Global Coffee Shops Market

Global Coffee Shops Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Format (Dine?in, Takeaway/Drive?thru, and Delivery), By Product Type (Regular Coffee, Specialty Coffee, and Cold Brew & Iced Coffee), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Coffee Shops Market Summary, Size & Emerging Trends

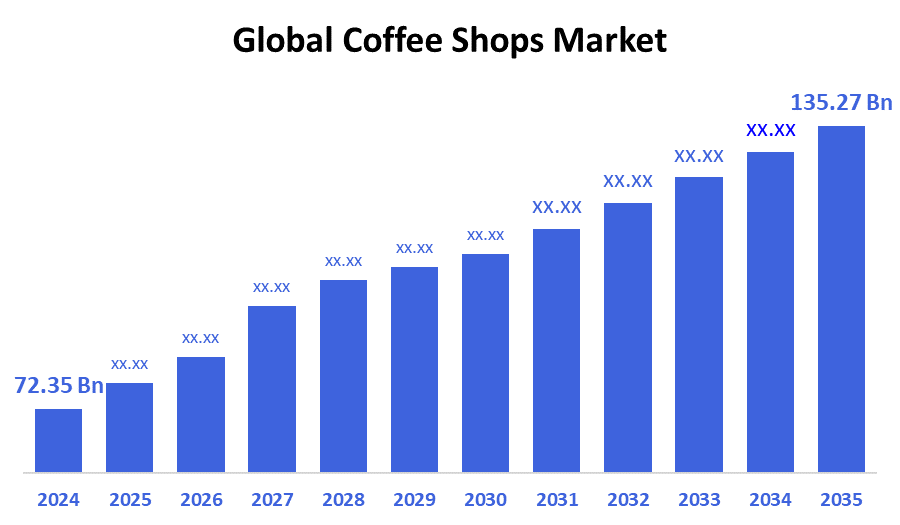

According to Decision Advisors , The Global Coffee Shops Market Size is expected to grow from USD 72.35 Billion in 2024 to USD 135.27 Billion by 2035, at a CAGR of 7.2% during the forecast period 2025-2035. Growing consumer demand for specialty and premium coffee, expansion of takeaway/delivery formats, and heightened interest in sustainable and ethically sourced offerings are key emerging trends.

Key Market Insights

- North America accounted for the largest revenue share in the coffee shops market in 2024

- Asia Pacific is expected to register the fastest growth during the forecast period

- The specialty coffee segment is projected to dominate the product category in terms of revenue share

- Takeaway and drive-thru formats are anticipated to witness significant adoption post-COVID due to increased demand for convenience

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 72.35 Billion

- 2035 Projected Market Size: USD 135.27 Billion

- CAGR (2025-2035): 7.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Coffee Shops Market

The coffee shops market revolves around establishments serving brewed coffee and related beverages across dine-in, takeaway, and delivery models. These outlets range from global franchises and chain brands to independent specialty cafés. The market is witnessing robust transformation fueled by evolving consumer lifestyles, urbanization, and demand for both premium and functional beverages. During the COVID-19 pandemic, dine-in services saw significant decline, while takeaway and delivery gained strong momentum. Tariff and trade war implications, especially on green coffee imports and packaging materials, have influenced operating costs. Operators are increasingly focusing on digital integration, sustainable sourcing, and customer experience enhancement to remain competitive.

Coffee Shops Market Trends

- Rising demand for ethically sourced and sustainable coffee products

- Growth in specialty coffee, cold brews, and non-dairy alternatives

- Digital ordering, contactless payments, and app-based loyalty programs on the rise

- Store formats evolving with more emphasis on delivery and drive-thru

- Aesthetic café experiences are attracting millennial and Gen Z consumers

Coffee Shops Market Dynamics

Driving Factors: The growth of the coffee shops market is primarily driven by increasing urbanization

The growth of the coffee shops market is primarily driven by increasing urbanization, which brings more consumers into cities with higher disposable incomes. This urban crowd often seeks social and leisure experiences, fueling the growing café culture. Additionally, a rising young population embraces coffee as a lifestyle choice, favoring premium and artisanal beverages over standard offerings. The expansion of takeaway and delivery services, accelerated by digital ordering platforms, has further boosted accessibility and convenience, encouraging more frequent purchases. These combined factors create a robust environment for sustained market expansion.

Restrain Factors: Import tariffs can increase costs, especially for specialty beans sourced globally

Several challenges hinder coffee shop operators, including fluctuating raw coffee bean prices that impact profitability. Import tariffs can increase costs, especially for specialty beans sourced globally. Rising operational expenses such as rent, labor wages, and utilities squeeze margins further. Competition from retail-ready coffee products, like instant and ready-to-drink beverages available in supermarkets, offers consumers cheaper alternatives, limiting coffee shops’ market share. Additionally, increasing labor and real estate costs, particularly in urban hubs, pose significant financial burdens on operators, making it harder to sustain competitive pricing and quality simultaneously.

Opportunity: Emerging Tier 2 and Tier 3 cities offer untapped growth potential as urbanization spreads beyond major metros

Emerging Tier 2 and Tier 3 cities offer untapped growth potential as urbanization spreads beyond major metros. Innovating with plant-based coffee alternatives aligns with rising consumer demand for health-conscious and environmentally friendly options. Bundling coffee with food items enhances average transaction value and improves customer retention. Sustainability-focused strategies, including ethical sourcing and waste reduction, resonate well with socially responsible consumers, enhancing brand loyalty. Furthermore, leveraging digital platforms to engage customers through personalized promotions, mobile ordering, and loyalty programs presents significant opportunities to capture and retain market share while optimizing operational efficiencies.

Challenges: Global trade tensions have increased the cost of raw materials

Global trade tensions have increased the cost of raw materials, such as coffee beans and packaging, straining supply chains. Disruptions caused by political instability, climate change, and transportation delays affect availability and pricing stability. Maintaining consistent product quality across multiple outlets is crucial but challenging, impacting brand reputation. Compliance with health and sustainability regulations requires ongoing investment and operational adjustments. Additionally, consumer price sensitivity, especially during economic uncertainty, limits pricing power, forcing operators to balance quality with affordability to retain customers without sacrificing margins.

Global Coffee Shops Market Ecosystem Analysis

The global coffee shops market ecosystem includes raw coffee suppliers, roasters, equipment manufacturers, packaging providers, logistics and distribution partners, digital service providers, chain/franchise operators, and independent café owners. The ecosystem also involves regulatory and certification bodies promoting ethical sourcing and sustainability. Market expansion is shaped by evolving customer preferences, supply chain resilience, and technological integration across front-end and back-end operations.

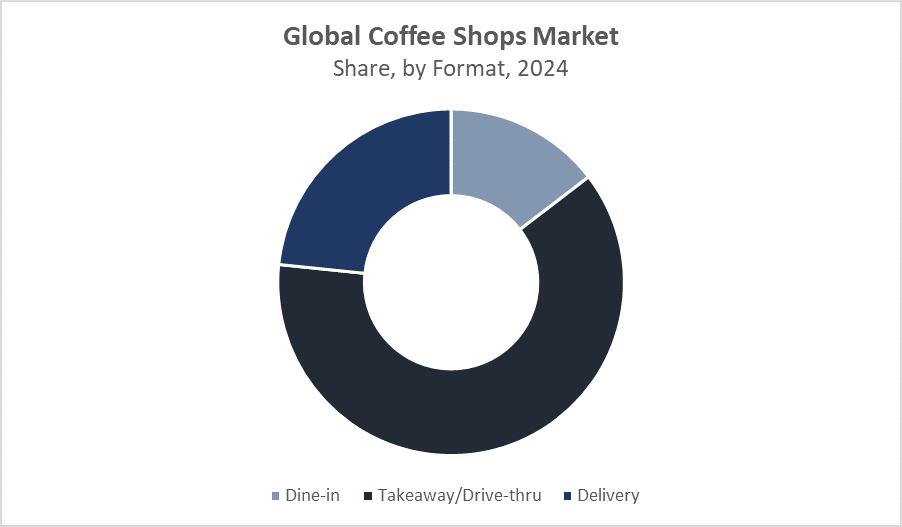

Global Coffee Shops Market, By Format

The takeaway and drive-thru segment has witnessed significant expansion in recent years, particularly accelerated by health-conscious consumer behavior post-pandemic. Customers now prefer quick, contactless service formats that minimize wait times and reduce physical interaction. This segment benefits from high consumer turnover, lower overhead costs per transaction, and scalability across urban and suburban locations. Major chains have heavily invested in drive-thru infrastructure and app-based pre-ordering systems, making this format one of the fastest-growing in the global coffee shops market. The model’s convenience and time efficiency make it especially attractive to working professionals, commuters, and younger consumers with busy lifestyles.

The delivery format segment registered the fastest growth rate in the global coffee shops market during the forecast period. Growth in this segment is driven by increasing digitalization and the proliferation of third-party food delivery apps. The delivery model allows coffee shops to expand their customer base beyond physical locations, particularly in densely populated urban areas. Operators are optimizing delivery menus, packaging, and logistics to enhance service quality. Consumer preference for convenience and at-home consumption continues to fuel this segment, making it a key revenue driver and a strategic growth area for both chains and independent cafés in the coming years.

Global Coffee Shops Market, By Product Type

The regular coffee segment accounted for the largest revenue share in the global coffee shops market during the forecast period. Regular coffee remains the most widely consumed beverage globally, driven by its affordability, simplicity, and familiarity across all demographics. It forms the foundation of most coffee menus and attracts repeat customers seeking traditional flavors and consistent quality. The segment benefits from high-volume sales and broad market penetration, particularly in mature markets such as North America and Europe. Despite the rise of specialty and cold beverages, regular coffee continues to dominate due to its widespread appeal and strong consumer loyalty.

The specialty coffee segment is projected to witness strong revenue growth and higher margins during the forecast period. This segment is gaining increasing popularity among millennials and Gen Z consumers who seek premium, artisanal, and ethically sourced beverages. Specialty coffee includes single-origin brews, hand-crafted drinks, and custom roasts, often prepared with a focus on flavor complexity and brewing techniques. The segment's growth is fueled by evolving consumer preferences, rising disposable incomes, and a growing café culture in urban areas. Coffee shops offering specialty beverages can differentiate themselves in a competitive market, attracting loyal customers and commanding premium pricing.

North America accounted for the largest revenue share in the global coffee shops market during the forecast period.

The region benefits from a mature café culture, widespread coffee consumption, and the presence of well-established brands such as Starbucks, Dunkin’, and Tim Hortons. High consumer spending, strong brand loyalty, and a robust drive-thru and delivery infrastructure continue to support market dominance. In addition, ongoing innovation in premium offerings and loyalty programs enhances customer retention. The United States remains the key contributor to the region’s market share, supported by a dense urban population and a tech-enabled retail coffee environment.

Asia Pacific is projected to register the fastest growth rate in the global coffee shops market during the forecast period.

The region’s growth is fueled by rising disposable incomes, rapid urbanization, and an expanding middle-class population. Increasing Western influence and lifestyle changes have led to a surge in café culture across countries like China, India, South Korea, and Indonesia. Global and regional coffee chains are aggressively expanding in Tier 1 and Tier 2 cities, targeting young, aspirational consumers. The digital economy, including mobile ordering and delivery platforms, further enhances market accessibility and accelerates consumption in both metropolitan and developing areas.

Europe maintained a steady revenue share in the global coffee shops market during the forecast period.

The region boasts a strong tradition of coffee consumption, with high demand for artisanal and specialty coffee products. Countries such as Italy, France, Germany, and the United Kingdom remain core markets, where consumers prioritize quality, origin, and café ambiance. Despite market maturity, innovation in premium offerings and sustainability practices drives ongoing consumer engagement. Additionally, growth in convenience-driven formats like takeaway and delivery is supporting evolving consumption habits across the region, particularly among younger and urban populations.

WORLDWIDE TOP KEY PLAYERS IN THE COFFEE SHOPS MARKET INCLUDE

- Starbucks Corporation

- Dunkin’ Brands

- Costa Coffee

- Tim Hortons

- McCafé

- Luckin Coffee Inc.

- Coffee Bean & Tea Leaf

- Blue Bottle Coffee

- Peet’s Coffee

- Independent Specialty Cafés

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the coffee shops market based on the below-mentioned segments:

Global Coffee Shops Market, By Format

- Dine-in

- Takeaway / Drive-thru

- Delivery

Global Coffee Shops Market, By Product Type

- Regular Coffee

- Specialty Coffee

- Cold Brew & Iced Coffee

Global Coffee Shops Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Coffee Shops Market in 2024?

A: The Global Coffee Shops Market size was USD 72.35 billion in 2024.

Q: What is the expected market size of the Global Coffee Shops Market by 2035?

A: The market is projected to reach USD 135.27 billion by 2035.

Q: What is the forecasted CAGR of the Global Coffee Shops Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of 7.2% during the forecast period 2025-2035.

Q: Which region held the largest market share in the coffee shops market in 2024?

A: North America accounted for the largest revenue share in 2024.

Q: Which region is expected to register the fastest growth in the coffee shops market?

A: Asia Pacific is expected to show the fastest growth during the forecast period.

Q: What are the major formats in the global coffee shops market?

A: The market is segmented into Dine-in, Takeaway/Drive-thru, and Delivery formats.

Q: Which coffee shop format is witnessing significant growth post-COVID?

A: Takeaway and Drive-thru formats have seen significant adoption due to increased consumer demand for convenience.

Q: Which product type dominates the global coffee shops market?

A: Regular coffee accounts for the largest revenue share, while specialty coffee is projected to witness strong growth.

Q: What are the key trends shaping the coffee shops market?

A: Rising demand for ethically sourced and sustainable coffee, growth in specialty and cold brew coffee, digital ordering, and enhanced café experiences are key trends.

Q: What are the main growth drivers for the coffee shops market?

A: Increasing urbanization, rising disposable incomes, expanding café culture, and growth of takeaway and delivery services drive market growth.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |