Global Coir Market

Global Coir Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product (Coir Fiber, Coir Pith, and Coir Yarn/Twines), By Application (Horticulture, Mattresses & Upholstery, Geotextiles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Coir Market Size Summary, Size & Emerging Trends

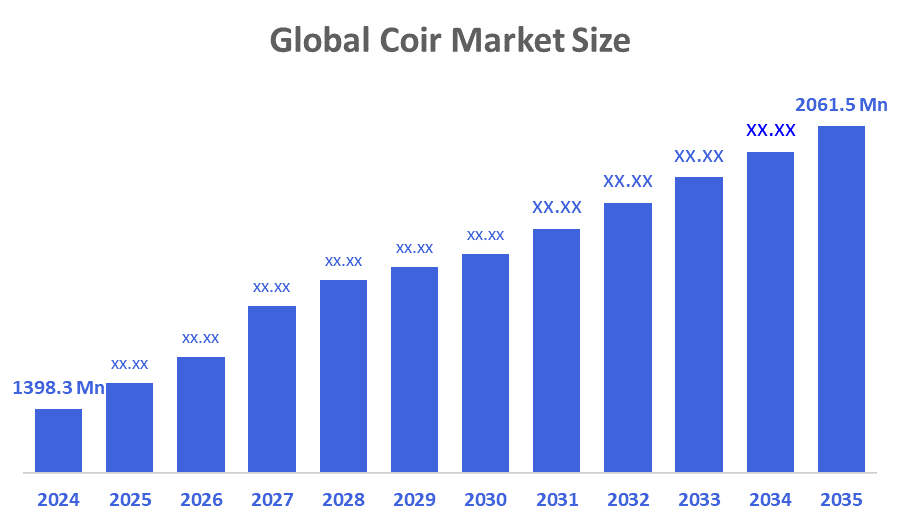

According to Decision Advisor, The Global Coir Market Size is expected to Grow from USD 1398.3 Million in 2024 to USD 2061.5 Million by 2035, at a CAGR of 3.59% during the forecast period 2025-2035. The rising demand for eco-friendly, biodegradable materials in agriculture, textiles, and erosion control is fueling market expansion.

Key Market Insights

- Asia Pacific dominates the global coir market and is expected to retain the largest share during the forecast period.

- Coir Fiber is the most widely consumed product type due to its versatility and high tensile strength.

- Horticulture leads in application usage, particularly due to increasing use of coir pith as a soil conditioner and substrate.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1398.3 Million

- 2035 Projected Market Size: USD 2061.5 Million

- CAGR (2025-2035): 3.59%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Coir Market

The coir market focuses on natural fiber products derived from coconut husks, such as coir fiber, pith, mats, yarns, brushes, and geotextiles. As industries increasingly shift toward eco-friendly and biodegradable alternatives, coir is emerging as a sustainable solution across horticulture, mattresses, erosion control, and home décor applications. Its natural resilience, water retention capacity, and biodegradability make it ideal for both industrial and consumer use. Government support in leading production countries like India, Sri Lanka, and the Philippines through subsidies, export incentives, and R&D funding has accelerated industry development. Moreover, global awareness surrounding plastic alternatives and soil-friendly substrates further boosts coir adoption. With expanding applications in organic farming, green infrastructure, and eco-conscious product design, the coir market is positioned for steady, long-term growth across both developed and emerging economies.

Coir Market Trends

- Surge in demand for coir-based horticultural products due to global shift toward organic farming.

- Rising adoption of coir geotextiles in road construction and soil erosion control projects.

- Increasing R&D in composite materials using coir fibers for automotive and construction applications.

- Export-oriented growth driven by EU and North American preference for biodegradable goods.

Coir Market Dynamics

Driving Factors:

Growing demand for biodegradable alternatives in agriculture and packaging

The global shift toward sustainability is significantly boosting the demand for natural, biodegradable materials like coir. In agriculture, coir pith is increasingly replacing peat moss in horticulture due to its excellent water retention, aeration, and nutrient-holding capacity ideal for organic and hydroponic farming. Meanwhile, the packaging industry is seeking eco-friendly alternatives to plastics, where coir fibers are now being used in protective packaging and insulating products. As industries aim to reduce their carbon footprint and meet green regulations, coir’s versatility, renewability, and minimal environmental impact position it as a preferred material across sectors.

Restrain Factors:

Lack of standardization and inconsistent quality

While coir is gaining international traction, quality inconsistencies remain a major barrier. Variations in fiber strength, length, and moisture content affect performance and limit its application in industries that require precision and uniformity, such as automotive or composites. Furthermore, a large part of the coir industry especially in India and Sri Lanka relies on traditional, labor-intensive methods with limited automation. This affects both scalability and efficiency, causing delays in large-scale supply and affecting global competitiveness. The absence of universally accepted grading and standardization also hinders export opportunities and customer trust in international markets.

Opportunity:

Innovation in coir composites and rising export potential

Technological advancements are enabling the integration of coir with polymers and resins to create durable biocomposites, which are now being considered in automotive interiors, construction panels, furniture, and eco-friendly packaging. These composites offer the added advantage of being lightweight, biodegradable, and cost-effective making them appealing in developed markets focused on sustainability. Meanwhile, demand for coir-based home furnishings, mattress components, and decorative items is surging in Europe and North America. This opens strong export potential for producing countries, especially as consumers and companies alike shift toward greener, ethically sourced materials.

Challenges:

Seasonality of raw materials and trade dependencies

Coir production is highly dependent on coconut harvesting seasons, leading to irregular availability and price volatility of raw husks. Inconsistent supply affects manufacturing schedules, especially for exporters catering to time-sensitive orders. Additionally, the market is vulnerable to international trade barriers, such as anti-dumping duties, complex certification processes, and quality regulations particularly in the EU and U.S. These hurdles can restrict market access for small and mid-sized exporters. Coupled with logistical issues and port delays, these factors create uncertainty in the global coir supply chain and limit long-term market expansion.

Global Coir Market Ecosystem Analysis

The global coir market ecosystem comprises raw material suppliers (primarily coconut producers), manufacturers, exporters, and end-users across agriculture, home furnishings, and construction. India, Sri Lanka, and Indonesia dominate production, supported by government-backed coir development boards. Exporters distribute to high-demand regions like Europe and North America, where sustainable product demand is rising. End-users include horticulture companies, mattress and furniture manufacturers, and erosion control solution providers. The ecosystem thrives on renewable sourcing, low-cost labor, and increasing global awareness of eco-friendly and biodegradable alternatives.

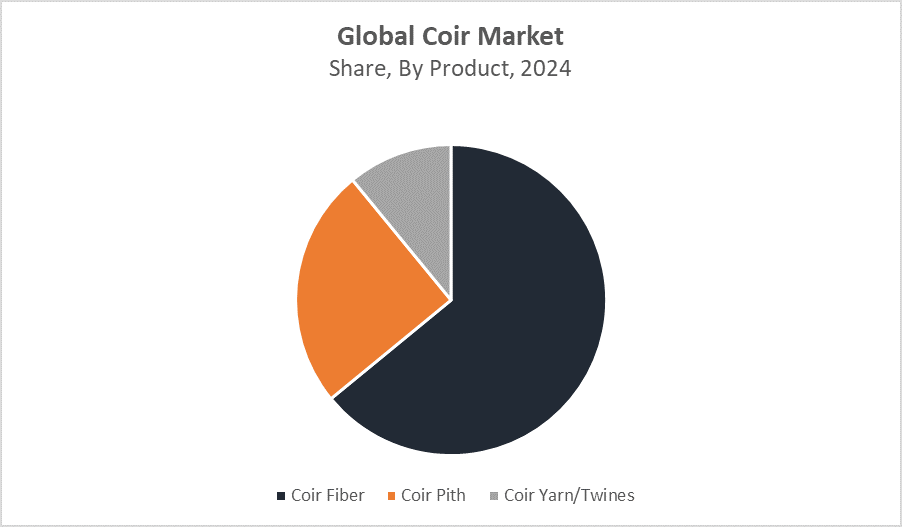

Global Coir Market, By Product

Coir fiber represents the largest segment in the global coir market by revenue. Extracted from the outer husk of coconuts, it is categorized into brown and white fiber types each serving different end uses. Brown coir, known for its stiffness and durability, is commonly used in mats, brushes, ropes, doormats, and mattress filling. White coir, being finer and more flexible, is often utilized in making yarns and twines. Its high tensile strength, resistance to saltwater, and biodegradability make it a sustainable alternative to synthetic fibers in various industrial and domestic applications. In construction and automotive industries, coir fiber is increasingly being used for insulation and soundproofing materials. Its long shelf life and performance under varying climatic conditions have ensured stable demand across emerging and developed economies.

Coir pith, also known as coco peat, is a by-product of fiber extraction and has evolved from waste material to a valuable resource in the horticulture and floriculture sectors. It is widely used as a soil conditioner and growing medium due to its excellent water retention, aeration, and nutrient absorption capabilities. These qualities make it particularly suitable for hydroponics, nursery plantations, greenhouse farming, and organic agriculture. Processed coir pith is often compressed into blocks, discs, or grow bags for easy transportation and use. Demand has surged globally, especially in regions like North America and Europe, where sustainable and peat-free growing substrates are being encouraged. Coir pith's eco-friendly profile, combined with the rising global emphasis on organic farming, positions it as a rapidly expanding segment of the coir industry.

Global Coir Market, By Application

Horticulture stands as the dominant application segment in the coir market, driven primarily by the extensive use of coir pith (also known as coco peat) as a soil substitute and growing medium. Its natural water retention, aeration, and microbial properties make it ideal for a wide range of horticultural applications—including greenhouse farming, hydroponics, seed germination, and vertical gardens. As environmental regulations push growers away from traditional peat moss (which has a high environmental cost), coir pith has emerged as a sustainable and renewable alternative.

The mattresses & upholstery segment holds a significant portion of the coir market, leveraging the natural strength, resilience, and ventilation properties of coir fiber. Traditionally used in developing regions, coir-based mattresses are now gaining international appeal as consumers increasingly look for eco-friendly, non-toxic, and breathable alternatives to synthetic foam and latex products. Coir fiber is particularly valued in the production of orthopedic mattresses and seat cushions, where its firm support and moisture-wicking properties improve comfort and durability. The growing health consciousness, coupled with environmental awareness, has led to a spike in demand for natural bedding solutions, especially in Europe and Asia-Pacific.

Asia Pacific dominates the global coir market, both in production and export, accounting for over 60% of the total market share.

India, Sri Lanka, and Indonesia are the key contributors, owing to vast coconut plantations and an established coir processing industry. India alone accounts for over 70% of global coir production and has a robust domestic and export ecosystem. Factors such as abundant raw material availability, low-cost labor, and strong government support including subsidies, coir board initiatives, and export incentives—have sustained the region's leadership. These countries export large volumes of coir fiber, pith, and yarn to Europe and North America. Increasing mechanization and the growth of coir-based industries in Southeast Asia are also enhancing production efficiency and product diversity in the region.

Europe is the fastest-growing region in the global coir market, projected to expand at a CAGR of 6.2% during the forecast period.

This growth is driven by strict environmental regulations promoting the use of biodegradable, renewable materials and reducing reliance on peat and synthetic alternatives. Coir pith is increasingly favored in horticulture, landscaping, and greenhouse farming, especially in countries like Germany, the Netherlands, France, and the UK. European demand is strong for coir-based garden substrates, geotextiles, and biodegradable packaging. Public and private sectors are investing in sustainable urban development, boosting the adoption of coir in erosion control, soil stabilization, and green infrastructure. Additionally, a growing consumer preference for eco-friendly home furnishings and mattresses is opening new market opportunities for exporters.

WORLDWIDE TOP KEY PLAYERS IN THE COIR MARKET INCLUDE

- Sri Lanka Coconut Development Authority

- Allwin Coir

- RA Coir Exports

- Benlion Coir Industries

- Kumaran Coirs

- Vaighai Agro Products

- Thiraviyam Coir Products

- Coco & Coir

- Premier Coir Products

- Coir Board (India)

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the coir market based on the below-mentioned segments:

Global Coir Market, By Product

- Coir Fiber

- Coir Pith

- Coir Yarn/Twines

Global Coir Market, By Application

- Horticulture

- Mattresses & Upholstery

- Geotextiles

Global Coir Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 156 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |