Global Cold Chain Market

Global Cold Chain Market Size, Share, and COVID-19 Impact Analysis, By Type (Storage, Transportation, Packaging, Monitoring Components), By Application (Food & Beverages, Pharmaceuticals, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Cold Chain Market Summary

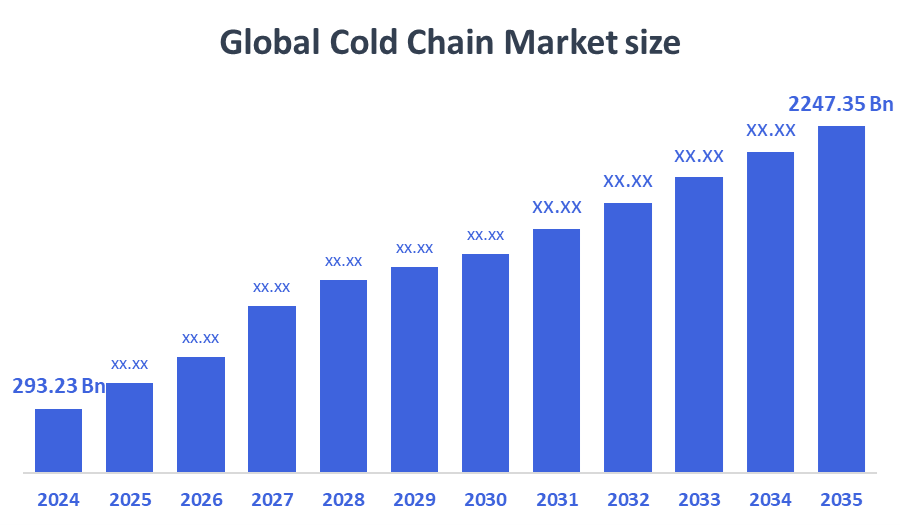

The Global Cold Chain Market Size Was Estimated At USD 293.23 Billion in 2024 and is Projected to Reach USD 2247.35 Billion by 2035, Growing at a CAGR of 20.34% from 2025 to 2035. Increased demand for perishable goods, stricter food safety laws, the growth of the pharmaceutical and healthcare industries, improvements in refrigeration technology, the rise of organized retail and e-commerce, and growing consumer awareness of food quality and freshness are all driving the cold chain market's expansion.

Key Regional and Segment-Wise Insights

- In 2024, the cold chain market in North America had the biggest revenue share, accounting for 32.4%.

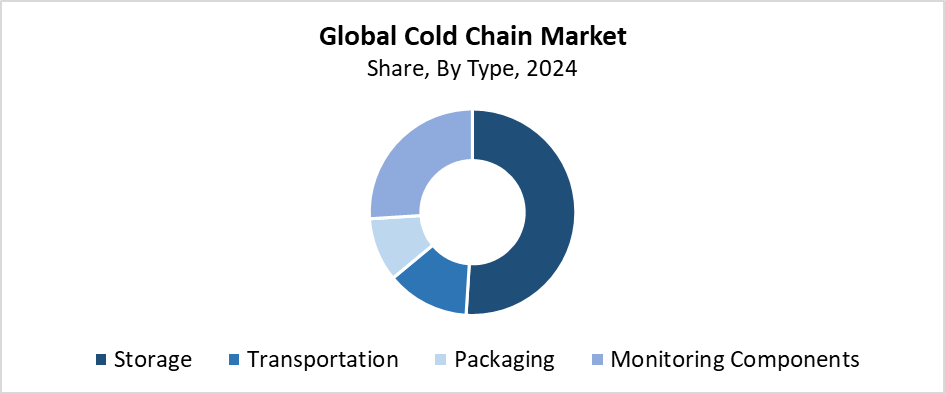

- With a revenue share of 51.7% in 2024, the storage segment led the market by type.

- In 2024, the food and beverage segment dominated the market based on application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 293.23 Billion

- 2035 Projected Market Size: USD 2247.35 Billion

- CAGR (2025-2035): 20.34%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The cold chain market represents a temperature-controlled supply system that handles storage and shipping, and distribution of perishable goods, including food, medications, and chemicals. The system preserves optimal temperature conditions from production until consumption to safeguard product quality and extend shelf life while ensuring safety. The market expands due to increasing worldwide fresh and frozen food demand and pharmaceutical distribution growth with strict temperature requirements and stringent food safety regulations, and expanding organized retail and e-commerce platforms. The demand for efficient cold chain solutions has grown because of urbanization and rising consumer quality awareness, and international food and pharmaceutical industry expansion.

The Cold Chain market experiences substantial improvement through technological progress. The combination of GPS tracking, real-time monitoring systems, and IoT-enabled temperature sensors and automated cold storage facilities enhances transparency, reduces spoilage, and ensures regulatory compliance. Blockchain technology provides data security and traceability functions for the market. Global governments implement subsidies and establish legislative frameworks and safety standards to advance cold chain infrastructure development, which helps prevent food waste and safeguards public health. The worldwide cold chain market experiences strong expansion because of these joint development initiatives.

Type Insights

The storage segment held the largest revenue share of 51.7% and dominated the cold chain market in 2024. The supremacy of storage facilities in the cold chain market results from their essential role in protecting perishable products like food, medications, and chemicals. The growth of food processing, pharmaceutical, and e-commerce sectors leads to rising requirements for cold storage warehouses, together with refrigerated warehouses and cold rooms. The development of better insulating materials along with automated storage systems and energy-efficient refrigeration technology has expanded storage capacity while reducing operational costs. The growing worldwide trade of temperature-sensitive items, along with increasing consumer interest in fresh products, has led to substantial investments in cold storage infrastructure.

The monitoring components segment of the cold chain market is expected to grow at the fastest CAGR throughout the forecast period. Real-time temperature and condition monitoring of perishable items during storage and transit has become a major factor driving this rapid market expansion. Advanced monitoring technologies, including IoT sensors, RFID tags, GPS tracking, and cloud-based platforms, enable enhanced visibility, traceability, and data analytics to help reduce spoilage and maintain strict food safety and pharmaceutical standards. The expanding market growth is being driven by the rising implementation of smart cold chain solutions across retail businesses, logistics companies, and manufacturing facilities. The investment in advanced monitoring systems has become essential for the changing cold chain market because consumer awareness about product quality and safety continues to rise.

Application Insights

The food and beverage sector dominated the cold chain market in 2024, accounting for the largest revenue share. The industry leadership exists because of the essential requirement to transport and store perishable foods under controlled temperatures, including dairy products, meat, seafood, as well as fruits and vegetables. The main factors driving this market demand include the expanding retail sector, alongside e-commerce growth and worldwide population increase, and rising consumer interest in fresh and processed products. The implementation of cold chain solutions in this sector receives further support from strict food safety regulations as well as consumer education on food quality and programs to minimize waste. Technological advancements in refrigeration and real-time monitoring systems enable food and beverage cold chains to enhance their reliability and operational efficiency.

The pharmaceuticals segment of the Cold Chain market will show substantial growth throughout the forecast period because of the increasing requirements for biologics, together with vaccines and temperature-sensitive medical products. The expanding biotechnology sector and global pharmaceutical business, together with customized medicine, require strict temperature control to maintain both product safety and efficacy. The COVID-19 pandemic revealed the essential role of reliable cold chain systems, especially for vaccine distribution. The supply chain needs strict temperature monitoring and documentation because health agencies, including the FDA and WHO, require it through their regulatory standards. The pharmaceutical industry represents one of the fastest-expanding segments in the cold chain market because of growing investments in specialized cold storage facilities and refrigerated transportation alongside real-time monitoring technology.

Regional Insights

North America led the global cold chain market by generating the largest revenue share of 32.4% in 2024. The high-tech distribution network, high perishable food needs, and growing pharmaceutical temperature-controlled delivery requirements make this region the market leader. The United States and Canada have increased their cold storage facility and refrigerated transportation investments to meet the rising requirements of e-commerce grocery and restaurant, and biopharmaceutical distribution businesses. Modern cold chain technology implementation through automated warehousing and IoT monitoring systems receives support from the FDA and USDA's strict food safety and medication regulations. The worldwide industry leadership of North America remains strong because of its leading cold chain service providers and ongoing technological advancements.

Europe Cold Chain Market Trends

The European cold chain market experienced consistent growth throughout 2024 because of increased interest in pharmaceutical and temperature-sensitive food items. The region's priority on food safety and environmental sustainability, alongside waste reduction, drives increased investment in environmentally friendly refrigeration systems and energy-efficient cold storage facilities. The European Union ensures high standards in cold chain operations through its rigorous regulations, which include HACCP and GDP pharmaceutical guidelines. The transport infrastructure, combined with the advanced logistics systems of Germany, France, and the Netherlands, enables significant contributions. Reliable cold chain systems face increasing demand because of growing international trade activities and digital food market expansion. The European cold chain industry maintains its focus on innovative solutions while implementing traceable systems and sustainable practices.

Asia Pacific Cold Chain Market Trends

The Asia Pacific cold chain industry will experience the fastest growth during the forecast period because of rising disposable income and medical product needs, along with quick urban development. Emerging nations, including China and India, together with Southeast Asia, rely on productive cold chain logistics because their organized retail, e-commerce, and foodservice sectors expand quickly. The industry experiences growth because of governmental initiatives to improve supply chain operations while reducing food waste and safeguarding medical products and vaccines. The industry sees rising spending on refrigerated transportation systems, along with cold storage facilities and smart monitoring technology solutions. The worldwide cold chain market experiences significant growth in the Asia Pacific because consumers become more aware of food quality, safety, and shelf life management.

Key Cold Chain Companies:

The following are the leading companies in the cold chain market. These companies collectively hold the largest market share and dictate industry trends.

- Americold Logistics, Inc.

- A.P. Moller - Maersk

- United States Cold Storage

- United Parcel Service of America, Inc.

- Burris Logistics

- NICHIREI CORPORATION

- Wabash National Corporation

- NewCold

- LINEAGE LOGISTICS HOLDING, LLC

- Sonoco ThermoSafe (Sonoco Products Company)

- Tippmann Group

- Others

Recent Developments

- In November 2024, Lineage, Inc. announced that it has acquired the assets of Coldpoint, a cold storage and transportation solutions provider based in Kansas City. By adding Coldpoint's 621,000-square-foot facility with cutting-edge intermodal capabilities to its worldwide network, Lineage strengthens its services along the protein corridor with direct rail access to U.S. ports, and broadens its presence in the Kansas City region.

- In November 2024, CJ Logistics America established a brand-new, 270,000-square-foot cold storage facility in Georgia, USA. It is ideally situated close to major roads and railroads in an area that is important for the production of chicken. The facility, which has 30,000 racked pallet slots, on-site USDA inspection facilities, and sophisticated refrigeration and blast freezing equipment, provides customized storage solutions for a range of products, including proteins, baked goods, and finished goods. This investment reaffirms CJ Logistics America's dedication to providing top-tier cold chain solutions to well-known international brands.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cold chain market based on the below-mentioned segments:

Global Cold Chain Market, By Type

- Storage

- Transportation

- Packaging

- Monitoring Components

Global Cold Chain Market, By Application

- Food & Beverages

- Pharmaceuticals

- Others

Global Cold Chain Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |