Global Commercial Vehicle Telematics Market

Global Commercial Vehicle Telematics Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Provider (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Commercial Vehicle Telematics Market Summary

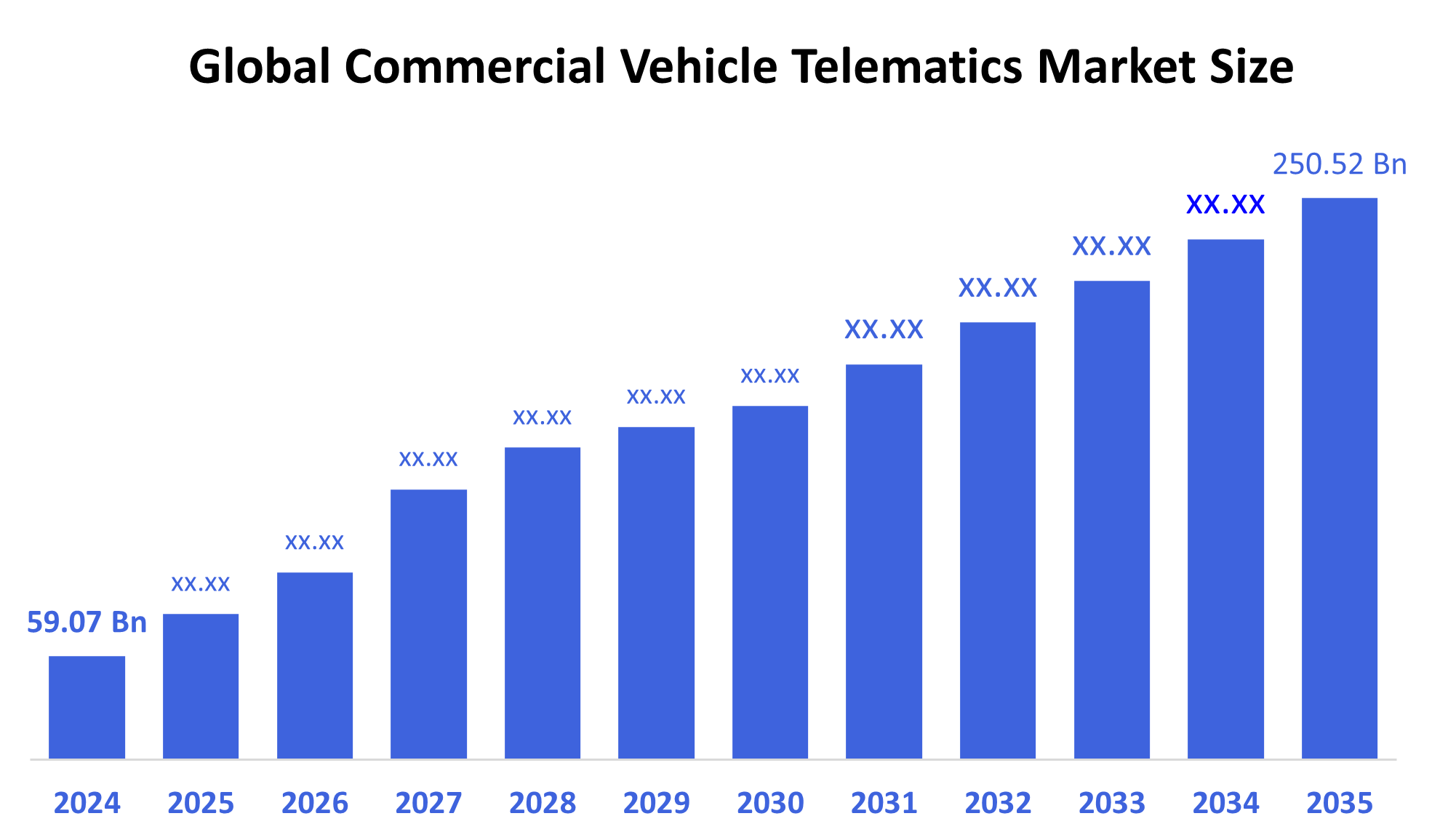

- The Global Commercial Vehicle Telematics Market Size Was Estimated at USD 59.07 Billion in 2024 and is Projected to Reach USD 250.52 Billion by 2035, Growing at a CAGR of 14.04% from 2025 to 2035.

- Improved safety and compliance features, the rise of connected vehicle technology and the Internet of Things (IoT), the integration of cutting edge technologies like artificial intelligence, machine learning, and 5G networks, and the growing demand for fleet management and operational efficiency are all factors propelling the commercial vehicle telematics market.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 33.4% and dominated the market globally.

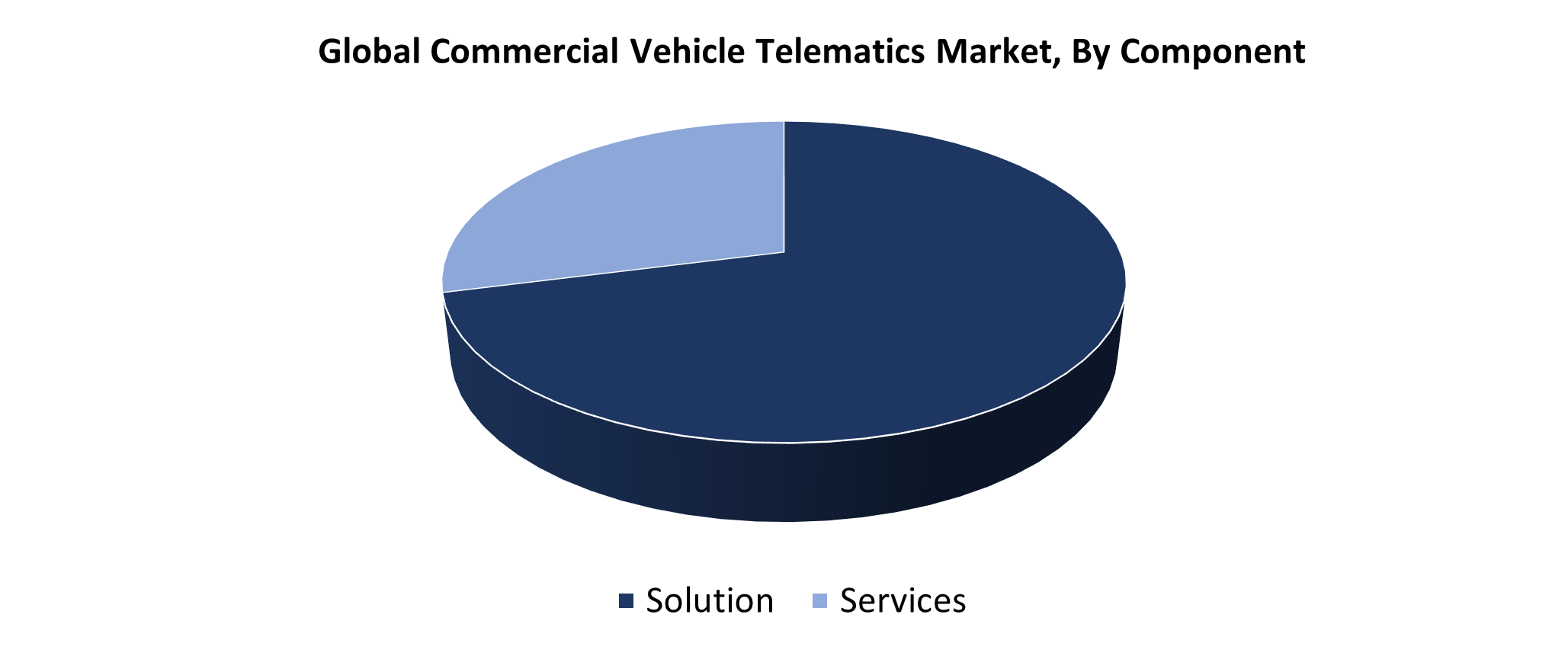

- In 2024, the solution segment had the highest market share by component, accounting for 71.4%.

- In 2024, the OEM segment had the biggest market share by provider, accounting for 59.5%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 59.07 Billion

- 2035 Projected Market Size: USD 250.52 Billion

- CAGR (2025-2035): 14.04%

- North America: Largest market in 2024

The commercial vehicle telematics market refers to the use of information technology combined with communication systems to monitor and control, as well as improve commercial vehicle operations. Real-time monitoring systems track both vehicle location and driver actions, along with fuel consumption data and diagnostic information from the vehicle. The increasing market demand for enhanced driver safety, together with better fleet management and regulatory adherence, drives the current market growth. The combination of increasing gasoline costs and operational cost savings drives businesses to adopt telematics solutions. Market growth occurs because businesses need immediate tracking solutions and optimized route planning, which stems from expanding logistics and e-commerce operations. The market adoption depends heavily on the capability of these systems to extend vehicle operational availability while reducing maintenance expenses.

Commercial vehicle telematics experiences a transformation through technological progress, which includes cloud computing, IoT, and AI-driven analytics. Automated reporting, together with real-time monitoring and predictive maintenance, has become possible through these developments, which enhance fleet efficiency and safety. Various governments worldwide support telematics usage by creating regulations that address safety requirements, together with driver time restrictions and vehicle emission standards. The implementation of telematics stands as a key tool for modern fleet control systems, while programs for smart transportation infrastructure and digital development create additional support for industry advancement.

Component Insights

The solution segment led the commercial vehicle telematics market with the largest revenue share of 71.4% in 2024. The leading position of telematics solutions stems from their extensive benefits, which include fuel management along with driver behavior monitoring and route optimization, and real-time vehicle tracking. The growing preference among businesses for integrated solutions with actionable analytics stems from their need to boost fleet efficiency alongside cost reduction and safety enhancements. The appeal of these solutions grows stronger because of their integration with cloud platforms alongside powerful analytics capabilities. The market dominance of the solution segment emerges from the rising demand for unified fleet management solutions that comply with regulatory standards across multiple sectors.

The commercial vehicle telematics market's service segment is anticipated to experience substantial growth during the projection period. The growing demand for ongoing maintenance and data management services that maintain telematics systems at their peak performance levels drives this expansion. Businesses require system integration services, along with training and consulting and analytics support for their growing adoption of advanced telematics solutions. The transition to managed services together with subscription-based models, enables fleet operators to receive the newest features and updates without substantial initial costs. The service segment expands because telematics ecosystems grow more complex, while organizations need expert help to interpret data and meet regulatory standards.

Provider Insights

The OEM segment dominated the commercial vehicle telematics market with the largest revenue share of 59.5% in 2024. Factory-installed telematics systems in commercial vehicles dominate the market because they deliver enhanced performance and better reliability, and seamless integration. The rising demand for integrated connection and fleet management features drives automakers to include telematics systems in their manufacturing process. The data collection and diagnostic capabilities of OEM-provided telematics systems exceed those of other solutions because they maintain optimal compatibility with vehicle hardware and software systems. OEMs needed to include telematics as standard features because regulatory requirements for safety and emissions monitoring and remote diagnostics forced them to do so to preserve their market leadership.

The Aftermarket segment of the commercial vehicle telematics market is expected to experience the fastest growth rate throughout the forecast period. The increasing requirement of fleet operators for telematics solutions that provide affordability alongside adaptability and scalability for their existing vehicle fleets is the main factor behind this growth. Businesses of small and medium size show interest in aftermarket telematics solutions because they offer adaptable features as well as affordable prices and installation options compared to OEM solutions. The rising need for instant vehicle monitoring and fuel control systems and driver conduct tracking, along legal adherence monitoring boosts the adoption of aftermarket telematics solutions. The rapid expansion of the market continues because mobile applications, along with cloud-based platforms and plug-and-play devices, have enhanced accessibility and simplicity of aftermarket solutions.

Regional Insights

The commercial vehicle telematics market is dominated by the North America region with the largest revenue share of 33.4% in 2024. The area's advanced transportation network, together with its numerous commercial vehicle fleets and its position as an early adopter of telematics technologies, represents the primary drivers behind this market leadership. The implementation of government regulations regarding electronic logging devices (ELDs) and emissions control alongside driver safety requirements has accelerated telematics adoption across public transportation and construction, as well as logistics sectors. The region maintains its dominant position because of major telematics companies operating there and extensive digital infrastructure investment. The telematics industry in North America continues to grow as businesses become more interested in predictive maintenance and fuel efficiency, along with real-time fleet tracking capabilities.

Asia Pacific Commercial Vehicle Telematics Market Trends

During the forecast period, the Asia Pacific will experience the fastest growth rate in the Commercial Vehicle Telematics Market. The quick development in the Asia Pacific derives primarily from industrial growth alongside e-commerce expansion and improved logistics and transportation requirements throughout China, India, Japan, and Southeast Asia. The implementation of telematics systems receives support from local governments because they establish regulations concerning fleet tracking, together with pollution control measures and vehicle security standards. Small and mid-sized fleet owners now find telematics solutions more accessible due to the increased popularity of smartphones, combined with better internet connections and reduced telematics hardware costs. The global telematics industry will see its primary expansion power emerge from the Asia Pacific due to corporations seeking better operational effectiveness and legal adherence.

Europe Commercial Vehicle Telematics Market Trends

The European commercial vehicle telematics market experienced consistent growth during 2024 because of new laws relating to driver adherence, emission control, and vehicle protection standards. Smart mobility initiatives, together with government green logistics programs and fleet management digital technology adoption, have accelerated telematics deployment throughout the European region. The construction, public transportation, and logistics sectors increasingly adopt telematics systems for fuel efficiency and predictive maintenance alongside real-time tracking capabilities. The European Union's tachograph and electronic logging device (ELD) regulations have driven increased adoption rates. European fleet operators' market growth stems from adopting sophisticated telematics technologies while the industry gains recognition of cost efficiencies and sustainability benefits.

Key Commercial Vehicle Telematics Companies:

The following are the leading companies in the commercial vehicle telematics market. These companies collectively hold the largest market share and dictate industry trends.

- Geotab Inc.

- CalAmp Wireless Networks Corporation

- Verizon Communications Inc.

- Pioneer Corporation

- PTC Inc.

- Trimble Inc.

- Fleet Complete

- Omnitracs

- Samsara Inc.

- Fleetx Technologies Private Limited

- Others

Recent Developments

- In March 2025, Xona Space Systems and Trimble Inc. established a partnership to combine Trimble's rectification services with Xona's high-performance navigation solution, PULSARTM. The goal of this collaboration is to provide high-precision, secure positioning for a range of applications, such as IoT, low-power mass mobile, and GIS.

- In January 2025, Geotab Inc. improved its fleet management products by adding software solutions to its Order Now program. Businesses and channel partners may now easily access a carefully chosen selection of hardware and software alternatives through the Geotab Marketplace, which is integrated into the MyGeotab platform. By expediting deployment, decreasing transactional friction, and streamlining the procurement process, the integration will let companies swiftly adjust to market demands.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the commercial vehicle telematics market based on the below-mentioned segments:

Global Commercial Vehicle Telematics Market, By Component

- Solution

- Services

Global Commercial Vehicle Telematics Market, By Provider

- OEM

- Aftermarket

Global Commercial Vehicle Telematics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |