Global Coffee Substitute Market

Global Coffee Substitute Market Size, Share, and COVID-19 Impact Analysis, By Product (Herbal Coffee Substitutes, Grain Based Coffee Substitutes, Plant Based Coffee Substitutes), By Form (Powder, Liquid), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Coffee Substitute Market Summary

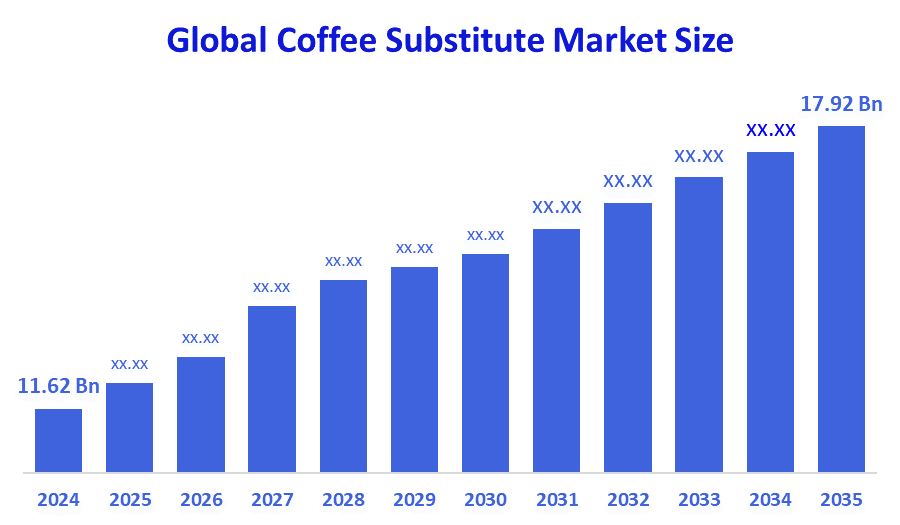

The Global Coffee Substitute Market Size Was Estimated at USD 11.62 Billion in 2024 and is Projected To Reach USD 17.92 Billion by 2035, Growing at a CAGR of 4.02% from 2025 to 2035. The Coffee Substitute Market Size is experiencing Growth due To increasing health consciousness, a rising demand for sustainable products, and the convenience of instant preparation options.

Key Regional and Segment-Wise Insights

- In 2024, Europe held the largest revenue share of over 34.7% and dominated the Market Globally.

- In 2024, the herbal coffee substitutes segment had the highest market share by product, accounting for 59.4%.

- In 2024, the powder segment had the biggest market share by form, accounting for 58.7%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 11.62 Billion

- 2035 Projected Market Size: USD 17.92 Billion

- CAGR (2025-2035): 4.02%

- Europe: Largest market in 2024

- Asia Pacific: Fastest Growing Market

The coffee substitute market includes different types of beverages that duplicate the taste, smell, and mouthfeel of traditional coffee, both with and without caffeine. The production of coffee substitutes commonly uses chicory root along with barley, dandelion, mushrooms, and cereals. The main industry drivers include increasing consumer interest in health matters, together with caffeine-related health concerns and the need for natural functional beverages. People who need caffeine-free options or follow lifestyle choices such as detox diets or pregnancy choose coffee alternatives as their healthier beverage option. The demand for these products increases due to the rising popularity of clean-label products and plant-based lifestyles, and digestive health trends. The consistent worldwide growth of the market results from the increasing number of vegan and wellness-conscious consumers.

The advancement of technological breakthroughs has led to significant market expansion for coffee substitutes through enhanced product taste and texture and improved nutritional content. The development of new processing techniques, including roasting along with fermenting, and extraction, aims to replicate the rich coffee flavor and aroma. The addition of functional substances including nootropics and prebiotics and adaptogenic botanicals enhances the health benefits of these products. Retail and internet channels now distribute more products because of enhanced shelf stability and packaging solutions. Industry growth receives support from government initiatives that focus on plant-based eating and sustainable farming practices. The combination of public health campaigns to reduce caffeine intake and organic farming subsidies supports this growth. The coffee substitute market benefits from an environment that develops because of increased funding for clean-label production, together with food innovation initiatives.

Product Insights

The herbal coffee substitutes segment held the largest revenue share of 59.4% within the worldwide coffee substitute market during 2024 because customers sought natural caffeine-free beverages with additional health benefits. The popularity of products featuring chicory root, along with dandelion and ashwagandha, and mushroom blends grew because they provided a coffee-like taste while offering digestive improvement and stress reduction, and general wellness benefits. The herbal market gained increased appeal because consumers sought organic, clean-label products while plant-based lifestyles became more popular. The market leader position of this segment emerged in 2024 because consumers could find numerous herbal coffee substitutes in standard retail outlets and health-focused stores alongside marketing campaigns that emphasized sustainable practices and wellness benefits.

The plant-based coffee substitutes segment of the coffee substitute market will experience strong growth throughout the forecast period as consumers become more aware of the health and sustainability benefits of plant-based products. The market for coffee substitutes based on barley, rye, and other grains experiences growth because consumers want natural products that are organic and environmentally friendly alternatives to traditional coffee. The segment expands because of the growing popularity of flexitarian and vegan lifestyles, together with concerns about coffee cultivation's environmental impact. Plant-based coffee alternatives experience rapid growth because manufacturers develop better formulations and flavors, which attract consumers, and e-commerce platforms and specialty retailers make these products easily available.

Form Insights

The powder segment dominated the coffee substitute market by generating 58.7% of the total revenue in 2024 because it provides convenience and a long shelf life, together with simple preparation methods. Customers easily make beverages through powdered coffee alternatives, which use chicory and barley along with herbal mixtures at home or work or during travel. The market growth exists because of innovative packaging solutions and portion-controlled sachets, together with strong retail and online channel demand. Consumers select powder versions instead of ready-to-drink alternatives because these options deliver concentrated flavor profiles and cost-effective solutions. In 2024, the powder segment maintained its market leadership because customers preferred customized drink options, and they could combine powder products with health supplement ingredients.

The liquid segment within the coffee substitute market experiences significant growth because consumers prefer ready-to-drink beverages during the forecast period. Ready-to-drink beverages attract busy consumers who want their coffee alternatives ready immediately because they do not require preparation. The combination of improved taste, extended shelf life, and added nutritional content through formulation developments has attracted health-conscious buyers seeking practical benefits such as added vitamins, adaptogens, and antioxidants. Modern retail outlets and internet platforms have made liquid substitutes more accessible while offering greater variety to consumers. The worldwide acceptance of liquid coffee alternatives among various consumer groups is accelerating because of rising wellness trends, natural beverage preferences, and effective marketing efforts.

Regional Insights

The North American market for coffee substitutes demonstrates steady growth because of rising health awareness, together with increasing demand for caffeine-free and low-caffeine products. People who want to avoid caffeine-related problems have turned to herbal blends and chicory and mushroom-based beverages, which now enjoy increasing popularity. The market expands because consumers seek natural products alongside organic and plant-based options. Several products maintain easy availability through established retail channels, which include supermarkets and specialty shops, together with e-commerce platforms in the region. Ready-to-drink beverages, together with beneficial ingredients and innovative flavors, drive market growth. The worldwide coffee substitute market identifies North America as an essential market because consumers focus on wellness, together with clean-label products.

Europe Coffee Substitute Market Trends

The European region for the coffee substitutes market generated the highest revenue share at 34.7% during 2024 due to consumer demand for caffeine-free and health-conscious products. European customers now prefer herbal and plant-based coffee alternatives because of rising wellness interest and natural product demand, as well as caffeine-related health concerns. Beverages made from chicory, dandelion, and mushrooms gained significant popularity among German and French, and British consumers. The region's advanced retail channels, which contain online platforms and health-focused stores, allow products to reach broad audiences. The government implements favorable policies for clean-label goods and sustainable agricultural practices.

Asia Pacific Coffee Substitute Market Trends

The coffee substitute market in the Asia Pacific will experience the fastest growth throughout the forecast period because of rising health awareness, along with rising disposable income and increasing demand for natural caffeine-free products. Consumers require better coffee alternatives because of quick urbanization and changing life patterns. The expanding e-commerce platforms, together with improved product distribution networks, have led to the growing availability of coffee alternative products throughout the region. Traditional herbal beverages enjoy cultural acceptance in China, India, Japan, and South Korea, which drives substantial demand growth for plant-based and herbal alternatives. The market receives assistance from both innovative flavor developments and convenient packaging, which positions the Asia Pacific as a key driver of worldwide coffee substitute market expansion.

Key Coffee Substitute Companies:

The following are the leading companies in the coffee substitute market. These companies collectively hold the largest market share and dictate industry trends.

- Hand Family Companies

- Kein Kaffee

- Rishi Tea and Botanicals

- Four Sigma Foods, Inc.

- Mud Wtr Inc.

- Teeccino Caffe, Inc.

- Postum

- Dandy Blend

- Minus Coffee

- Anthonys Goods

- Nestlé S.A.

- Urban Platter

- Others

Recent Developments

- In September 2024, Sip Herbals (U.S.) introduced Pumpkin Spiced Faux Joe, a new coffee alternative, as part of its product range expansion.

- In August 2024, Vybey, an Australian company, unveiled a novel coffee substitute that contains adaptogens and nootropics.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the coffee substitute market based on the below-mentioned segments:

Global Coffee Substitute Market, By Product

- Herbal Coffee Substitutes

- Grain Based Coffee Substitutes

- Plant Based Coffee Substitutes

Global Coffee Substitute Market, By Form

- Powder

- Liquid

Global Coffee Substitute Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Aug 2025 |

| Access | Download from this page |