group elements (PGE). Within the Basna development block, the license encompasses 30 square kilometres in Bhalukona-Jamnidih. Geological surveys revealed great potential akin to major global nickel belts, and Deccan Gold Mines Limited (DGML) won this license following a competitive auction.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the chromium mining market based on the below-mentioned segments:

Global Chromium Mining Market, By Product

- Ferrochrome

- Chromite Ore

- Chemicals

Global Chromium Mining Market, By Application

- Metallurgical

- Refractory

- Others

Global Chromium Mining Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 188 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |