Global Cocoa Pod Husk Flour Market

Global Cocoa Pod Husk Flour Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Type (Organic and Conventional), By Application (Food & Beverage, Animal Feed, and Fertilizers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Cocoa Pod Husk Flour Market Summary, Size & Emerging Trends

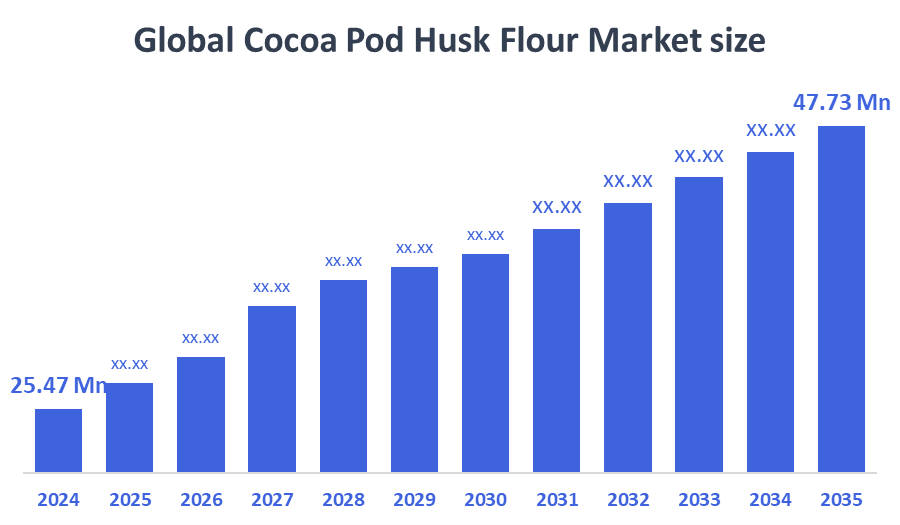

According to Decision Advisors, The Global Cocoa Pod Husk Flour Market Size is Expected to Grow from USD 25.47 Million in 2024 to USD 47.73 Million by 2035, at a CAGR of 5.88% during the forecast period 2025-2035. Rising awareness of sustainable food ingredients and growing demand for natural additives in food and animal feed are key drivers propelling the market growth.

Key Market Insights

- Latin America is expected to account for the largest share in the cocoa pod husk flour market during the forecast period.

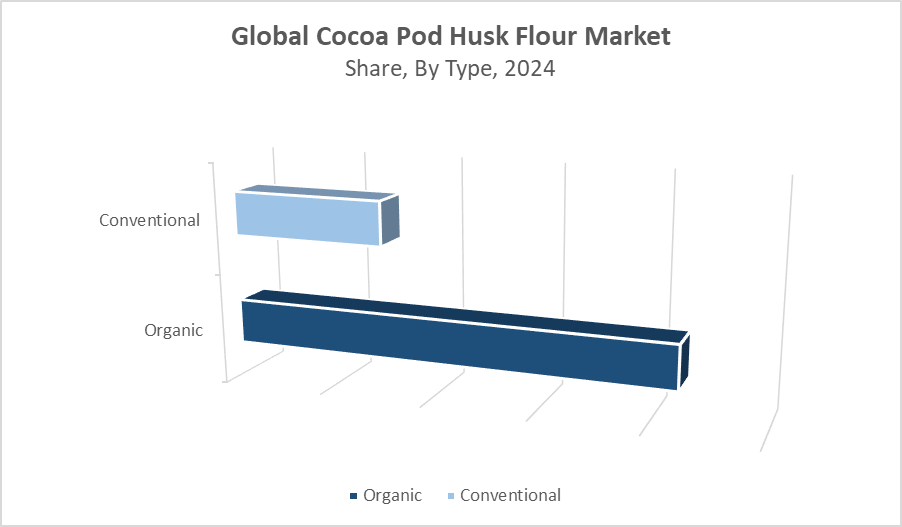

- Organic cocoa pod husk flour is anticipated to dominate in terms of revenue.

- The food and beverage segment holds the largest application share globally.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 25.47 Million

- 2035 Projected Market Size: USD 47.73 Million

- CAGR (2025-2035): 5.88%

- Latin America: Largest market in 2024

- Asia Pacific: Fastest growing market

Cocoa Pod Husk Flour Market

Cocoa pod husk flour is derived from the outer shell of the cocoa pod, a by-product of cocoa processing. It is increasingly used as a natural, high-fiber ingredient in food and beverage products, animal feed, and organic fertilizers. The rising consumer preference for clean-label products and eco-friendly agricultural inputs supports market expansion. Additionally, the upcycling trend towards sustainable use of agricultural waste further accelerates demand. Producers are focusing on improving processing technologies to enhance the nutritional profile and functional properties of cocoa pod husk flour, driving its wider adoption in various industries.

Cocoa Pod Husk Flour Market Trends

- Growing consumer preference for organic and natural food ingredients.

- Increasing utilization of cocoa pod husk flour in animal feed as a sustainable fiber source.

- Advances in processing techniques to improve flavor and reduce bitterness.

Cocoa Pod Husk Flour Market Dynamics

Driving Factors: Rising awareness of dietary fibre

The growing global focus on sustainability and health has fueled demand for natural, nutritious food ingredients like cocoa pod husk flour. This demand is supported by rising awareness of dietary fibre benefits, which promote digestive health and wellness. Simultaneously, increasing cocoa production worldwide ensures a steady, abundant supply of raw cocoa pods, which are often underutilised. The expansion of organic farming practices also encourages the use of organic cocoa pod husk flour, aligning with consumer preferences for clean-label and eco-friendly products. Together, these factors drive robust growth in the cocoa pod husk flour market.

Restraint Factors: Cocoa pod husk flour faces challenges limiting widespread adoption

Despite its benefits, cocoa pod husk flour faces challenges limiting widespread adoption. In several regions, consumer awareness about this ingredient remains low, which slows market growth. Additionally, the natural bitterness inherent to cocoa husks can affect the taste of food products, requiring improved processing techniques to make the flour more palatable. Processing infrastructure is still developing, especially in key production regions, which limits production efficiency and consistent quality. These factors combined pose significant hurdles for manufacturers and suppliers aiming to expand market penetration.

Opportunity: Functional ingredient development

Emerging technological innovations present substantial opportunities in the cocoa pod husk flour market. Advances in flavour enhancement and processing methods can reduce bitterness and improve the flour’s sensory qualities, increasing its appeal for food and beverage applications. Functional ingredient development, such as fibre-rich blends, can attract health-conscious consumers. Additionally, expanding organic food sectors in emerging economies where consumers are becoming more aware of sustainable and natural ingredients creates new markets. These opportunities enable companies to innovate product offerings, expand distribution, and capture growing demand for organic and functional food ingredients globally.

Challenges: Complex supply chains add further difficulty

The cocoa pod husk flour market faces several key challenges. Obtaining organic certification involves significant costs and strict regulatory compliance, which can be prohibitive for smaller producers and limit organic product availability. Complex supply chains add further difficulty, as coordinating harvesting, processing, and distribution across cocoa-growing regions requires infrastructure and logistics improvements. Inconsistent quality and seasonal variations also complicate supply reliability. These issues restrict rapid market growth and make it difficult for some manufacturers to scale operations or compete in global markets, requiring strategic investments and partnerships to overcome.

Global Cocoa Pod Husk Flour Market Ecosystem Analysis

The global cocoa pod husk flour market ecosystem involves cocoa farmers, processing units, food and feed manufacturers, organic fertilizer producers, and distributors. Regulatory bodies oversee safety and quality standards. Strong collaboration among stakeholders ensures efficient raw material use, sustainable sourcing, and continuous product innovation. This interconnected system supports market expansion by transforming cocoa waste into valuable ingredients for diverse applications in food, agriculture, and animal nutrition.

Global Cocoa Pod Husk Flour Market, By Type

Organic cocoa pod husk flour is projected to dominate the market, capturing approximately 62% of the global market share. This strong position is fueled by increasing consumer demand for organic, non-GMO, and clean-label products, especially in the food and beverage industry. As health-conscious consumers become more selective about ingredients, organic cocoa pod husk flour is gaining popularity due to its natural origin, high fibre content, and sustainable production. It is widely used in bakery products, dietary supplements, and functional foods. Moreover, growing awareness of ethical sourcing and environmentally friendly farming practices further supports the rise of organic variants, particularly in North America, Europe, and parts of Asia.

Conventional cocoa pod husk flour holds a steady share of around 38% in the global market. It continues to serve as a cost-effective option for applications where organic certification is not essential. This includes animal feed formulations and organic fertiliser production, where the focus is more on functionality and affordability than clean-label status. The conventional segment is particularly strong in developing regions, where lower production costs and wide availability of raw material support its usage. However, while it offers steady demand, the growth rate for this segment is expected to be slower compared to organic, due to the global trend shifting toward sustainable and certified food systems.

Global Cocoa Pod Husk Flour Market, By Application

The food and beverage segment holds the largest share, accounting for approximately 54% of the global cocoa pod husk flour market revenue. This dominance is attributed to the rising demand for high-fibre, plant-based, and clean-label ingredients in health foods and functional products. Cocoa pod husk flour is increasingly used as a dietary fiber supplement in baked goods, cereals, energy bars, snacks, and beverages. Its sustainability profile and antioxidant properties make it highly appealing to food manufacturers looking to replace synthetic or low-nutrient fillers with natural alternatives. The trend toward gut health and sustainable food sourcing is expected to further fuel demand in this segment.

The animal feed segment accounts for roughly 28% of the market share. Cocoa pod husk flour is valued in livestock and poultry feed formulations for its fiber content and ability to improve digestion and feed efficiency. With increasing pressure on livestock industries to adopt cost-effective and sustainable feed sources, cocoa by-products like husk flour are becoming more attractive. This segment is seeing strong traction in Latin America, Africa, and parts of Asia, where animal farming is expanding and sustainable feed alternatives are in demand.

Latin America holds the largest share of the global cocoa pod husk flour market, primarily due to its position as a leading cocoa-producing region. Countries such as Peru, Brazil, Ecuador, and Colombia have a well-established cocoa farming industry, ensuring abundant availability of raw material. In addition to strong local demand for sustainable agricultural inputs and animal feed, Latin American countries are actively exporting cocoa derivatives, including husk flour, to North America and Europe. Government initiatives supporting agro-industrial processing and growing interest in upcycled products further reinforce the region’s dominance in this market.

Asia Pacific is the fastest-growing region in the cocoa pod husk flour market, driven by rapid industrialisation, a growing middle-class population, and increasing disposable income. Rising health consciousness among consumers in countries like India, China, Indonesia, and Malaysia is fueling demand for natural, high-fibre food products. Simultaneously, expanding organic agriculture and interest in sustainable feed and fertiliser solutions are boosting demand in the agri-input sectors. The growth is further supported by government policies promoting food innovation and sustainable farming, along with increasing investment in food processing infrastructure.

Europe demonstrates steady growth in the cocoa pod husk flour market, underpinned by its strong health food culture, stringent food safety regulations, and preference for clean-label and organic ingredients. Countries like Germany, France, and the UK are key markets where cocoa by-products are being incorporated into functional foods, bakery, and dietary supplements. European consumers are highly aware of environmental impacts and support products aligned with circular economy principles, which benefits ingredients like cocoa pod husk flour that promote zero-waste production. Strict sustainability regulations further drive demand in animal feed and organic fertilisers.

WORLDWIDE TOP KEY PLAYERS IN THE COCOA POD HUSK FLOUR MARKET INCLUDE

- Barry Callebaut AG

- Olam International Limited

- Cargill, Incorporated

- Nestlé S.A.

- Blommer Chocolate Company

- United Cocoa Processor, Inc.

- ECOM Agroindustrial Corp. Ltd.

- ADM Cocoa (Archer Daniels Midland)

- JB Foods Limited (JB Cocoa)

- Niche Cocoa Company Limited

- Others

Product Launches in Cocoa Pod Husk Flour Market

- In January 2024, Olam International introduced a new organic cocoa pod husk flour designed specifically for the natural food ingredient market. This launch highlights Olam's commitment to sustainable product innovation and circular economy practices by utilizing cocoa by-products that were previously discarded. The product is positioned as a fiber-rich, clean-label ingredient ideal for use in bakery applications such as bread, cookies, health bars, and muffins. By tapping into rising demand for high-fiber, plant-based, and upcycled food ingredients, Olam aims to cater to both industrial manufacturers and health-conscious consumers looking for sustainable nutrition solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Adviors has segmented the cocoa pod husk flour market based on the below-mentioned segments:

Global Cocoa Pod Husk Flour Market, By Type

- Organic

- Conventional

Global Cocoa Pod Husk Flour Market, By Application

- Food & Beverage

- Animal Feed

- Fertilizers

Global Cocoa Pod Husk Flour Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What is driving the growth of the global cocoa pod husk flour market?

The market growth is primarily driven by rising awareness of sustainable food ingredients, growing demand for natural additives in food and animal feed, and increasing consumer preference for organic and clean-label products.

Q. Which region holds the largest market share in cocoa pod husk flour?

Latin America holds the largest share in the global cocoa pod husk flour market, due to its position as a major cocoa-producing region with strong local demand and export activities.

Q. What are the main applications of cocoa pod husk flour?

The primary applications include food and beverage products, animal feed formulations, and organic fertilizers, with the food and beverage segment accounting for the largest market share.

Q. How does organic cocoa pod husk flour differ from conventional cocoa pod husk flour?

Organic cocoa pod husk flour is derived from certified organic farming practices and is preferred for clean-label and non-GMO food products, whereas conventional flour is often used in animal feed and fertilizer applications due to its cost-effectiveness.

Q. What are the key challenges faced by the cocoa pod husk flour market?

Challenges include limited consumer awareness, bitterness of the product requiring advanced processing, complex supply chains, and regulatory hurdles related to organic certification.

Q. Which region is the fastest growing market for cocoa pod husk flour?

Asia Pacific is the fastest growing market, supported by rising health consciousness, expanding organic agriculture, and government policies promoting sustainable food innovation.

Q. Who are the leading players in the global cocoa pod husk flour market?

Key players include Barry Callebaut AG, Olam International Limited, Cargill, Incorporated, Nestlé S.A., Blommer Chocolate Company, and others focusing on sustainable sourcing and innovative product development.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |