Global Coating Pretreatment Market

Global Coating Pretreatment Market Size, Share, and COVID-19 Impact Analysis, By Type (Phosphate, Chromate, Blast Clean, and Chromate Free), By Application (Automotive & Transportation, Appliance, and Construction), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

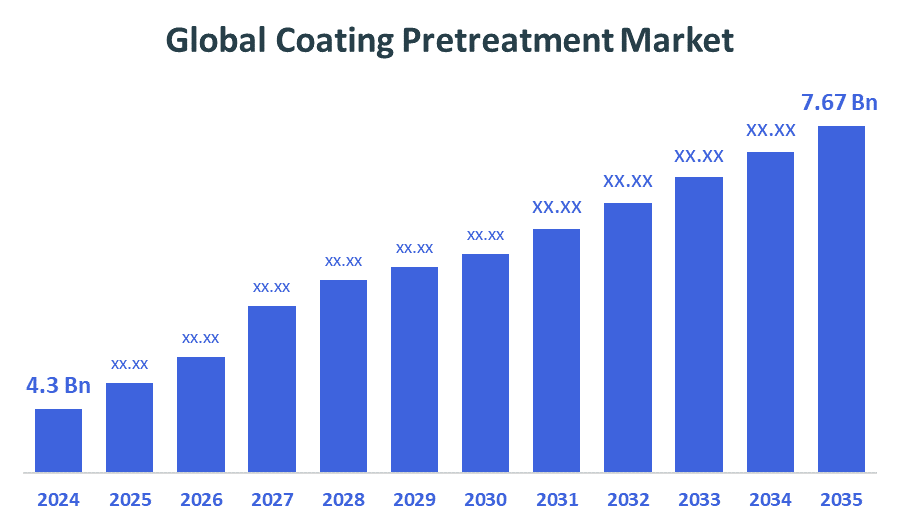

Global Coating Pretreatment Market Insights Forecasts to 2035

- The Global Coating Pretreatment Market Size Was Estimated at USD 4.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.4% from 2025 to 2035

- The Worldwide Coating Pretreatment Market Size is Expected to Reach USD 7.67 Billion by 2035

- North America is Expected to Grow the fastest during the forecast period.

Coating Pretreatment Market

The global coating pretreatment market involves surface preparation processes applied before coating to enhance adhesion, corrosion resistance, and durability of metals and other materials. Pretreatment typically includes cleaning, phosphating, and conversion coating, which are essential in industries like automotive, aerospace, and construction. Government initiatives worldwide are driving market growth by enforcing stringent environmental regulations to reduce hazardous emissions and promote eco-friendly pretreatment technologies. For example, regulations like the EPA’s Clean Air Act in the U.S. encourage the adoption of water-based and non-toxic pretreatment solutions. Additionally, subsidies and incentives for green manufacturing further boost market expansion. Increasing demand for high-performance coatings and rising awareness of surface protection in end-use industries contribute to the steady growth of this market. Overall, advancements in sustainable pretreatment processes and government support are shaping a dynamic and expanding global coating pretreatment landscape.

Attractive Opportunities in the Coating Pretreatment Market

- With tightening global environmental regulations, there is a major growth avenue for eco-friendly pretreatment solutions that reduce hazardous emissions. The shift toward sustainable, non-toxic, and water-based technologies opens new market potential, especially in regions with strict compliance requirements.

- Rapid industrialization and infrastructure development in emerging markets like China, India, and Southeast Asia are driving demand for advanced surface protection. These growing sectors present vast opportunities for market penetration and adoption of innovative coating pretreatment solutions.

- Advancements in nanotechnology and automated pretreatment processes can improve efficiency, reduce costs, and enhance coating performance. These innovations appeal to end-users seeking high-performance and sustainable solutions, and can create new product lines and applications, including renewable energy infrastructure like wind turbines and solar panels.

Global Coating Pretreatment Market Dynamics

DRIVER: Growing awareness of surface protection to extend product lifespan drives adoption

Key growth factors for the global coating pretreatment market include rising demand from automotive and aerospace industries for enhanced corrosion resistance and durability. Increasing industrialization and infrastructure development boost the need for protective coatings. Strict environmental regulations push manufacturers toward eco-friendly, water-based pretreatment solutions, fostering innovation. Additionally, growing awareness of surface protection to extend product lifespan drives adoption. Technological advancements in pretreatment methods, such as nanocoatings and chemical-free processes, also fuel growth. Government incentives promoting sustainable manufacturing further encourage market expansion. Together, these factors create strong momentum for continuous market development.

RESTRAINT: Strict environmental regulations

The complexity of process integration and the need for skilled labor limit widespread adoption. Strict environmental regulations, while driving eco-friendly solutions, also increase compliance costs and operational challenges. Additionally, the availability of cheaper, less effective alternatives in some regions restricts market growth. Fluctuating raw material prices and supply chain disruptions can impact production costs and timelines. Lastly, limited awareness of advanced pretreatment benefits in emerging markets slows adoption rates, restraining overall market expansion.

OPPORTUNITY: Innovations in nanotechnology and automation in pretreatment processes

Growing adoption of water-based and chromium-free pretreatment technologies presents a major growth avenue, especially as governments worldwide tighten environmental regulations. Expanding automotive, aerospace, and construction sectors in emerging economies provide vast potential for market penetration. Innovations in nanotechnology and automation in pretreatment processes can enhance efficiency and reduce costs, attracting more users. Additionally, increasing demand for corrosion-resistant coatings in renewable energy infrastructure, like wind turbines and solar panels, opens new markets. Collaborations between chemical manufacturers and end-users to develop customized pretreatment solutions also present growth possibilities. These opportunities position the market for strong future expansion amid evolving industry and environmental demands.

CHALLENGES: Compliance with stringent and varying environmental regulations across regions

Challenges in the global coating pretreatment market include high costs and technical complexity of adopting advanced, eco-friendly technologies. Compliance with stringent and varying environmental regulations across regions increases operational burdens. Limited skilled workforce and technical expertise hinder efficient implementation. Fluctuating raw material prices and supply chain disruptions pose additional risks. Furthermore, resistance to change from traditional pretreatment methods slows market adoption, especially in developing regions. These factors collectively create hurdles for seamless market growth and innovation.

Global Coating Pretreatment Market Ecosystem Analysis

The global coating pretreatment market ecosystem includes raw material suppliers, pretreatment solution providers, equipment manufacturers, end users (automotive, aerospace, construction), and regulatory bodies. Key players develop chemicals and technologies, while equipment firms enable efficient application. Environmental regulations drive demand for eco-friendly solutions. Technological advances like nanotechnology enhance performance and sustainability. North America and Asia-Pacific dominate, with regulatory focus in the former and rapid industrial growth in the latter. This interconnected network supports innovation and market expansion amid evolving industry needs.

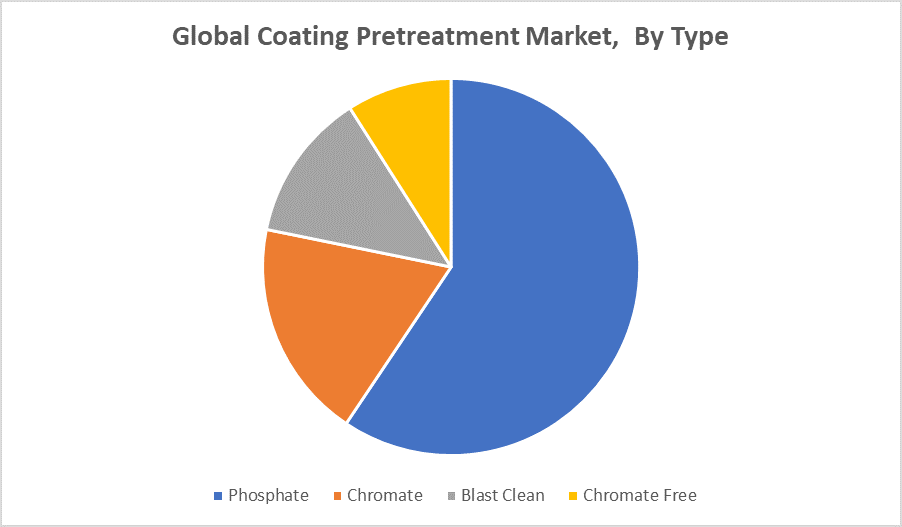

Based on the type, the phosphate segment dominated the coating pretreatment market with a share over the forecast period

The phosphate segment has dominated the coating pretreatment market due to its effective corrosion resistance and strong adhesion properties. It remains the preferred choice across industries such as automotive and construction because of its proven reliability and cost-effectiveness. Phosphate pretreatment processes improve coating durability and extend the lifespan of metal substrates. Despite emerging eco-friendly alternatives, phosphate-based solutions continue to hold a significant market share, supported by widespread adoption and ongoing technological improvements enhancing their environmental performance throughout the forecast period.

Based on the application, the automotive & transportation segment dominated the coating pretreatment market in 2024

In 2024, the automotive & transportation segment dominated the coating pretreatment market due to the industry's high demand for corrosion-resistant and durable coatings. Pretreatment processes are critical in this sector to ensure long-lasting protection of vehicle components against harsh environmental conditions. The growth of automotive production, especially in emerging markets, alongside increasing consumer focus on vehicle longevity and aesthetics, has driven the extensive adoption of advanced pretreatment technologies, making this segment the largest contributor to the market.

Asia Pacific is anticipated to hold the largest market share of the coating pretreatment market during the forecast period

Asia Pacific is anticipated to hold the largest market share in the coating pretreatment market during the forecast period, driven by rapid industrialization and urbanization in countries like China, India, and Japan. The region's expanding automotive, construction, and manufacturing sectors fuel demand for effective surface protection solutions. Additionally, growing environmental regulations and increasing investments in advanced pretreatment technologies support market growth. Rising consumer awareness and government initiatives promoting sustainable practices further strengthen Asia Pacific’s position as the dominant market in this sector.

North America is expected to grow at the fastest CAGR in the coating pretreatment market during the forecast period

North America is expected to grow at the fastest CAGR in the coating pretreatment market during the forecast period, driven by stringent environmental regulations and strong demand for advanced, eco-friendly pretreatment solutions. The region’s well-established automotive and aerospace industries are investing heavily in innovative coating technologies to enhance product durability and comply with sustainability standards. Additionally, ongoing technological advancements and government incentives promoting green manufacturing practices are accelerating market growth in North America compared to other regions.

Recent Development

- In July 2024, PPG launched the DURANEXT™ Portfolio, featuring electron-beam and UV-curable coatings designed for the metal coil coating industry. This innovative range offers remarkable curing speed and operational efficiency, enabling faster production cycles and lower energy consumption. It enhances coating durability and finish quality, making it ideal for sectors like automotive and construction. The DURANEXT™ Portfolio reflects PPG’s dedication to advancing high-performance, sustainable coating pretreatment technologies.

Key Market Players

KEY PLAYERS IN THE COATING PRETREATMENT MARKET INCLUDE

- Henkel AG

- PPG Industries

- BASF SE

- AkzoNobel N.V.

- Axalta Coating Systems

- The Sherwin-Williams Company

- RPM International Inc.

- Chemetall (a BASF company)

- Jotun Group

- Henan Yuanlong Chemical Co., Ltd.

- Others

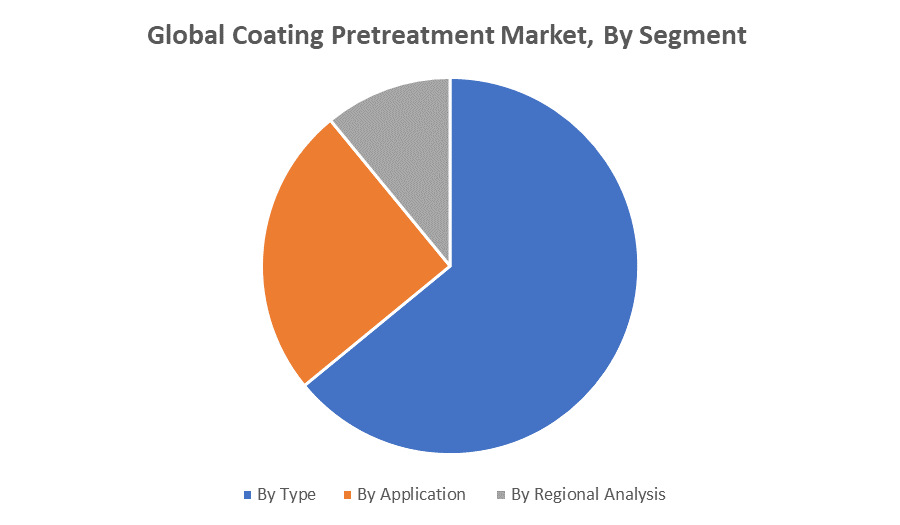

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the coating pretreatment market based on the below-mentioned segments:

Global Coating Pretreatment Market, By Type

- Phosphate

- Chromate

- Chromate Free

- Blast Clean

Global Coating Pretreatment Market, By Application

- Automotive & Transportation

- Construction

- Appliance

Global Coating Pretreatment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 256 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Aug 2025 |

| Access | Download from this page |