Global Cloud Native Technologies Market

Global Cloud Native Technologies Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Organization Size (Large Enterprises and SMEs), By Industry (IT & Telecom, BFSI, Retail, and Healthcare), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Cloud Native Technologies Market Size Summary, Size & Emerging Trends

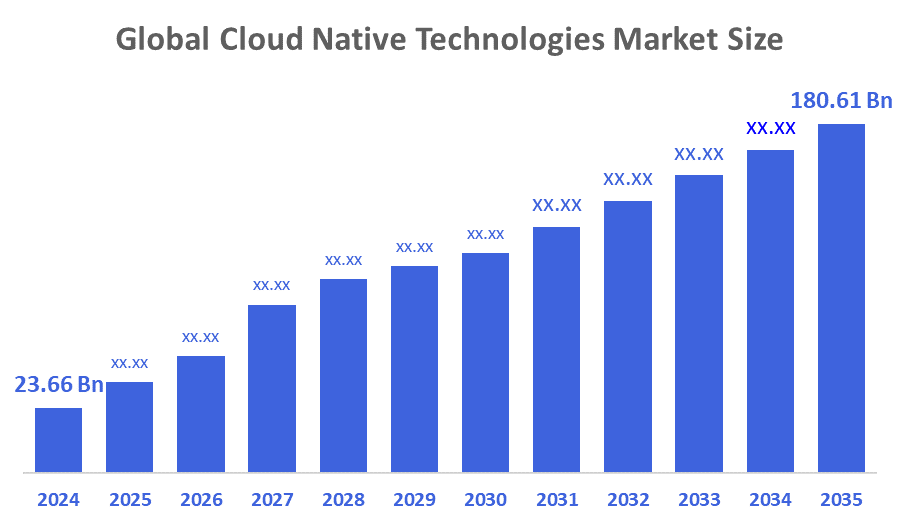

According to Decision Advisor, The Global Cloud Native Technologies Market Size is expected to Grow from USD 23.66 Billion in 2024 to USD 180.61 Billion by 2035, at a CAGR of 20.3% during the forecast period 2025-2035. The surge in demand for scalable, flexible, and agile application development is significantly driving the adoption of cloud native technologies across multiple industries.

Key Market Insights

- North America is expected to hold the largest share of the cloud native technologies market during the forecast period.

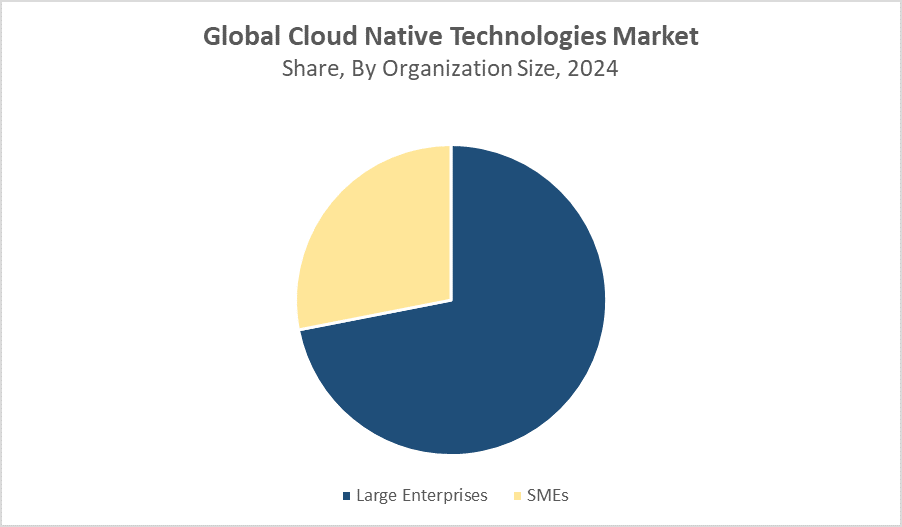

- Large enterprises dominated the market by organization size in terms of revenue in 2024.

- The IT & Telecom sector led the industry segment due to rapid digital transformation and the shift toward microservices architecture.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 23.66 Billion

- 2035 Projected Market Size: USD 180.61 Billion

- CAGR (2025-2035): 20.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Cloud Native Technologies Market

The cloud native technologies market focuses on solutions and practices that leverage cloud computing to build, run, and scale applications using containers, microservices, service meshes, and continuous delivery. These technologies enable organizations to be more agile, resilient, and scalable in deploying modern software. Increasing reliance on Kubernetes, Docker, serverless platforms, and container orchestration systems is transforming how enterprises manage their infrastructure and development pipelines. With growing pressure to innovate quickly and deliver digital services efficiently, cloud native strategies are gaining strong traction across industries such as IT, banking, healthcare, and retail.

Cloud Native Technologies Market Trends

- Rapid adoption of Kubernetes and container orchestration for scalable deployment.

- Shift toward DevOps and CI/CD practices enhancing automation and development cycles.

- Growing use of service meshes and microservices to build distributed, resilient applications.

- Rise of hybrid and multi-cloud strategies to prevent vendor lock-in and increase flexibility.

Cloud Native Technologies Market Dynamics

Driving Factors: Growing need for scalable, agile, and cost-effective IT infrastructure

The rise in demand for faster application development, deployment, and scalability is driving the adoption of cloud native technologies. Organizations are leveraging microservices, containerization, and serverless computing to improve agility and reduce time to market. The need to modernize legacy systems and meet dynamic customer demands in sectors such as BFSI, retail, and healthcare is accelerating cloud native adoption. Additionally, the increased investment in digital transformation and cloud computing initiatives is providing a strong growth foundation.

Restrain Factors: Complex implementation and talent shortage

Despite the advantages, deploying cloud native technologies involves significant complexity in architecture design, security, and operational models. Many organizations face a shortage of skilled professionals with expertise in Kubernetes, microservices, and DevOps. Moreover, integration with legacy systems, security challenges, and the lack of standardized best practices can slow adoption, particularly among small and medium enterprises (SMEs).

Opportunity: Increasing demand for multi-cloud and hybrid cloud ecosystems

As organizations seek greater flexibility and resilience, demand for multi-cloud and hybrid cloud deployments is growing rapidly. This creates opportunities for cloud native solutions that offer interoperability, portability, and robust DevSecOps capabilities. The adoption of open-source platforms and managed Kubernetes services is enabling businesses to scale their cloud native efforts efficiently. Additionally, SMEs are increasingly adopting SaaS-based cloud native tools to stay competitive without heavy upfront investments.

Challenges: Security, governance, and regulatory compliance

The highly distributed nature of cloud native applications increases the attack surface and complexity in managing security and compliance. Organizations must implement rigorous governance frameworks, automated policy enforcement, and real-time monitoring. Compliance with data privacy laws such as GDPR, HIPAA, and industry-specific regulations adds further complexity. Ensuring consistent security across containers, APIs, and services remains a significant challenge for enterprises transitioning to cloud native infrastructure.

Global Cloud Native Technologies Market Ecosystem Analysis

The cloud native technologies market ecosystem includes platform providers (e.g., Red Hat, VMware, Microsoft Azure), infrastructure orchestration tools (e.g., Kubernetes, Docker), CI/CD providers, and managed service platforms. Cloud service providers such as AWS, Google Cloud, and Microsoft Azure play a central role, offering native integration and scalable infrastructure. Open-source communities also contribute to innovation in the space. The ecosystem is highly dynamic, with collaboration between cloud vendors, startups, and enterprises driving the development of end-to-end cloud native environments.

Global Cloud Native Technologies Market, By Organization Size

What key advantages helped the large enterprises segment outperform others in the cloud native technologies market in 2024?

The large enterprises segment dominated the cloud native technologies market in 2024 due to their greater financial and technical resources, which enabled faster adoption of complex, scalable, and container-based architectures. These organizations invested heavily in Kubernetes, microservices, and DevOps practices to modernize legacy systems and enhance operational efficiency. Their need for robust infrastructure, security, and compliance support also aligned closely with the capabilities of cloud native technologies. Moreover, large enterprises had the capacity to build in-house expertise and integrate advanced CI/CD pipelines, giving them a significant edge over smaller companies and positioning them as the leading contributors to market revenue.

How did the SMEs segment accelerate its adoption of cloud native technologies in 2024?

The SMEs segment showed strong growth in the cloud native technologies market in 2024 due to the increasing availability of cost-effective, scalable, and user-friendly cloud solutions tailored to smaller businesses. Cloud native technologies offered SMEs the agility to innovate quickly, reduce infrastructure costs, and compete more effectively with larger enterprises. The rise of managed services, open-source platforms, and pay-as-you-go pricing models made adoption more accessible. Additionally, digital transformation accelerated by remote work trends and customer demand for faster services pushed SMEs to embrace containerization, microservices, and DevOps practices, contributing to their rising presence in the market.

Global Cloud Native Technologies Market, By Industry

Why was the IT & Telecom industry preferred for cloud native technology adoption in 2024?

The IT & Telecom sector accounted for the largest revenue share in the cloud native technologies market in 2024 due to its critical need for scalability, high availability, and rapid service delivery. As digital service providers, companies in this sector were among the earliest adopters of cloud native architectures leveraging Kubernetes, microservices, and container orchestration to handle massive data volumes and user demands efficiently. Continuous innovation, demand for low-latency applications, and the push for 5G and edge computing further accelerated adoption. Additionally, these companies had both the technical expertise and budgets to implement complex cloud native solutions at scale, positioning the IT & Telecom sector as the top contributor to market revenue.

Why is the healthcare industry shifting toward cloud native platforms in 2024?

The healthcare industry increasingly adopted cloud native platforms in 2024 as it sought more scalable, secure, and agile solutions to meet growing demands for digital healthcare services. With the rise of telemedicine, electronic health records (EHR), and real-time patient monitoring, healthcare providers required flexible infrastructure that could support dynamic workloads and ensure high availability. Cloud native technologies enabled faster deployment of applications, improved data interoperability, and enhanced system reliability. Additionally, advancements in security and compliance frameworks allowed providers to meet stringent regulatory requirements, making cloud native platforms a viable and increasingly preferred choice in the healthcare sector.

North America held the largest share of the global cloud native technologies market.

This dominance is primarily due to the region's strong ecosystem of established cloud-native technology providers, including major players like Amazon Web Services (AWS), Microsoft, and Google. Enterprises in North America have been early adopters of cloud native solutions, incorporating advanced DevOps practices and microservices architecture to enhance agility and scalability.

The United States is the leading country in the North American cloud native technologies market.

It has a highly mature IT infrastructure and is home to some of the world's largest cloud service providers and software companies, including AWS, Microsoft, Google, and IBM. U.S.-based enterprises across industries especially finance, healthcare, and technology have embraced cloud native architectures to accelerate software delivery, improve scalability, and enhance system reliability. The widespread adoption of DevOps, microservices, and Kubernetes is further supported by a robust developer community and investments in automation tools.

Asia Pacific region is expected to experience the fastest growth during the forecast period.

This rapid expansion is driven by increasing digital transformation, a booming startup ecosystem, and rising cloud investments across countries like China, India, and Southeast Asian nations. Governments in the region are also playing a proactive role by investing in smart infrastructure and digital public services, which further accelerates demand for scalable and resilient cloud native architectures. As businesses in Asia Pacific modernize their IT infrastructure, the region is becoming a key hotspot for cloud native technology adoption.

India is emerging as one of the fastest-growing markets for cloud native technologies in the Asia Pacific region.

This growth is driven by rapid digital transformation, the expansion of cloud-first startups, and increased adoption by large enterprises across banking, telecom, and retail sectors. Government initiatives like Digital India, coupled with rising cloud investments from global tech companies, are accelerating the shift toward modern IT infrastructure. Indian companies are adopting containerization, CI/CD pipelines, and managed Kubernetes services to improve development speed and reduce operational overhead.

WORLDWIDE TOP KEY PLAYERS IN THE CLOUD NATIVE TECHNOLOGIES MARKET INCLUDE

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google LLC

- IBM Corporation

- VMware Inc.

- Red Hat, Inc.

- Oracle Corporation

- SUSE

- Docker, Inc.

- HashiCorp

- Rancher Labs

- Alibaba Cloud

- Platform9

- Others

Product Launches in Cloud Native Technologies Market

- In June 2024, Red Hat launched an enhanced version of OpenShift Platform Plus, featuring improved DevSecOps tools and expanded multi-cloud support. This upgrade targets large enterprises managing complex workloads, helping them enhance security and scalability across hybrid cloud environments.

- In March 2024, Google Cloud introduced its Cloud Native Application Protection Platform (CNAPP), which integrates runtime security, policy management, and workload protection. CNAPP streamlines the deployment of secure cloud native applications by offering end-to-end visibility and automation for DevOps teams.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the cloud native technologies market based on the below-mentioned segments:

Global Cloud Native Technologies Market, By Organization Size

- Large Enterprises

- SMEs

Global Cloud Native Technologies Market, By Industry

- IT & Telecom

- BFSI

- Retail

- Healthcare

Global Cloud Native Technologies Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 155 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |