Global Chronic Hepatitis B (CHB) Market

Global Chronic Hepatitis B (CHB) Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Antivirals, and Immune Modulators), By Gender (Male, and Female), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Chronic Hepatitis B (CHB) Market Size Insights Forecasts to 2035

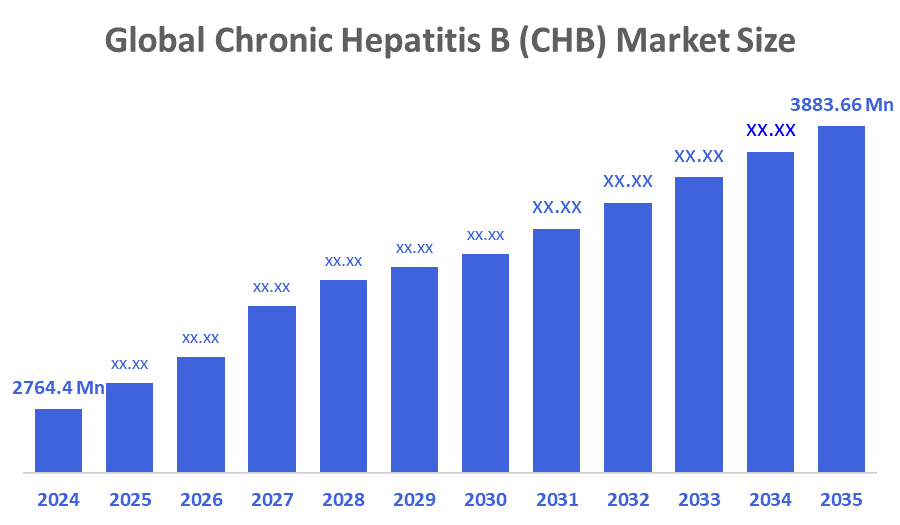

- The Global Chronic Hepatitis B (CHB) Market Size Was Estimated at USD 2,764.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.50 % from 2025 to 2035

- The Worldwide Chronic Hepatitis B (CHB) Market Size is Expected to Reach USD 3883.66 Million by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Chronic Hepatitis B (CHB) Market Size was worth around USD 2,764.4 Million in 2024 and is predicted to Grow to around USD 3883.66 Million by 2035 with a compound annual growth rate (CAGR) of 3.50 % from 2025 to 2035. The market for chronic hepatitis B (CHB) is driven by the increasing prevalence of the illness worldwide, increased awareness, improvements in antiviral treatments, and government-run immunisation and screening initiatives. Moreover, strong R&D pipelines for innovative therapies and a rising healthcare environment are additional key factors in market growth.

Market Overview

The global business devoted to the prevention, diagnosis, and treatment of chronic hepatitis B virus (HBV) infection, including medications, immunotherapies, vaccinations, and healthcare delivery systems, is referred to as the chronic hepatitis B (CHB) industry. It covers the market for novel medications, new curative treatments, and supportive infrastructure, including pharmacies in hospitals and others. The most prevalent serious liver infection in the world is hepatitis B. It is brought on by the hepatitis B virus, which damages the liver. Blood and infected bodily fluids are the means by which the hepatitis B virus (HBV) is spread. Direct blood contact, unprotected sexual contact, illicit drug use, and contaminated or unsterilized needles can all spread it to other people.

The majority of hepatitis B infections resolve on their own in 1-2 months without therapy. If the infection persists for longer than six months, it may progress to chronic hepatitis B, which can cause liver failure, cirrhosis (liver scarring), chronic inflammation of the liver, and/or liver cancer. Fatigue, lack of appetite, stomach discomfort, fever, nausea, vomiting, and rarely joint pain, hives, or rash are signs of hepatitis B. Jaundice, or yellowing of the skin and whites of the eyes, may follow the darkening of the urine. Compared to youngsters, adults are more prone to experience symptoms.

The World Health Organisation (WHO) forecasts that 254 million individuals worldwide have chronic hepatitis B (CHB) as of 2022, with an estimated 1.2 million new infections each year adding to this ongoing burden. The WHO has published updated global guidelines on hepatitis B and simplifying treatment criteria, expanding access, and emphasize vaccination, aiming to reduce the global burden of HBV and improve equity in care.

With a focus on treatments and immunotherapies, venture funding flows into biotechs supporting a market. For instance, A $30.1 million equity investment was recently obtained by Assembly Biosciences to further the clinical development of ABI-4334, a next-generation capsid assembly modulator for chronic hepatitis B. Following encouraging Phase 1b study results that showed robust antiviral effectiveness and a favourable safety profile for ABI-4334 in patients with chronic HBV infection, this funding supports continued research and collaboration with Gilead Sciences.

Report Coverage

This research report categorises the chronic hepatitis B (CHB) market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the chronic hepatitis B (CHB) market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the chronic hepatitis B (CHB) market.

Driving Factors

The increasing global incidence of chronic hepatitis B (CHB) cases boosts market demand for diagnostics, antiviral treatments, and management options, driven by improvements in effective medications such as nucleoside analogues and new candidates that improve viral suppression and patient outcomes. Further, increased awareness and screening initiatives encourage early detection and treatment uptake to reduce complications like liver cirrhosis and hepatocellular carcinoma, while extensive vaccination efforts lower new infections but maintain treatment requirements for the current chronic carrier population. Moreover, the increase in elderly and high-risk populations, such as those with compromised immune systems, raises vulnerability to complications, requiring enhanced monitoring and interventions, supported by technological advancements in sensitive diagnostics like molecular assays and point-of-care tests for early identification.

In February 2024, GSK’s investigational therapy bepirovirsen was granted by the FDA as a fast track designation for chronic hepatitis B (CHB), underscoring its potential to address the unmet need for functional cures.

Restraining Factors

The market for chronic hepatitis B (CHB) is restricted by substantial treatment expenses, fewer curative options, pharmaceutical difficulty, and low awareness in several domains, among other factors that limit treatment adoption and dissemination.

Market Segmentation

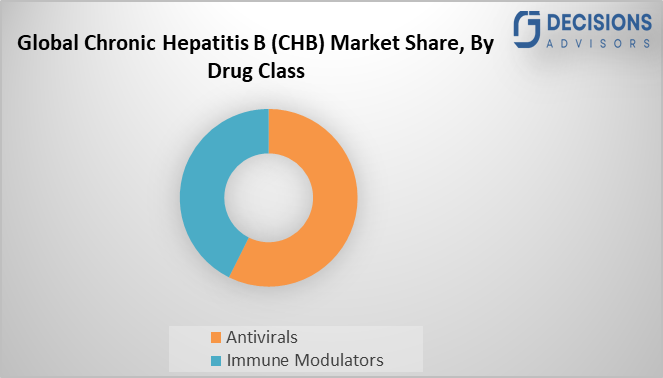

The chronic hepatitis B (CHB) market share is classified into drug class, gender, and distribution channel.

- The antivirals segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period.

Based on the drug class, the chronic hepatitis B (CHB) market is segmented into antivirals, and immune modulators. Among these, the antivirals segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. The effectiveness of antiviral therapy for chronic hepatitis B (CHB), well it suppresses HBV DNA. Also, at the baseline viral load (higher loads decrease response rates) give HBeAg status (positive patients exhibit slower seroconversion), host genetics (IL28B polymorphisms favouring interferon response), and adherence (non-adherence spikes resistance), histological improvement and a decreased risk of HCC.

- The male segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on gender, the chronic hepatitis B (CHB) market is differentiated into male, and female. Among these, the male segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because of factors like higher baseline HBV DNA levels, slower HBeAg seroconversion, and androgen-mediated viral replication enhancement; the incidence of hepatocellular carcinoma (HCC) is up to three to five times higher in males with chronic hepatitis B (CHB) than in females. Male susceptibility is further increased by host characteristics such as genotype C infection and family history of HCC, highlighting the need for potency-focused regimens and sex-specific monitoring.

Regional Segment Analysis of the Chronic Hepatitis B (CHB) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the chronic hepatitis B (CHB) market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the chronic hepatitis B (CHB) market over the predicted timeframe. The key factor for the Asia Pacific region's leading position is its solid and quickly expanding healthcare system with a novel R&D structure and government support for it. This is due to the high prevalence of chronic hepatitis B (CHB) and robust public health initiatives in nations like China and India. Moreover, widespread vaccination, screening, and antiviral reimbursement that influences China accounts for around one-third of regional revenue, while India is the market with the quickest rate of growth due to universal immunisation, reasonably priced generics, and increased access to diagnostics in underprivileged areas.

In June 2025, AusperBio raised $50 million to further the development of AHB-137, a therapy for chronic hepatitis B. According to the company, the cash will enable it to extend its manufacturing alliances, invest in its expanding pipeline, and begin Phase 2 clinical studies outside of mainland China.

North America is expected to grow at a rapid CAGR in the chronic hepatitis B (CHB) market during the forecast period. North America is also impacted by the chronic hepatitis B (CHB) market, and the U.S. holds a significant share of the market because of its high prevalence (850,000–2.2 million chronic cases per CDC). Moreover, the regional marketplace is propelled by the strong and broad screening, reimbursement for antivirals like tenofovir, and innovation in cure-focused medicines from companies like Gilead and Vir Biotechnology, along with a robust healthcare environment. Despite lower incidence rates, North America is ahead in disease burden due to key factors like increased awareness, immigrant populations from high-endemic areas, and better diagnostics.

In March 2025, the FDA’s clearance of PBGENE-HBV marks a historic step in HBV treatment—bringing gene-editing technology into human trials for the first time in the US, with the potential to deliver a true functional cure. The purpose of PBGENE-HBV is to eradicate cccDNA and inactivate integrated HBV DNA, which are issues that existing therapies are unable to resolve.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the chronic hepatitis B (CHB) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Antios Therapeutics

- Arbutus Biopharma

- Ascletis Pharmaceuticals

- Assembly Biosciences

- Gilead Sciences

- GlaxoSmithKline

- Ionis Pharma

- Janssen and Arrowhead Pharmaceuticals

- Janssen Sciences Ireland

- Roche

- Romark Laboratories

- Vedanta Biosciences

- Vir Biotechnology

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Karolinska Development AB announced that its portfolio company SVF Vaccines had presented new preclinical data on its immunotherapy SVF-001, which targeted hepatitis B and D. Moreover, as a late-breaking abstract at the HepDart scientific meeting held December 7–11 in Honolulu, Hawaii. The results were follow-up data from a previously reported study, which showed an extended antiviral effect in preclinical models.

- In August 2025, Aligos Therapeutics announced that dosing in the Phase II B-SUPREME clinical trial (NCT06963710) of its investigational ALG-000184 for the treatment of patients with chronic hepatitis B virus (HBV) infection had begun. Besides, compared to current treatments, it may result in more thorough viral suppression due to its capacity to block several stages of the HBV lifecycle.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the chronic hepatitis B (CHB) market based on the below-mentioned segments:

Global Chronic Hepatitis B (CHB) Market, By Drug Class

- Antivirals

- Immune Modulators

Global Chronic Hepatitis B (CHB) Market, By Gender

- Male

- Female

Global Chronic Hepatitis B (CHB) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected market size and growth rate for the Global CHB Market?

The market was valued at USD 2,764.4 million in 2024 and is expected to reach USD 3,883.66 million by 2035, growing at a CAGR of 3.50% from 2025 to 2035, driven by rising prevalence and antiviral advancements.

- Which region holds the largest market share?

Asia Pacific dominates due to high CHB prevalence in countries like China and India, supported by vaccination programs, screening, and affordable generics; China accounts for about one-third of regional revenue.

- What are the main market segments by drug class?

The market divides into antivirals (leading segment with high HBV suppression rates) and immune modulators; antivirals like entecavir and tenofovir dominate for their potency and low resistance.

- Why does the male segment lead by gender?

Males hold the largest share due to higher HCC risk (3-5 times greater), elevated HBV DNA levels, slower HBeAg seroconversion, and androgen-driven replication, necessitating targeted monitoring and therapy.

- What are the key driving factors for market growth?

Increasing global CHB cases (254 million chronic patients per WHO), awareness campaigns, vaccination expansions, geriatric/high-risk populations, diagnostic innovations, and R&D in functional cures like bepirovirsen fuel demand.

- Which companies are key players?

Major firms include Gilead Sciences, GlaxoSmithKline, Vir Biotechnology, Assembly Biosciences, Arbutus Biopharma, and Ionis Pharma, with recent activities like AusperBio's $50M raise for AHB-137 and Aligos' Phase II trial start.

- What recent developments highlight innovation?

In June 2025, AusperBio raised $50M for AHB-137 Phase 2 trials; August 2025 saw Aligos dosing in B-SUPREME for ALG-000184; December 2025 featured SVF Vaccines' preclinical data on SVF-001 immunotherapy.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Drug Class

- Market Attractiveness Analysis By Gender

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Robust R&D pipelines for groundbreaking treatments and an expanding healthcare landscape are crucial elements

- Restraints

- Strict adherence to regulations and limited awareness

- Opportunities

- The rising global prevalence of the disease, advancements in antiviral therapies, and government-led vaccination and screening programs

- Challenges

- Significant medical costs, limited healing alternatives

- Global Chronic Hepatitis B (CHB) Market Analysis and Projection, By Drug Class

- Segment Overview

- Antivirals

- Immune Modulators

- Global Chronic Hepatitis B (CHB) Market Analysis and Projection, By Gender

- Segment Overview

- Male

- Female

- Global Chronic Hepatitis B (CHB) Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Chronic Hepatitis B (CHB) Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Chronic Hepatitis B (CHB) Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Antios Therapeutics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Arbutus Biopharma

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Ascletis Pharmaceuticals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Assembly Biosciences

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Gilead Sciences

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- GlaxoSmithKline

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Ionis Pharma

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Janssen and Arrowhead Pharmaceuticals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Janssen Sciences Ireland

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Roche

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Romark Laboratories

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Vedanta Biosciences

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Vir Biotechnology

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Antios Therapeutics

List of Table

- Global Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- Global Antivirals, Chronic Hepatitis B (CHB) Market, By Region, 2024-2035(USD Billion)

- Global Immune Modulators, Chronic Hepatitis B (CHB) Market, By Region, 2024-2035(USD Billion)

- Global Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- Global Male, Chronic Hepatitis B (CHB) Market, By Region, 2024-2035(USD Billion)

- Global Female, Chronic Hepatitis B (CHB) Market, By Region, 2024-2035(USD Billion)

- North America Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- North America Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- U.S. Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- U.S. Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- Canada Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- Canada Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- Mexico Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- Mexico Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- Europe Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- Europe Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- Germany Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- Germany Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- France Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- France Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- U.K. Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- U.K. Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- Italy Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- Italy Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- Spain Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- Spain Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- Asia Pacific Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- Asia Pacific Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- Japan Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- Japan Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- China Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- China Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- India Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- India Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- South America Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- South America Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- Brazil Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- Brazil Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- The Middle East and Africa Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- The Middle East and Africa Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- UAE Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- UAE Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

- South Africa Chronic Hepatitis B (CHB) Market, By Drug Class, 2024-2035(USD Billion)

- South Africa Chronic Hepatitis B (CHB) Market, By Gender, 2024-2035(USD Billion)

List of Figures

- Global Chronic Hepatitis B (CHB) Market Segmentation

- Chronic Hepatitis B (CHB) Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Chronic Hepatitis B (CHB) Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Chronic Hepatitis B (CHB) Market

- Chronic Hepatitis B (CHB) Market Segmentation, By Drug Class

- Chronic Hepatitis B (CHB) Market For Antivirals, By Region, 2024-2035 ($ Billion)

- Chronic Hepatitis B (CHB) Market For Immune Modulators, By Region, 2024-2035 ($ Billion)

- Chronic Hepatitis B (CHB) Market Segmentation, By Gender

- Chronic Hepatitis B (CHB) Market For Male, By Region, 2024-2035 ($ Billion)

- Chronic Hepatitis B (CHB) Market For Female, By Region, 2024-2035 ($ Billion)

- Antios Therapeutics: Net Sales, 2024-2035 ($ Billion)

- Antios Therapeutics: Revenue Share, By Segment, 2024 (%)

- Antios Therapeutics: Revenue Share, By Region, 2024 (%)

- Arbutus Biopharma: Net Sales, 2024-2035 ($ Billion)

- Arbutus Biopharma: Revenue Share, By Segment, 2024 (%)

- Arbutus Biopharma: Revenue Share, By Region, 2024 (%)

- Ascletis Pharmaceuticals: Net Sales, 2024-2035 ($ Billion)

- Ascletis Pharmaceuticals: Revenue Share, By Segment, 2024 (%)

- Ascletis Pharmaceuticals: Revenue Share, By Region, 2024 (%)

- Assembly Biosciences: Net Sales, 2024-2035 ($ Billion)

- Assembly Biosciences: Revenue Share, By Segment, 2024 (%)

- Assembly Biosciences: Revenue Share, By Region, 2024 (%)

- Gilead Sciences: Net Sales, 2024-2035 ($ Billion)

- Gilead Sciences: Revenue Share, By Segment, 2024 (%)

- Gilead Sciences: Revenue Share, By Region, 2024 (%)

- GlaxoSmithKline: Net Sales, 2024-2035 ($ Billion)

- GlaxoSmithKline: Revenue Share, By Segment, 2024 (%)

- GlaxoSmithKline: Revenue Share, By Region, 2024 (%)

- Ionis Pharma: Net Sales, 2024-2035 ($ Billion)

- Ionis Pharma: Revenue Share, By Segment, 2024 (%)

- Ionis Pharma: Revenue Share, By Region, 2024 (%)

- Janssen and Arrowhead Pharmaceuticals: Net Sales, 2024-2035 ($ Billion)

- Janssen and Arrowhead Pharmaceuticals: Revenue Share, By Segment, 2024 (%)

- Janssen and Arrowhead Pharmaceuticals: Revenue Share, By Region, 2024 (%)

- Janssen Sciences Ireland.: Net Sales, 2024-2035 ($ Billion)

- Janssen Sciences Ireland.: Revenue Share, By Segment, 2024 (%)

- Janssen Sciences Ireland.: Revenue Share, By Region, 2024 (%)

- Roche: Net Sales, 2024-2035 ($ Billion)

- Roche: Revenue Share, By Segment, 2024 (%)

- Roche: Revenue Share, By Region, 2024 (%)

- Romark Laboratories: Net Sales, 2024-2035 ($ Billion)

- Romark Laboratories: Revenue Share, By Segment, 2024 (%)

- Romark Laboratories: Revenue Share, By Region, 2024 (%)

- Vedanta Biosciences: Net Sales, 2024-2035 ($ Billion)

- Vedanta Biosciences: Revenue Share, By Segment, 2024 (%)

- Vedanta Biosciences: Revenue Share, By Region, 2024 (%)

- Vir Biotechnology: Net Sales, 2024-2035 ($ Billion)

- Vir Biotechnology: Revenue Share, By Segment, 2024 (%)

- Vir Biotechnology: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 261 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |